Summary:

- The general narrative in the financial media (and the White House) is, apparently, that “Big Tech is dead” while oil is evil and massively profitable.

- That being the case, investors may be surprised to learn that Google generated $16.02 billion in free cash flow in Q4. That was $3.75 billion more than Exxon.

- Meanwhile, Google’s results were somehow “disappointing” while Exxon’s results were “so good” they were denounced by the White House.

- My point is this: Investors who want to build and hold a well-diversified portfolio for the long term should not be dissuaded from doing so by false narratives based on cherry-picked data.

- Google will likely trade down today after a 7.3% rally Thursday and in light of its Q4 “miss.” GOOG is a BUY on the pullback – and here’s why.

Justin Sullivan

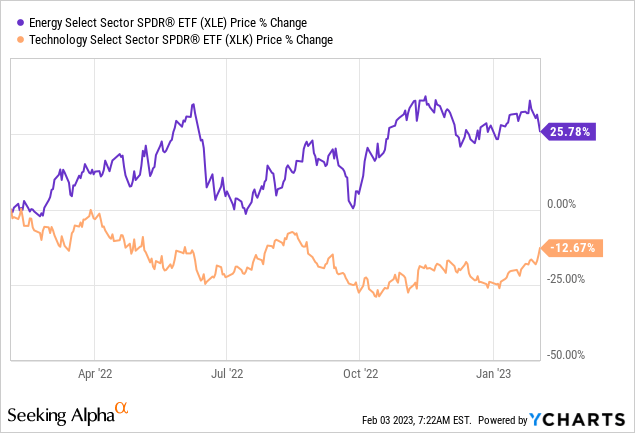

After the 2022 bear-market mauling of the technology sector, and the corresponding huge out-performance by oil and gas stocks (see graphic below), the general consensus in the financial press appears to be that “Big Tech is dead” and that investors should get ready for a decade where “hard assets” will dominate investing. And while Big Tech’s Q4 reports released this week were – in general – “weak,” I thought it might be good to give investors another perspective: Google (NASDAQ:GOOG) (NASDAQ:GOOGL) generated $16.02 billion in free-cash-flow during Q4 – $3.75 billion more than Exxon (XOM). Yes, of course the two companies are in drastically different businesses, but the FCF profiles are interesting given the financial media is pushing oil Google gas as “the place to be” and that Big Tech is in decline. Well, all I can see is: “Long Live Big Tech.”

As the graphic above shows, the SPDR Energy Select ETF (XLE) has outperformed the SPDR Technology Select ETF (XLK) by 38%-plus over the past year. However, the XLE’s out-performance was even more pronounced prior to this year’s huge rally in tech shares. Indeed, at pixel time the Invesco Nasdaq-100 Trust (QQQ) is +17.8% YTD.

Q4 Earnings

OK, so it’s “Alphabet” … but I am old school, so please forgive me for sticking with “Google.”

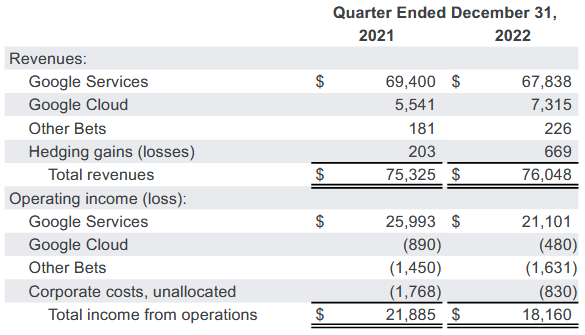

Google’s Q4 and full-year 2022 earnings report was released yesterday after the market closed and it was generally regarded as “a miss” on both the top and bottom lines:

- Revenue of $76.05 billion (+1.0% yoy) missed consensus by $440 million.

- GAAP EPS of $1.05/share missed by $0.14, and was down from $1.53/share in the year earlier quarter (-31.4%).

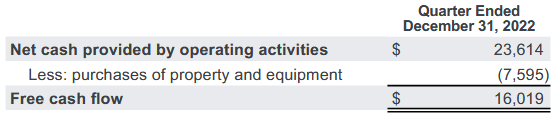

However, free cash flow generation of $16.02 billion was still very strong:

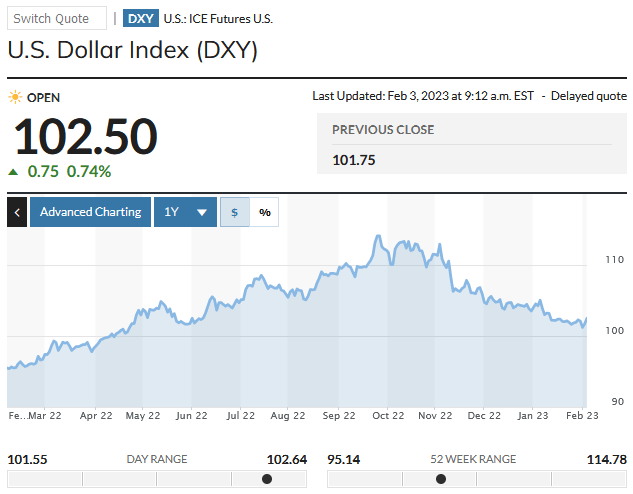

FCF as a percentage of revenue was very healthy 21.1%. In my mind, that’s impressive given that foreign currency was a 7% headwind due to the strong U.S. dollar, and was especially heavy (13%) in Google’s second largest geographical segment (EMEA – Europe, the Middle East, and Africa). In constant currency terms, Google grew revenue across the board in every geographical segment and at a 7% rate on a consolidated basis.

On an operating segment basis, and as mentioned earlier, while top-line revenue was relatively flat, Google Cloud revenue grew 32% yoy:

However, as seen in the graphic, Google Cloud still lost $480 million, but that was a big improvement from an $890 million loss in the year earlier quarter. The Google Services Segment, which includes the company’s Search and YouTube operations, saw operating income drop $4.9 billion yoy due to a pull-back in advertising and the aforementioned negative impact of foreign currency.

The number of employees, somewhat of a contentious issue with investors these days, grew to 190,234 by year end, up a whopping 33,734 yoy – or 21.6%. In January, Google announced it would reduce its workforce by ~12,000. In the Q4 release, the company said it expects to incur a charge of between $1.9-$2.3 billion for severance and related charges – the majority of which will be recognized in Q1 FY23.

Going forward, Google CEO Sundar Pichai’s comments on the Q4 conference call were likely a direct response to the recent ChatGPT phenomenon – the fast growing Web app ever:

First, the AI opportunity ahead. AI is the most profound technology we are working on today. Our talented researchers, infrastructure and technology make us extremely well positioned, as AI reaches an inflection point. More than six years ago, I first spoke about Google being an AI-first company. Since then, we have been a leader in developing AI. In fact, our Transformer’s research project and our field-defining paper in 2017, as well as our path-breaking work in diffusion models are now the basis of many of the generative AI applications you’re starting to see today.

Pichai then went on to talk about GOOG’s language models – LaMDA and PaLM – as well as DeepMind. He said “In the coming weeks and months, we’ll make these language models available, starting with LaMDA.” However, with the release of ChatGPT, OpenAI – and by extension, Microsoft (MSFT) – obviously got the jump on Google. It’s likely a “code-red” development for Google.

Indeed, I wrote about the big upside potential in DeepMind back in 2020 when Google’s AI Lab announced it had cracked the code on the “protein-folding problem” with a neural-network based algorithm called Alpha Fold (see GOOG: Next Stop $2,100).

However, it’s already 2023 and, arguably, Google has kept its tremendous AI assets under-wraps for far too long. That said, GOOG has long been considered a (the?) leader in AI and now it’s up to the company to accelerate the monetization of these AI assets going forward. No doubt – it’s a challenge, but also a huge opportunity.

Google ended the year with $113.762 billion in cash, or an estimated $8.79/share based on the average of 12.947 billion fully-diluted share count as of the end of Q4.

With such a strong cash position, a strong free cash flow profile, the opportunity for significant cost-efficiency improvements (i.e. headcount reduction), big opportunities in AI, and a forward P/E of only 20.8x, GOOG is a buy.

Another reason the company is a buy is because one of the primary headwinds the company has faced – the strength of the U.S. dollar – likely peaked back in September. In my opinion – and despite the rally today (Friday) on the heels of the jobs report – the U.S. dollar index is likely to fall back below 100 sooner rather than later:

MarketWatch

That being the case, GOOG will likely faces much easier yoy comparisons in the back-half of 2022.

Exxon

By comparison, Exxon had a record-year and generated $12.27 billion in FCF in Q4. With quarterly revenue of $95.429 billion, FCF was 12.9% of total revenue during the quarter. That compares to 21.1% FCF/revenue for Google, and points out the differences (and advantage) of an asset-light software business like Google as compared to an asset-heavy model like Exxon. After all, this was a “down” quarter for Google and an “up” quarter for Exxon.

Exxon ended the year with $29.7 billion in cash, or an estimated $7.18/share based on the average of 4.138 billion fully-diluted shares outstanding as of the end of the year.

Shareholder Returns

During full-year 2022, Google – which pays no dividend – repurchased $59.3 billion worth of its shares. That caused the average fully-diluted share count to fall from 13.553 billion to 13.159 billion, or by 2.91%.

