Summary:

- We continue to be bearish on Netflix.

- While we’re constructive on Netflix’s 7.66M added subscribers, we still don’t expect the subscriber growth to meaningfully boost revenue in the near term.

- We also expect Netflix’s new ad-supported service, included for the first time this quarter, will be pressured by weaker ad spending in 1H23.

- We’re bullish on the long-term rebound story of Netflix but believe the stock will dip further in the near term due to macro headwinds.

simarik

Netflix (NASDAQ:NFLX) stock jumped nearly 7% following its 4Q22 earnings report. Despite the 40% surprise in added subscribers reaching 7.66M compared to expectations of 4.57M, we continue to be bearish on the stock.

Netflix has had a rough year, to say the least. The stock dropped nearly 51% during 2022, underperforming both competition in the streaming space and S&P 500 Index (SPY). For the first time in the past several quarters, we believe Netflix is on the path to reaccelerate revenue growth with the company’s new ad-tier offered in November and a change-up in management. Still, we believe Netflix’s path to recovery is a long one, and we don’t expect to see the stock rebound in the near term. Our bearish sentiment on Netflix in 1H23 is based on our belief that strong subscription growth won’t meaningfully be reflected in revenue growth in the near term as the weaker spending environment pressures the company. We believe that Netflix’s venture into the ad-support service space is a good long-term growth driver but not something investors will see manifest meaningfully in the near term. Companies worldwide are cutting ad budgets as the weak spending environment of 2022 spills into this year. We recommend investors wait on the sidelines for a better entry point on the stock.

Great subscription growth but depressing revenue

We believe Netflix, alongside the larger tech peer group, has yet to escape the rough macro headwinds of 2022. Netflix’s 4Q22 earning results were well-received by the market with great subscription adds, but we believe the truth of Netflix’s performance in 1H23 lies in its financials. Netflix itself has notably decided to stop providing guidance for subscribers this quarter and focus on different revenue streams instead- paid memberships, ad-supported tiers, and paid sharing plans. While Netflix was in-line with revenue expectations with a 1.9% revenue growth, it still reported the slowest revenue growth on record. The company also fell short of EPS estimates by nearly 77%. We don’t expect Netflix to reaccelerate revenue growth in the near-term due to macro headwinds.

We believe Netflix’s massive added subscribers this quarter made it clear that the company can continue driving subscriptions on the back of audience loyalty to specific high-hit content, with Wednesday being the latest of the sort. The Adams Family spin-off became Netflix’s second most popular TV series on the platform, accumulating 1.196B hours of viewing time. We also believe the cheaper ad-supported plan also boosted subscribers, although the company didn’t disclose specific numbers of ad-tier subscribers. Still, we believe Netflix’s financials are struggling- Netflix’s operating income climbed 7%, beating expectations, but its operating margin fell to 17.9% in 2022 from 20.9% a year prior. We believe the company still has a long way to go before regaining revenue growth. Netflix’s revenue growth has slowed down over the past several quarters.

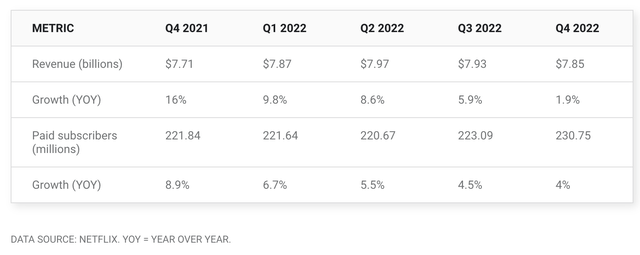

The following graph outlines Netflix’s revenue growth over the past few quarters.

We continue to believe that Netflix is pressured by the weak spending environment and recovering from 2022. To elaborate on this more, we break down our bear thesis into two points:

