Summary:

- Tesla, Inc. enters its 13th full year as a public company with a bang.

- Even as a Tesla long, I cannot justify a 75% run in a month.

- I offer 13 reasons to be cautious about Tesla stock here.

jetcityimage

I was recently at a movie theater looking for auditorium #14 but went past it since I thought it was (the absent) #13 and ended up opening the door of auditorium #15 before my folks stopped me. What did the number thirteen ever do to these people to be treated so unfairly?

But Tesla, Inc. (NASDAQ:TSLA) has entered its 13th full year as a publicly traded company with a bang, gaining more than 75% YTD. Maybe because Elon Musk sees himself as the Devil’s Champion. As a Tesla long, I cannot be happier with the start to the thirteenth year, superstitions aside. But, read that again. 75% Year-To-Date with a full 330 days left in the year!

All of a sudden, it appears like the market is in full “risk-on” mode in the new year. I am personally convinced this run will not be the norm for the rest of the year because there is only so much money supply (thanks to the Fed) and valuation will once again begin to matter. To make things fun, I am presenting thirteen reasons to be cautious about Tesla’s stock here on in its thirteenth full year as a publicly listed company. I will break these 13 reasons into 4 business reasons, 4 stock fundamental reasons, 3 macro reasons, and 2 technical reasons. Let us get into the details.

Four Business Reasons

- Margin Erosion: I remember a lecture during my MBA days where the professor talked about two basic business models: “The Walmart (WMT) model” and “The Apple (AAPL) model.” What he meant by that is being clear in whether you are a volume-based, low-cost operator or a margin-based, high-quality operator. Tesla is sending a mixed message to the market with its recent (well received) price cuts: you cannot be luxury brand that commands a premium (company and stock) while also trying to cater to the masses beyond a point. Price cuts will only go so far before it starts impacting a business negatively, especially a premium, margin-based business. In addition, SA Contributor Sean Chandler rightly points out that Tesla’s competitors are perfectly capable of handling a pricing war.

- Demand Erosion: Yea, I know that sounds a bit contradictory to state demand erosion right after margin erosion. But Tesla’s pricing needs to be perfect over a period of time to balance attracting new customers, while keeping existing (repeat) customers happy with an eye on margin. Tesla’s drastic price cuts late 2022 and early 2023 left some existing customers fuming at the immediate drop in their car’s value. Also, despite primarily attracting largely price insensitive customers till now, Tesla’s cars are not a necessity yet and the demand is still elastic.

“The demand for Tesla cars is relatively price elastic. This means that consumers are very sensitive to the price of the product. This also means when the price is decreased, there will be a higher increase in demand, relative to the price decrease.“

- Market Share: Despite the heavy price cuts in the fourth quarter, Tesla’s overall share of the U.S EV market dropped to 65% in 2022 from the 72% it had in 2021. Don’t get me wrong, 65% is still a monstrous share but just like we are seeing in the Cloud market, first mover advantage is not eternal. I had a personal experience a few days ago where I was surprised at some of the comparable features in a Hyundai EUV at a much lesser price tag compared to Tesla. In other words, when competition catches up and your premium product becomes a commodity, you are bound to lose some of your gloss.

- The Elon Musk Problem: Some may see this as grasping at the straws but the Musk Problem is real. Twitter doesn’t have a CEO yet. Musk’s focus away from Tesla is not getting as much attention in the last few weeks because of the price cuts, resulting demand, and most importantly the stock’s recovery. But the elephant in the room is yet to be addressed and will be unlikely anytime soon given his whims and controlling nature. In addition to his own time, the fact that several key Tesla employees have been pulled into Twitter isn’t sobering. Lastly, I won’t put it past Musk to get into new lengthy legal battles for no reason except to send a message to his detractors.

Four Stock Fundamental Reasons

- Forward Multiple: A forward multiple of nearly 50 throws away my favorite comparison thesis out the window. Tesla is no longer cheaper than The Clorox Company (CLX). A multiple of 50 is increasingly harder to justify in the current economic conditions, recent market rally notwithstanding.

- PEG: That also means the stock’s Price-Earnings/Growth (“PEG”) is also no longer as attractive. With an expected earnings rate of 25%/yr, Tesla’s PEG is now 2, a far cry from the attractive 0.83 at the time of the article linked above.

- Price Target: At the current price per share of $190, the stock is just 2.50% away from its median price target. Keep in mind, this is Tesla we are talking about and analysts have generally been very generous towards the stock in terms of estimates and multiples.

