Summary:

- As Tesla, Inc. slashes EV prices in an effort to gain more market share in the high-end EV market, others like Ford Motor Company are rising to the challenge by cutting EV prices as well.

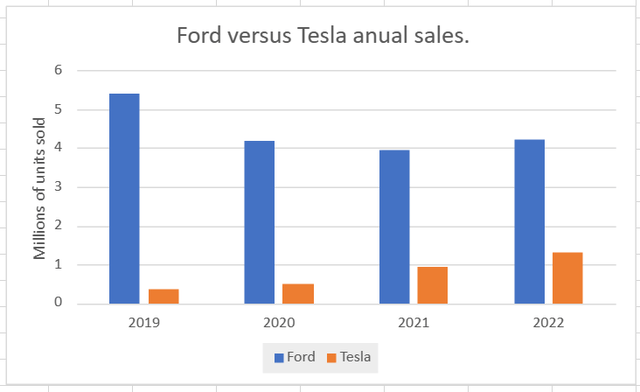

- The biggest difference between the financial impact that this will have on Tesla versus Ford is that the EV models for which prices are cut make up a small portion of total vehicle sales.

- While Ford’s legacy ICE sector tends to be far more cyclical which makes it a liability currently within the context of a global economic slowdown, it can help finance the price war.

- Tesla by contrast is set to feel the negative effects of declining profit margins across the board.

- With its stock price declining, Ford is increasingly a buy, while Tesla’s stock price has moved away from reasonable valuation territory after a very brief encounter with it, which makes it a sell.

SimonSkafar

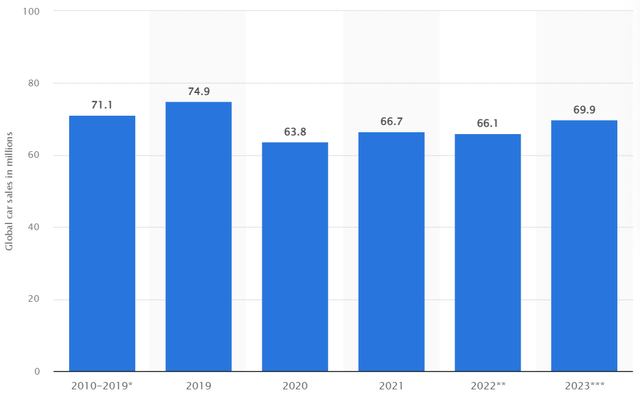

Investment thesis: Within the context of a slowing global economy this year, Ford Motor Company (NYSE:F) is likely set to perform poorly, given that its still-dominant ICE-powered (internal combustion engine) vehicle segment is highly cyclical, in contrast to the Tesla, Inc. (NASDAQ:TSLA) product lineup, which is 100% electric vehicles (“EVs”). EVs have proven in the past to be more immune to cyclical factors, including recently as the COVID crisis hit, as global EV sales continued to gain in 2020, even as much of the rest of the global economy, including car sales, declined. Tesla thus seems primed to continue growing sales this year, even as perhaps much of the rest of the auto industry is likely to suffer, while its recent decision to slash prices on its cars will further boost sales. Ford, on the other hand, is set to only see a boost to its still-small EV segment, with its much-larger ICE segment set to continue struggling.

Based on this argument, Tesla stock should be a buy and Ford a sell. When looking at the longer-term picture, and taking current valuations into consideration, the opposite may be true. Profits are likely to be impacted by the EV price war, which would disproportionally impact Tesla since it only sells EVs. The effects of a likely global economic rebound will benefit mostly the ICE segment, with benefits to the EV sector being marginal at best. When also accounting for other factors, such as Tesla’s recent stock price appreciation, which arguably is moving away from what was for the first time a moment of convergence between fundamentals and a fair valuation, even as Ford’s stock price is moving to levels arguably bellow a fair valuation level, it is arguably Tesla which is, in fact, a sell, and Ford which is starting to become a buying opportunity.

Ford posted a horrible year-end financial report, while Tesla continues to see growth & profits

For the full year of 2022, Ford reported a net loss of $2.15 billion, after posting a profit of $17.9 billion in 2021. Ford’s results seem to be more erratic post-COVID, and overall for 2022 rather disappointing. Tesla, on the other hand, has seen a steady improvement in results for the same period. For 2021, it saw a profit of $5.52 billion, which increased dramatically to $12.56 billion in 2022. It should be noted that Tesla’s two-year net earnings average surpassed Ford’s two-year average for the same period.

Ford’s revenues increased by 16% in 2022 compared with the previous year, while Tesla saw an increase of 51% for the same period. It should be noted that for the two years combined, Ford saw total revenues of about $275 billion, while Tesla had total revenues of $135 billion for the same two-year period. Profit margins were therefore twice as high for Tesla in comparison to Ford last year. With the deep discounts that Tesla implemented, it may lead to a bump in sales, but those profit margins are set to shrink significantly.

Ford should sustain EV discounting on the back of its ICE-powered vehicle sales & profits, while Tesla is discounting across the board

It may be hard to grasp this at the moment, coming on the back of a terrible 2022 that Ford suffered from a financial performance perspective, but Ford has the upper hand at the moment in the EV price-discounting war versus Tesla. The global economy is likely to see signs of a sustained, perhaps even somewhat robust economic recovery in the second half of this year, which will, among other things, lead to a rebound in conventional auto sales.

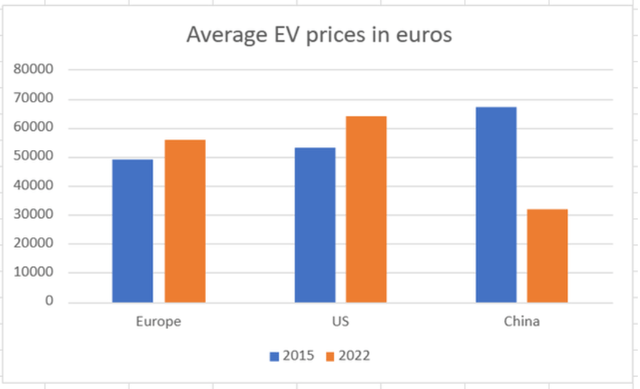

The reason why an economic recovery will favor conventional cars is that the U.S., as well as the global middle class, continues to buy mostly conventional cars. As I pointed out in my recent article covering Tesla, in Europe, as well as in North America, the average sale price of EVs actually increased since 2015.

The reason why EV prices are rising, even as supposedly scaling up production and technological advances should have had the opposite effect and should have led to a decline in average EV sales prices is due to the price/range issue. The perhaps still not fully understood reality of the EV trend is that it paves the way for income-based inequality in terms of mobility that a personal vehicle can offer. In other words, unlike the ICE-powered car option, where one can legally get from Miami to Seattle in the same timeframe in a $15,000 new vehicle as well as one can in a $100,000 vehicle, the difference between the cheapest EV performance and the most expensive options will be measured in days on such a trip. That would be the case even more so in winter driving conditions, as EV range performance tends to see a significant drop due to the cold weather.

I covered this concept a great deal some years ago in an article dedicated to the subject, which I believe is becoming more and more relevant in terms of understanding the past, present and future evolution of the global auto market. For our purpose here in this article, it is enough to understand the essence of it, namely that the EV segment is destined to mostly take the luxury car segment, while ICE-powered cars that appeal to the more utility/price-conscious middle-class consumers will continue to dominate this particular income demographic for the foreseeable future, as long as consumer choice will prevail.

Looking beyond the poor financial performance of Ford last year, and perhaps expectations of a tough year this year, as the global economic slowdown seems to be culminating, it is perhaps time to look beyond, to arguably better times ahead. Pressures ranging from the commodities situation, in part caused by the Ukraine war to high-interest rates, which the market increasingly fears is set to last for longer than expected, make it hard to contemplate a recovery on the horizon. I think it will happen, simply because governments across the world need to find a way to get there out of political considerations.

An economic recovery when it will finally happen will probably send global auto sales once more into new record territory and will first and foremost favor the makers of cars that cater to the middle class. Ford has an impressive ICE-powered lineup of such cars, ranging from the Focus sedan to the F-150 truck series which does come with a high price tag, but it is a very utilitarian vehicle that appeals to semi or fully rural households, small contractors as well as a range of industries ranging from construction to mining.

Ford’s own sales growth pattern largely resembles what the global market has been doing, with some variation, confirming its cyclical nature. Tesla on the other hand seemed to be unaffected by the overall global auto sales volumes trends of the last few years.

What this shows is that Tesla is on its own global sales growth path, while Ford is mostly tied to the overall trend in global auto sales. A potential for a global economic recovery will not mean much for Tesla, or its investors, who at this point are in my opinion more than pricing in the growth prospects we should see going forward. Tesla is currently trading at a forward P/E ratio of around 49.

Ford on the other hand is trading at a P/E ratio of under 9, with the market seemingly betting that the poor sales and financial performance we have seen since 2020, are set to continue.

As I pointed out in a recent article where I announced my entry into Tesla stock, when the P/E ratio reached around 30, for the first time, Tesla’s valuation resembled fundamentals, when pricing in the continued growth prospects, and other factors.

Ford on the other hand, with a forward P/E of under 9 resembles fundamentals to some extent, given the different respective sales growth paths that the companies are on, as well as many other fundamental factors. The one thing it does not reflect in my view is the prospect of a global economic recovery, where, unlike Tesla, Ford can see a significant bump in demand and therefore sales for its non-EV lineup of vehicles.

Assuming that Ford will see a significant improvement in its ICE segment due to global cyclical trends, it can help to offset the costs associated with its efforts to slash EV prices in an effort to fight for high-end EV market share in a contest that Tesla started, forcing competitors to react. In other words, Tesla’s timing in regard to starting a market share turf war might not have been the most ideal, if I am correct and the global economy is set to see a significant improvement going forward, which might arguably come with a recovery in global auto sales. Companies like Ford as well as other successful ICE producers can sustain their EV market turf war on the back of improving revenues and profits from their ICE segment, which is something that Tesla cannot.

Investment implications

When Tesla stock was trading at around $120/share, for a P/E ratio of around 30, I deemed it to make sense from a fundamental point of view. Within weeks it shot up to above $190/share, which once again brings it way above what basic fundamentals might dictate, in other words, the market got ahead of itself. I, therefore, decided to sell my Tesla shares, and I will look to get back in when the stock price will once more meets the fundamentals, which at this point I see as being around a forward P/E of 30. I expect Tesla stock to trade in a matter that will have it intersect those fundamentals more and more often, as it matures as an automaker.

I have been invested in Ford stock for a few years now. I first bought its stock at around $12/share and sold a significant portion of that position at over $16/share. I recently added more shares to my position as it dipped to under $13/share. It might not seem to make sense in the next few months, but I do believe that we will see more and more upbeat news in regard to the global economy as we approach the second half of the year. The China post-zero-Covid economic rebound story, the end to monetary tightening, and even potential talk of a reversal in interest rate trends, a potential lessening of geopolitical frictions as certain stakeholders decide that breaking the cycles of escalation will be in everybody’s interests while continuing will be assessed to serve increasingly no one’s interests.

Ford Motor Company is a cyclical investment opportunity, which should benefit from the changing in the economic cycle, from what has been a poor start to the decade, to what might resemble a return back to normal times. As previous sales patterns have suggested, Tesla’s revenues & profits are less likely to see a significant improvement on the back of an improving global economy. Bottom line is that Tesla, Inc.’s future growth is more than baked into its valuation at this point, while Ford’s long-term prospects are set to improve, which is yet to be baked in, which is where the potentially beneficial investment opportunity arises.

Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.