1. Weaker spending environment slowing down ad-tier gains

Netflix launched its “Basic with Ads” subscription in November after audience pushback about raising subscription prices in early 2022. The ad-tier subscription costs $6.99 per month, 55% lower than the standard subscription. We’re constructive on the long-term impact of Netflix’s ad-tier plans, with the digital ad market estimated to grow at 13.1% CAGR between 2023-2028. Yet, we don’t expect Netflix to enjoy returns from the ad-tier plan in the near term due to the slowdown in ad spending amid macro headwinds. We believe Paramount’s (PARA) 3Q22 earnings results are a good tell of the current state of the ad space, as the company fell short of revenue expectations reportedly due to weaker ad revenue. We believe the weak spending environment has negatively impacted ad budgets and will hinder Netflix’s ad-tier subscriptions from meaningfully boosting earnings through ad revenues. Insider Intelligence reported that the weak ad spending of 2022 is creeping into 2023, with 30% of major advertisers reporting ad budget cuts and another 74% stating that the economic downturn will change their budget decisions. We believe Netflix needs to meaningfully leverage its ad-tier base through the ad spending market to fill the gap between the Basic with Ads subscription and the standard one; we don’t see this happening in the near term.

Aside from the softer ad spending environment, Netflix is a newborn in the ad space, meaning it has a lot of catching up to do to meaningfully compete with others in the ad space. Greg Peters, Netflix’s COF and CPO, addressed this in the earnings call, remarking that Netflix needs “some time” to compete with Alphabet (GOOG) or Meta Platforms (META) in the ad space. We believe Netflix is well-positioned to grow its ad revenue but don’t expect it to manifest meaningfully in 1H23.

2. Recovering from 2022

While Netflix is a household name leading the streaming industry, the company took a hit in 2022, and we believe part of what Netflix is facing now is a recovery from the lows of last year, both in terms of expanding its subscriber base and recovering revenue growth. We believe the strong USD posed a major headwind for the company last year as Netflix achieves the bulk of its revenues from markets outside the U.S. We believe a major reason Netflix’s revenue increased only 6% Y/Y for FY2022 is FX headwinds. We’re less concerned than we were late last year about FX headwinds eating away at revenue in 1H23 as the US dollar Index that tracks the USD against other global currencies is down from its 52-week high in September. We believe the company will face less severe headwinds now that the strong USD has slightly deflated. Still, we expect the company’s diverse regional revenue streams to make it vulnerable to potential FX headwinds in 2023 if the stronger USD returns amid market uncertainty.

Valuation

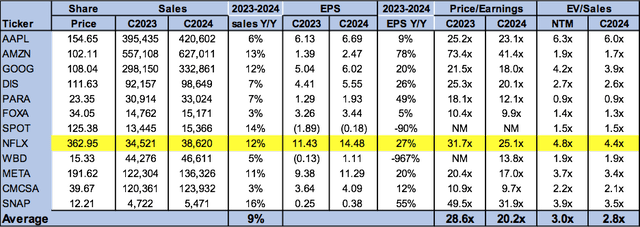

Netflix is not cheap, trading at 25.1x C2024 EPS $14.48 on a P/E basis compared to the peer group average of 20.2x. On EV/Sales, the stock is trading at 4.4x C2024 versus the peer group average of 2.8x. We believe the stock is highly valued and recommend investors wait for a better entry point on the stock.

The following table outlines the company’s valuation compared to the peer group average.

Word on Wall Street

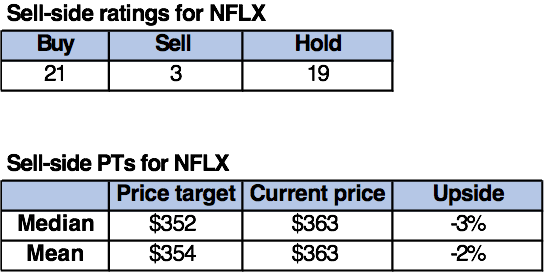

Wall Street is divided on Netflix’s rating but leaning more toward the bullish sentiment. Of the 43 analysts covering the stock, 21 are buy-rated, 19 are hold-rated, and the remaining are sell-rated. The stock is currently priced at $363 per share. The median sell-side rating is $352, while the mean is $354.

The following tables outline Netflix’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We continue to be sell-rated on Netflix as we don’t see the stock recovering in 1H23. We believe Netflix will likely continue to boost its subscription numbers but expect this will have a marginal impact on the company’s revenue in the near term. We expect Netflix is still pressured by macro headwinds, namely the weaker ad spending that may hinder its ad-tier plans. We’re bullish on Netflix in the long run as we believe it’s finally headed in the right direction to jump-start revenue growth, but we don’t see this happening in the near term. We’re staying tuned to see where Netflix goes next but recommend investors exit the stock and revisit it once the downside has been factored in.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.