Chevron: What A Big Dividend Disappointment

Summary:

- Chevron generated record free cash flow of $37.6 billion last year (an estimated $19.58/share) – up a whopping $16.5 billion from the previous record $21.1 billion in 2021.

- Despite the massive gain in free cash flow, Chevron decided to increase the quarterly dividend only 6.3%, to an annual rate of only $6.04/share.

- For long term Chevron investors like myself, the relatively piddly dividend increase was a massive disappointment, especially in light of the $75 billion share buyback announcement.

- My followers know I have long considered Chevron the best integrated international major on the planet. Operationally it arguably still is.

- However, the company’s decision to massively over-emphasize share buybacks is a major red-flag for investors moving forward.

Mario Tama

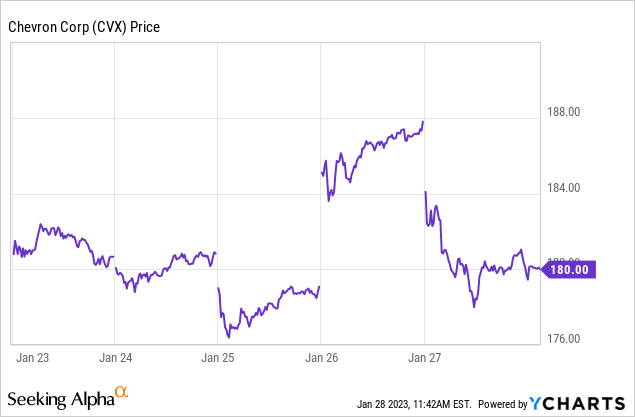

Chevron’s (NYSE:CVX) stock went on a roller-coaster ride last week after announcing a 6.5% increase in the quarterly dividend and a massive and open-ended $75 billion buyback plan. The announcement came after the market closed on Wednesday. Shares responded by gaping up $6-plus on Thursday morning and traded higher from there. Then came a relatively strong Q4 earnings report on Friday morning – at least in my opinion. However, the report missed expectations and was followed by less than inspiring commentary on the Q4 conference call. As a result, CVX shares gave back most all of the gains it had racked up on Thursday (see below).

I say it was “less than inspiring” because the commentary on the dividend was just that. Chevron, who has a long record of prioritizing the dividend over shares buybacks, has obviously had a major change of direction. The company now appears to be over-emphasizing share buybacks over the dividend – just as shares hit an all-time high. That being the case, investors need to be clear-eyed about the prospects for their Chevron holdings going forward.

Shareholder Returns

Let’s take a quick look back at the last two years of Chevron’s shareholder returns.

FY2021

As mentioned in the bullets, for full-year 2021 Chevron generated record free-cash-flow of $21.1 billion, or an estimated $10.98/share based on the weighted average of 1.922 billion fully diluted shares outstanding as of year-end 2021.

Total shareholder returns for FY21 were $11.6 billion, of which $10.2 billion was in the form of dividends and $900 million worth of share buybacks.

After such a strong FY21, the quarterly dividend was increased 6% – from $1.34 to $1.42 per share.

FY2022

The Q4 and full-year 2022 results released Friday showed – as expected – a massive yoy increase in Chevron’s free-cash-flow to $37.6 billion – a whopping $16.5 billion yoy increase and an estimated $19.58/share based on the weighted average of 1.920 billion fully diluted shares outstanding as of year-end 2022.

Total shareholder returns for FY22 were $22.25 billion, of which $11.0 billion was in the form of dividends and $11.25 billion worth of share buybacks.

After such a strong FY22, the quarterly dividend was increased only 6.3% – from $1.42 to $1.51 per share.

Perhaps it’s easier for Chevron shareholders to understand what has taken place here to summarize the results in table form:

| Free-cash-flow |

Estimated FCF/share |

Dividend Increase |

Annual Dividend |

|

| FY2021 | $21.1 billion | $10.98 | 6.0% | $5.68/share |

| FY2022 | $37.6 billion | $19.58 | 6.3% | $6.04/share |

To put it in perspective, Chevron generated incremental FCF of an estimated $8.60/share in FY22 as compared to FY21, yet the dividend increased by only $0.36/share. Anyhow you slice that, it is a massive disappointment and – in my opinion – is a slap-in-the-face to the ordinary shareholder.

Meantime, note that share buybacks increased from $900 million in 2021 to $11.25 billion in 2022 ($250 million more than FY22 dividends). Even more telling was that Chevron touted that it ended the year with share buybacks moving at a $15 billion annual run-rate – or ~$4 billion more than the company paid out in dividends during 2022.

Even more disappointing was Chevron CEO Mike Wirth’s response to BofA energy analyst Doug Leggate’s question on the Q4 conference call having to do with the real purpose of the stock buyback plan:

Doug Leggate:

I just want to try and understand a little bit about the comment around really just how you think about the purpose of the buyback. Is this really about dividend management at this point?

