Summary:

- Meta Platforms reported quarterly results, and although results were once again not great, the stock rallied and sentiment seems to change.

- It is still unclear if Zuckerberg’s vision of the Metaverse will become a success, but Meta Platforms can also grow without the Metaverse.

- Another $40 billion share repurchase program as well as reduced expenses and capital expenditures was seen bullish by investors and analysts.

- While the stock is not a screaming buy anymore, Meta Platforms is still undervalued and a good investment at this point.

Derick Hudson/iStock Editorial via Getty Images

Last week, Meta Platforms (NASDAQ:META) reported annual results and although results were not really great, investors were euphoric. Meta Platforms actually missed on earnings per share expectations while revenue could beat by $480 million. But in my opinion, the quarterly results reported this quarter are not really different from the results reported in October 2022. Nevertheless, the stock market reaction now is completely different from the reaction three months ago making Meta Platforms not only a good investment but also a great case study.

One Lesson from Meta

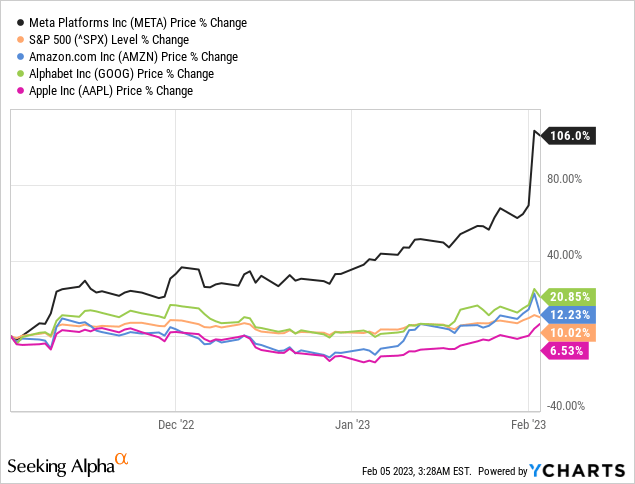

At the time of writing, Meta Platforms is trading for more than $190 and compared to its low of $88. This is an increase of more than 100%.

The low was set about three months ago after the last earnings call and in early November I published my article titled Meta Platforms: Once In A Lifetime Buying Opportunity? and I rated Meta Platforms as a “Strong Buy”. And as I have written in another article, I usually don’t like the term “Buying Opportunity of a lifetime”:

Investors – and especially unexperienced investors that just started investing a few years ago – often talk about the buying opportunity of a lifetime. I have expressed in the past that I rather hate this term as it is very seldom true when people are calling out for the buying opportunity of a lifetime. As a rule of thumb, when people are talking about the buying opportunity of a lifetime one should not buy. The term is often used when completely overvalued assets have declined a few percentage points and went from absurdly overvalued to only extremely overvalued.

But in case of Meta Platforms, the term seems to be justified and I don’t want to brag, but the article was published when Meta Platforms was trading only a few bucks above its bottom. This time I also went back to what was written in November. And to rescue the honor of Seeking Alpha contributors, most articles were bullish in November, and we only had a few sell ratings. But of course, we also had one story claiming that Meta could see another 70% downside. I also read comments in my own articles very seldom (I simply don’t have the time), but this time I went back to read what was written. And aside from many comments that made sense and can be seen as quite reasonable, we had comments about Meta Platforms imploding further or going down at least to $75 (which was of course a possibility) and of course commentors were mocking the headline with comments like “Is it once in a lifetime if its hitting new lows every day of the week” or “Definitely a once in a lifetime opportunity – up or down is the question” or “Once in a lifetime tax loss selling maybe…”

And I am not saying it is easy to time the market – it is not. Publishing the article so close to the bottom was luck. Not only did I publish several bullish articles before (in October 2021, when the company was still called Facebook, Inc., and trading for $326 I published my first rather bullish article), but I also did not buy Meta Platforms at the bottom but already initiated my position earlier. But over the long run (at least 5 to 10 years), it doesn’t matter if you bought Meta Platforms for $88, $120 or $150. And let’s be honest – even if you bought Meta at $120 or $130 or $140 your abilities to time the market might not be perfect. But compared to those who screamed “Sell” when Meta dipped below $100 you are a genius.

