Summary:

- Company extends its recent winning streak by adding another high-margin contract offshore Brazil for the currently idle drillship Dhirubhai Deepwater KG2.

- Earlier this month, the company successfully replenished liquidity and extended near-term debt maturities at reasonable terms.

- Going forward, market participants are likely to focus on Transocean’s ability to find work for at least some of its cold-stacked drillships.

- With dayrates in a healthy uptrend and high-specification drillships basically sold out, operators might be increasingly required to award contracts with terms sufficient for the costly and time-consuming reactivation of cold-stacked assets.

- While shares might be ripe for a breather following the impressive 200% run from September lows, investors should consider adding on any major weakness.

pabst_ell

Note: I have covered Transocean (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

Shares of leading offshore driller Transocean have been on a tear recently with the stock up an impressive 50% over the past month alone, vastly outperforming peers Valaris (VAL), Noble Corp. (NE), Diamond Offshore Drilling (DO) and even Seadrill (SDRL) as the company has proven its ability to get a handle on its long-standing debt and liquidity issues.

Three weeks ago, the company managed to issue $525 million in new 8.375% Secured Notes for net proceeds of $515 million, above the high-end of management’s projections of between $450 and $500 million.

The additional debt issuance was required to replenish the company’s cash reserves following $566 million in Q4 capital expenditures for the recently delivered 7th generation drillships Deepwater Atlas and Deepwater Titan and to ensure compliance with the $500 million minimum liquidity requirement governing the company’s secured credit facility going forward.

Not surprisingly, management decided to use the momentum for a major secured debt refinancing:

Transocean Ltd. announced today that Transocean Inc., its wholly-owned subsidiary has priced its previously-announced offering of U.S. $1.175 billion aggregate principal amount of senior secured notes due 2030 (the “Notes”) to eligible purchasers pursuant to Rule 144A/Regulation S. The Notes will be fully and unconditionally guaranteed on a senior unsecured basis by Transocean Ltd. In addition, the Notes will be guaranteed on a senior secured basis by certain of Transocean Inc.’s subsidiaries that guarantee the existing (i) 7.75% Senior Secured Notes due 2024 issued by Transocean Phoenix 2 Limited (the “Thalassa Notes”), (ii) 5.875% Senior Secured Notes due 2024 issued by Transocean Guardian Limited (the “Guardian Notes”), (iii) 6.25% Senior Secured Notes due 2024 issued by Transocean Proteus Limited (the “Proteus Notes”) and (iv) 6.125% Senior Secured Notes due 2025 issued by Transocean Pontus Limited (the “Pontus Notes” and collectively, the “Existing Secured Notes”), in each case, up to a secured guarantee cap equal to the principal amount of such notes being refinanced (together with any applicable premium, fees and expenses) (the “Secured Limited Guarantee Cap”). Accordingly, Transocean Inc.’s subsidiaries that guarantee the Thalassa Notes, the Guardian Notes, the Proteus Notes and the Pontus Notes, will be subject to a Secured Limited Guarantee Cap on the Notes equal to $247 million, $320 million, $256 million and $352 million, respectively.

The Notes will also be secured by a lien on Deepwater Thalassa, Deepwater Proteus, Transocean Enabler, Transocean Encourage and Deepwater Pontus (the “Collateral Rigs”) and certain other assets related to the Collateral Rigs, up to the applicable Secured Limited Guarantee Cap.

(…)

The Notes will bear interest at the rate of 8.75% per annum.

In layman’s terms: Transocean managed to extend an aggregate $1.175 billion in senior secured debt with maturities in 2024 and 2025 all the way to 2030 at an annual interest rate of 8.75%.

While the refinancing will raise the company’s annual interest obligations by another $20 million, near-term liquidity relief appears to be well worth the price.

Some investors might wonder why the company’s 5.375% senior secured notes scheduled to come due in May haven’t been included in the deal.

Unfortunately, these notes are secured by the CAT-D rigs “Transocean Equinox” and “Transocean Endurance” which recently failed to extend their respective long-term contracts with Equinor (EQNR).

While Transocean Equinox is already sitting idle, Transocean Endurance is currently scheduled to run off contract in June, potentially followed by Transocean Encourage in November and Transocean Enabler in March 2024.

The early release of the Transocean Equinox also triggered a $121 million early redemption payment under the above-discussed 5.375% senior secured notes in January.

