Summary:

- Tesla is the world’s largest EV maker and has an emerging solar, storage and potentially even a robotics business in the future.

- The company reported strong financial results in the fourth quarter of 2022, as it beat both revenue and earnings growth estimates.

- Its stock is undervalued inartistically according to my valuation model.

jetcityimage

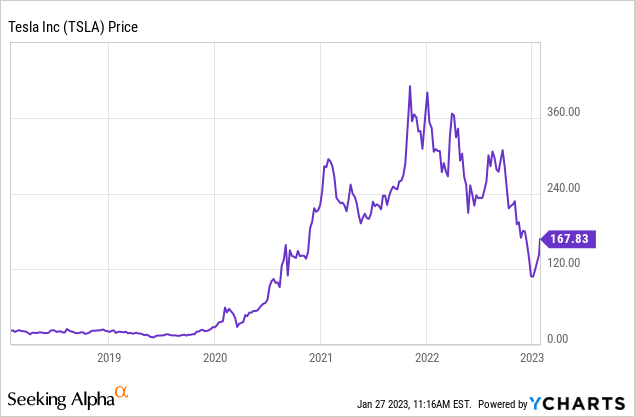

Tesla (NASDAQ:TSLA) is the world’s largest EV marker and a true technology titan. The company recently reported strong financial results for the fourth quarter of 2022, as it beat both top and bottom line growth estimates despite concerns about flagging demand. Tesla’s share price plummeted by 72% from its all time highs in November 2021, but since the start of 2023 its stock has popped by 48% on strong momentum. Despite the partial rebound, my valuation model indicates Tesla stock is undervalued and has many competitive advantages from its full self driving technology to manufacturing efficiency. In this post I’m going to break down its recent financials, before diving into my valuation model, let’s dive in.

Growing Financials

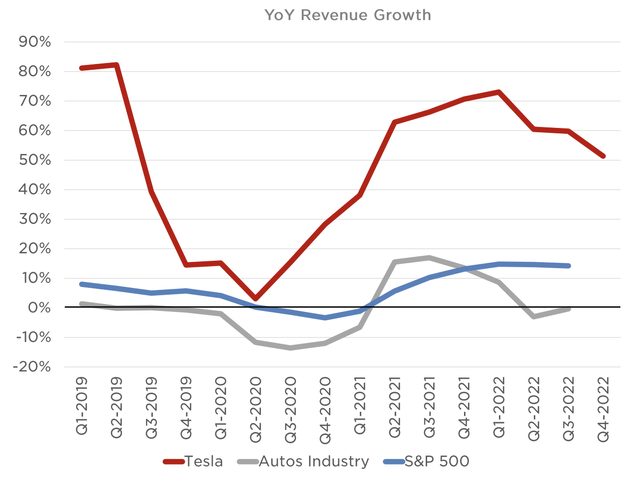

Tesla reported strong financial results for fourth quarter of 2022. Revenue was $24.32 billion, which beat analyst estimates by $17.21 million and increased by a solid 37.24% year over year. This was slower than the prior quarters growth rate of 55.49%, but still solid overall given the macroeconomic environment. The chart below shows the auto industry has reported virtually flat revenue growth in the recent quarter (on average) and previously only reported ~19% growth. The S&P 500 average revenue growth was ~15%, which is significantly less than Tesla. As Tesla is a large part of the S&P 500, they are also dragging up this average.

Tesla Revenue growth vs Auto Industry (Q4,22 report)

