Summary:

- Affirm Holdings, Inc.’s guidance leaves too much to be desired.

- Affirm’s balance sheet has started to increase the number of loans it retains. I believe this could become a serious issue.

- I was extremely hopeful that Affirm Holdings, Inc. had succeeded in turning around its business. But after these results, I’ve lost my confidence in its prospects.

Drew Angerer/Getty Images News

Investment Thesis

Affirm Holdings, Inc. (NASDAQ:AFRM) is yet another company in fintech that has hit a wall. During its fiscal Q2 2023 earnings call, Affirm seemed eager to be upfront with shareholders and recognize some of the mishaps the company has made of late.

Affirm is a strong favorite amongst retail investors. And, while I’m not sure how its loyal shareholders will take this set of results, I personally believe that I’ve finally seen enough.

Here’s why I’m no longer bullish on its prospects.

Please note, Affirm is now reporting fiscal Q2 2023. All references here are to fiscal and calendar year.

The Slide of the Buy Now, Pay Later Business

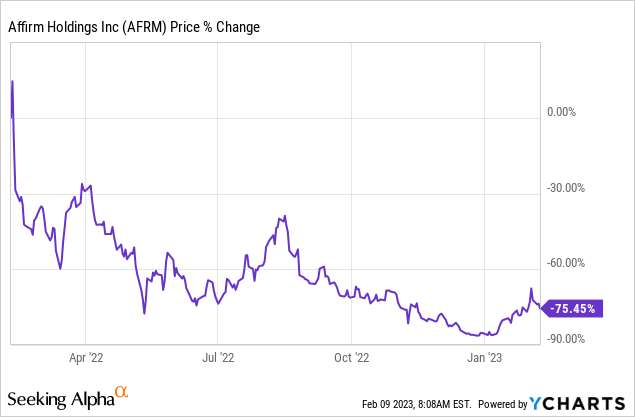

Affirm is a company that continues to see its share price slide. No matter how low AFRM stock gets, it sometimes feels that cheap can always get cheaper. Admittedly, I was caught fully off guard. I felt and assumed and believed, that Affirm’s slide had found a floor.

But this turned out not to be the case. Today, Affirm’s share prices appear to be sliding to an all-time low. But there are good reasons for this slide.

Revenue Growth Rates Slow Down

Everyone loves to buy into growth companies. The problem though is when growth companies reduce their near-term growth rate expectations.

As it stands right now, I simply can not see how Affirm can return to growing at 20% CAGR any time soon.

What’s more, Affirm has now started to increase the number of loans it retains on its books.

During fiscal Q2 2023, Affirm retained more loans on its balance sheet compared with the prior year’s quarter, a 500 basis points increase from a year ago to 44% in the most recent quarter.

I believe that this starts to get too close to a meaningful risk factor.

Previously, the appeal of Affirm was that it didn’t retain the bulk of its loans and was able to shed the risk of its consumer loans. At least a substantial portion.

But if Affirm is now struggling in a higher rate environment to convince credit holders to take on the debt, that could be a serious issue.

Management Needs to Get Paid, to Remain Incentivized

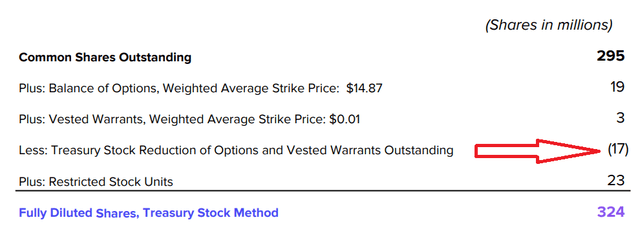

In the table that follows, we can see that approximately 17 million stock-based compensation (“SBC”) shares are under water.

What this means is that management previously received stock-based compensation and this amounts to approximately 5% of Affirm’s market cap.

Furthermore, given that Affirm’s share price has fallen considerably in the past year, this SBC is now anti-dilutive. This means that these options are out of the money.

Consequently, if Affirm wishes to retain talented executives within its ranks, Affirm will need to either find the cash to support employees’ take-home packages or offer out even more shares at a lower price point.

On the other hand, the fact that Affirm has decided to shed 19% of its workforce will allow Affirm to emerge out of this period leaner and stronger.

Moving on, let’s dig further into Affirm’s profitability.

Affirm’s Profitability Profile Does Not Impress

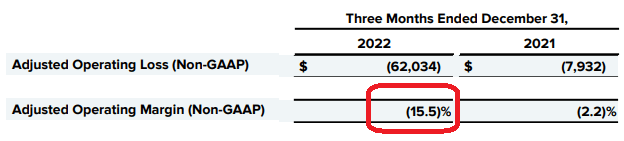

AFRM shareholder letter

As you can see above, Affirm Holdings, Inc.’s adjusted operating margins appear to be struggling to move in a positive direction.

That being said, Affirm remains resolute with its guidance that Affirm will exit fiscal 2023 with profitability.

Moreover, when asked on the earnings call about Affirm’s long-term profitability target and whether Affirm will reach 20% to 30% non-GAAP operating margins as Affirm had in the past guided, management stated that,

So, not sure that we would hold ourselves to the framework that we outlined a year and a half ago in this very moment.

But I think part of the reason we laid out our profitability commitment to the end of the [fiscal] year was a reflection of the fact that we were wanting to get ahead of that from a framework standpoint.

Essentially reiterating that Affirm continues to strive toward long-term prospects even if at the present moment the macro environment has become more challenging.

The Bottom Line

Affirm Holdings, Inc. has been hailed by the media and investors for its innovative offering. It took the payment platforms by storm. And from my point of view, Affirm was a success. The problem, though, is that capitalism got in the way, and too many well-funded peers have decided they, too, want a share of this highly lucrative market.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.