When you are buying Meta now, you are probably not too late when investing with a long-term horizon. The stock is still a great buy in my opinion, but it is not a screaming bargain anymore. The lesson here is: If you want to make really great investments, you have to buy when everybody else screams “Sell!” and the light seems darkest. And to be honest, Meta Platforms is still not reporting great results and the company is still not out of the woods, but sentiment already seems to change, and you have to pay twice the price you had to pay three months earlier.

Quarterly Results/Annual Results

When looking at the annual results, they were not great, and Meta Platforms doesn’t deserve the term “growth company” right now. In fiscal 2022, revenue declined slightly from $117.9 billion in the previous year to $116.6 billion – a decline of 1.1% year-over-year. Income from operations declined 38.1% year-over-year from $46,753 million in fiscal 2021 to $28,944 million in fiscal 2022. And diluted earnings per share declined 37.6% year-over-year from $13.77 in fiscal 2021 to $8.59 in fiscal 2022. The main reason for the declining operating income (and declining EPS) were the increased costs for research and development – from $24,655 million in fiscal 2021 expenses increased 43% to $35,338 million in fiscal 2022. And finally, free cash flow declined 52.0% year-over-year from $38,439 million in fiscal 2021 to $18,439 million in fiscal 2022.

When looking at the segment results, the biggest part of revenue is still stemming from “Family of Apps” and in fiscal 2022 revenue from this segment declined 1.0% from $115,655 million to $114,450 million. Revenue from “Reality Labs” also declined from $2,274 million to $2,159 million – a decline of 5.1% year-over-year. This is certainly not a good sign as Meta Platforms’ big hopes rely on this segment as one of the major drivers of growth in the years to come.

Growth

And although current results don’t reflect this, I am still confident about Meta Platforms and its growth potential in the years to come. We might not talk about the same growth rates as in the past, but I see no reason why Meta Platforms should not grow in the mid-to-high single digits (even double-digit growth should be possible again).

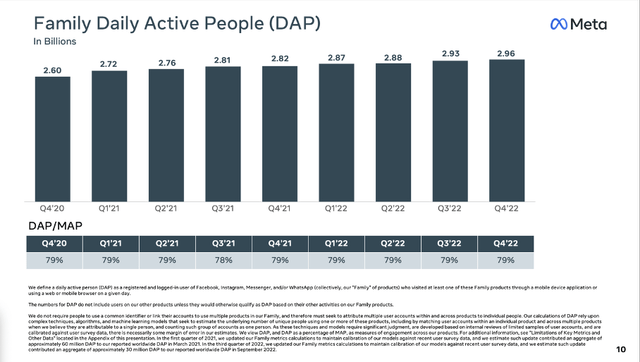

A first positive sign is the growing core business of Meta Platforms. The daily (and monthly) average users of Facebook, Instagram and WhatsApp are still growing. Facebook’s daily active users were 2,000 million in Q4/22 and compared to the same quarter last year this is an increase of 4.1% YoY growth.

And when looking at the family of Apps (including Facebook, Instagram, and WhatsApp) the daily average users are also growing. In Q4/22, 2.96 billion people were using the products daily and compared to 2.82 billion in Q4/21 this is an increase of 5.0% YoY.

And we should not expect high growth rates in the years to come as Facebook is already reaching more than 3.7 billion people monthly across the Family of Apps – half of the world’s population. In theory there is still growth potential, but it is limited, and no one should expect high growth rates for the monthly average users. Facebook can focus on improving the DAP/MAP and DAU/MAU ratio and turning more monthly users in daily users. But these ratios are very stable in the past few years.

