Summary:

- In my fiscal Q1 FY25 preview note on Micron Technology, Inc., I had expressed a cautious stance, which correctly anticipated a weak NAND market ahead (NAND makes up 26% of Micron’s revenues).

- The NAND demand cycle seems to be at a local peak as it faces volume and pricing headwinds due to slower growth and inventory corrections at the customers’ level.

- NAND weakness has impacted fiscal Q2 FY25 revenue and gross margin guidance and caused it to miss expectations, and the outlook is expected to remain weak for at least a couple more quarters.

- I expect a valuation multiple de-rating to follow almost unanimous downgrades in EPS, revenue and gross margins over the next 4 quarters. Technicals vs. the S&P 500 are also bearish.

- HBM demand is expected to grow handsomely at a 36% CAGR until 2030. As a market leader, Micron is a key beneficiary of this industry trend. This is a key upside risk monitorable for my bearish view.

Henrik Sorensen/DigitalVision via Getty Images

Performance Assessment

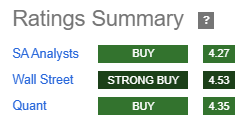

Micron Technology, Inc. (NASDAQ:MU) has been having a rather bullish sentiment by Seeking Alpha analysts, Wall Street, and the Quant Ratings:

Micron Ratings Summary (Seeking Alpha)

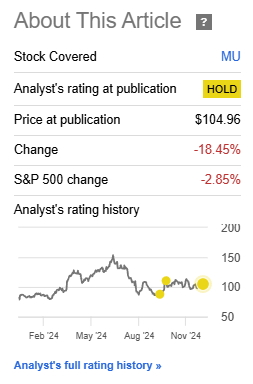

However, I have had a more cautious view of the stock, as explained in my Q1 FY25 preview note a week or so ago. I believe this stance has kept me away from the danger of a precipitous 18% drop after the Q1 FY25 earnings release:

Performance since Author’s Last Article on Micron (Seeking Alpha, Author’s Last Article on Micron)

Thesis

I am downgrading my stance to a “Sell” after Q1 FY25 results as Micron seems plagued by a challenging outlook and poor execution:

- NAND demand cycle seems to be at a local peak

- Q2 FY25 revenue and gross margin guidance has materially missed expectations

- I expect a valuation multiple de-rating to follow downgrades in EPS, revenue and gross margins

- Relative technicals show MU vs. SPX500 to be moving toward the bottom of the broader multi-quarter range

- HBM demand is a key upside risk monitorable.

NAND demand cycle seems to be at a local peak

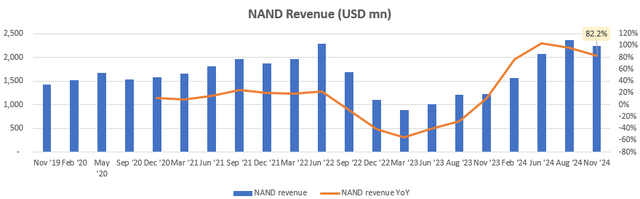

NAND revenues constitute a decent 25.7% chunk of overall Q1 FY25 revenues and has grown well recently on the back of volume and pricing increases in recent quarters:

NAND Revenue (USD mn) (Company Filings, Author’s Analysis)

But commentary suggests that we may be at a cycle peak. In Q1 FY25, the volume and pricing trends started to turn:

Sequentially, NAND revenue decreased 5%, with bit shipments and prices both decreasing in the low-single-digit percentage range…

– CFO Mark Murphy in the Q1 FY25 earnings call.

I am not so surprised by this development, as a slowdown in orders and pricing headwinds in the NAND business was a major thesis point in my Q1 FY25 preview, in which I had a heading titled:

A slowdown in orders and pricing headwinds may reduce NAND Flash revenues.

Management attributes slower growth in consumer devices’ NAND content, inventory corrections and weaker demand dynamics as the key reasons for the slowdown in demand growth ahead:

Our outlook for industry NAND bit demand growth in both calendar 2024 and 2025 is now in the low-double-digits percentage range, which is lower than our prior expectations. Key drivers include slower growth in NAND content in consumer devices, ongoing inventory adjustments and demand dynamics in different end markets

– CEO Sanjay Mehrotra in the Q1 FY25 earnings call.

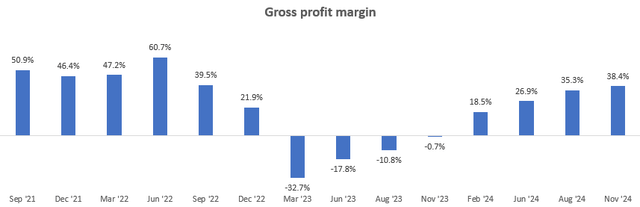

I expect the pricing headwinds to also weigh down on gross profit margins. I believe going forward, gross profit margins are more likely to remain stable or even decline slightly:

Gross Profit Margin (Company Filings, Author’s Analysis)

This is bad news for the stock given historical precedence:

Historically, the stock has struggled to outperform when gross margin expansion remains muted

– BoFA Analyst Vivek Arya on Micron’s Q1 FY25 results.

Q2 FY25 revenue and gross margin guidance has materially missed expectations

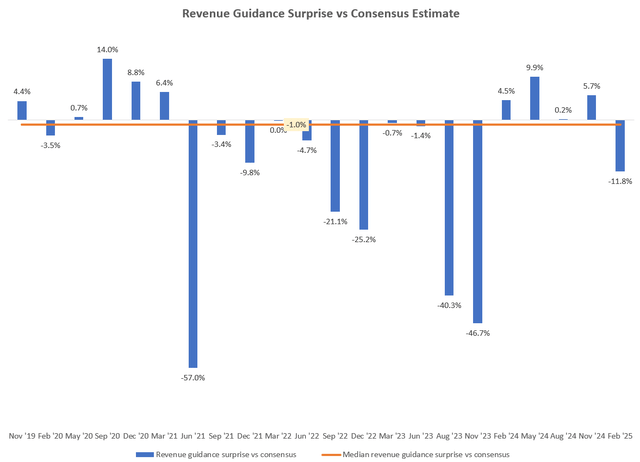

Micron missed Q2 FY25 revenue guidance expectations ($9 billion consensus vs. $7.9bn actual at the mid-point of the range) by 11.8%:

Revenue Guidance Surprise vs Consensus Estimate (Capital IQ, Author’s Analysis)

In addition to overall NAND weakness, according to Micron’s Executive VP and Chief Business Officer Sumit Sadana, the enterprise SSD segment is expected to see some inventory correction going ahead, particularly in the data center vertical. This aligns with TrendForce and DRAMeXchange’s industry commentary for Q4 CY24:

TrendForce forecasts a slowdown in enterprise SSD revenue as procurement demand begins to cool. Total procurement volume is expected to dip, with the peak buying period behind and server OEM orders being slightly revised downward. As shipment volume declines, overall industry revenue is also projected to decrease in the fourth quarter.

Particularly for Micron, customers have shifted orders toward 60TB SSDs, which are not ready yet:

Q4 may pose challenges, as some orders have shifted toward 60TB SSDs—a product that Micron is still in the process of validating with multiple clients.

– TrendForce, DRAMeXchange.

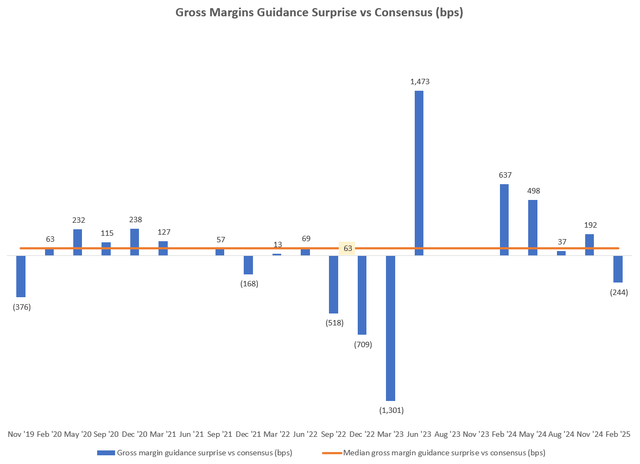

Micron missed on Q2 FY25 gross margin guidance expectations vs. consensus too (40.9% consensus vs. 38.5% actual at the mid-point of the range):

Gross Margins Guidance Surprise vs Consensus (bps) (Capital IQ, Author’s Analysis)

This is driven by continued pricing weakness in NAND, but also underproduction effects (presumably as customers sort through excess inventory) that are expected to persist for a couple of more quarters:

we expect NAND under loading to affect fiscal Q3 gross margins…

– CFO Mark Murphy in Q1 FY25 earnings call.

