Summary:

- KO is a dividend king that delivered excellent organic growth in 2022 but will face tough comps and macro headwinds in 2023.

- The benefits of its inflationary price hikes and optimistic growth forecasts have likely been priced in.

- With short-term Treasury yields approaching 5%, KO’s yield and dividend growth rate doesn’t offer much appeal.

- I examine KO’s valuation and dividend strength to see if the stock is attractive at current levels.

Anne Czichos/iStock Editorial via Getty Images

With Pepsi (PEP) set to report Q4 Earnings today, I thought I’d take a look at its big brother Coca-Cola (NYSE:KO) to see if the stock might be an attractive buy before it reports its own Q4 earnings next week on Valentine’s Day.

Following Up A Blowout 2022

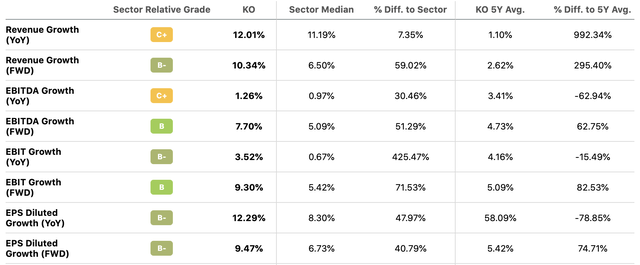

Coca-Cola enjoyed fantastic sales growth in 2022, with strong demand for its products enduring despite significant price hikes spurred by rapid inflation and overcoming forex headwinds from an historically strong dollar. The food and beverage giant delivered 12% revenue growth in 2022 and is riding high on forecasts of 10% sales growth in 2023.

KO Growth Metrics (Seeking Alpha)

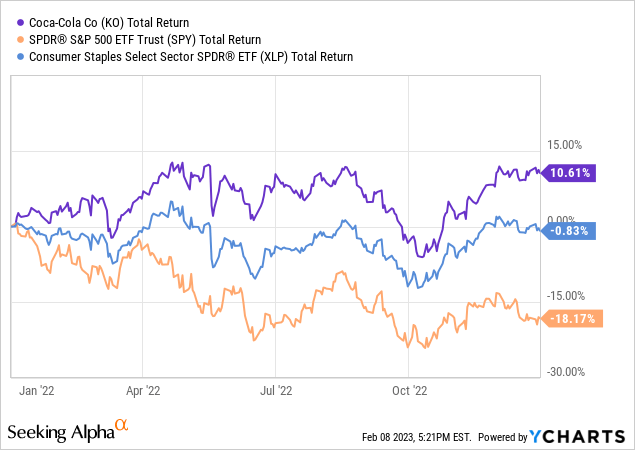

All of this was wonderful news for investors, as KO handily outperformed both the S&P 500 and the consumer staples sector (XLP) by 28% and 10%, respectively. It also restarted its share buyback program, which it had paused during the previous two years.

2023 has gotten off to a rocky start for the company, with inflation-resilient sectors such as staples, healthcare, and energy selling off as hopes for a deflationary year and an eventual end to Fed rate hikes have lifted investors’ appetite for risk and helped beaten-down sectors like tech, industrials, and real estate to rebound. KO has fared decently during this shift but remains down 6% YTD.

Entering A Challenging 2023

The macro backdrop is quite different now than it was in much of 2022, with inflation slowly receding and consumers and politicians wary of further price hikes. Energy prices have fallen drastically over the past six months, with natural gas, oil, and gasoline now lower than they were a year ago, and the dollar has weakened substantially to levels not seen since June.

US Gasoline Price Chart (TradingEconomics.com)

While more favourable foreign exchange rates and energy prices should help lower KO’s costs and improve their margins, they also make it extremely difficult for them to justify further price increases, and instead could exert pressure on the company to lower prices if economic conditions continue to deteriorate — or, at the very least, to hold prices steady for a long period of time.