Because it seems to us that, if you take your Brent sensitivity into account, the run rate at the high end of the range puts you about a $90 breakeven on your oil price. And I’m just wondering if this is about value or about managing confidence in future dividend growth.

In my opinion, Leggate – one of the few energy analysts that consistently calls-out energy company CEOs out for short-changing the ordinary shareholder – hit the nail on the head: The massive over-emphasis on stock buybacks will – by reducing CVX’s outstanding share-count – also reduces Chevron’s overall dividend obligation. Here was CEO Wirth’s response:

CEO Mike Wirth:

We do not do buybacks to manage dividends. Dividend — absolute dividend load is an outcome. It’s not a reason that you would do buybacks.

Our dividend growth expresses confidence in the ability to grow free cash flow at mid-cycle prices, and it is a long-term decision, a long, long, long-term decision.

For those investors in Exxon (XOM), the “long, long, long-term” comment must be very reminiscent of the “lost decade,” when Exxon delivered a negative total return for ordinary shareholders while CEO pay zoomed 30% higher, the company wasted $10s of billions of shareholder capital on share buybacks, and dividend growth was uninspiring (to say the least). All we ever heard from Exxon management about this pathetic performance was the same old mantra, quarter-after quarter, that Exxon is “managed for the long-term” …. as if, somehow, other energy companies were not. Regardless, Chevron’s pivot from being dividend centric to share buyback centric is a big red-flag for investors going forward.

Ironically, Wirth spent much of the call pounding the table on how great Chevron’s future looks. And I agree! Over the years, I have written often on Seeking Alpha about the strength of Chevron’s position in the Permian, its strong position in global LNG with its assets in Australian and Angola, and the natural gas upside potential in the Mediterranean as a result of the Noble Energy acquisition. Even the massive TCO project – which has been a big cap-ex spend for years now – was reported to have construction “largely complete.” So, this year, the TCO project will transition from a big cap-ex spend to, finally, generating strong revenue growth.

So it appears – in my opinion – to be somewhat hypocritical to on the one-hand to deliver such strong results in FY21 and FY22, and to observe how strong the company’s future potential is, and then on the other hand to give such a puny dividend increase relative to the massive free cash flow the company is generating. I mean either Chevron believes it has a great future (I certainly do), and backs it up with strong dividend growth, or it doesn’t.

Meantime, Chevron certainly cannot use the balance sheet as an excuse for giving such a relatively small dividend: the company has a pristine balance sheet and ended the year with a net-debt of only 3.3%. Indeed, a strong balance sheet is one of the primary reasons I have favored Chevron over the years.

Also, Chevron cannot use the “dividend must be sustainable over the long (long, long, long-term) excuse, because – as energy investors know – the shale oil producers solved this potential “problem” years ago by instituting a (base+variable) dividend policy. The base dividend is for the long, long, long-term and the variable dividend enables shareholders to share in windfall profits – just like those Chevron generating in FY21 and FY22.

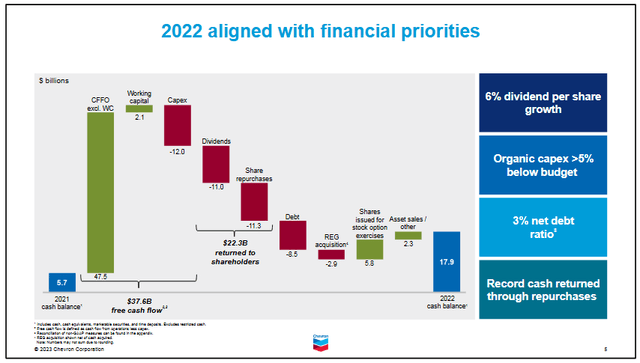

The following slide from Chevron’s Q4 presentation is illuminating:

Chevron

Note that the company ended the year with a whopping $17.9 billion in cash. Once again, and just to put things into perspective, Chevron could have rewarded shareholders with the 6.3% base dividend increase and have declared a special (or variable) dividend of $4/share and still ended the year with $10+ billion in cash and a sparkling clean balance sheet. That obviously didn’t happen.

The graphic above also displays another point that shareholders should pay attention to: That shares issued for employee stock options equated to $5.8 billion dollars in 2022 – more than half of the amount of cash spent on share repurchases (!). I hope those who argue with me on my position that energy companies that over-emphasize share buybacks as compared to dividends directly to shareholders are giving already very highly compensation executives even more compensation (at their expense …) are paying attention here. And that isn’t the only way executives benefit from share buybacks. It is commonly the case that bonus compensation plans in the energy sector are based on per-share metrics (like production/share, reserves/share, etc.). As a result, it’s easy to see why share buybacks are so prevalent and popular among energy company CEOs. That’s because those bonus plans typically get paid out whether or not ordinary shareholders are seeing decent total returns (or not). Exxon’s “lost decade” is Exhibit No. 1.

