Amazon: Recent Quarter Is A Reminder That Red Flags Should Not Be Ignored

Summary:

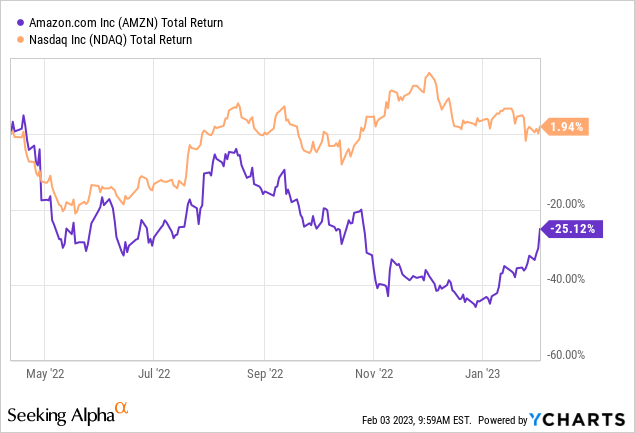

- After falling 25% since April of last year, a sudden spike in Amazon’s share price in January is sparking a fear of missing out.

- The pressure for cost-cutting measures will likely increase as profitability and free cash flow remain elusive.

- Enterprise spending is waning and competition in the cloud space is intensifying, which creates additional risks for AWS.

Noah Berger/Getty Images Entertainment

Amazon (NASDAQ:AMZN) has just reported its full year results for fiscal year 2022 and with that investor enthusiasm has cooled off as we were once again reminded that share prices could be detached from business performance.

Although AMZN is undoubtedly one of the greatest success stories of our time, this does not mean that the share price could go up indefinitely. I first warned of all the risks associated with monetary intervention back in April of last year and showed why Amazon share price was at the greatest risk of mean reversion.

Back then it was hard to conceive the idea of a massive share price decline of a behemoth such as Amazon that has also become a synonym of unprecedented growth, technological progress, and disruption. Nonetheless, this is exactly what followed.

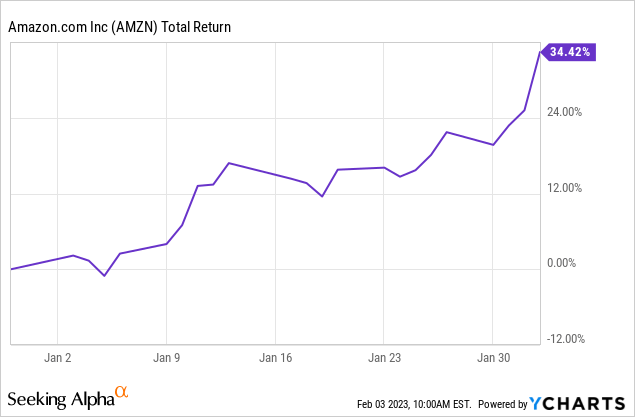

After the disastrous performance over the course of 2022, investors got a glimpse of hope this year as Amazon’s share price returned a staggering 34% in a matter of weeks.

Taken together, the massive decline of 2022 and the sharp increase in January of this year created the illusion that AMZN is trading at a significant discount and also prompted fear of missing out on a share price that is once again going vertical.

Nevertheless, Amazon’s stock price is influenced by the unprecedented amount of liquidity with the markets, and this continues to be a major driver. As far as actual business performance is concerned, I am still having difficulties turning optimistic, with yesterday’s results raising some important red flags.

Mixed Quarterly Results

It was hard to cherry-pick only the positives from the most recent quarter, even as the total net sales figure increased meaningfully.

Amazon Q4 2022 Earnings Presentation

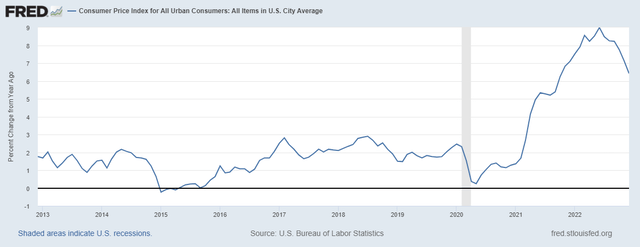

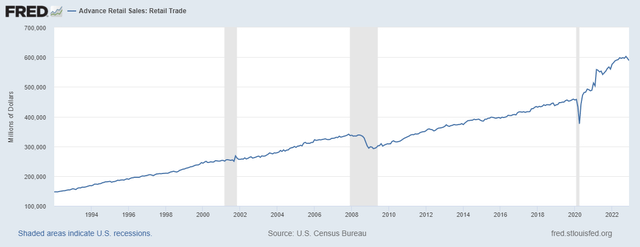

One of the punchlines from the latest quarter was the impressive 13% year-on-year revenue growth of the North America segment. As impressive as this sounds, I am not that surprised given the near double-digit inflation rate in the United States and retail sales still gravitating above the long-term trend line (see the graphs below).

