An Update On The Intel-Tower Deal And Organic Growth Of Foundry Businesses

Summary:

- Eleven months after the deal for Intel to acquire Tower was announced, an important regulatory hurdle remains to be overcome, namely in China.

- In this case, despite all the geopolitical tensions and semiconductor-related sanctions, there is a glimmer of hope.

- For this matter, I base myself on differentiated products which are needed by China as the world’s largest semis market and which do not necessarily compete with the more commoditized products manufactured there.

- Still, in the worst-case scenario that the deal does not go through, both companies can rely on organic revenue growth to make progress in their foundry services.

- Adopting a cautionary stance due to grim industry-level forecasts for 2023, I have Hold positions for both stocks despite being undervalued with respect to the sector.

PonyWang

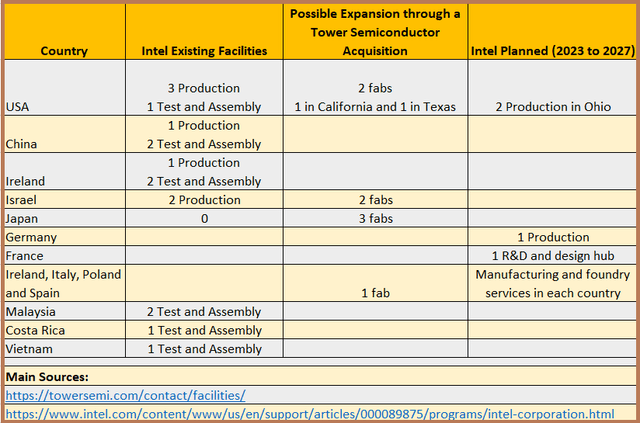

When I last covered Tower Semiconductor (NASDAQ:TSEM) back in June last year, Intel (NASDAQ:INTC) had made a $5.4 billion deal for the acquisition of the Israeli company. I was bullish on the merger due to the boost it would bring to the U.S. company’s IFS (International Foundry Services) segment, together with expanding its global footprint, as pictured below. I even touched upon the regulatory side but failed to anticipate that Chinese regulators would scrutinize the deal in such detail, and this, after a lot has happened in terms of U.S. sanctions and heightened geopolitical tensions.

Table Built Using Corporate Data and information from (www.seekingalpha.com)

Seven months later, the aim of this thesis is to provide an update on the deal, which, while appearing less likely, still has a slim chance of being approved by the Chinese authorities. Also, bearing in mind organic growth, I cover Intel’s IFS financial results for the fourth quarter of 2022 (Q4). I do the same for Tower’s third quarter of 2022 (Q3) which is already a foundry operator, and this is in the context of uncertain macroeconomic conditions impacting the semis industry.

U.S. Sanctions Biting Chinese Chip Industry

In October last year, the United States put in place new rules which, among other things, force companies to obtain a license to supply advanced chips and equipment allowing their manufacture in China, and also prohibit the export of certain microchips manufactured using American technology or know-how.

As such, there are risks incurred by one of the main Chinese chip manufacturing companies, Yangtze Memory Technologies Corp (a subsidiary of Tsinghua Unigroup) as for the first time, these measures extend the restrictions to 3D NAND or flash memory, which are considered to be less valuable, compared to processors produced by Intel, for example. The company’s flash memories, used for mass storage of data could be impacted by restrictions concerning 3D products used for stacking 128 layers and more.

In addition to the chips themselves, the restrictions cover the production technologies like intellectual property (expertise), materials, chemicals, and manufacturing equipment. Moreover, pertaining to the engraving technologies of 18 nanometers or less, the aim also seems to target China’s CXMT (ChangXin Memory Technologies) in DRAM memories, which are used in PCs, tablets, smartphones, and servers.

Now, Tower, which specializes in analog chips used in cars, medical sensors, and energy management, has investment plans at its manufacturing sites in Israel, Texas, and Japan to increase its production capacity for 200 and 300-millimeter wafers. This implies that it competes with Chinese foundry operator SMIC or Semiconductor Manufacturing International Corporation, a pure-play foundry operator, specifically for 200 mm wafers.

In addition, the antitrust issue in China may stem from SMIC’s (Semiconductor Manufacturing International Corporation) partnership plans with CXMT to build a factory in Jingsheng as part of its move to switch to 17 nanometers (from older 19 nm) process nodes. In this way, CXMT would have improved its competitive position relative to South Korea’s Samsung (OTCPK:SSNLF) and SK Hynix, and Micron Technology (MU).

These projects are coming to a halt and the new sanctions are resulting in massive layoffs in China, giving the authorities the perfect excuse for a tit-for-tat reaction by blocking the Intel-Tower deal.

Looking Deeper into the Deal

However, a deeper look shows that at the time of the deal, on February 15 2022, reveals that, in addition to expanding its global footprint, Intel’s objective is to offer one of the industry’s “broadest portfolio of differentiated technology” as pictured below.

Intel Corporate News (www.intel.com)

Thus, the aim would be to skew Tower towards a more specialty product set in the chips industry, in addition to taking advantage of the company’s expertise in contract manufacturing. For this purpose, as I had mentioned in my thesis on GlobalFoundries (GFS) recently, U.S. companies can only be competitive if they manufacture high-value and feature-rich chips where they can extract better margins in order to offset the higher costs. The reason is that it is 44% dearer to build and operate a fab in America than in Taiwan.