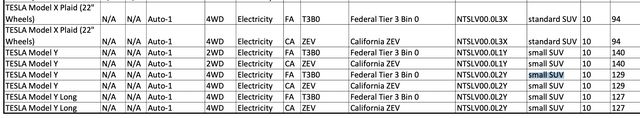

Breaking down the revenue in more granular detail, Tesla reported 49% year over year growth in its regulatory credit revenue to $467 million. This was driven partially by tailwinds from the Inflation reduction act offered by the U.S. government. This offered a $7,500 EV tax credit scheme for US vehicles with U.S made batteries, which helped make Tesla vehicles a more cost effective purchase. It should be noted not all Tesla vehicles are eligible for the tax credit. According to EPA data, the Tesla model Y is classed as a “Small SUV”. However, the IRS seems to be classifying the 5 seater variant different to the 7 seater variant. Therefore the “manufacturers suggested retail price” [MSRP] price cap is $55,000 for the small SUV or 5 seater Tesla and $80,000 for the 7 seater model. At the time of writing, the Tesla Model Y, long range now starts at $52,990 as I believe Tesla has reduced its price to fall under the $55,000 threshold and thus it is now eligible. However, the Model Y performance starts at ~$56,990 and thus would likely be “not eligible”. The incentive scheme is very complicated and continuously evolving, it also varies by state. I would suggest, checking out the Tesla’s official state list and requirements and the IRS details here for further information. The rules will also be changing again in March so stay tuned for updates. Either way my investment thesis is not based upon the extent of tax credits, Tesla is no longer as reliant on this as it once was in its early days.

Tesla EPA data (EPA) Tesla Vehicles Eligible (Verge (tax credit data))

Given climate change is a hot topic and many governments such as the U.K and U.S.A have introduced plans to ban new fossil powered vehicles by 2030 and 2035, Tesla is in a strong position. Traditional automakers will now be required to spend millions of dollars on capital expenditure in order to convert their plants over to make them more suitable for the manufacture of EV vehicles at scale. Tesla has a strong first mover and technological advantage from this regard as the company has focused on EV manufacturing in a vertically integrated way from its inception.

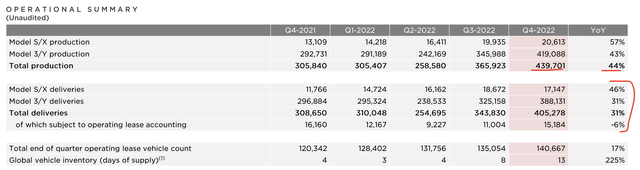

Moving onto vehicle deliveries, in Q4,22 Tesla reported total deliveries of 405,278 vehicles which increased by 31% year over year, and was a record quarter.

Vehicle Deliveries (Q4,22 report)

These vehicles deliveries were driven primarily by the Model 3/Y, which reported 388,131 vehicles which increased by a rapid 31% year over year. The Model S/x has also started to increase in popularity, as deliveries rose by 46% year over year to 17,147.

Vehicle Deliveries 2 (Q4,22 report)

The company also reported strong production figured of 439,701 vehicles in the quarter which increased by 44% year over year. This is a major feat as Elon Musk has stated in the past that building a prototype is “relatively easy”, but scaling production is the “hard part”. I personally agree with this statement as someone who has worked in the automotive industry in the past. Manufacturing at scale as many challenges from sourcing components to quality control, cost efficiency and labor. For example, a single component quality failure can cause huge disruption and expensive product recalls. Tesla has even suffered with quality issues itself during the “ramp up” phase of production. Tesla has also experienced production issues in the past, for example its Shanghai factory reported an extensive production delay, due to the hard lockdown policy in China in mid 2022.

The positive for Tesla is its “vertically integrated” model has helped to improve the reliability of the companies supply chain and save on costs. For example Tesla has previously purchased land rights on areas where Lithium can be mined, a key component in batteries. On the manufacturing side, Tesla has created unique technology such as the “Gigapress”, which minimizes the number of discrete components which need to be welded together. This innovation continuous and thus traditional auto manufacturers will likely be playing catch up in the EV manufacturing space. Recently Tesla announced a huge $3.6 billion investment into its Nevada plant.

Despite Tesla producing strong production and delivery numbers, there were some signs of lower demand which were apparent. For example, in December Tesla reduced the shifts of its gigafactory workers and delayed recruiting of talent in Shanghai. In addition, reports indicate Tesla reduced its production rate in January 2023, due to lower demand, after previously slashing its vehicle prices in China.

