Summary:

- Alphabet has been making a massive investment in buybacks for the last few quarters.

- In the trailing twelve months, Alphabet has spent close to $60 billion on buybacks which is the second-highest amount after Apple.

- If Alphabet’s free cash flow continues to grow at a steady pace, we could see total buybacks of close to a trillion dollars in this decade.

- Apple has been able to expunge 40% of its outstanding stock since starting the buybacks, allowing the EPS to grow by 66% on a standalone basis.

- It would be important to note the buyback pace of Alphabet in this quarter to gauge the future scale of this program and its impact on Alphabet’s EPS.

400tmax

Alphabet (NASDAQ:GOOG) has made a bit bet in increasing the buyback program. The company has already spent close to $60 billion on buybacks in the trailing twelve months. Apple (AAPL) is in first place in terms of buybacks with $85 billion allotted to it over the last four quarters. It is likely that Alphabet’s management wants to replicate Apple’s strategy by having a steady increase in buybacks as the free cash flow increases over time. Since the start of its buyback program, Apple has expunged 40% of its outstanding stock which has helped to increase the EPS by 66% on a standalone basis.

The recent dip in Alphabet’s price in the last quarter might have caused the management to modify the buyback pace. If Alphabet continues at the current buyback scale, it would be in a position to expunge 5% of its outstanding stock in 2023 at the current price. While buybacks alone do not guarantee that a company will be able to outperform the broader market, the strong fundamentals of Alphabet along with the tailwinds of buyback can certainly improve the long-term growth trajectory of the stock.

Taking a stand

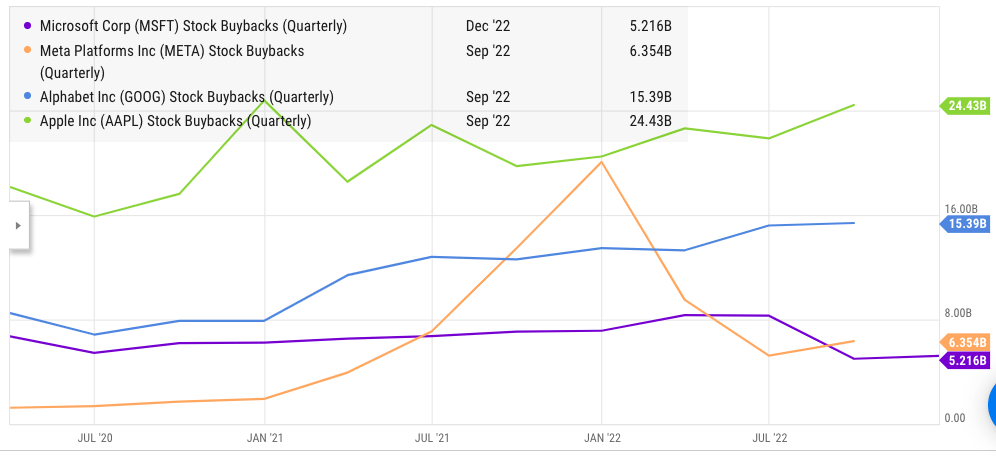

Some of the major tech companies have employed a buyback program as an option to return massive cash reserves to their shareholders. Apple, Microsoft (MSFT), Meta (META), and Alphabet have the highest buyback programs. However, Meta and Microsoft have reined in the buyback program in the last few quarters as they try to conserve cash amid broader tech downturn.

Ycharts

Figure 1: Decline in buyback pace in Meta and Microsoft while Alphabet and Apple continue to ramp up buybacks.

Alphabet has seen a sharp stock price correction in the last quarter. This would be a test for the management whether they choose to slow down the buybacks or retain the current level.

Alphabet’s unique position

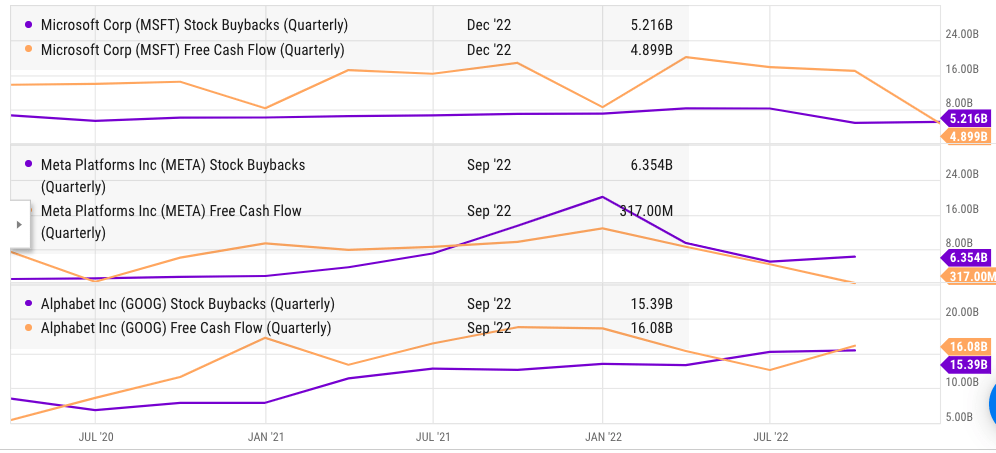

Alphabet is in a unique position because it has healthy free cash flows and there are few business verticals that require massive investment. Meta is trying to invest heavily in virtual reality which requires the company to conserve cash. Microsoft is also investing massively to close the market share gap with Amazon’s cloud operations. Amazon is investing in its logistics and video streaming services. On the other hand, Alphabet is producing significant free cash flows which do not require a similar scale of investment.

