Summary:

- Micron’s Q1 FY 2025 earnings report revealed Q2 guidance below analysts’ forecasts, leading to a significant stock drop.

- Inventory build-up by PC and smartphone manufacturers impacted Micron’s near-term revenue and earnings.

- Management forecasts robust revenue growth and improved profitability in the second half of FY 2025, presenting a buying opportunity.

- The stock is a buy for risk-tolerant investors.

vzphotos

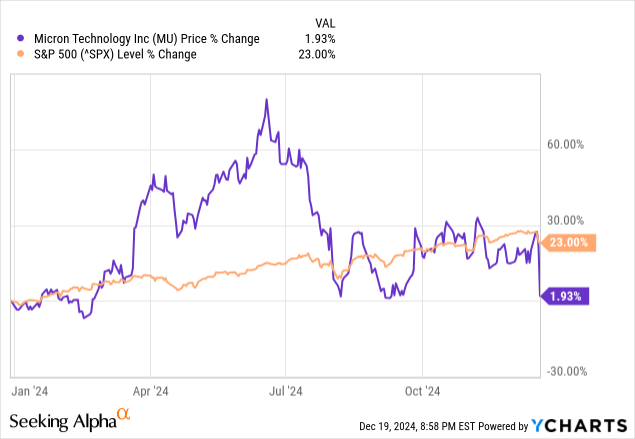

Several of the short-term worries that I identified in the last article I wrote about the company in October played out in Micron’s (NASDAQ:MU) (NEOE:MU:CA) recently reported first-quarter fiscal year (“FY”) 2025 earnings report. The market’s concerns showed up in the second quarter of FY 2025 guidance that was substantially under analysts’ forecasts. The fact that the Federal Reserve hinted that it would lower rates next year less than initially projected did not help the market’s mood. The stock responded by dropping 16% the day after reporting earnings to $87.09. The stock price is only up 1.93% year-to-date as of December 19 compared to the S&P 500’s (SPX) 23% rise.

The good news is that management projects robust revenue growth and improved profitability in the second half of FY 2025. This article will discuss why Micron’s first half of FY 2025 will produce lackluster results and why results should improve in the second half. It will also discuss the company’s fundamentals from the first quarter FY 2025 report, risks, valuation, and why investors may have an excellent opportunity to buy Micron at the current price.

Short-term worries materialize

Chief Executive Officer (“CEO”) Sanjay Mehrotra predicted at the Deutsche Bank Technology Conference on August 28, 2024, that PC (Personal computer) and smartphone manufacturers would build up High-Bandwidth Memory (“HBM”) Dynamic Random Access Memory (“DRAM”) inventory in preparation for manufacturing AI PCs and smartphones. During the summer, manufacturers bought more HBM DRAM and NAND chips than they needed in anticipation of memory manufacturers raising prices. By building up inventory, manufacturers can lengthen the time before they go out and buy those same chips at higher prices. Computer and smartphone manufacturers’ building inventory can negatively impact Micron, making it harder to raise prices and generate more revenue until manufacturers draw down their inventory.

CEO Mehrotra also said the following at the Deutsche Bank Technology Conference:

We have shared before and as is well known in the broad industry reports that consumer retail channels, industrial, automotive tend to be relatively weaker right now, as well as China has some weakness too. But overall, there are long — strong longer-term trends in industrial in automotive markets again driving healthy content growth, as we look ahead into the future.

The weakness in “consumer retail channels, industrial, automotive” appears to have extended into the first quarter. On the first quarter FY 2025 earnings call, CEO Mehrotra said the following about PCs: “The PC refresh cycle is unfolding more gradually, and we expect PC unit volume growth to be flattish in calendar 2024, slightly below prior expectations.” He said the following about automotive: “Lower than expected automotive unit production, combined with a shift toward value-trim vehicles from premium models and electric vehicles (EVs), has slowed memory and storage content growth and resulted in inventory adjustments at OEMs.” CEO Mehrotra also discussed industrials: “Industrial market demand continues to be impacted by inventory adjustments, and we expect a recovery in this market later in calendar 2025.” His overall prediction was that bit shipments, the storage capacity of all the units shipped, would be flat sequentially in the second quarter.

