Medtronic: A Turnaround In 4 Steps

Summary:

- Medtronic has underperformed the market considerably over the last seven years.

- The company realized that it’s not working and initiated a turnaround strategy.

- The turnaround can be categorized into four steps.

- Shares have fallen 33% since the highs, but still aren’t attractive enough given the execution risks.

JHVEPhoto

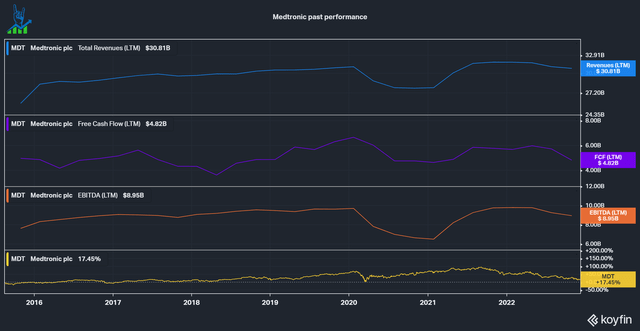

Medtronic plc (NYSE:MDT), a leading medical developer and manufacturer of medical devices in the Diabetes, Cadiovascular, Neuroscience and Medical Surgery spaces, is in the midst of a transformation aimed at improving its operations and financial performance. Over the last seven years, the company has significantly underperformed the market, as can be seen in the chart below, in growth of fundamentals and total return for shareholders.

Despite facing challenges in recent years, the company is implementing a turnaround strategy to regain its competitiveness and increase shareholder value. This article will take a closer look at the elements of Medtronic’s turnaround plan, exploring the changes the company hopes to make and the impact they will have on its future.

Medtronic past underperformance (Koyfin)

A turnaround in four steps

Medtronic’s turnaround story has four areas of focus:

- Capital Allocation

- Operating model

- Culture

- Management Incentive

Let’s take a look at the different steps.

A better Capital Allocation

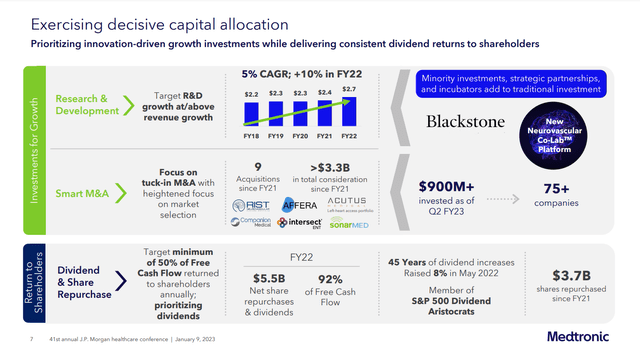

Medtronic shared its steps to improve capital allocation. The company wants to focus on R&D and “smart” M&A to drive growth and on Dividends to return capital to shareholders. The company has been steadily increasing its R&D investments $2 billion to $2.7 billion since 2016. R&D should allow the company to generate organic growth.

I dislike that the company talks about “smart” M&A, I am not a fan of companies giving names like that to their strategy without elaborating on it. Everything they say is that they focus on tuck-in/bolt-on acquisitions with a heightened focus on market selection. But what about the criteria that make it smart? What is the IRR hurdle? How does the company make sure deals are accretive? Will M&A be paid in cash, debt or equity? Does ROIC play a role in the process? Especially the last point is very important if we consider that MDT has a negative ROIC-WACC spread, according to Gurufocus. If the ROIC-WACC spread is negative, then the company destroys value (less return than the cost of capital), so ROIC should be a priority.

Additionally, the company is looking to streamline its portfolio. It is spinning off its Patient Monitoring and Respiratory Interventions business into “NewCo”, without a doubt the most thoughtful name I heard in quite a while. This represents just around 7% of revenues and won’t have a very material impact, but it shows that management wants to streamline the company.

