Summary:

- With peak in streaming losses already behind us, Disney’s business model is shaken by yet another restructuring.

- Record high quarterly margins at Disney’s parks and experiences would not be the silver bullet to high shareholder returns.

- Higher future margins are already priced in and with that upside appears limited, even if management executes on its current strategy.

Charley Gallay

Optimism seems to be returning at The Walt Disney Company (NYSE:DIS) as the company reported its first quarter results for the current fiscal year.

The upbeat numbers have resulted in a wave of much-needed hype for shareholders after years of disappointing share price performance, lack of dividend payments, and uncertainty around its new strategy. The new (old) CEO is also bringing hope that the media powerhouse could once again return to profit and reinstate the dividend earlier than expected.

As it usually happens in markets, euphoria could quickly turn into desperation, and vice versa. At present, it appears that the latter is the case, as reassuring media coverage and enthusiastic speech on the earnings call took over.

(…) our new structure is aimed at returning greater authority to our creative leaders and making them accountable for how their content performs financially. Our former structure severed that link and it must be restored. Moving forward, our creative teams will determine what content we are making, how it is distributed and monetized and how it gets marketed. Managing costs, maximizing revenue and driving growth from the content being produced will be their responsibility.

Bob Iger – Chief Executive Officer

Source: Disney Q1 2023 Earnings Transcript

Unfortunately, however, medium to long-term shareholder returns have little to do with the occasional gimmicks of investor sentiment, and the latest quarterly results did little to alleviate fears related to achieving sustainable profitability and high returns on capital.

Talking About Shareholder Returns

It has been roughly three years since I first warned of the major risks for Disney shareholders as the company embarked on an acquisition-led strategy to conquer the direct-to-consumer space at a time when the share price was at all-time highs.

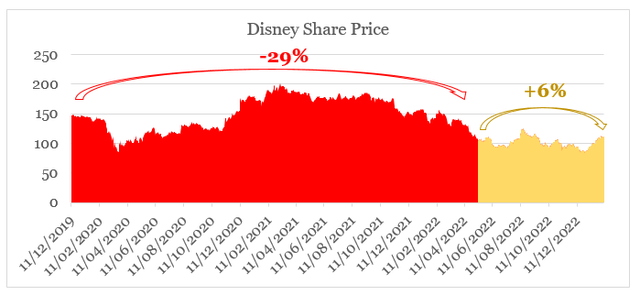

After a staggering 29% decline in Disney’s share price, in May of last year Disney’s share price was already much closer to the company’s fair value and I turned neutral on the stock.

Prepared by the author, using data from Seeking Alpha

Since May of last year, Disney stock returned 6% which hardly is a reason to rejoice given the performance in recent years and all the risk and uncertainty around the company.

Having said all that, I’m still having a difficult time turning optimistic on the stock and would need solid evidence that the company could execute on a new strategy and support its currently elevated multiples through sustainably higher margins.

A New Hope for Profitability (Graph 1)

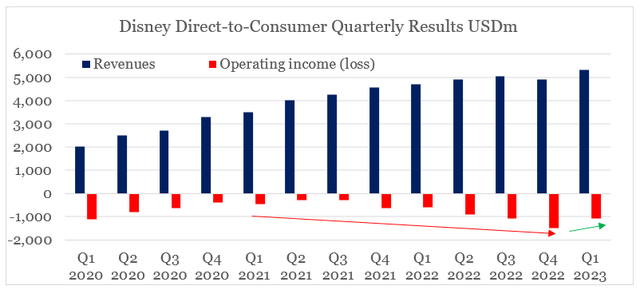

As expected, one of the major focus areas during the latest earnings call was the state of Disney’s streaming business. While Disney+ subscriber numbers were not what most people expected them to be, the management put a strong emphasis on prioritizing profitability.

Like many of our peers, we will no longer be providing long-term subscriber guidance in order to move beyond an emphasis on short-term quarterly metrics, although we will provide color on relevant drivers. Instead, our priority is the enduring growth and profitability of our streaming business.

Bob Iger – Chief Executive Officer

Source: Disney Q1 2023 Earnings Transcript

Combining this narrative with what appears to have been a peak in losses for the Direct-to-Consumer segment gave shareholders the much-needed respite.

Prepared by the author, using data from Quarterly Reports

While all that sounds great on paper, the reality is that competition in the sector is not going away and content-related costs will remain elevated.

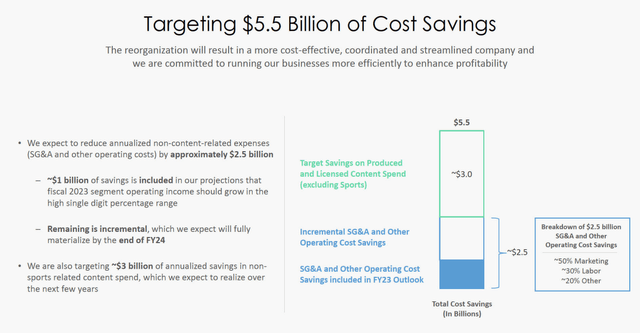

The 50% marketing, 30% labor and 20% technology split of the expected $2.5bn reduction in annualized non-content-related expenses broadly makes sense. For a company that no longer targets subscribers growth, marketing expenses could be reduced and apparently reducing the workforce by approximately 7,000 people is not expected to have a material impact on the business.

