Summary:

- The operating income decline of 2022 should be at least partially reversed soon.

- The 2023 expense guidance has been lowered due a slower hiring trajectory, a lower cost of revenue and revisions with respect to facilities.

- CEO Mark Zuckerberg talked about compounding earnings in the 4Q22 call and the stock looks cheap for long-term investors if he can deliver.

Justin Sullivan

Introduction

My thesis is that Meta (NASDAQ:META) will be getting more efficient with their spending in 2023. It doesn’t mean they will stop making metaverse investments, but they are being more careful than they were in 2022.

The Numbers

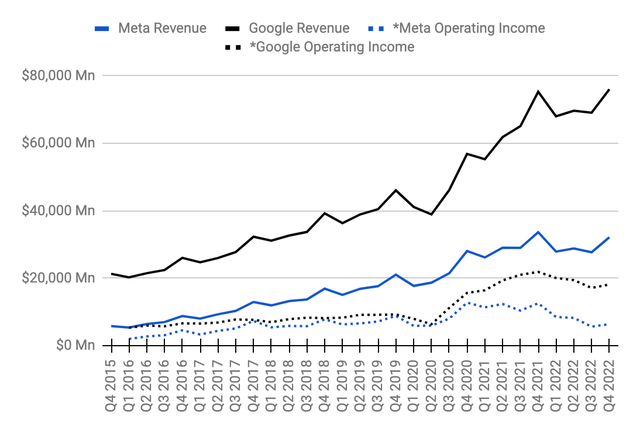

Google (GOOG) (GOOGL) has always had more revenue than Meta, but Meta had incredible operating margins until 2022. Meta’s operating margins were so good in prior years that they almost had as much operating income as Google despite the fact that their revenue was much lower:

Meta and Google Operating Income (Author’s spreadsheet)

*The adjusted operating income above for Meta is higher than the GAAP numbers in 1Q19 and 2Q19 because legal expenses of $3 billion and $2 billion, respectively, are excluded. The adjusted operating income above for Google is higher than the GAAP numbers in 2Q17, 2Q18 and 1Q19 because fines of $2,736 billion, $5,071 billion and $1,697 billion, respectively, are excluded.

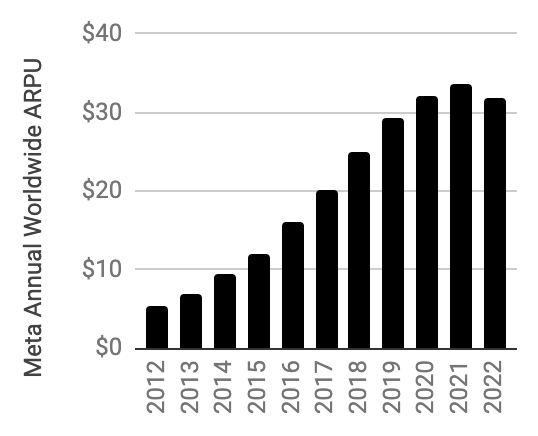

One of the reasons Meta has to be more careful with their expenses is because their average revenue per user (“ARPU”) has stopped increasing for now:

Meta ARPU (Author’s spreadsheet)

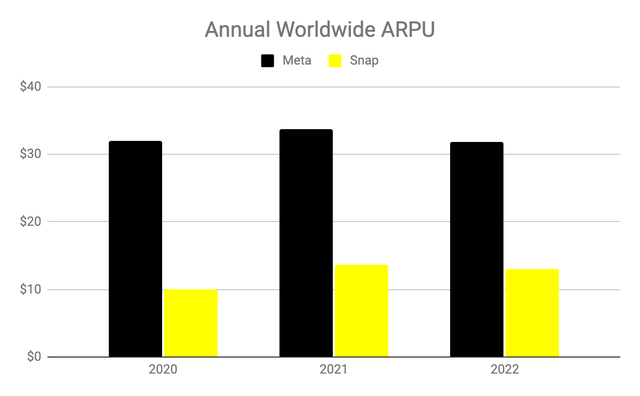

It wasn’t just Meta where ARPU slowed down in 2022. Snap (SNAP) saw their ARPU decline from $13.64 in 2021 down to $12.98 in 2022:

ARPU for Meta and Snap (Author’s spreadsheet)

Snap is especially disappointing with ARPU right now because they have a high percentage of their users in the lucrative North American market.