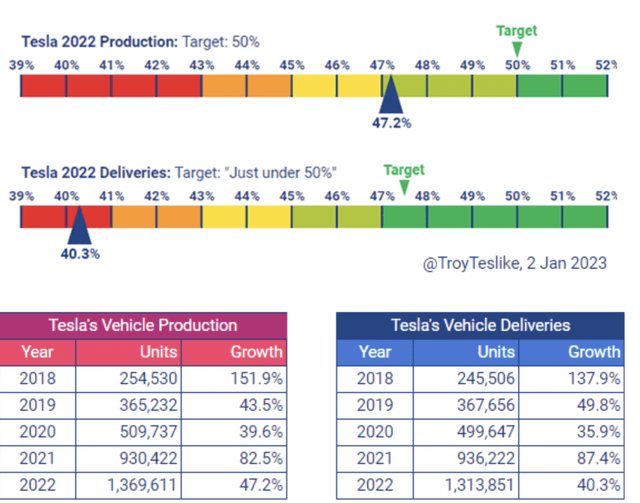

The graphic below shows Tesla’s full year production growth rate target was 47.2%, which was slightly lower than managements target of 50%. However, its 2022 deliveries grew by 40.3% year over year, which was substantially lower than the target of “just under 50%”, outlined by management. This divergence indicates lower demand. A positive for Tesla, is I believe this demand drop is primarily driven by the macroeconomic environment and uncertainty. In addition, the EV market is still forecast to grow at a rapid 22.5% compounded annual growth rate [CAGR] and reach a value of $1.1 trillion by 2030.

Tesla Deliveries (TroyTeslike using Initial Delivery numbers released pre earnings)

Moving onto Tesla’s other segments, the company reported “record growth” of 152% in its energy storage deployed to 2,462 MWh. For the full year of 2022, Tesla has deployed over 6.5GWh of energy storage, up from just 4GWH in 2021. Tesla’s solar deployed also increased by a solid 18% year over year to 100MW. Energy storage and Solar roofs are not a huge part of Tesla’s current business but it has a large total address market. Biden previously outlined plans to derive close to 45% of all U.S energy from Solar by 2050, up from just 3% in 2021. Solar and wind energy which are transient by nature, thus they require storage to ensure steady/stable electricity long term. Estimates indicate that the global energy storage market will grow by 15 fold by 2030.

Autonomous Driving

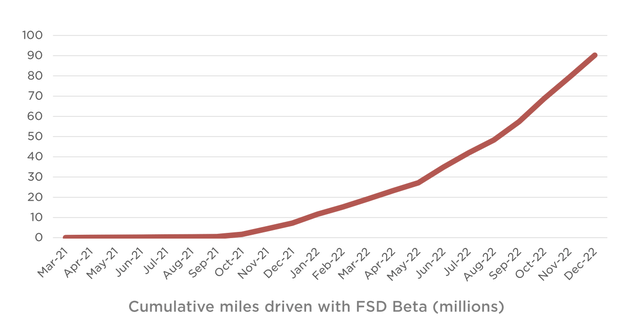

I estimate that Tesla has a higher chance of mastering autonomous driving than almost any company on the plant. I believe this is due to its vast number Tesla vehicles on the road which are always “learning”. For example, Google’s Waymo completed 10 million miles of driving in 2020 (in a single year) and 10 million miles in the prior 10 years. This may sound impressive but given Waymo only had around 700 registered vehicles on the road in 2021, the company is trailing Tesla massively. For example, if we just analyse Tesla’s latest full self driving beta program. This has racked up over 90 million miles by the end of the fourth quarter of 2022, substantially more than Waymo. The beauty of Tesla is the company has a strong culture with its customers. Tesla drivers will happily test and volunteer for feature testing. However, I believe if traditional automakers tried to get this kind of adoption they would struggle and law suits would be plentiful. Tesla’s full self driving beta, has been rolled out for around 400,000 customers across North America.