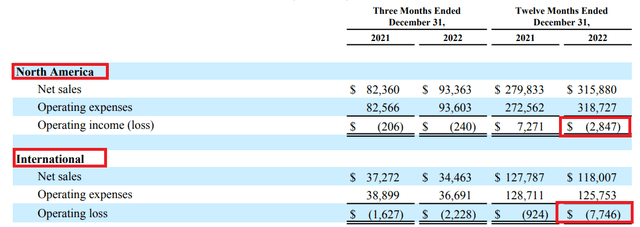

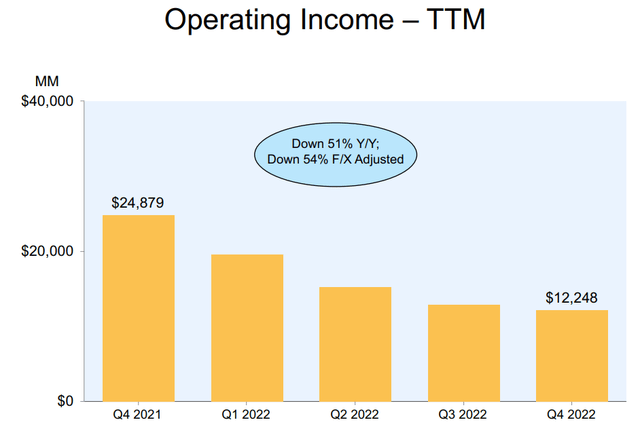

As before, one of my main concerns is Amazon’s GAAP profitability, which is still ‘just around the corner’ even as the company’s total revenue hit a new all-time high and a recession was avoided during 2022. Over the course of the year, operating income was consistently lower and hit one of its lowest levels during the last quarter.

Amazon Q4 2022 Earnings Presentation

During the call, investors got the impression that this was due to one-off items, such as the employee severance packages and impairments.

The operating income was negatively impacted by 3 large items, which added approximately $2.7 billion of costs in the quarter. This was related to employee severance, impairments of property and equipment and operating leases and changes in estimates related to self-insurance liabilities. This cost primarily impacted our North America segment. If we had not incurred these charges in Q4, our operating income would have been approximately $5.4 billion.

Source: Amazon Q4 2022 Earnings Transcript

Although this was indeed a headwind for Amazon’s margins, the exclusion of the $2.7bn expense is still not enough to turn the North America and International segments into profit and their results would still have been worse than those reported in fiscal year 2021.

Having said that, we should also bear in mind that we did have significant cost headwinds in fiscal year 2021.

As we mentioned in the last earnings call, we did see more than $4 billion in costs from inflationary pressures and loss productivity and disruption in our operations.

Source: Amazon Q4 2021 Earnings Transcript

And in fiscal year 2020 for that matter.

Our Q4 results include approximately $4 billion in COVID-related operating costs, including additional employee pay during the holidays. We continue to see productivity headwinds from physical separation and training of new employees and of course investments in PPE for employees and enhanced cleaning for our facilities. This Q4 spend brings our total COVID-related costs for the year to more than $11.5 billion.

Source: Amazon Q4 2020 Earnings Transcript

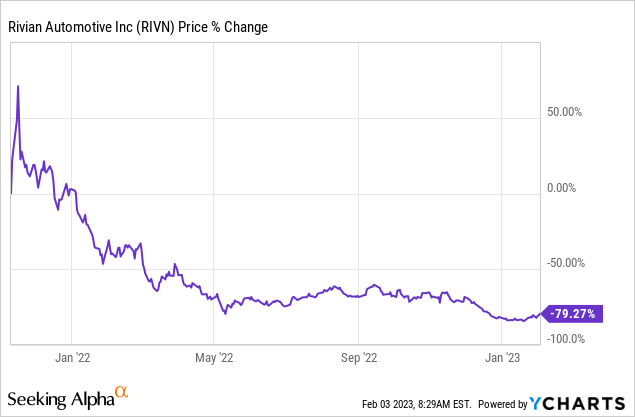

The net income figure also included a one-off pre-tax valuation loss on Rivian (RIVN) investment.

I’d point out that this net income includes a pretax valuation loss of $2.3 billion included in nonoperating income from our common stock investment in Rivian Automotive. As we’ve noted in recent quarters, this activity is not related to Amazon’s ongoing operations but rather the quarter-to-quarter fluctuations in Rivian’s stock price.

Source: Amazon Q4 2022 Earnings Transcript

Although it is fair to say that this has little do to with Amazon’s operations, it is hardly a simple “quarter-to-quarter” fluctuation, with RIVN share price losing nearly 80% of its value since the IPO.

Rivian represents a major business opportunity for Amazon, which similarly to the Amazon Studios would require enormous investments in the coming years.

The advertising business was a bright spot during the quarter, registering an impressive 23% growth over the same period a year ago.