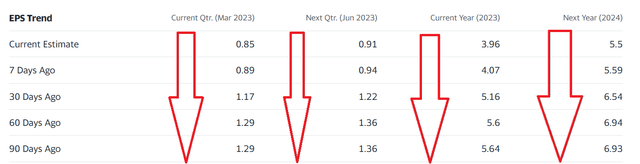

- Falling Estimates: Despite all the recent news about increasing demand due to price cuts, earnings estimates have steadily been falling as shown below. This is consistent across the board: current quarter, next quarter, current year, and next year. As estimates keep falling, stock valuation goes up.

Falling Estimates (Yahoo Finance)

Three Macro Reasons

- Market Complacency: Granted, Tesla is a much stronger company fundamentally than the traditional “meme” stocks but is undoubtedly part of the “risk-on” trade group. We are hearing more and more noise about these stocks being back. Inflation has undoubtedly cooled down and the Federal Reserve has calmed the market’s nerves with an expected 25 BPS rate hike. But it is a fool’s errand to go completely “risk-on” and bet that things will be back to 2021 levels. Don’t bet against Mr. Powell to send the market on a tail-spin at the slightest hint of him losing the inflation battle.

- Recession or Fears of One: Make no mistake about it, despite the recent price cuts, Tesla’s cars are priced to attract wealthier consumers. What is “wealthy” is up for debate as always. Just ask the 1%. But with median U.S household income at $70,000, we can be reasonable and say that the average Tesla owner’s household is wealthy (at least in comparison) with a median income of $146,000 in 2022. And most of the recent layoffs (at least the ones making headlines) have been in high-paying tech jobs, which obviously have a larger percentage of Tesla owners. Add to it the fact that Musk’s recent political stance and statements were in direct contradiction to the early adopters of Tesla. Suffice to say, the percentage of wealthier, liberal to moderate millennials and Gen-Zs have a lot more options to pick from now than they did a few years ago.

- China: China has been both a problem and solution for many companies, including Tesla. Besides the COVID lockdowns and economic policies, China’s BYD is a bigger problem than it appears now. What looked like a Golden Goose is now turning into a competitor at the global level, beginning with Europe. Europe’s intent to phase out combustion vehicles by 2035 is such an aggressive goal that it seems impossible to accomplish that without an “EV for the people”. BYD is being looked at the “Toyota of EV”, meaning one for the masses.

Two Technical Reasons

- Moving Average: Despite the monstrous YTD run, TSLA stock is more than 20% away from its 200-Day moving average. Clearly, the base has shifted technically and a 20% gain from here would make the rest of the fundamental aspects even more bloated.

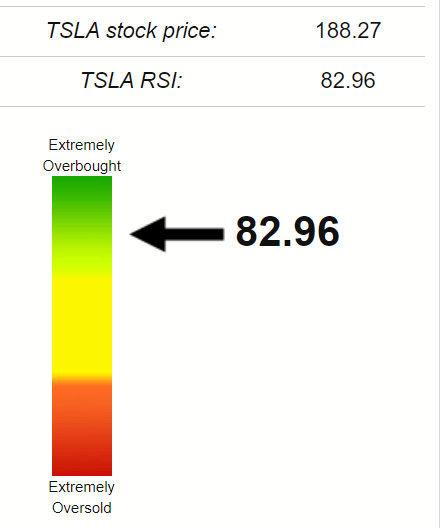

- RSI: A Relative Strength Index (“RSI”) above 70 is considered overbought. Thanks to the enormous run YTD, Tesla’s RSI is at 83 as shown below. As I’ve written in a few past articles, a high RSI is a double-edged sword as the stock has short-term momentum to go up further but is at a much higher risk of a free fall back as well.

TSLA RSI (stockrsi.com)

Conclusion

I still hold a large position in Tesla, Inc., although I recently trimmed some gains in a non-taxable account. But the fact that I still hold a position in the stock does not make me blind towards reality. Tesla’s stock has roared back in 2023, but the fundamental challenges still remain from business, competitive, and macro standpoints. In the current environment, I find it hard to justify a forward multiple of nearly 50.

Tesla, Inc. stock is a comfortable hold here for me given the recent run up, and I recommend waiting for a pullback into the $150 range if you are looking at initiating a position. At $150, Tesla’s PEG will be a more reasonable 1.50 based on expected earnings growth rate of 25%/yr for the next five years.

Disclosure: I/we have a beneficial long position in the shares of TSLA, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.