Full Self Driving (Q4,22 report)

Profitability and Balance Sheet

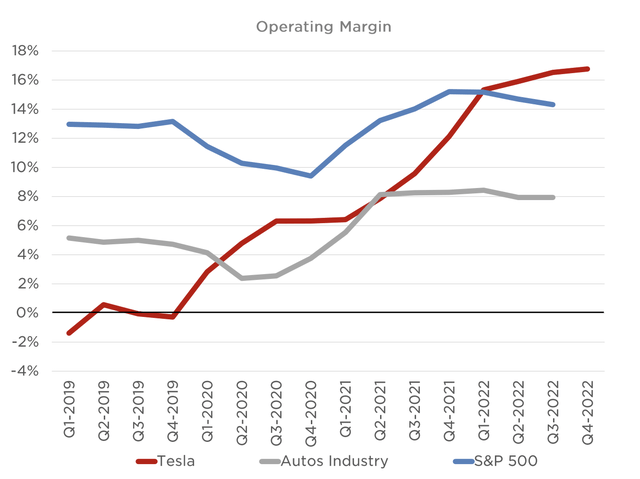

Tesla reported earnings per share [EPS] of $1.07, which beat analyst estimates by $0.02. Tesla has in the past been the centre of a debate as to whether it is an “automotive company” or a technology company. Let’s look at the facts, Tesla derives the majority of its revenue from the sale of automotive vehicles. However, when we review its operating margin of ~17%, this is substantially higher than the automotive industry average of 8%. Now although, this is driven partially by the aforementioned vertical integration and manufacturing prowess. Tesla has a strong “technology base”, as its self driving technology is charged as an upsell. This is only expected to increase in price in the future as the technology improves and offers a lucrative blue sky opportunity.

Operating margin (Q4,22 report)

Tesla reported an increase in its Cost of Goods Sold [COGS] per unit year over year. This was driven by an increase in lithium prices, as-well as early ramp up inefficiencies in its Austin and Berlin factories. The mix of vehicle sales has also tilted more towards the Model Y, which is slightly more expensive to manufacture than the Model 3. Overall, I don’t deem these to be major issues and its ramp up issues should at least get solved as production scales.

Tesla has a fortress balance sheet with $22.185 billion in cash and short term investments. In addition, the company reported total debt of ~$3 billion, but this is management given the profitability and strong cash position.

Valuation

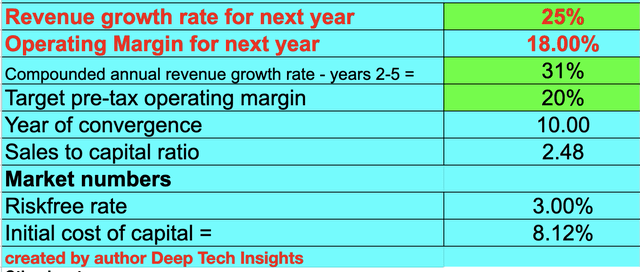

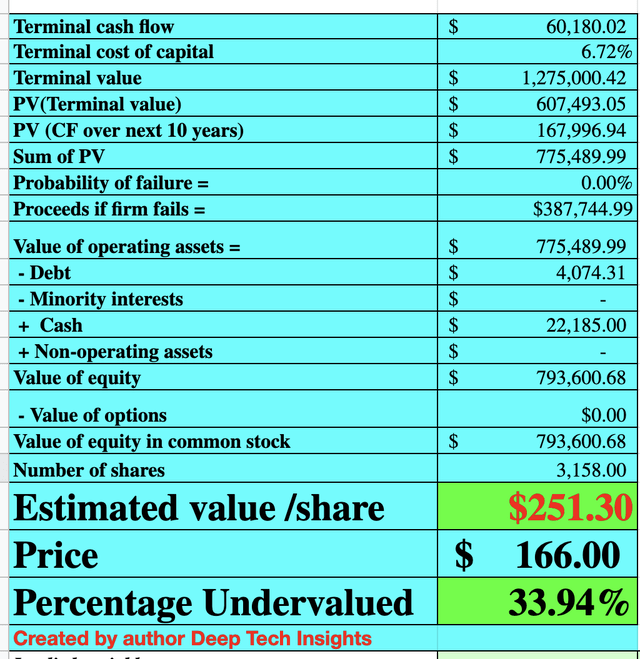

In order to value Tesla I have plugged its latest financials into my discounted cash flow valuation model. I have forecast 25% revenue growth for “next year” which is 2023 in my model. This is slower than the prior growth rate of over 37%. Therefore this is fairly conservative given the lower demand signals and forecasted recession, I will discuss this more the “Risks” section.