On the other hand, Exxon returned $29.8 billion to shareholders with a relative 50/50 split – with $14.9 billion in dividend payments and $14.9 billion of share repurchases. That caused Exxon’s average fully diluted share count to fall from 4.275 billion to 4.205 billion, or by 1.64%.

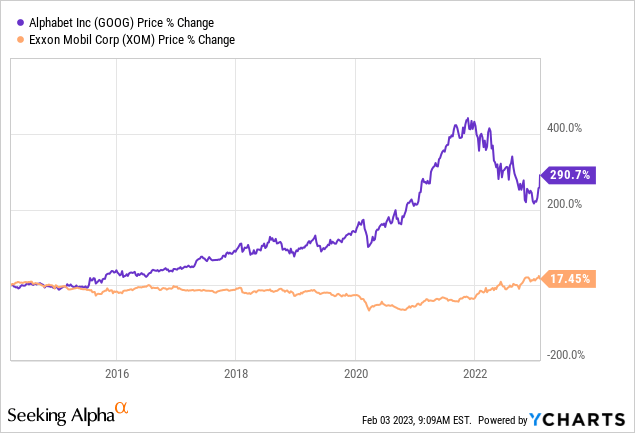

Given my recent push-back on the O&G companies that have greatly over-emphasized share buybacks over the dividend (see Chevron: What A Big Dividend Disappointment), and the fact that Google pays no dividend at all, some of my followers might accuse me of being a hypocrite for owning shares of Google. However, they should consider that the primary reason I own Exxon (and Chevron) is for income (i.e. the dividend) and to protect my portfolio from inflation because – as my followers also know – I believe that oil is the primary driver of inflation. I own Google for capital appreciation. And both stocks have done just that:

As you can see, over the past decade – and despite the 2022 bear-market mauling of GOOG and huge rally in Exxon, Google’s stock has out-performed Exxon by 270%-plus. Meantime, Exxon yields 3.27% and has increased the dividend – I believe – every year since I have owned it.

Summary and Conclusion

Some of you may be asking: So, Michael – what’s your point? My point is simple: Investors should not follow the day-to-day prognostications and narratives issued non-stop by the financial press. The key to long-term success and wealth creation is to build a well-diversified portfolio and hold it through the market’s up-n-down cycles. Google is now – and will be – just fine. So will Exxon. Both generate strong FCF.

Yet the reasons to hold each company are different (at least from my point of view). But as the clean-energy and EV transition accelerate, and because peak oil will likely happen sooner rather than later (if not already …), investors should be careful not to over-emphasize any one particular sector – especially the very cyclical O&G sector.

For the reasons mentioned earlier, and despite the current and popular narrative in the press, GOOG is a buy here.

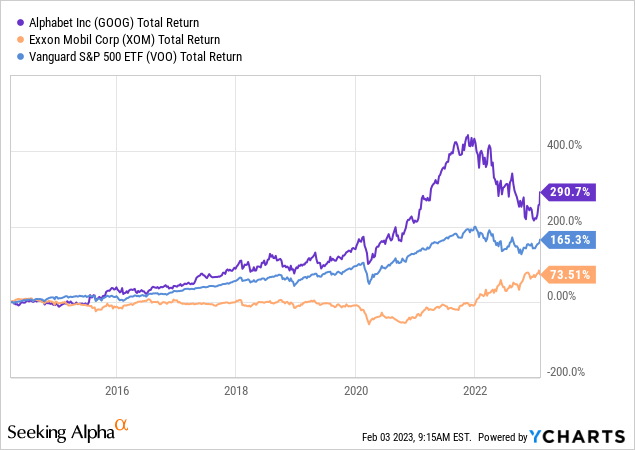

Considering the previous chart was unfair to Exxon since it pays a substantial dividend, I’ll end with a 10-year total returns comparison of Google, Exxon, and the Vanguard S&P 500 ETF (VOO):

As you can see, even when the dividend is factored into the returns, and despite the 2022 bear-market in tech and massive rally in O&G shares, Exxon has significantly lagged not only Google, but the S&P 500 outperformed XOM stock by a factor of 2.2x over the past decade. That being the case, investors should take advantage of the pull-back in GOOG and consider initiating a position or adding to an existing position. Meantime, don’t let the press scare you out of technology stocks (i.e. the “Tech Wreck”): GOOG, the QQQ’s, semiconductor companies like Broadcom (AVGO) – all of them will be big winners in the 21st Century – one that will likely driven by technology, clean-energy, and EVs – not by oil.

Disclosure: I/we have a beneficial long position in the shares of GOOG, XOM, CVX, VOO, QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.