The inventory build-up and weaker consumer demand have likely put downward pressure on DRAM memory chip prices, contributing to second-quarter revenue and earnings guidance below analysts’ expectations.

The weakness of consumer retail also extended to Micron’s NAND memory business. NAND is a type of computer memory that retains its memory when a user turns the power off. Computer, phone, and consumer device manufacturers use NAND in solid-state memory drives. CEO Mehrotra said the following about NAND memory on the first quarter earnings call (emphasis added):

Our outlook for industry NAND bit demand growth in both calendar 2024 and 2025 is now in the low double-digits percentage range, which is lower than our prior expectations. Key drivers include slower growth in NAND content in consumer devices, ongoing inventory adjustments and demand dynamics in different end markets, as outlined earlier, and a temporary moderation in near-term data center SSD purchases by customers after several quarters of very rapid growth.

Slower NAND bit demand has led to a supply demand imbalance, necessitating the overall industry to reduce supply to restore balance. As a result, Micron will reduce supply. CEO Mehrotra said on the earnings call:

We have reduced NAND capital expenditures (“CapEx”) versus prior plan and have slowed the pace of technology node transitions. In addition, we are reducing NAND wafer starts by a mid-teens percentage versus prior levels. These actions will align our supply to current market demand.

The above statement is terrible news for the company’s NAND business in the short term.

The market should improve in the second half of FY 2025

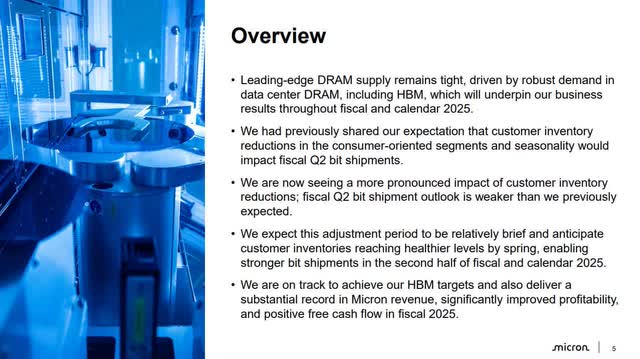

Micron First Quarter FY 2025 Investor Presentation

Although the company’s revenue growth and profitability may disappoint in the first half of 2025, investors should be optimistic about Micron for several reasons. Revenue growth in the data center remains robust. CEO Mehrotra said the following on the earnings call about the data center business:

We have upgraded our view of server unit percentage growth and now expect it to reach low teens in calendar 2024, fueled by strong AI demand as well as a robust traditional server refresh cycle. And we anticipate server unit growth to continue in 2025. Micron achieved new records in both total data center revenue and the revenue mix for data center in fiscal Q1. Our portfolio of high-capacity DRAM products, including monolithic die-based 128 gigabyte DIMMs and LP5-based server DRAM products, continues to see robust demand and remains on track to generate multiple billions of dollars in revenue in fiscal 2025. We made excellent progress on HBM, more than doubling our revenue sequentially during the quarter and exceeding our plans as a result of solid execution on yield and capacity ramps. In fiscal Q1, our HBM gross margins were significantly accretive to both DRAM and overall company gross margins.

Artificial Intelligence (“AI”) chip manufacturers use HBM DRAM chips because of their greater power efficiency and speed advantage over traditional DRAM, which is needed for rapid data transfer between the processor and memory, enabling faster processing of large language models. NVIDIA (NVDA) uses Micron’s HBM3E 8H in its Blackwell B200 and GB200 platforms, which NVIDIA only started shipping at the beginning of the fourth quarter of calendar year (“CY”) 2024. Micron also started high-volume shipments to a second customer in December 2024 and will soon begin shipping to a third customer in the first quarter of CY 2025. CEO Mehrotra also discussed the prospects for HBM moving forward on the earnings call:

We have increased our HBM market TAM estimate to now exceed $30 billion in 2025, and we continue to expect to achieve HBM market share commensurate with our overall DRAM market share sometime in the second half of calendar 2025. As we have said before, our HBM is sold out for calendar 2025, with pricing already determined for this time frame. In fiscal 2025, we expect to generate multiple billions of dollars of HBM revenue.