A second driver of growth could be the ongoing switch from Feeds to Reels. At least profitability should improve again in the quarters to come as Meta is struggling to monetize Reels in a similar way as Feeds. During the earnings call, Mark Zuckerberg commented on Reels and the path for monetization:

Currently, the monetization efficiency of Reels is much less than Feed. So the more that Reels grows, even though it adds engagement to the system overall, it takes some time away from Feed and we actually lose money. But people want to see more Reels though. So the key to unlocking that is improving our monetization efficiencies that way we can show more Reels without losing increasing amounts of money. We are making progress here and our monetization efficiency on Facebook has doubled in the past 6 months.

And management is confident it will be able to profitably grow Reels with the demand that Facebook is seeing either in late 2023 or early 2024. And while Facebook is still struggling to monetize Reels in a similar way as Feeds, advertisers saw over 20% more conversions than in the year before, which is a good sign. And in the fourth quarter of 2022, ad impressions across the Family of Apps increased by 23%, which is a good sign. Simultaneously, the average price per ad decreased 22% year-over-year, but over the long run higher ad impressions are a good sign.

And a final monetization opportunity, which I already mentioned in my last article is Business Messaging. During the earnings call, Mark Zuckerberg also talked about the company’s plan for business messaging:

Facebook and Instagram are the first two pillars of our business. And in the next few years, we hope to bring Messaging Online as the next pillar. One way of doing this is click-to-message ads, which is now the $10 billion run-rate. And paid messaging is the other piece of this. We are earlier here, but we continue to onboard more businesses to the WhatsApp Business Platform where they can answer customer questions and updates and sell directly in chat. So for example, Air France has started using WhatsApp to share boarding passes and other information, other flight information, in 22 countries and 4 languages. And businesses often tell us that more people open their messages and they get better results on WhatsApp than other channels.

Metaverse

And when talking about Meta Platforms’ growth potential in the years (and decades) to come, we also must talk about the metaverse. The biggest news about the Metaverse – and the news investors wanted to hear – was the reduced spending for fiscal 2023. The lower expenses are probably going hand-in-hand with Mark Zuckerberg’s year of efficiency he announced during the earnings call. Both news were probably part of the reasons why the shares jumped 20% after earnings were announced.

Meta Platforms is expecting full expenses for fiscal 2023 to be between $89 billion and $95 billion – compared to $87,665 million in fiscal 2022 (but much lower than the previous outlook of $94 to $100 billion). Reasons are slower anticipated growth in payroll expenses. And capital expenditures are now expected to be in a range of $30 billion to $33 billion – compared to $32,036 million in fiscal 2022 and a previous estimate between $34 billion and $37 billion. The reduced outlook reflects updated plans for lower data center construction spendings in 2023 with a new data center architecture that is more cost efficient.

We still don’t know if the metaverse will be the next big cash cow for Meta Platforms – but the great news is that Meta Platforms is not dependent on the Metaverse. I already argued in past articles: If the Metaverse does not work out and Meta Platforms is never generating a dime in profits from the Metaverse, Meta Platforms is still a great business with its Family of Apps. If Meta Platforms would stop spending $13 billion in operating expenses for Reality Labs right away, we would have about $4 to $5 higher earnings per share.

