Summary:

- Nvidia Corporation’s GPUs have powered the birth of a game-changer: OpenAI’s ChatGPT – the Generative AI causing a buzz in the tech world.

- Microsoft Corporation and Nvidia unite to unleash a “massive cloud AI supercomputer,” showcasing Nvidia’s unrivaled AI prowess.

- Nvidia’s ChatGPT hype speeds towards commercialization, outpacing last year’s metaverse/omniverse buzz.

- Is Nvidia’s growth premium sustainable, or will the hype bubble burst?

Justin Sullivan

NVIDIA Corporation (NASDAQ:NVDA) stock has outperformed the S&P 500 (SP500) since it bottomed in October, up more than 90% through its highs last week.

Bearish investors betting on a further decline must be stunned at how quickly investors have jumped back into the Jensen Huang-led company.

We believe NVDA’s outperformance is closely linked to the hype surrounding OpenAI’s ChatGPT. Keen investors should know that the Generative AI platform is trained on Nvidia’s GPUs. As such, investors optimistic about the potential of Generative AI have likely joined the recent buying frenzy.

Deep learning is also “expected to get bigger and more profitable.” As the clear leader in the AI ecosystem, Nvidia is well-positioned to benefit from the hype (even if it doesn’t translate to significant revenue generation yet in the near term), lifting its valuations further.

Citigroup (C) even highlighted that further advances in ChatGPT’s developments by OpenAI and Microsoft (MSFT) could see Nvidia gain a potential $3B to $11B in revenue over the next twelve months.

Microsoft has also committed to driving monetization and adoption of its progress with OpenAI’s advanced AI models across Azure and its suite of products and services. Despite the recent layoffs, CEO Satya Nadella & team reportedly invested another $10B into OpenAI.

Hence, investors who expect the proliferation of Generative AI across enterprises and applications could see the need for more Nvidia GPUs.

In addition, Meta Platforms’ (META) use of AI to overcome the signaling challenges due to Apple’s (AAPL) App Tracking Transparency has seen constructive developments. The WSJ reported recently:

Heavy investment in artificial intelligence tools has enabled the company to improve ad-targeting systems to make better predictions based on less data, according to the interviews and documents. The company is shifting to forms of advertising less dependent on harvesting user data from off its platforms. – WSJ.

As such, despite the curtailment of enterprise IT spending due to significant macro headwinds, strategic AI investments requiring Nvidia’s ecosystem could move to the forefront as companies look “to quickly and economically grow AI production at scale to drive business growth.”

Therefore, AI-first companies may need to build close partnerships with Nvidia as they explore opportunities to develop their strategic AI edge, as seen in Microsoft’s collaboration with Nvidia, announced in November 2022.

Baidu, Inc.’s (BIDU) announcement that it’s ready to launch its ChatGPT-style chatbot demonstrates that China is highly advanced in AI. With Google potentially releasing its first Generative AI products in 2023, we believe it’s clear that ChatGPT is moving beyond hype and into productization.

With this in mind, we believe it’s clear why NVDA has recovered so quickly, as the bears likely didn’t anticipate ChatGPT’s public preview release to take the world by storm.

But, the critical question for NVDA investors has always revolved around its steep growth premium.

At an NTM EBITDA of 53.4x or an NTM normalized P/E of 49.5x, we believe NVDA is expensive.

Nvidia has surged significantly from its July 2022 lows of less than 27x, in line with its 10Y average of 27.1x.

Hence, we believe the reward/risk of adding NVDA now seems much less attractive than four weeks ago, when we revised our rating to a Buy.

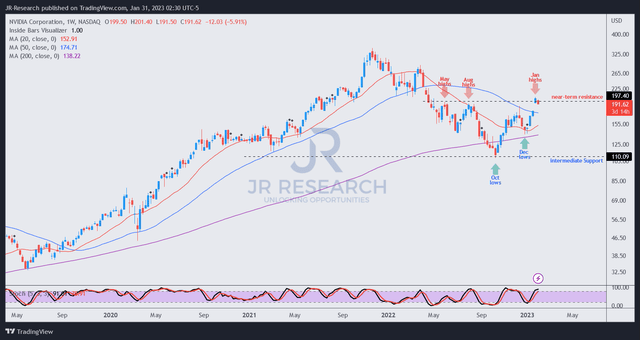

NVDA price chart (weekly) (TradingView)

The silver lining in NVDA’s medium-term price chart is we believe its October lows will not likely be revisited.

Its rapid recovery over the past four weeks sent NVDA surging to re-test its May and August 2022 highs, likely drawing some breakout traders/investors looking for a decisive upside break.

However, we urge investors to avoid chasing the momentum surge, as a pullback looks increasingly likely, with last week’s top a potential bull trap forming.

Despite that, NVDA formed a higher low in December, suggesting that the trend of lower lows from November 2021 is likely over.

The next steep pullback will be your opportunity to add if you missed the lows in October and December. With the upcoming Fed meeting, Powell could grant patient investors the chance to add on weakness if he returns with his hawkish feathers dousing the recent optimism on an earlier-than-expected Fed pivot.

Rating: Hold (Revise From Buy).

Disclosure: I/we have a beneficial long position in the shares of NVDA, META, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!