Lucid: Potential Takeover In The Making

Summary:

- EV maker Lucid might be acquired by its majority shareholder, Saudi Arabia’s Public Investment Fund.

- Acquisition might be likely given Saudi Arabia’s push into the electric vehicle space and the already existing cooperation with Lucid.

- Meanwhile, Lucid’s management and minority shareholders could accept a takeover bid given the business’ ongoing cash burn and likely prolonged timeline until profitability.

- There seems to be substantial upside here if both sides can come to terms on a transaction.

David Becker

Lucid Group (NASDAQ:LCID) is a $22bn market cap EV manufacturer, focusing on the luxury car segment. Recently, reports appeared that the company might be an acquisition target of the Public Investment Fund (or PIF). PIF is Saudi Arabia’s sovereign wealth fund and LCID’s majority shareholder, owning 61% of the company. The reports mention that PIF might be working with JPMorgan on a potential deal. LCID’s stock price jumped 43% on the news. While discussions have not been confirmed by either side, Saudi Arabian news outlet the Saudi Post reported that PIF might be interested in an acquisition. Moreover, on the same day, LCID announced its shareholder meeting will be held on April 2023 – more than a month earlier versus 2022. In addition to these rather interesting developments, there are several strategic arguments why a transaction might in fact materialize.

Firstly, a potential acquisition would come amid the Kingdom of Saudi Arabia’s (or KSA) push to diversify its revenues away from oil to other more sustainable alternatives. One such alternative has been the still nascent electric vehicle space, which is expected to grow at a 29% CAGR from 2022 through 2028 in the Middle East. Given the industry’s growth potential as well as KSA’s relative proximity to large markets and minerals required for EV production (such as cobalt and graphite), the country has been seeking to become a regional EV hub. As part of its EV-focused strategy, KSA aims to export over 150k EVs in 2026. Moreover, its Vision 2030 program entails KSA targeting at least a 30% share of electric passenger cars in the capital city of Riyadh. As evidence of the country’s ambitions in the space, in May 2022 Saudi Arabia announced a $2bn investment into an electric vehicle battery metals plant. Moreover, in November 2022 KSA launched its own EV brand Ceer in cooperation with Taiwanese electronics company Foxconn.

Considering KSA’s broader strategy, LCID would seem to be a highly strategic asset for PIF. Saudi Arabia’s fund has been invested in LCID since 2018. During the last equity financing round in December 2022, PIF acquired $915m worth of LCID stock at the average price of $10.64/share (versus the current price of $12.87/share). Importantly, both sides have an already existing tight cooperation:

- In February 2022, LCID announced plans to build a new manufacturing facility in KSA. The facility – which is expected to be built by 2026 – will have an annual capacity of 155k vehicles per year. LCID is expected to receive $3.4bn in incentives and financing from the Saudi Arabian government.

- In April 2022, Saudi Arabia’s government agreed to purchase up to 100k electric vehicles from Lucid over the next decade. First deliveries are expected this year.

- In October 2022, LCID opened its first retail studio in Riyadh, Saudi Arabia.

- In 2021, the company entered into an agreement with PIF to implement certain recruitment and talent development programs involving participants from PIF.

Given the significant degree of collaboration between both sides and KSA’s ambitions in the EV space, recent reports might not seem surprising from the buyer’s perspective. Another point here is that Lucid is among the most advanced EV makers in the luxury segment. A potential acquisition would give Saudi Arabia a jump start in the luxury EV space given LCID’s extensive know-how (for instance, in battery technology, where LCID is among the leading players). It has been rumored that PIF might seek to take LCID private before re-listing it on the Saudi Arabian stock exchange. This would fit with the Kingdom’s goal to list all PIF-owned companies in a stated effort to create the third-largest stock exchange globally.

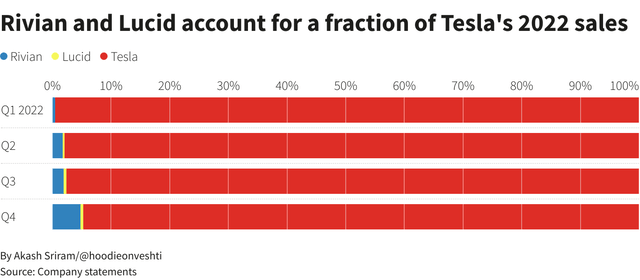

Meanwhile, Lucid’s management and minority shareholders might accept a potential acquisition bid at a reasonable premium, given the business’ ongoing cash burn and likely prolonged timeline until profitability. LCID has thus far failed to reach sufficient scale required to reach mass production and hence profitability. Impacted by broader macroeconomic/sector headwinds and increasing competition, LCID produced 7.2k vehicles in 2022 – significantly below the previously guided 12-14k and multiples below close competitor Tesla (TSLA) which manufactured 1.3m vehicles. Not surprisingly, Lucid has been incinerating cash, with operating losses of $688m in Q3’22 and $1.8bn through three quarters of 2022. Meanwhile, as of Q3’22 LCID had $3.9bn in gross cash. Worth noting is that the company has agreed to several credit facilities which would expand the figure to $5.6bn, moreover, in December 2022 LCID completed an equity raise of $1.5bn (with $915m coming from PIF). Nonetheless, LCID’s cash runway is likely sufficient only through the end of 2023 (as also stated by the company’s CFO during the Q3’22 earnings call). This implies other debt/equity raises in the foreseeable future, which could further diluting existing equity holders.