The data center memory business can potentially drive outsized growth for several years. As for the company’s laggard consumer segment business, it expects revenue growth to return to the PC, mobile, and industrial markets in the second half of FY 2025.

Overall, management expects robust DRAM bit demand growth in the mid-teens percentage range in calendar 2025. The company expects CY 2025 DRAM industry bit supply to grow roughly in line with bit demand, which is generally favorable for pricing and profitability. The proliferation of AI drives an increasing demand for high-performance HBM memory. Since Micron’s business tilts more towards DRAM than NAND, CY 2025 should eventually end as an excellent year for Micron.

Although NAND may have short-term issues, it still should be a significant long-term growth driver. If you are familiar with Pure Storage (PSTG), you may understand that NAND flash memory drives will likely displace hard disk drives in the data center over the next few years, driving long-term growth in this memory category.

Company fundamentals

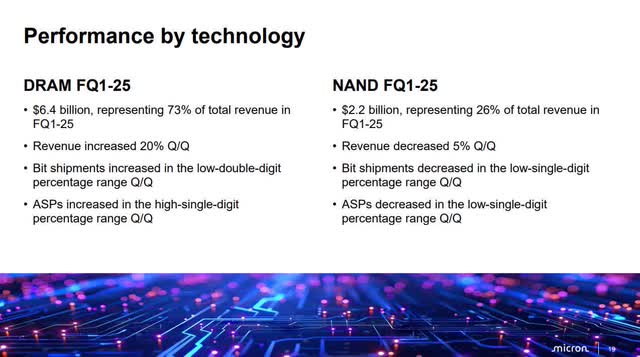

Micron First Quarter FY 2025 Investor Presentation

The company’s DRAM business, the locomotive for Micron’s growth, increased revenue by 20% sequentially. Bit shipments rising in the low double-digit range indicate higher sales volumes and solid demand for Micron’s DRAM chips. ASPs (average selling prices) growing in the high single-digit range sequentially means the company raised the prices for its DRAM chips during the quarter, increasing profitability.

Micron’s NAND revenue decreased by 5% sequentially. Lower first-quarter bit shipments indicate lower sales volume and declining demand for its NAND products, which negatively impact revenue. ASP’s sequential decrease means the company lowered prices for its NAND, negatively impacting profitability.

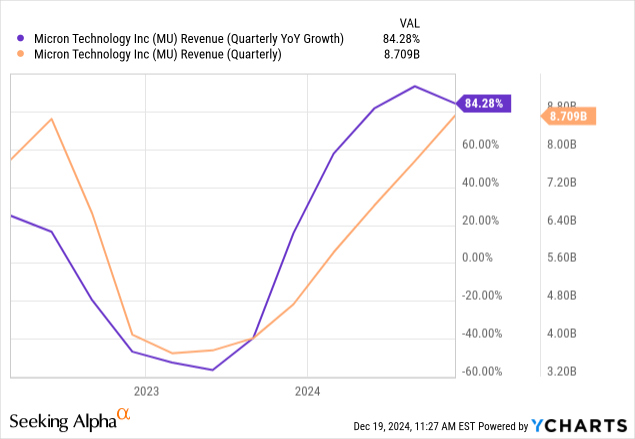

Micron’s first quarter FY 2025 revenue grew 84% to $8.71 billion, beating analysts’ estimates by $11.74 million.

The company also measures revenue by business unit. The star of the show was its Compute and Networking Business Unit (“CBNU”), which accounts for over 50% of its business. CBNU grew 46% sequentially to $4.4 billion, a quarterly record. Cloud server DRAM demand and HBM revenue, which more than doubled sequentially in the quarter, fueled CBNU revenue growth.