On top of the challenge of besting 2022’s quarterly results in 2023, consumer spending growth is now predicted to slow from a solid 2.8% in 2022 to a near-stagnant 0.2% in 2023, potentially making the company’s current growth forecasts look a bit too rosy. Living in Europe, it’s of course a bit difficult for me to get a sense of things on the ground in the USA, but I’ve heard multiple friends who’ve recently traveled to the US complain about how expensive bags of chips were, while many of my US friends are complaining about utility bills that are exorbitantly higher than previous years.

Of course these are just anecdotes, but I think investors would be wise to prepare for consumer spending to contract in 2023 and not assume that Coca-Cola’s brand strength will make its sales and earnings as immune to the current macro environment as it was to last year’s inflationary environment.

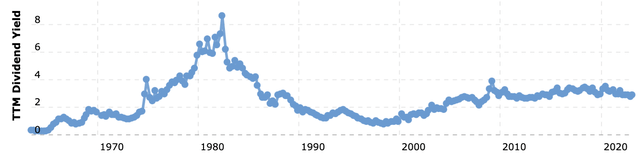

Decent Yield But Low Dividend Growth

Coca-Cola is a Dividend King with 60 years of consecutive dividend growth, and as such makes sense as a core holding in any conservative DGI portfolio. Based on yield alone, I tend to view KO as a buy whenever its yield exceeds 3%. Except for a decade from the mid-1970s through the mid-1980s, this threshold has been a fairly reliable gauge of value for the stock.

KO Historical Yield (Macrotrends)

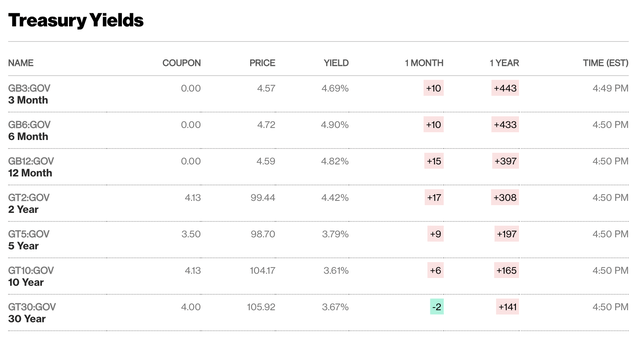

However, the Fed’s rapid rate-hike campaign has brought us into a new era, and short-term Treasuries now yield more than 4.5%:

US Treasury Yields 2/8/23 (Bloomberg)

Needless to say, in this new higher-rate environment, a 3% yield is simply too low a threshold to rate KO as a buy based its dividend alone.

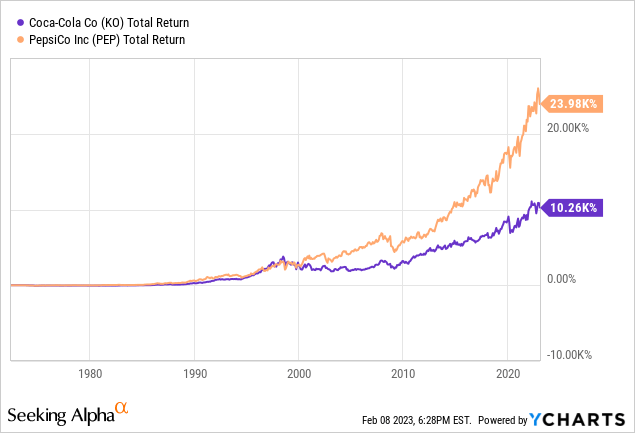

One metric that becomes much more important for equity investors as risk-free Treasury yields rise is dividend growth CAGR, which is also a main reason I hold PEP instead of KO in my own “Defensive DGI” portfolio. While KO has a (slightly) superior dividend growth record, PEP’s dividend growth rate is significantly higher and has helped to deliver significantly better investor returns over the past two decades.