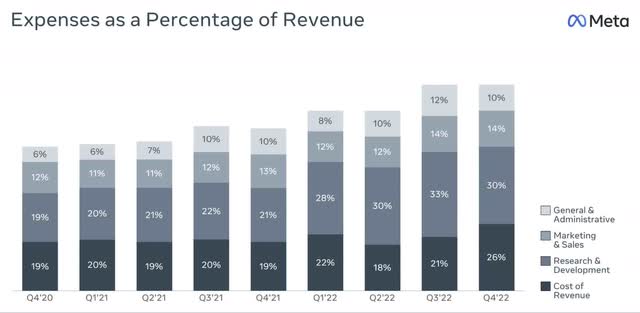

CEO Mark Zuckerberg opened the 4Q22 call by saying the theme for 2023 is the Year of Efficiency. Meta closed 2022 with layoffs and restructuring. Now they’re figuring out how to spend less on capex and they’re flattening their organizational structure by minimizing middle management. The 4Q22 slides show that expenses as a percentage of revenue got out of hand in 3Q22 and 4Q22 and management knows they need to fix this:

Meta Expenses (4Q22 slides)

Per the 2022 10-K, operating income fell from $46.8 billion on revenue of $117.9 billion in 2021 down to $28.9 billion on revenue of $116.6 billion in 2022 and CEO Zuckerberg said the following in the 4Q22 call:

I am also focused on delivering better financial results than what we have reported recently and on meeting the expectation that I outlined last year of delivering compounding earnings growth even while investing aggressively in future technology.

CFO Susan Li stated in the 4Q22 call that they now expect 2023 expenses to be in the range of $89 to $95 billion which is down from their prior estimate of $94 to $100 billion. She said they now expect 2023 capex to be $30 to $33 billion which is down from their prior guidance of $34 to $37 billion.

In the 4Q22 follow-up call, CFO Li said the factors behind the lower 2023 expense guidance were a slower hiring trajectory, a lower cost of revenue primarily due to depreciation changes, and revisions with respect to facilities. She spelled out the fact that the new data center architecture is more flexible and efficient in terms of accommodating both AI and non-AI workloads. Beyond this, the 4Q22 release says that multiple data center projects have been canceled.

One of the comments CEO Zuckerberg made at the end of the 4Q22 call stuck with me:

I do want to continue to emphasize the dual goals here of making the company a better technology company and increasing our profitability.

Based on everything Meta has accomplished up to this point, I am optimistic that they can meet both these goals in the near future.

Valuation

Apple (AAPL) has made things tough in recent years with their privacy changes, but digital advertising will continue to flourish in the long run. In 4Q22, Google, Meta, Amazon and Snap had advertising revenue of $59 billion, $31.3 billion, $11.6 billion and $1.3 billion, respectively. Meta is one of the few companies in the world with the scale to fully benefit as we continue shifting to digital advertising.

Shareholders went through vicissitudes in 2022 when we saw multiple quarters with disappointing levels of operating income. Again, CEO Zuckerberg said Meta is going back to reporting better financial results than what we’ve seen recently and they plan to continue compounding earnings. They can’t continue to compound earnings if they don’t pass the 2021 operating income level fairly soon. As such, I think 2023 operating income will be closer to the 2021 level of $46.8 billion than the 2022 level of $28.9 billion. I think Meta is worth 12 to 18x 2021 operating income which is $560 to $840 billion when rounded to the nearest $5 billion.

The number of Meta shares outstanding shrank nearly 7% from 2,848,292,671 in October 2020 down to 2,651,548,674 in October 2022 and a new $40 billion buyback authorization was announced in 4Q22. The 2022 10-K shows that there were 2,592,639,548 shares outstanding as of January 27th made up of 2,225,763,078 A shares plus 366,876,470 B shares. Multiplying this by the February 6th share price of $186.06 gives us a market cap of $482 billion. The market cap is less than my valuation range and I think the stock is a buy for long-term investors.

Forward-looking investors should pay close attention to the 1Q23 release in a few months to make sure management is doing what they say in terms of being more efficient and bringing down expenses.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Disclosure: I/we have a beneficial long position in the shares of META, AAPL, AMZN, GOOG, GOOGL, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.