Alphabet might increase investment in Other Bets like Waymo but there are limits to prudently investing in these projects.

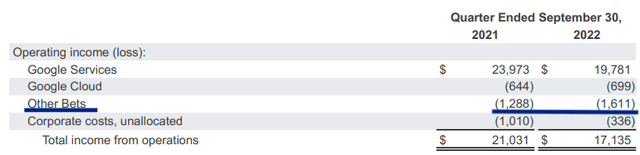

Figure 2: The company already reported $1.6 billion loss in Other Bets out of a total operating income of $17 billion in the last quarter.

Ycharts

Figure 3: Alphabet has a relatively stable free cash flow which meets the requirement for buyback program.

A trillion-dollar question

It is difficult to gauge the future scope of the buyback program. The management has not given a clear answer and it might also depend on the trajectory of the stock price and free cash flow of the company. A steady growth in free cash flow might give the management greater room for a hike in buybacks. It is certainly possible that Alphabet might end up investing close to a trillion dollars in buybacks in this decade.

This can expunge 40% to 50% of the outstanding stock and lead to 70% growth in EPS on a standalone basis over the entire decade. On an annualized basis, the buyback program alone could give a tailwind of 6% to 7% for the EPS. This should be taken into consideration while looking at the long-term potential of Alphabet stock.

Impact on stock trajectory

Buybacks alone have not been sufficient to deliver returns that beat the broader market. There are several stocks that relied heavily on buybacks like Exxon (XOM). However, long-term returns for them have not outpaced S&P 500. Hence, it is important to look at the fundamentals of the company. Alphabet has successfully weathered the dip caused by Great Recession and the pandemic. It is likely that the decline in ad spending due to recent inflationary pressures will be transitionary and Alphabet will regain the YoY growth trajectory once it faces easier comps from the previous year.

The Google Cloud revenue has also reached $7 billion in the last quarter or $28 billion on an annualized basis. The operating margin in this segment is negative 10% compared to the average 30% operating margin of Amazon’s (AMZN) AWS. It is highly likely that Google will be able to close this massive margin gap as it achieves better economies of scale.

Ycharts

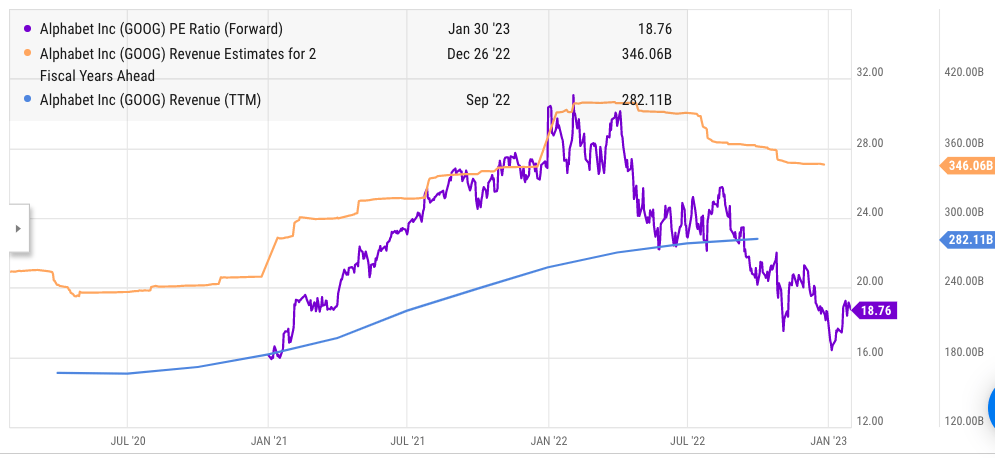

Figure 4: Future revenue growth estimates and forward PE ratio.

Despite the tech slowdown, the future revenue growth estimates of Alphabet are quite strong. The stock is trading at a modest forward PE ratio of 18.7 compared to close to 30 a year back. The long-term fundamentals and the strong tailwind from buybacks can help the stock deliver above-average returns over the next few years.

Investor Takeaway

Alphabet has been investing heavily in its buyback program. One of the key reasons behind it is that it has a massive cash pile which does not require investment in new initiatives launched by the company. It is possible that Alphabet will invest close to a trillion dollars in buybacks over this decade which can give an EPS tailwind of 6% to 7% annually.

The fundamentals of the company are also quite strong with Google Cloud showing strong growth and an annualized revenue rate of $28 billion. As the margin gap with Amazon and Microsoft is reduced, Google Cloud could be another cash cow for the company. The headwinds faced by advertising business are likely to be transitionary and the company should start showing good double-digit growth as demand returns within the market. The stock is trading at a modest price point which makes it a good long-term buy and hold option.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.