Mobile Business Unit (“MBU”) revenue was down 19% sequentially to $1.5 billion. The mobile business is in the middle of an inventory correction, and the company has shifted supply from the MBU to CBNU to meet data center demand. Embedded Business Unit revenue was down 10% sequentially to $1.1 billion. Auto, industrial, and consumer customers are in an inventory correction. Storage Business Unit (“SBU”) revenue was up 3% sequentially to $1.7 billion, a quarterly record. Demand for data center solid-state drives drove SBU revenue.

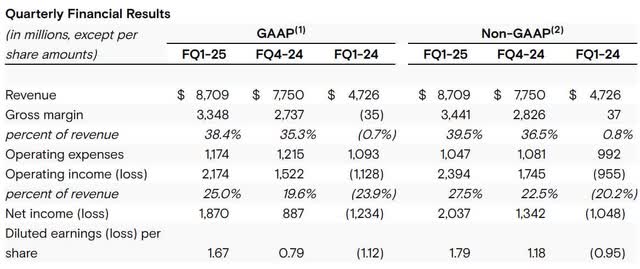

Micron First Quarter FY 2025 Earnings Release

Management prefers to emphasize non-GAAP (Generally accepted accounting principles) metrics on earnings calls and their guidance. Most of the difference in Micron’s GAAP and non-GAAP metrics in its first quarter results came from stock-based compensation (“SBC”). Still, the company’s first quarter FY 2025 SBC as a percentage of revenue was 2.53%, which is relatively low in the tech industry.

The company’s non-GAAP gross margins expanded three points sequentially to 39.5%. Chief Financial Officer (“CFO”) Mark Murphy said on the first quarter earnings call, “Gross margin improvement was driven by higher pricing in DRAM, improved product mix to data center in both DRAM and NAND, offset partly by lower pricing in NAND.”

Micron’s first-quarter operating expenses dropped $34 million sequentially to $1.05 billion. On the earnings call, the CFO attributed the drop to “lower labor-related costs and ongoing tight expense control.” Its non-GAAP operating income grew 37% sequentially to $2.39 billion. Non-GAAP operating margins expanded five points sequentially to 27.5%.

The company’s first quarter FY 2025 non-GAAP diluted earnings-per-share (“EPS”) grew 52% sequentially to $1.79, beating analysts’ estimates by $0.02. In the year-ago quarter, Micron produced a loss per share of $0.95. The company’s first-quarter adjusted EBITDA (earnings before interest, depreciation, and amortization) was $4.4 billion. Adjusted EBITDA margin expanded 265 basis points sequentially and 31 points year over year to 50.6%.

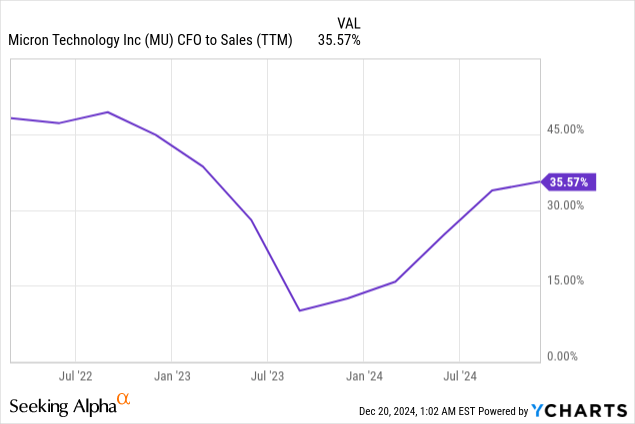

Micron’s first quarter FY 2025 trailing 12-month (“TTM”) cash from operations (“CFO”) to sales was 35.57%. The following chart shows that the company’s cash-generation capabilities are returning after an industry downturn in 2023.