Improvements in Capital Allocation (Medtronic at JP Morgan Healthcare conference)

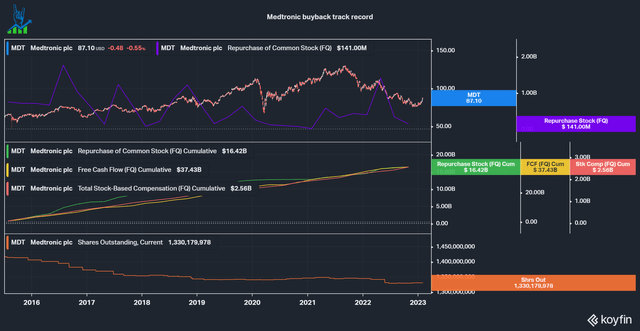

The last part of the Capital Allocation is return of capital. Medtronic has a long history of growth dividends at 45 years of raises, making them a Dividend Aristocrat and almost a dividend king (50 years of raises). Additionally, the company repurchased a lot of shares in the past. Let’s take a look and see if that was a good use of capital. Over the last seven years shares outstanding increased significantly. I look at seven years instead of my usual ten, because a large acquisition increased the share count by around 40% in 2015. Over that time period, the company reduced shares outstanding by 6.6%. $16.42 billion (44% of FCF) was spent, while $2.56 billion was given out in stock-based compensation. This represents 14% of the current market cap. This shows that buybacks weren’t a good use of capital in the past, so I like the change for management to prioritize dividends, a much better return of capital if management is not good at buybacks.

MDT buybacks track record (Koyfin)

A better Operating Model

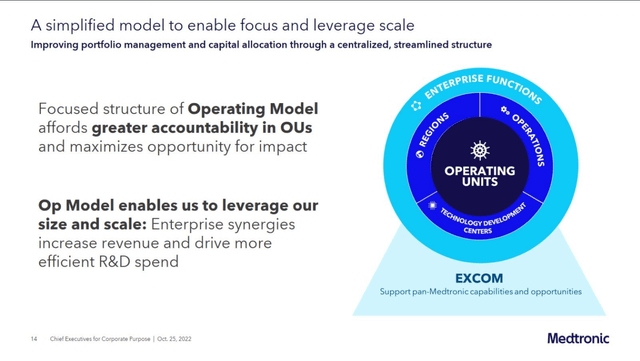

Medtronic is looking to increase the accountability of the operating groups with its new operating model. In this change, the operating group system is eliminated and the business parts are moved into 19 focused and accountable operating units. This is a great step and something that is in my opinion necessary to run a conglomerate. Great examples are Danaher (DHR) and Thermo Fisher (TMO), which both have a decentralized approach to their operating groups and are accountable for their results. Medtronic will keep enterprise functions centralized and leverage its scale in shares R&D and technology centers.

MDT Operating Model (MDT Investor Handout)

A better Culture

In order to increase the morale of the company a new mission statement was introduced: The Medtronic Mindset. It aims to reinvigorate a company culture focused on winning. This to me looks like a very generic mission statement, but maybe it will have some success in reinvigorating a company culture.

A new mission statement (Medtronic Investor Handout)

A better Compensation structure

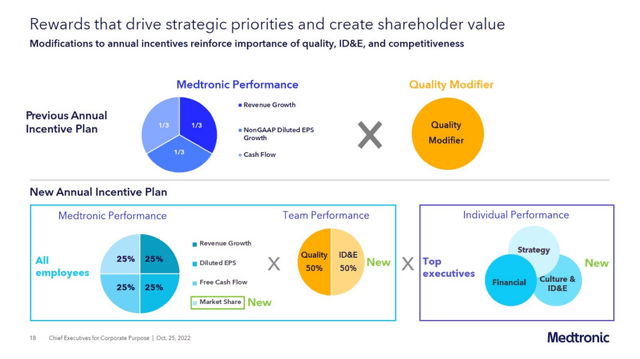

Long-time readers of Heavy Moat Investments will know that I like to review management compensation structures and believe that it is a vital part of an investment case. Medtronic is introducing several changes. For one the pay mix is shifted more towards variable/at risk payouts (92% for the CEO and 85% for other operating officers) and more towards long-term goals instead of short-term (80% long-term for the CEO, 70% for other operating officers). This is a welcome change, together with the fact that most of the compensation is in equity. According to Seeking Alpha, the company has next to no insider ownership with just 1.2 million shares, representing 0.09% of the company, with insiders. Although this compensation structure will not result in huge insider ownership, it should steadily drive it in the right direction over the years.

Short-term incentives (see the picture below) now include GAAP EPS instead of Non-GAAP EPS and Free Cash Flow instead of normal Cash Flow. Additionally, each part only accounts for 1/4 instead of 1/3 and market share is a new criterion. Each incentive plan now also includes a set of individual performance goals.