Keep in mind that these rigs have been purpose-built to the specifications of Equinor and are still working at rates substantially above current market levels. That said, Equinor hasn’t made a decision regarding the Transocean Encourage and Transocean Enabler yet and with drilling activity offshore Norway expected to improve going into 2024, these rigs might very well secure new work without being required to leave their core market.

With the fate of the Transocean Encourage and Transocean Enabler still in limbo, I consider the timely refinancing of the notes secured by these rigs a major success for Transocean.

Following the redemption of the remaining outstanding 5.375% senior secured notes in May, Transocean won’t face any major debt maturities until November 2025.

But the good news doesn’t stop here.

After the close of Tuesday’s session, Transocean announced a new 30-month contract award for the 6th generation ultra-deepwater drillship Deepwater Dhirubhai KG2 offshore Brazil at a dayrate of $430,000. In combination with a $39 million mobilization fee, total contract value calculates to an impressive $431 million.

While the rig has been sitting idle in Asia for approximately twelve months, reactivation and mobilization costs should actually be well below the above-discussed mobilization fee.

The contract announcement comes as sort of a surprise given the fact that the rig has been mostly operating in the Asia-Pacific region so far.

Just six months ago, the Deepwater Dhirubhai KG2 was considered the frontrunner in an ONGC drillship tender which subsequently ended up being cancelled and re-tendered.

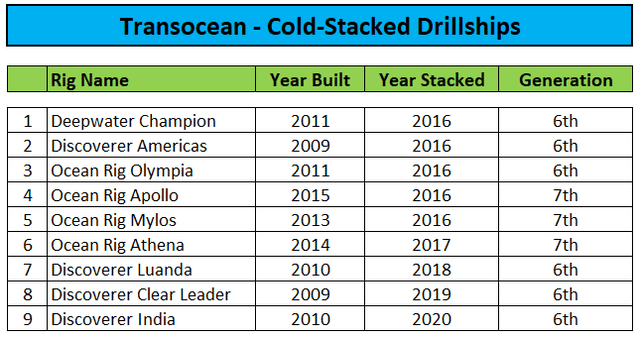

That said, with the low-hanging fruits in the form of warm-stacked drillships having been picked, market participants are likely to focus on Transocean’s ability to find work for its cold-stacked drillship armada:

Fleet Status Report

Unfortunately, the company’s most capable rigs have been cold-stacked for many years already with a potential return to market entirely unclear at this point.

At least so far, Transocean has never reactivated a cold-stacked drillship but on the recent Q3 conference call, management pointed to the possibility of near-term contract awards offshore Brazil for one or two of these rigs.

On the flip side, competitor Valaris recently pointed to increased costs and extended time requirements for the reactivation of cold-stacked drillships:

As mentioned on our first quarter conference call, reactivation costs for the 4 floaters reactivated to date are expected to average $40 million to $45 million per rig. This includes all costs to reactivate the rigs that does not include mobilization costs or costs for contract or region-specific upgrades for which we would generally expect to be compensated.

We anticipate that future floater reactivations including VALARIS DS-17, will be in the range of $65 million to $75 million on average. This estimate is higher than our reactivations to date due largely to inflation, both personnel and goods and services related and the need for additional spare parts following the 4 reactivations already completed.

Please note that the drillship Valaris DS-17 has been cold-stacked for less than three years.

Reactivating the former Ocean Rig 7th generation drillships Apollo, Mylos, and Athena which have been cold-stacked since 2016 will likely come at a much higher price tag and actually might be considered not feasible at all while drillships idled in more recent years like the Discoverer Clear Leader and Discoverer India are of lower specification.

Anyway with dayrates in a healthy uptrend and high-specification drillships basically sold out, operators might be increasingly required to award contracts with terms sufficient for the costly and time-consuming reactivation of cold-stacked assets.

That said, I would expect the remaining stranded newbuilds to be picked up from the shipyards first before offshore drillers consider reactivating rigs that have been cold-stacked for more than half a decade already.

Bottom Line

Since the beginning of the year, Transocean has made great progress as the company replenished liquidity and extended near-term debt maturities at reasonable terms while bagging another high-margin drillship contract offshore Brazil.

Investors have honored the company’s winning streak by pushing shares to new multi-year highs with analysts raising price targets across the board.

In addition, with profitable backlog increasing and expectations for industry conditions to improve even further over the course of this year, additional upside looks likely even with the company looking expensive from a fundamental perspective relative to peers.

While shares might be ripe for a breather following the impressive 200% run from September lows, investors should consider adding on any major weakness.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.