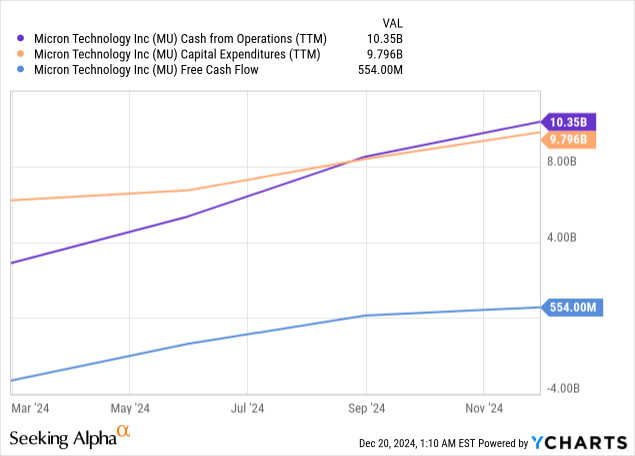

Micron’s TTM CFO was $10.35 billion, TTM CapEx was $9.79, and TTM FCF was $554 million.

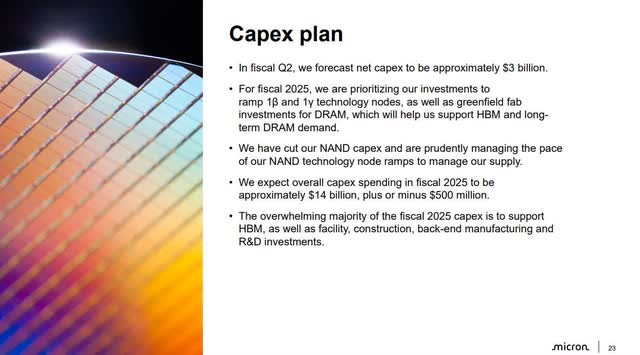

The company spent $3.2 billion in CapEx in the first quarter of FY 2025. Management forecasts that the second-quarter FY 2025 CapEx will be around $3 billion.

Micron First Quarter FY 2025 Investor Presentation.

The good news is that management plans to invest heavily in DRAM chips. Micron uses 1β DRAM process technology in its HBM3E memory chips. As stated earlier in this article, NVIDIA’s Blackwell chips incorporate HBM3E memory chips. The company will use extreme ultraviolet (EUV) lithography to manufacture its 1γ technology node, which will be in its next-generation memory products. These advanced nodes will help it stay on the cutting edge of producing the highest-density, fastest-speed, and lowest-power-consumption chips. Tom’s Hardware website states:

Micron pins a lot of hope on its 1γ DRAM process technology and hopes that usage of EUV will enable it to build the industry’s smallest DRAM cell, which will be a major competitive advantage for its upcoming memory chips as it will enable the company to build the cheapest and more energy efficient memory devices in the industry.

The company’s investment in this area is good news for investors, as it should help keep Micron on the cutting edge of the types of DRAM chips used in AI data center applications. The bad news is that management cut its NAND CapEx, which means this business has reduced revenue growth potential in the near term. However, in the long term, reducing CapEx could help restore a better supply demand balance and set Micron up for long-term growth in NAND.

Micron First Quarter FY 2025 Investor Presentation.

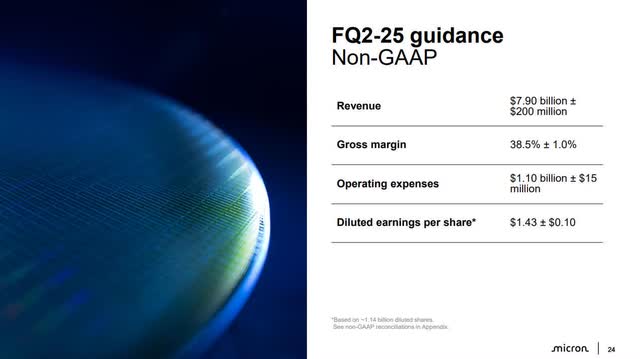

Management’s second-quarter revenue guidance of $7.9 billion was well below analysts’ estimates of $9.03 billion before earnings — a massive disappointment to the market. Analysts also forecasted an EPS of $1.97 before the earnings release and were not too happy to see management’s guidance of $1.43. A primary reason that the stock dropped after the earnings release was that analysts and investors expected a significant upturn in the memory market. The big disappointment came in understanding that a big upturn may still be several quarters away.

