Summary:

- Micron Technology, Inc. enjoys a leading position in cutting-edge AI memory technology with exposure to data center megatrends.

- The 17% share price decline opens an investment opportunity in an already undervalued company.

- Weak personal computer demand and inventory adjustments weigh on short-term outlook, but such fluctuations are typical in the industry.

- Revenue will likely return to growth mood in the second half of 2025.

vzphotos

Investment Thesis

Micron Technology, Inc. (NASDAQ:MU) reported a solid Q1 2025, with revenue and profits hitting record levels in the three months ended November 2024. However, disappointing Q2 2024 guidance weighed down on shares. Two months ago, we highlighted Micron as a compelling investment given its leading position in the memory microchip market and attractive valuation. With data center sales up 400% YoY and share price down 17% in post-market trading, our thesis remains intact.

Leading Technology

Micron’s 400% YoY Data Center revenue growth in the three months ended November 2024 confirms our original thesis that the company is at the leading edge of memory technology. Micron manufactures fifth-generation Low-Power Double Data Rate “LPDDR5X,” a type of Random Access Memory “RAM” found in the Grace H100 CPU, a vital component of the Grace Hopper H200 system. It also manufactures High Bandwidth Memory “HBM3e,” the same RAM found in the Hopper GPU, another key component of the GH 200 system. The seismic YoY growth in LPDDR5X and HBM3e suggests that Micron is a key supplier of Nvidia (NVDA) systems powering the AI data center megatrends, giving it exposure to key growth tailwinds.

Low Valuation

Micron is one of the most undervalued companies in the semiconductor space, with a forward P/E ratio of 15x, and by extension, carries the least risk for one’s portfolio. This holds true when compared to various sub-segments in the microchips market. For example, the average 1-year forward P/E ratio for Analog devices that I cover is 24x. Micron valuation is less than the least valued ticker within the analog semiconductor space.

| Company | 1-Year Forward PE |

| Marvell (MRVL) | 36.77 |

| Texas Instruments (TXN) | 32.62 |

| Analog Devices (ADI) | 28.86 |

| Broadcom (AVGO) | 26.51 |

| Infineon (OTCQX:IFNNF) | 23.8 |

| Microchip Technology Inc. (MCHP) | 23.05 |

| STMicroelectronics (STM) | 18.70 |

| NXP Semiconductors (NXPI) | 17.09 |

| Skyworks Solutions (SWKS) | 16.42 |

| ON Semiconductor (ON) | 15.30 |

Micron’s attractive valuation shines brighter when juxtaposed against Logic microchip manufacturers, such as Nvidia, Advanced Micro Devices (AMD), Arm Holdings plc (ARM), and Intel (INTC).

| Company | 1-year Forward P/E |

| Nvidia | 29x |

| AMD | 24x |

| Intel | 20x |

| ARM | 66x |

And semiconductor foundries and wafer fabrication suppliers, as shown below:

| Company | 1-year Forward PE |

| Taiwan Semiconductor (TSM) | 23x |

| GlobalFoundries (GFS) | 24x |

| Applied Materials (AMAT) | 16x |

| ASML (ASML) | 29x |

| ASM International (OTCQX:ASMIY) | 32x |

| KLA Corp (KLAC) | 21x |

While Micron’s low valuation is more aligned with other memory chips, such as Western Digital (WDC) Samsung, SK Hynix, and Microchip Technology (MCHP), none of these enjoy the growth and dynamism of Micron. Samsung (OTCPK:SSNLF), while a supplier of high-end memory chips, is facing significant challenges in other business lines, most notably its smartphone market, due to increased competition from Chinese players with high-quality, low-priced products. Western Digital (WDC), while undervalued at 9x, doesn’t have the technological edge of Micron, competing mostly in the commoditized SSD and Hard Desk Drive “HDD” markets. SK Hynix (OTCPK:HXSCF), while a formidable competitor in the HBM and DDRX markets, is a Korean-listed company lacking the market depth and analyst coverage of Micron. This leaves the latter as one of the top choices for investors seeking exposure to the memory chip market.

| Samsung (OTCPK:SSNLF) | 10x |

| SK Hynix (OTCPK:HXSCF) | 12x |

| Microchip Technology Inc. (MCHP) | 23x |

| Western Digital (WDC) | 9x |

Kioxia recently went public in Japan, raising $800 million, valuing the company at $5 billion. Although the company’s shares rose on its first trading day by 17%, valuing the company at 5.8 billion, this is still well below the $10 billion targeted by its major holder, Bain Capital. While part of these valuation dynamics are influenced by the broader soft valuation of memory chip manufacturers, it is worth noting that Kioxia hasn’t been profitable in four out of the five past years. This is a significant differentiator when juxtaposed against Micron’s valuation.