Moreover, looking into the near term, LCID’s position might be unlikely to get materially better from a competitive standpoint. TSLA – the dominant player in the EV segment – has recently initiated price cuts (up to 20%) across its models. This is expected to further pressure startups such as LCID and Rivian Automotive (RIVN) in light of shrinking consumer incomes and still high raw material/production costs. Worth noting that given LCID’s focus on higher-priced luxury cars, the company’s offerings do not qualify for US EV tax credits – unlike the cheaper models of Tesla – which further damages LCID’s price competitiveness. These arguments, coupled with tightening capital markets and increasing competition from legacy carmakers, suggest LCID’s management and minority shareholders might support a transaction in case of a generous acquisition proposal.

Valuation

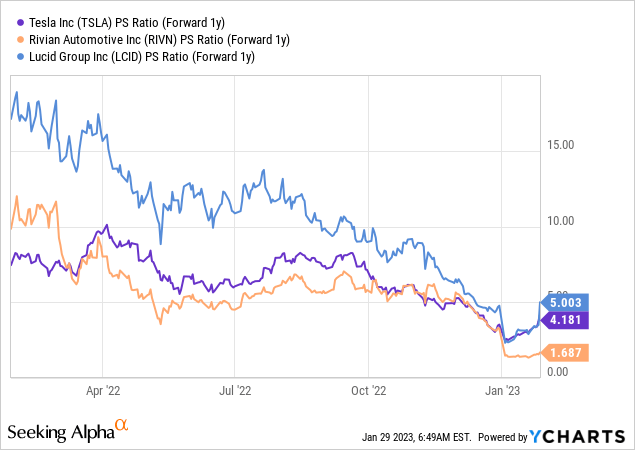

Lucid’s valuation is quite complex, given that it is mostly based on future growth rate and eventual market share captured by the company. However, given the strategic importance of the EV space to Saudi Arabia as well as scarcity of potential targets in the luxury EV segment, I think the buyer might be prepared to pay a very large premium to current prices. LCID is currently trading at 5x 2024E revenues – this compares to 4.2x for TSLA and 1.7x for RIVN. For reference, these companies were valued at much higher 10x+ multiples pre-2022.

YCharts

Lucid Group

Lucid went public via a SPAC in 2021. The company is led by a former Tesla executive. Lucid produces cars in its Arizona-located manufacturing facility and subsequently sells them through online and retail channels. As of 2021, the company operated twenty retail studios and service centers in the US as well as a network of in-house vehicle service locations and a mobile service fleet. Deliveries of the company’s first production vehicle, Lucid Air, started in late 2021. As of Q3’22, the company had 34k Lucid Air reservations, representing potential sales above $3.2bn (compared to $350m generated in nine months of 2021).

The company’s growth strategy involves releasing its luxury SUV Project Gravity (expected production in H1’24) and expected production of more affordable vehicles in higher volumes (such as Lucid Air Pure). Another growth vector is international expansion, including into Asia-Pacific and the Middle East. The management has noted that continuing growth has been key in the company’s path to profitability. To fulfill the existing reservations, LCID has continued to invest in its Arizona-located manufacturing facility – it is expected to have production capacity of 90k vehicles per year by the end of 2023 (compared to 34k as of December 2021).

Risks

There are several risks worth highlighting:

- Saudi Arabia’s recent push to establish its own EV brand, which might potentially negatively impact LCID’s relationship with the country’s government. Having said that, LCID’s management has stated that the company focuses on the luxury segment of the market, which means the two brands would not compete directly.

- The acquisition rumors come after previous reports that PIF sought to acquire WWE as well as Formula One owner Liberty Media. While neither of the reports materialized in a company sale announcement, the current situation seems to materially differ given Saudi Arabia’s already existing tight cooperation with Lucid. Meanwhile, PIF’s attempt to scoop up Liberty Media was rejected by the target company.

- Worth noting that LCID is a highly shorted stock, with the current short interest at 25.5% of total float. This compares to just 3.4% for TSLA. High short interest and a subsequent short squeeze following the recent acquisition rumors might partially explain the share price jump. Given this, it might be worth waiting for a price decline before initiating a position in LCID.

Conclusion

Lucid currently presents an interesting situation with a potential near-term catalyst. Given Saudi Arabia’s increasing focus on electric vehicles as well as the already existing collaboration with Lucid, I expect PIF to make an acquisition offer. Meanwhile, LCID’s management and minority shareholders might be willing sellers here, given the ongoing cash burn and likely prolonged timeline until profitability. With these points in mind, I would expect an acquisition offer at a material premium to current prices. Having said that, investors might wait for a price retracement for a better entry point here.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LCID over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Highest conviction ideas for Premium subscribers first

Thanks for reading my article. Make sure to also check out my premium service – Special Situation Investing. Now is a perfect time to join – with today’s high equity market volatility, there is an abundance of lucrative event-driven opportunities to capitalize on. So far our strategy has generated 30-50% returns annually. We expect the same going forward.

SIGN UP NOW and receive instant access to my highest conviction investment ideas + premium weekly newsletter.