Medtronic short-term incentives (Medtronic Investor Handout)

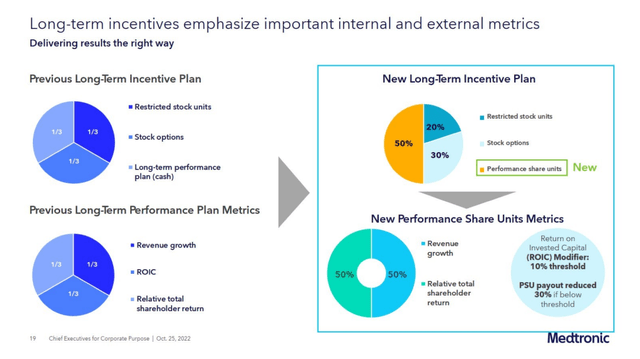

The long-term incentives now focus on at-risk Performance share units (50%), which replaces the Performance cash incentives (used to be 33%, now 0%). Additionally, the long-term performance now uses ROIC as a modifier with a 10% threshold (3.5% above its 6.5% WACC), which will reduce PSU payouts by 30% if not met. This is a good change. Prior ROIC was just a component that could fall away if ROIC was low, now it would impact the payouts a lot more. I would have wished for an even higher reduction if not met though or at least have a second threshold of ROIC<WACC, which would result in a 70%+ reduction in compensation. Compensation is certainly going in the right direction, but there is still room for improvement.

Medtronic long-term incentives (Medtronic Investor Handout)

Is Medtronic an attractive investment?

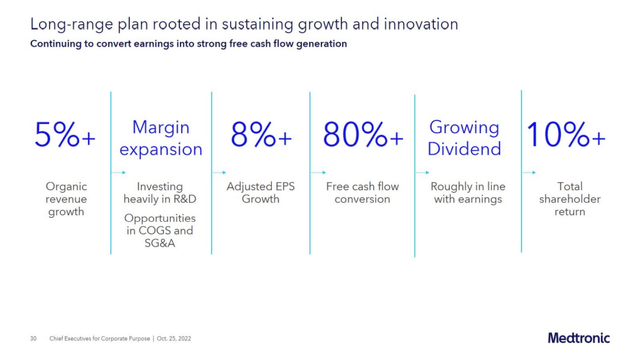

Medtronic shared its long-term expectations for its total shareholder return. This consists of a 5% organic revenue growth, margin expansion and high FCF conversion. 8% Adjusted EPS growth plus 2% average dividend yield results in an estimated 10% total Shareholder return expectation which management gives investors.

Total Shareholder Return expectation (Medtronic Investor Handout)

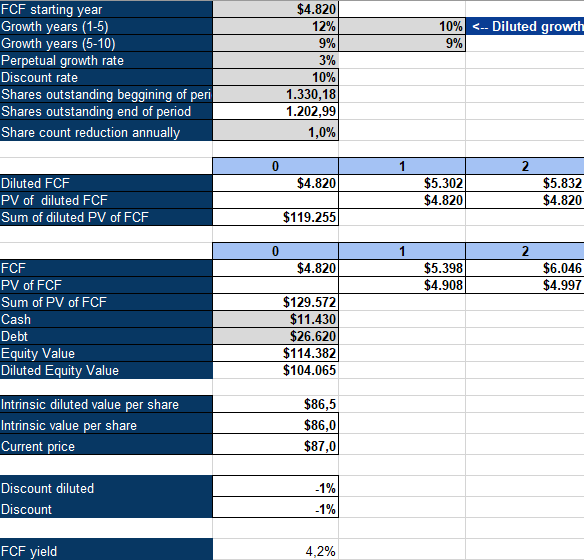

Considering that this is a turnaround play with uncertainties, I do not find that a satisfactory return and I’d want at least 15% expected returns. Medtronic is going in the right direction, but it is not a safe return. I see Medtronic as a hold right now. Using an inverse DCF analysis with a 10% discount, a 3% perpetual growth rate and a 1% annual buyback yield, I come to the same conclusion. Shares are not priced attractively given the uncertainties of the turnaround.

MDT Inverse DCF Analysis (Authors Model)

Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice.