Summary:

- Cisco is doing what it does without much fanfare or worries.

- Cisco’s product based transformation is real and inevitable.

- 12th annual dividend increase is likely in two weeks.

- Technical indicators show a stock in consolidation.

Sundry Photography

Cisco Systems, Inc. (NASDAQ:CSCO) investors may feel like the forgotten youngest sibling in a family with three kids. Everyone is worried about the health of the oldest sibling, Intel Corporation (INTC) while marveling at the exploits of the middle sibling, Microsoft Corporation (MSFT). Those who have been following technology stocks since at least the 1990s will get why I am grouping these three companies together, as they definitely shared their growth and maturity phases, and appeared to share a common decline phase as well. Microsoft has since made a comeback of epic proportions while Intel has had severe issues, outside of its usual cyclical behavior. Cisco, on the other hand, has been going about its business as usual. Not excelling like Microsoft, but not as worrisome as Intel either.

It may not be all that bad for investors if a company flies under the radar, especially if it is in the midst of a transformation. Who would have predicted that Microsoft would turn into its current version when the stock seemed to be stuck in the $25 region for an eternity? But the ones who stuck around ended up feeling like geniuses. I am not saying Cisco will see a similar turnaround, but I am presenting a few points below that cover Cisco’s business, fundamental, and technical strengths below showcasing why the stock may deserve a place in your portfolio. Let us get into the details.

Business – Transformation

As covered in my 2022 review of Cisco, everything else being equal, you want your company to be product based (especially subscription base) than service oriented. Why?

- Products tend to have higher margins than services over time.

- This almost always results in a higher market multiple.

- Services can be leveraged to support the products (meaning one arm of the business complements the other, but the other way around is much harder).

- Products are stickier, meaning harder to replace, than services.

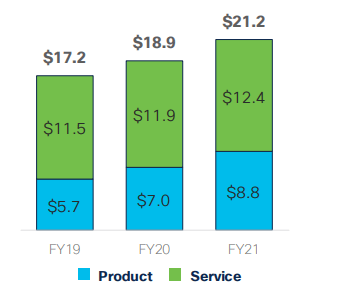

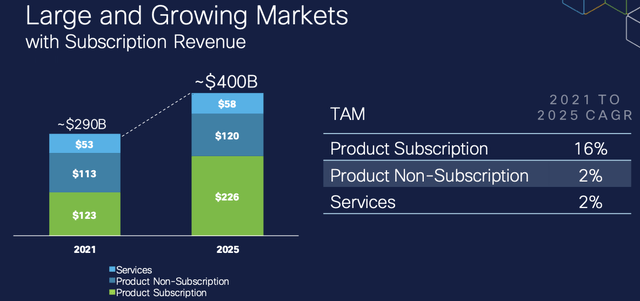

Cisco’s transformation into being a product and subscription based company is happening right in front of our eyes. The two charts shown below drive home this point. The first chart below shows that Cisco’s products represented 33% of revenue in 2019 but grew to 42% in 2021. Now, look at the second chart. It shows the Total Addressable Market (“TAM”) in services, subscription based products, and non subscription based products. It is easy to see where the growth is, and the fact that Cisco’s early numbers are showing promise is encouraging.

CSCO Prod Service (investor.cisco.com)

CSCO Transformation (investor.cisco.com)

Business – Resilience

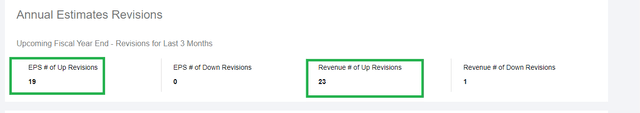

SA Contributor “The Value Investor” published an article a while ago that Cisco was surprisingly resilient. This resilience shows up in many forms, including the steady demand for its products and services, which results in steady earnings estimates and actuals. For example, it may be impossible or at least extremely challenging to find a stock with an earnings revisions history like the one below for Cisco. Another sign of this resilience is the fact that the stock is down just 12% YoY while stalwarts like Amazon.com (AMZN) and Google (GOOG) are down at least 25% in the same time frame. That Cisco never reached their heights recently goes hand in hand with the stock not losing as much ground from its highs.