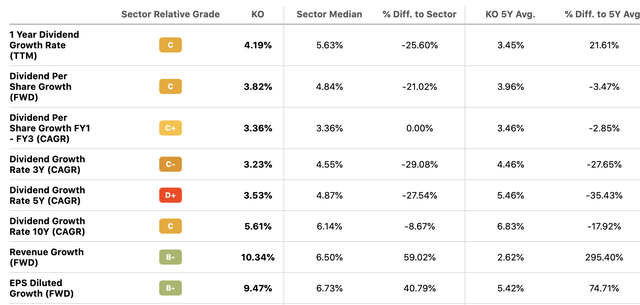

Over the past five years, KO has grown its dividend at an average of 3.5% per year, which mostly aligns with its longer-term average sales and EPS growth rates but falls short of the average dividend growth of an S&P index fund, negating the chance that any alpha will likely be derived from KO’s dividend growth. On the plus side, 2022 saw a relatively high 4.8% dividend increase, and KO is set to raise its dividend again next week, which will bring its current yield of 2.95% up to at least 3.07%, assuming another >4% dividend increase.

KO Dividend Growth Metrics (Seeking Alpha)

My main hope for KO’s near-term stock performance is that management might deliver a much higher dividend increase for 2023 to account for inflation, their strong 2022 performance, and their confidence in their long-term growth outlook. KO’s 77% payout ratio is a bit lower than its 5-year average of 88%, and its forward revenue and EPS growth forecasts suggest that a one-time ~10% dividend hike could be possible, which would bring KO’s forward yield closer to 3.25% and offer long-term investors more incentive to buy and hold shares at current prices, even as interest rates and Treasury yields continue to edge higher.

KO Historical Payout Ratio (Seeking Alpha)

On the other hand, I worry that another 3-5% dividend increase will confirm to investors that management views last year’s results (and possibly this year’s) as a short-term spike and will imply that they expect the company’s current double-digit growth to son return to historical levels around 3-5% per year. Looking at KO’s income statement, it would certainly appear that this is the more realistic scenario, as the company is still below its total revenue and gross profit figures from a decade ago despite its net debt doubling from $16B to $32B during that period.

KO Revenue History (Seeking Alpha)

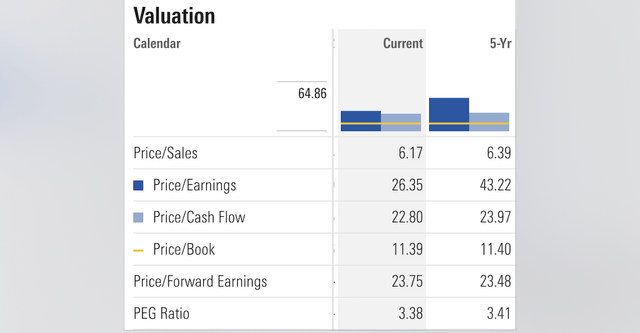

Valuation

Coca-Cola’s current valuation looks fair relative to its own historical levels, with shares trading slightly below their 5-year averages on most traditional metrics. However, its 6.17x PS ratio and 26.35x PE ratios do seem expensive to me on an absolute level given the company’s low long-term growth rates and low dividend growth rate.

Conclusion

Altogether, I think KO’s extremely strong brand recognition, pricing power, and economic resiliency warrant its premium valuation multiples, but higher Treasury yields combined with deteriorating consumer spending in a deflationary, recessionary macro environment offset its relative undervaluation to make shares appear slightly overvalued to me at current levels.

While KO is a fantastic company and I trust that management will deliver solid Q4 results, I worry that current 10% sales growth forecasts are a bit too optimistic in this environment and will be difficult to uphold against last year’s comps. Furthermore, barring a major dividend hike next week, KO’s current ~3% yield and 3-5% annual dividend growth CAGR don’t carry the same appeal they’ve had during the past decade’s low-interest-rate environment, and the stock may need to correct more before investors have a compelling reason to jump in.

Balancing KO’s long-term quality against its near-term headwinds and priced-in optimism, I rate KO shares a hold for long-term investors at their current price near $60, but I would recommend waiting for a greater margin of safety before buying, either on dips below $55 or if management does come through with an unexpectedly large dividend hike that pulls KO’s forward yield above 3.25%.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.