Tesla stock valuation 2 (created by author Deep Tech Insights)

To increase the accuracy of the valuation model, I have capitalised R&D expenses which has lifted net income. In addition, I have forecast 31% revenue growth per year in years 2 to 5, as I expect continued secular growth trends in the EV market to continue. I have also forecast the operating margin to increase by 2% year over year. Again, this is fairly conservative and I expect this to be driven by upsells to its self driving product and over the air software product improvements. Tesla is also working on a humanoid robot called Optimus, which adds immense optionality to the stock.

Tesla stock valuation 2 (Created by author Deep Tech Insights)

Given these factors I get a fair value of $251/share, the stock is currently trading at $166/share at the time of writing and thus is ~44% undervalued.

I believe the stock is trading lower than its “fair value” mainly due to macroeconomic uncertainty regarding demand and potential competition (discussed in the risks section). Also the market is not fully taking into account the “optionality” in the stock with regards to self driving vehicle technology, its robotic technology, manufacturing innovation and Tesla’s strong brand. In my estimates I have been fairly conservative and really only taken into account growth of its core automotive business. Elon Musk’s work with Twitter is also likely impacting Tesla’s stock negatively, as most investors would like to see more focus in my opinion.

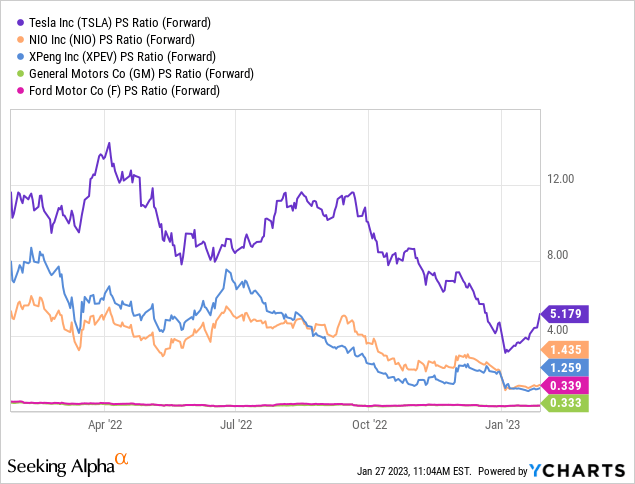

Tesla also trades at a forward price to sales ratio = 5.179x, which is 38% cheaper than its 5 year average. Tesla does trade at a higher price to sales ratio, than Chinese EV makers such as NIO (NIO) and XPeng (XPEV), but Tesla has much greater scale and a stronger global presence. Tesla also trades at a higher valuation, than traditional automakers such as General Motors (GM) and Ford (F), but as mentioned prior Tesla has higher margins and is growing substantially faster.

Risks

Recession/Competition

Many analysts have forecast a recession for 2023 and thus I do expect lower demand for all vehicles including Tesla’s. The good news is the economy and automotive industry tends to be cyclical so I expect this to rebound. Tesla is also facing strong competition, from players in China such as NIO, BYD and Xpeng, which I have discussed in a prior post. In addition, the Ford F-150 pickup has been the best selling vehicle in the U.S.A in previous years and Ford is launching an electric version which could eat market share away from Tesla.

Final Thoughts

Tesla is an automotive powerhouse which has continued to produce exceptional financial results despite a tough economic backdrop over the past few years. Tesla has also continued to grow its “technology moat” and has “innovation” in its blood, which can often be an overused buzzword. Elon Musk is a talented founder who truly does live and breath the company. Given Tesla’s stock has experienced a huge sell off and its stock is undervalued, it looks to be a great long term investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.