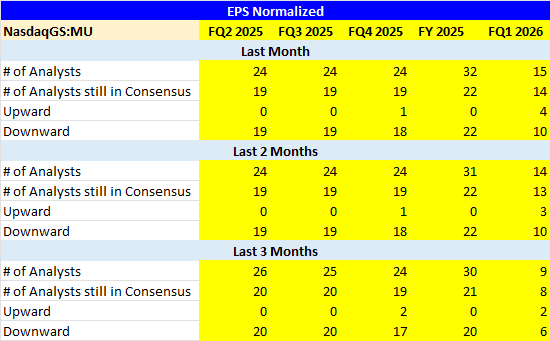

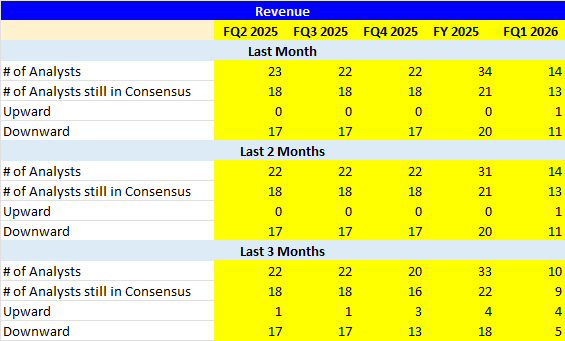

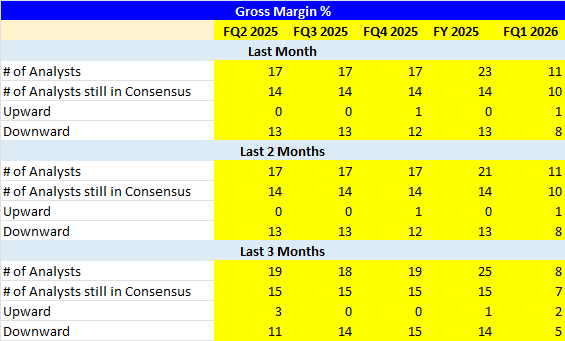

I expect a valuation multiple de-rating to follow downgrades in EPS, revenue and gross margins

Micron currently trades at a 1-yr fwd P/E of 13.36x. However, I anticipate a multiple de-rating to occur as investors may dump the stock following a barrage of downgrades to key fundamental metrics such as normalized EPS, revenues and gross margins over the next 4 quarters:

Normalized EPS Revisions (Capital IQ, Author’s Analysis) Revenue Revisions (Capital IQ, Author’s Analysis) Gross Margin Revisions (Capital IQ, Author’s Analysis)

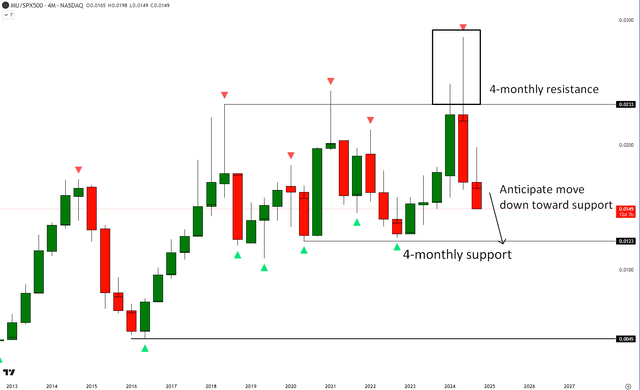

Relative technicals show MU vs. SPX500 to be moving toward the bottom of the broader multi-quarter range

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of MU vs. SPX500

MU vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Relative to the S&P500 (SPY, SPX, IVV, VOO), MU stock is en-route toward 4-monthly support after having posted a false breakout and strong rejection from the top of the range resistance. This would correspond to MU’s underperformance vs. the broader market index.

HBM demand is a key upside risk monitorable

Over the next 6 years until 2030, management expects HBM’s TAM to grow to $100 billion from the current levels of $16 billion. This corresponds to an impressive 36% CAGR. I believe Micron would be a major beneficiary as it is one of the market leaders in the high bandwidth memory (HBM) market, being one of the earlier companies along with SK Hynix to qualify its HBM3e for NVIDIA’s Blackwell products.

Indeed, in the recent earnings call, management shared bullish developments on HBM:

Our high-bandwidth memory shipments were ahead of plan, and we achieved more than a sequential doubling of HBM revenue.

– CEO Sanjay Mehrotra in the Q1 FY25 earnings call.

Hence, I identify the HBM growth drivers as potential upside risks to my overall bearish view on Micron.

Takeaway & Positioning

Ahead of Micron’s Q1 FY25 earnings release, I had a slight contrarian cautious stance on the stock. This has helped avoid danger by sidestepping the 18% post-earnings drop in MU stock.

After reviewing the earnings release and associated commentary, it is becoming clearer to me that the NAND business is likely at a cyclical peak. There should be a slowdown in orders and pricing going ahead for at least the next couple of quarters. This has been the key reason for a large ~12% and 244bps miss on Micron’s Q2 FY25 revenue and gross margin guidance vs. consensus expectations respectively. Moreover, there have been broad-based EPS, revenue and gross margin downgrades in the stock, which, I think, will result in a de-rating of the valuation multiple as investors dump MU due to a too many challenges ahead. Technically relative to the S&P500, MU is en-route downwards toward the 4-monthly support level, which implies scope for further underperformance. A key risk monitorable to my thesis is strong growth in the high bandwidth memory market, in which Micron is a leader along with SK Hynix.

Given the weak fundamentals and technicals, I rate the stock a “Strong Sell.”

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.