Share Buybacks

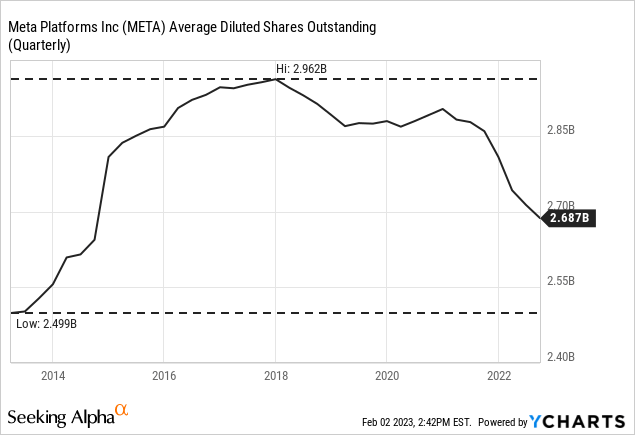

Aside from the expected lower expenses in fiscal 2023, the share buybacks are obviously also seen as a game changer by some analysts and contributors. And as I am seeing Meta Platforms still as undervalued, share buybacks are certainly a good idea. But I don’t know if this is a game changer as Meta Platforms already spent $27,956 million on share buybacks in fiscal 2022 and in fiscal 2021, Meta Platforms spent even $44,537 million. Of course, it would have been better the other way around, but another $40 billion share repurchase program should not be major news (in my opinion). Since early 2018, Meta Platforms is reducing its number of outstanding shares and since then, Meta Platform reduced the number of outstanding shares by 9.3%.

And as Meta Platforms doesn’t pay a dividend and has almost no debt on the balance sheet ($10 billion in debt are almost not worth mentioning), it can spend its free cash flow on share buybacks. In fiscal 2022, Meta Platforms generated only $18.4 billion in free cash flow, but we can expect a higher free cash flow again in 2023 due to lower expenses and capital expenditures. And when looking at the company’s balance sheet we also see $14,681 million in cash and cash equivalents as well as $26,057 million in short-term securities and these liquid assets could be used for share buybacks.

Intrinsic Value Calculation

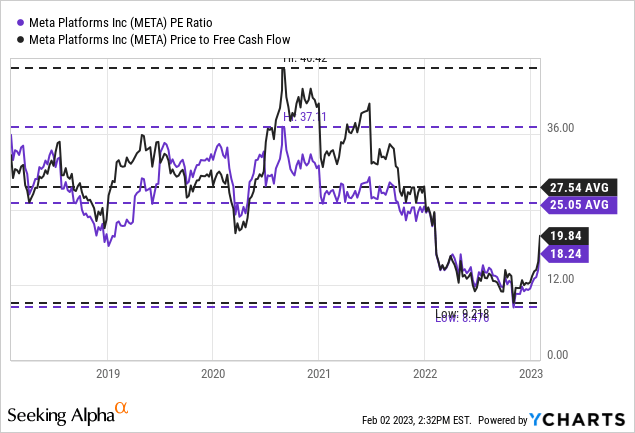

Without much doubt, Meta Platforms remains undervalued. It is not the screaming buy anymore it was in November 2022. But the stock is still trading below its intrinsic value in my opinion. When looking at simple valuation metrics, Meta Platforms doesn’t look so cheap anymore (especially compared to November 2022). Meta Platform is now trading for 19.84 times earnings and 18.24 times free cash flow. But we have always to keep in mind that Meta Platforms has depressed earnings per share as well as a depressed free cash flow right now.

When using the (depressed) free cash flow of the last four quarters as basis in our calculation, Meta Platforms would have to grow slightly above 6% from now till perpetuity to be fairly valued – and although it doesn’t seem like it, Meta Platforms should be able to grow at such a pace right.

But a free cash flow of only $18.4 billion seems unrealistic in my opinion. I would assume that revenue can improve again slightly and with expenses and capital expenditures not being higher than in fiscal 2022, free cash flow could be easily around $25 billion again. When taking this amount as basis, Meta Platforms would be fairly valued with only 5% growth.

In my opinion, we can take about $25 billion as basis for fiscal 2023 and assume 10% growth in the following years (maybe next 10 years) following by 6% growth till perpetuity. This leads to an intrinsic value of $314.22 for Meta Platforms. And if one might argue that 10% growth is rather optimistic, we should not forget that $25 billion as basis is rather low and Meta Platforms must grow its free cash flow 10% annually for 5 years to reach previous FCF levels again.

Conclusion

Meta Platforms is still a buy, in my opinion, and I would still prefer Meta Platforms compared to peers like Amazon (AMZN), Apple (AAPL) or Alphabet (GOOG). And after the strong run the stock had in the past three months, a correction seems likely, but over a 5-to-10-year time horizon (or longer), Meta Platforms is still a very good investment.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.