Also notable is that these executives typically sell their stock options as soon as they vest. Indeed, according to MarketBeat, Mike Wirth sold a whopping 180,000 shares in 2022 for proceeds of ~$29 million. That follows stock sales of ~$24.6 million in 2021. That being the case, it’s fair game for investors to ask the simple question: If the CEO is selling shares – at much lower prices than where Chevron stock is currently trading today – does he really believe that the stock currently represents “good value” and therefore warrants allocating $75 billion of shareholder capital to buying it? If so, why isn’t he holding onto his own shares?

The fact is, this is a rodeo that long-term energy investors have seen many times before (I’ve been investing in O&G companies for nearly 40 years): Energy companies almost always suspend share buybacks during down-cycles – when the stock prices are low and arguable DO represent good value – and then massively over-emphasize share buybacks during up-cycles – when stock prices are high and arguable do not represent compelling shareholder value.

Meantime, note that ConocoPhillips’ (COP) CEO Ryan Lance cashed out his COP stock options last year (even as COP was massively over-emphasizing its share buyback plan …) to buy stock in Freeport-McMoRan (FCX). That move was arguably a bet on copper and the future of EVs over oil (see Freeport-McMoRan: Why ConocoPhillips’ CEO Sold Oil & Bought Copper).

That article brings up a big picture point: The massive buybacks by big-oil companies are, effectively, forcing shareholders to double-down on their oil investments – not only as the CEOs of these companies sell their shares, but as the EV transition is in full-swing.

For instance, consider the following anecdote:

Last year, the two biggest EV makers alone, Tesla (TSLA) and BYD (OTCPK:BYDDY), combined to put over 3 million EVs into the global car fleet. If we assume each of these replaced an ICE-based vehicle that gets 20 mpg, and that each car is driven, say, 10,000 miles per year, that’s a whopping 1.5 billion gallon reduction in gasoline demand that otherwise would have been needed. And, of course, there are a plethora of other EV competitors nipping at the heels of the current “big two.”

Meantime, Bloomberg estimates that EVs will equate to 50% of U.S. new vehicle sales by 2030 (60% globally). The point is, do big-oil shareholders really want to be forced into doubling-down on their investments in the stocks of these companies instead of getting dividends directly from them so that they can choose to buy more shares – or – like the COP CEO, perhaps diversify into a bet on clean-energy or EVs (i.e. copper) instead?

Summary and Conclusions

Chevron’s decision to massively over-emphasized share buybacks over the dividend is a blow to ordinary shareholders who expected much more from the company. Based on Chevron’s full-year 2022 financial performance, and in-light of its prospects going forward – I was not only expecting a dividend increase of at least 10% this year, but I also thought Chevron might – in addition – declare a significant special dividend or announce it was adopting a (base+variable) dividend policy in order to significantly boost dividends paid directly to shareholders. Neither happened.

Instead, what Chevron shareholders got was an arguably very weak dividend increase and the company forcing them to double-down on oil instead of letting them decide if, and when, they wanted to buy more shares in Chevron – or, just perhaps, diversify into clean energy.

What a huge disappointment for this long-term Chevron shareholder. After a decade of rather lousy returns, the company is finally hitting its stride and it goes massively over-board on share buybacks while short-changing ordinary shareholders on the dividend. Investors beware: Chevron has changed its shareholder returns policy, and it benefits the executive management team much more than it benefits them.

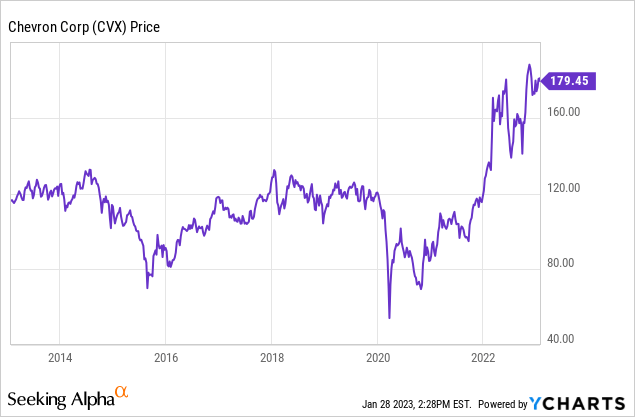

I’ll end with a 10-year price chart of Chevron and note that prior to January 2022 (and the Russian/Ukraine conflict), this stock went nowhere for an entire decade:

That being the case, practically all investors had for holding Chevron stock over that decade was the dividend. And now, Chevron is reducing its allocation percentage of FCF toward the dividend. That being the case, I reduce my rating on Chevron from BUY to HOLD.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of CVX, COP, FCX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.