Valuation

A cyclical stock like Micron is challenging to value because of the large cyclical swings in revenue, earnings, FCF, and rapid changes in investor sentiment. Take the valuations below with a grain of salt because the company is still coming off an industry downturn. If the memory market starts hitting on all cylinders, the stock could move quickly from looking overvalued or fairly valued to undervalued. However, if the recovery in the memory market stalls and is less than investors’ expectations, Wall Street may wildly overvalue Micron at current prices.

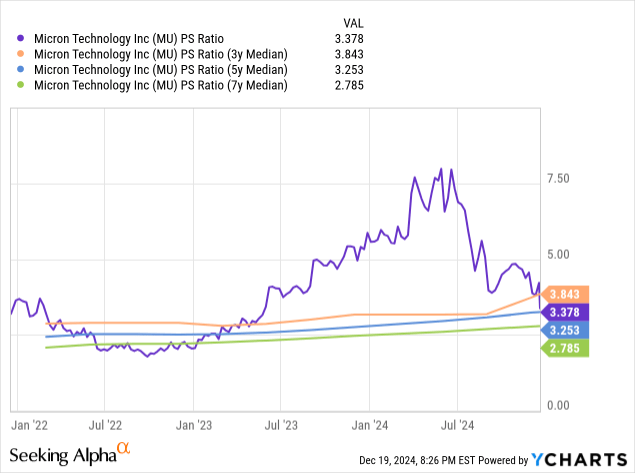

Micron’s price-to-sales (P/S) ratio as of December 19’s close is 3.378, below its three-year median, slightly above its five-year median, and well above its seven-year median. After its post-earnings drop, some might consider the stock fairly valued.

Micron’s price-to-earnings (P/E) is 25.16, well below the IT sector median of 30.24 and the average semiconductor P/E of 33.8. As a result, some may conclude that the market undervalues the stock.

Micron’s one-year forward price-to-earnings-to-growth (“PEG”) ratio is 0.14 (Micron’s one-year forward P/E of 8.97 divided by its FY 2026 analysts’ estimated EPS growth rate of 65.97%). Since its one-year forward PEG ratio is well below 1.00, some investors might consider this stock grossly undervalued.

If Micron’s one-year forward P/E matched its FY 2026 estimated EPS growth rate (a one-year forward PEG ratio of one), the stock price would be $763.93, up 777% over its December 19, 2024 closing price of $87.09. However, be careful about assuming that the stock will jump over 700% in one year. The market understands that the stock is cyclical and that the cycles are hard to predict. Investors may place a high discount on the uncertainty of Micron’s memory business, and may never value it at a PEG ratio of one.

Considering the stock’s cyclical nature and the uncertainty of some of the company’s end markets, the market fairly values the stock at current prices.

Risks

Micron has a significant business outside the U.S. market, with 80% of the company’s 2024 revenue generated from products shipped to customers outside the U.S., so the company has substantial geopolitical risk. The U.S. or foreign governments could potentially restrict sales of goods or services to one or more customers outside the U.S. market. One example of this risk was when China banned infrastructure operators from purchasing Micron products.

The Chinese government has invested heavily in developing a domestic semiconductor industry, especially in the memory market, since memory chips may be simpler to replace than logic chips. Some Chinese government investments include flash memory provider Yangtze Memory Technologies and DRAM memory provider ChangXin Memory Technologies. Eventually, Chinese homegrown companies may compete with Micron on a global stage. Considering these companies may receive government subsidies, they may have a competitive advantage.

Micron is a Buy

Since memory chip stock prices can be volatile, only risk-tolerant investors should consider this stock. Conservative investors should steer clear. Although the company has a potentially high upside in an up memory chip market, it has an extreme downside when the market turns sour.

An investment in Micron today involves believing it is still early in recovering from one of the memory chip industry’s severest downturns. When memory markets are in an upcycle, bit shipments are rising, and ASPs are rising, the company’s revenue growth and profitability can be significant. I classify cyclical stocks like Micron as a high-risk, high-reward investment. I maintain my Buy rating on Micron for risk-tolerant growth investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.