Q1 2025 Results

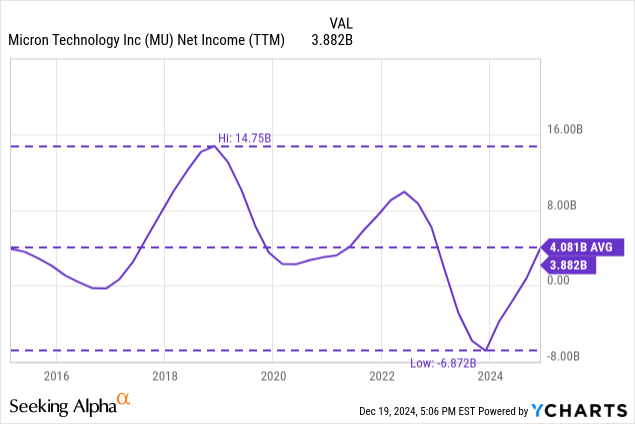

Micron set record sales in the three months ended November 2024, reaching $8.7 billion, up 84% YoY and 12.1% sequentially. Net income stood at $1.87 billion, or $1.67 per share, a significant improvement from last year’s 1.23 billion loss on the back of last year’s inventory write-off which pulled Micron to the red for the first time in more than a decade. Margins improved sequentially because of improving product mix on the back of higher sales of the high-margined AI memory chips, which currently contribute about 55% of total sales.

Consumer demand for Personal Computer SSDs, DRAMs and NAND flash memory remains weak, weighing down on growth. Having said that, nothing appears out of the ordinary of a typical market cyclicality. The slowdown is broad-based, with Micron maintaining its market share in a sluggish market.

This cyclicality also extends beyond consumer electronics, with Micron forecasting $7.9 billion plus/minus $200 million in sales in Q2 2025, suggesting moderation in data center demand. Gross margins are expected to remain relatively stable in Q2, reflecting a stable product mix compared to Q1 2025.

Balance Sheet, Capital Allocation, and Dividends

Micron has a solid balance sheet, with 7.6 billion in Cash and Cash equivalents, weighed against roughly $14.5 billion in interest-bearing debt. Operating cash flows stood at $3.2 billion during the quarter. Management spent nearly all of its operating cash flows on Capital expenditure “Capex,” leaving just about $112 million in Free Cash Flows, which wasn’t enough to cover the $131 dividend, pushing the cash payout ratio above 100% during the quarter. The company recently increased its Capex estimates for FY 2025 to $14 billion, as it continues to ramp up capacity, especially for HBM products used in data centers.

Final Thoughts and How I Might Be Wrong

Micron reported spectacular Q1 2025 results for the three months ended November 2024. The company expects a slight decline in sales in Q2 2025, with growth resuming in the second half of the year, prompting a 17% stock price decline, which, I believe, doesn’t mirror the fundamental strength of Micron’s market position. Such fluctuations are within the normal course of business, mirroring inventory digestion as its customers launch their new products. Micron manufactures the DDRX and HBM used in NVIDIA’s AI systems, and inventory buildup is often followed by demand adjustments.

Having said that, Micron is currently expanding its production capacity, and with every change comes risk. The fixed cost profile will change as the company builds HBM manufacturing facilities. If utilization rates fall below breakeven, Micron is at risk of becoming structurally unprofitable. On the other hand, this manufacturing expansion opens an opportunity to solidify its position with companies seeking stable supply chains and guaranteed capacity.

In terms of dividend coverage, I think that Capex will likely moderate, bringing the Cash Payout ratio below 100%. Overall, I think Micron’s leading memory technology, strong balance sheet, low valuation, and exposure to secular AI tailwinds, offers a compelling investment opportunity going into 2025.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.