We saw good growth in advertising revenues in Q4, up 23% year-over-year, excluding the impact of foreign exchange.

Source: Amazon Q4 2022 Earnings Transcript

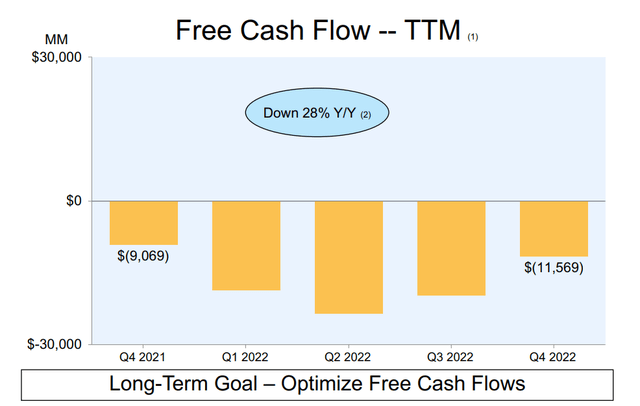

Having said all that, it was not surprising that free cash flow remained in negative territory during the quarter.

Amazon Q4 2022 Earnings Presentation

As pressure for cost-cutting measures increases and expectations of a positive free cash flow are mounting, it is also worth mentioning that the share of stock-based compensation within Amazon’s cash flow from operations reached a new all-time high during 2022 and now makes 42% of it.

Prepared by the author, using data from SEC Filings

Doing The Heavy Lifting

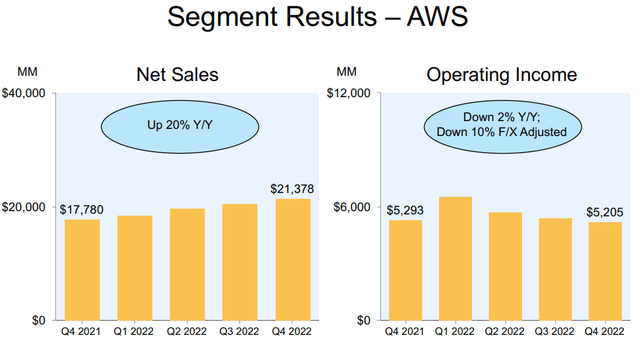

As usual, Amazon Web Services (AWS) was doing the heavy lifting in terms of profitability, and expectations to deliver were high. Topline growth within the segment did not disappoint and reached 20% over the same period a year ago, however, profitability did not follow suit.

Amazon Q4 2022 Earnings Presentation

Competition within the cloud sector has been intensifying at a time when enterprise spending is waning which creates significant risks even for the current leader in cloud infrastructure.

Starting back in the middle of the third quarter of 2022, we saw our year-over-year growth rates slow as enterprises of all sizes evaluated ways to optimize their cloud spending in response to the tough macroeconomic conditions. As expected, these optimization efforts continued into the fourth quarter.

Source: Amazon Q4 2022 Earnings Transcript

The reason why AWS’s performance is so crucial for Amazon is that the cloud business continues to subsidize the rest of the company’s business units.

Prepared by the author, using data from SEC Filings

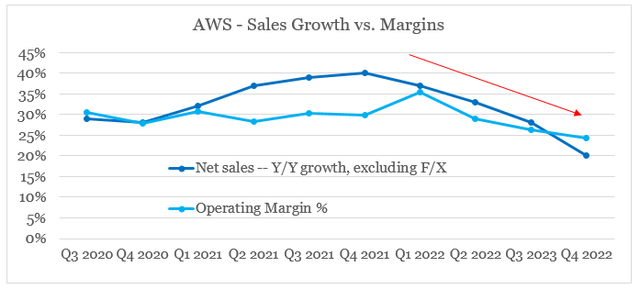

So far the cloud business continues to fire on all cylinders, however, quarterly revenue growth and margins appear to have already peaked.

prepared by the author, using data from SEC Filings

Conclusion

The massive increase in Amazon’s share price since January does not mean that all risks have suddenly gone away. While there’s always the possibility of the Federal Reserve once again turning extremely supportive, such a scenario is still within the realms of future speculations.

As far as the business itself is concerned, the red flags that I outlined back in 2022 (see here and here) are still with us, and the recent quarter only highlights some major idiosyncratic risks. On top of all that, investors should also keep in mind the probability of a recession over the next 12-18 months and properly evaluate the impact that such a scenario would have on Amazon’s business model.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.

All the research in this article is based on The Roundabout Investor strategy. An investment philosophy which finds high quality and reasonably priced investment opportunities. It capitalizes on inefficiencies in the market by avoiding short-termism, momentum chasing and narrative driven expectations.

In addition to exclusive roundabout investment opportunities, the service offers a concentrated portfolio based on the highest conviction ideas. A more holistic overview to the equity market is also utilized through the lens of factor investing techniques.

To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.