Nevertheless, I have a hard time cheering up for these sudden restructuring programs at a time when a business is desperate to achieve profitability and is struggling to fend off with more deep-pocketed competitors. Moreover, Disney has been undergoing restructuring after restructuring for quite some time now and as optimistic as this might sound, it’s never a good practice in business.

Parks and Resorts Strike Back (Graph 2)

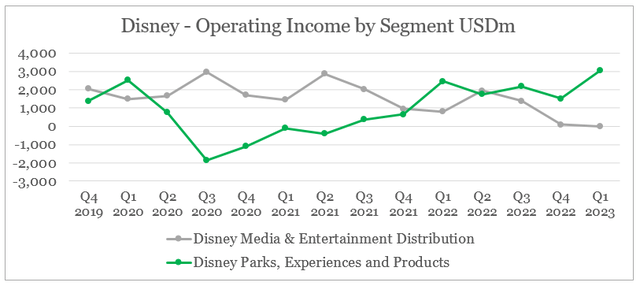

After nearly two years of pandemic lockdowns and restrictions, Disney’s Parks, Experiences and Products segment is back with a vengeance. Pent-up demand and strong consumer spending have resulted in the division achieving record-high profits just in time to offset declining profitability in Media and Entertainment.

Prepared by the author, using data from Quarterly Reports

This highly anticipated development was the second pillar that gave shareholders hope that a reversal in media and entertainment’s low profitability could coincide with sustainably higher margins parks and experiences. Indeed, there were no one-time items to call out during the latest quarter, but it seems likely that pent-up demand from the pandemic is playing a role in per capita guest spend.

At domestic parks and experiences, significant revenue and operating income growth in the quarter was achieved despite purposefully reducing capacity during select peak holiday periods by approximately 20% versus pre-pandemic levels in order to prioritize the guest experience. Per capita guest spend at our domestic parks also showed strong growth.

Christine McCarthy – Chief Financial Officer

Source: Disney Q1 2023 Earnings Transcript

The management also did not reaffirm that they expect the record high quarterly operating margin within the segment to be the norm going forward and reminded that Q1 of each year is seasonally one of the strongest ones.

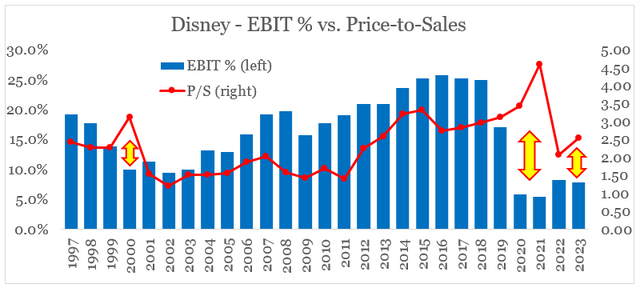

Return of Premium Multiples (Graph 3)

Prior to the mega deal to acquire 21st Century Fox and the new strategy to prioritize quantity of content over quality in order to promote its streaming services, Disney was trading at multiples of around three times sales on the back of the company’s operating margins of roughly 25%.

As we see in the graph below, however, operating profitability is not what it used to be and the bad news is that even with parks firing on all-cylinders, Disney’s operating profitability has a long way to go.

prepared by the author, using data from Annual and Quarterly Reports

We also could note that the recent jump in Disney’s share price has once again opened a wide gap between its P/S multiple and EBIT margin, which suggests that an improvement in margins already is being priced in.

Although this is hardly a bad sign, investors should be able to justify both large and sustainable jumps in Disney’s margins over the coming year, if current valuation multiples are to remain at their elevated levels.

Even if we assume that the ambitious $5.5bn cost savings plan is achieved immediately and with no consequences for the topline figure, we arrive at operating margin of roughly 14%, which is largely in line with Disney’s current sales multiple.

Realistically, however, Disney needs to execute flawlessly on this restructuring process, while also dealing with audience fatigue with some of its most successful franchises (e.g., Marvel and Star Wars), and last but not least, not losing market share. All that is definitely a possible scenario, but not a highly probable one.

Conclusion

The worst days for Disney seem to be already behind us, provided that the macroeconomic environment remains supportive and the management executes on its new cost-cutting program. Having said that, I still have a hard time turning bullish on the company as the road to high and sustainable profitability remains highly uncertain. Firstly, we have a promise of yet another restructuring process amidst more competitive pressures. Secondly, the record-high margins at Disney’s parks and resorts are unlikely to be sustained. And lastly, valuation multiples are largely pricing in future improvements in profitability, which creates additional risks for anyone buying at current levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication and are subject to change without notice.

All the research in this article is based on The Roundabout Investor strategy. An investment philosophy which finds high quality and reasonably priced investment opportunities. It capitalizes on inefficiencies in the market by avoiding short-termism, momentum chasing and narrative driven expectations.

In addition to exclusive roundabout investment opportunities, the service offers a concentrated portfolio based on the highest conviction ideas. A more holistic overview to the equity market is also utilized through the lens of factor investing techniques.

To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.