CSCO Revisions (Seekingalpha.com)

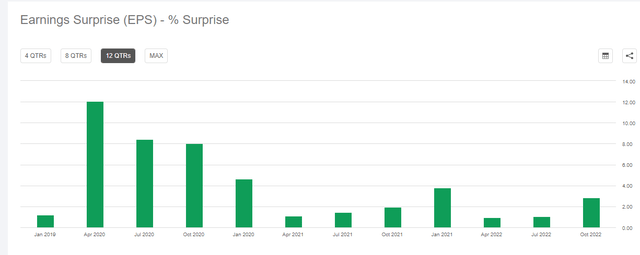

Finally, another example of the company’s resilience (also steadiness) is the fact that it has beaten earnings estimates every single time in the last twelve quarters.

CSCO Surprise (Seekingalpha.com)

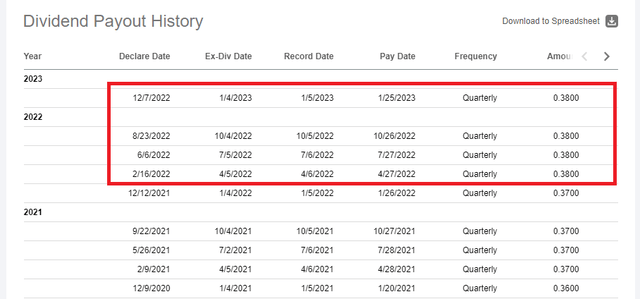

Fundamental – Upcoming Dividend Increase

Cisco has now paid the same quarterly dividend of 38 cents per share as shown below and being the dividend growth fan that I am, it only means one thing for me. A 12th annual dividend increase is likely on its way when the company announces its FQ2 2023 earnings in a couple of weeks. I look forward to covering the dividend increase in detail as outlined in this article, but for now, it suffices to say Cisco has enough room based on both earnings per share and free cash flow to offer at least a 5% dividend increase, which should place the new annual dividend and yield at $1.60 and 3.30% respectively.

CSCO Dividend History (Seekingalpha.com)

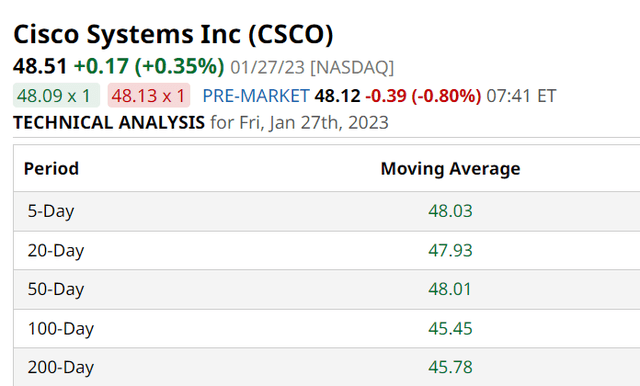

Technical Strength

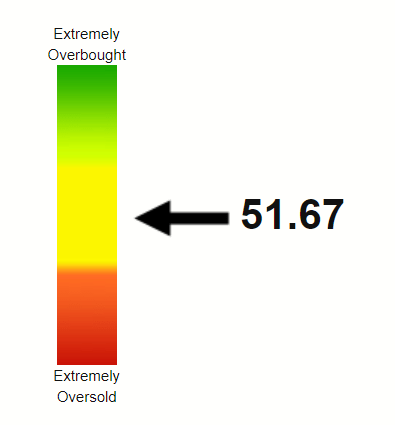

Like many technology stocks so far in 2023, Cisco is showing positive momentum, with the stock currently trading above all the commonly used moving averages. Most importantly, the stock is about 6% higher than the 200-Day moving average. This, plus the fact that the stock is having a Relative Strength Index (“RSI”) of about 50 tells me the stock has formed a nice base but is not yet ready to blast through the resistance. The upcoming earnings report is likely to decide whether the stock blasts through $50 and above or falls back to $45 and below.

CSCO Moving Avgs (Barchart.com)

CSCO RSI (stockrsi.com)

Conclusion

At a forward multiple of 13, Cisco appears cheap enough to warrant our attention here. With earnings expected to grow at 7%/yr for the next five years, the stock is not excessively priced, especially when we factor in the potential growth in the subscription based segment. The reason I don’t hold shares right now is that in its place, I own International Business Machines Corporation (IBM). By “its place”, I mean the position I had reserved in my portfolio for an old tech company that I bet on turning around. It may be too tempting to pass on Cisco if the yield approaches 4% due to a combination of dividend increase and the stock selling off. I will be watching the upcoming earnings release with interest.

Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOG, IBM, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.