This differentiation criteria for certain types of chips contrast sharply with more “commoditized” items where the objective is more to produce in bulk (huge volumes) and compete on a price basis, as most Chinese companies are good at. Also, with, the cost differential between China and the U.S. being more than Taiwan, it is even more difficult for American firms to compete in that country, simply on a cost basis.

Thus, instead of focusing only on factors like market share for 200 mm and looking towards differentiated products, there is a possibility that, after a lot of questioning and delaying, the Chinese authorities will finally grant permission to Intel. However, in case I am completely wrong in my above assessment of regulatory risks, there are also other reasons for Chinese authorities to give their go-ahead.

First, in light of heightened geopolitical tensions, the Covid pandemic which strained supply chains originating from China and the U.S. have taken concrete steps to prioritize domestic production through the CHIPS Act, large manufacturing plays have started to take steps to remove China from their components sourcing lists.

Second, as the world’s largest semiconductor market in 2021, both for domestic consumption and value-added services whereby its assembly plants use specialized chips from the likes of Intel or Tower to produce electronics goods which are then reexported, China cannot afford to further alienate investors, especially at a time when priorities are growing the economy and creating jobs. This also comes at a time when the semiconductor industry association or SIA has warned about demand softness in H1-2023.

Therefore, as a manufacturing hub and without the design prowess of America and its allies, China simply cannot turn down the deal.

However, in the worst-case scenario that it is rejected or permanently delayed, I assess organic growth.

Assessing Intel’s IFS and Tower For Organic Growth

In its latest earnings report for Q4, Intel’s management mentioned that it is working hard to see the Tower acquisition through. In this respect, the Chinese antitrust regulators have “suspended the clock” as to the regulatory process, and, consequently, it appears unlikely that this would be completed in the first quarter of 2023 as previously announced in August by the U.S. company.

Furthermore, Intel’s shares tumbled by around 10% on January 26 when Q4’s results were announced as revenues from its Client Computing and Datacenter/AI fell by 36% and 33% respectively on a year-on-year basis. On a positive note, its foundry business progressed by 30% year-over-year. Well, the $319 million obtained in IFS is a far cry from the billions in its other segments, but, there is substantial progress in the pipeline with deals valued at over $4 billion. Additionally, the company is engaged in discussions with 7 out of the 10 largest foundry customers. As a result, expect Intel’s organic pipeline to grow consistently as it also has active engagements with 43 potential customers.

As for Tower, it reported revenue of $427 million for Q3 (ending in September 2022), which represents a 10.4% year-on-year gain. Interestingly, organic revenue from its Israeli and Texas fabs (introductory table) grew by 22%. Now, The EPS of $0.62 beat consensus by $0,07 and was driven by the gross profit of $125 million, which was 46% higher than the amount in the previous quarter year. This is four times more than the revenue growth and is largely explained by the higher pricing power possible in a supply-constrained environment.

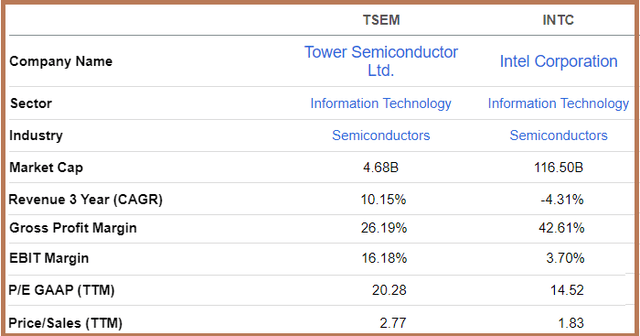

Intel also has pricing power as evidenced by its 42.6% gross margins (table below), which beats Tower by more than 16%, but, the chip giant’s lower EBIT (operating profit) margins show how higher costs in America can impact profitability. Furthermore, despite its higher valuations relative to Intel, thanks to its higher revenue growth and profitability, Tower still has a valuation grade of “B” and remains undervalued with respect to the IT sector. So is Intel with an “A” score.

Comparison of Metrics (seekingalpha.com)

Still, adopting a cautionary stance, despite both of these stocks being undervalued, it is better not to purchase shares of either due to the SIA’s grim outlook. There are also increasing risks of a recession hitting the U.S. economy which would imply a high degree of volatility for equities.

Conclusion

By looking deeper at Intel’s deal to acquire Tower and ignoring simplistic assumptions based on market share due to the Israeli company competing with China’s SMIC, I have highlighted the possibility of a green light by Chinese authorities in case the differentiation rationale gains ground. However, there are a lot of moving parts here and amid geopolitical tensions, Secretary of State Blinken’s visit to China next week shows that the lines of communication are still open.

Investors will also note that Tower is no stranger to China as in 2017 when its name was still TowerJazz, it attempted to open a wafer fab in Nanjing in partnership with Tacoma Semiconductor Technology. Things did not materialize as Tower’s partner faced bankruptcy. This could be the reason why Intel may be seeking the U.S. Commerce Department’s approval to invest $1.5 billion in its shuttered plant, located in Chengdu, but the request was met with a refusal as the company has benefited from funding through the CHIPS Act, which promotes production on American soil. Consequently, we can expect developments on this front.

Finally, taking into consideration the foundry-related revenues being generated by these two companies, it is found that both are growing organically and, while an M&A is surely a means to expand rapidly, it is not an absolute necessity for Intel to progress, especially given the fact that the outlook for the industry is now more subdued that it was in early 2022 when the Federal Reserve had not yet hiked interest rates.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.