Summary:

- Microsoft didn’t put up big growth numbers during its calendar fourth-quarter results, but the company remains one of the best free cash flow generators on the market today.

- Microsoft’s investment in OpenAI’s ChatGPT should benefit its product suite from Azure to Bing and beyond. AI could be a huge game changer in the coming years.

- We plan to make tweaks to our model if its Activision deal closes, but we value Microsoft north of $300 at the high end of our fair value estimate range.

- In light of Microsoft’s strong free cash flow generation, the company has tremendous dividend growth prospects, too. Shares yield ~1%.

Cristina Ionescu

By Valuentum Analysts

There are few companies these days as exciting as Microsoft (NASDAQ:MSFT). The company continues to work to close its proposed transaction of Activision (ATVI), and how awesome that it has its hands on OpenAI’s ChatGPT to integrate into its offerings from Azure to Bing and beyond. Microsoft still holds a strong net cash position and its free cash flow generation remains top notch.

The company, however, is trading at ~25x fiscal 2024 earnings estimates, but there could be upside to consensus numbers if artificial intelligence [AI] pans out, as some may be anticipating. Though there is a lot of hype surrounding AI these days, shares of Microsoft will likely be range-bound for the foreseeable future, trading about in-line with our fair value estimate at this time.

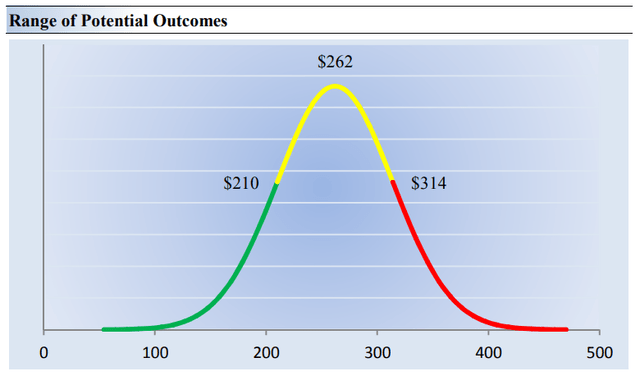

Our discounted cash-flow-based fair value estimate of Microsoft stands at $262 per share, and we continue to be huge fans of its dividend growth potential, which may be second to none. The high end of our fair value estimate stands at $314 per share, which means that after some period of share-price consolidation, we see upside potential for shares on the basis of a more optimistic valuation.

Our fair value estimate range of Microsoft. (Image Source: Valuentum)

Calendar Fourth-Quarter Results Could Have Been Better

Microsoft’s second-quarter results for fiscal 2023 (calendar fourth quarter 2022 results), released January 24, weren’t as good as we would have liked. The company’s sales were up only 1.9% on a year-over-year basis, while second-quarter non-GAAP earnings per share was only slightly better than the consensus forecast. Microsoft’s non-GAAP operating income fell 3% on a year-over-year basis, while non-GAAP net income fell 7%.

The company’s non-GAAP diluted earnings per share fell 6% from the same period a year ago. If we look at things on a constant-currency basis, sales in its ‘Productivity and Business Processes’ division jumped 13%, while revenue advanced 24% in its ‘Intelligent Cloud’ segment. We liked the robust sales expansion in these areas, especially at Azure and other cloud services, but its ‘More Personal Computing’ division, which includes Windows OEM and Xbox content, suffered revenue pressure, to the tune of 16%.

As we look ahead, Microsoft will be heavily dependent on its cloud operations, artificial intelligence and gaming to continue to satisfy investors. The software giant has parked big bucks in ChatGPT’s parent OpenAI, and we like the strategic decision, as the technology seems to fit well within its Windows operating system, augment its search engine operations (Bing), and integrate nicely into its Azure cloud service. We were mighty impressed with ChatGPT when we first tested it out a few months ago, and we’re super excited that Microsoft has pushed itself to become a leader in AI.

Microsoft Is Still A Strong Free Cash Flow Generator

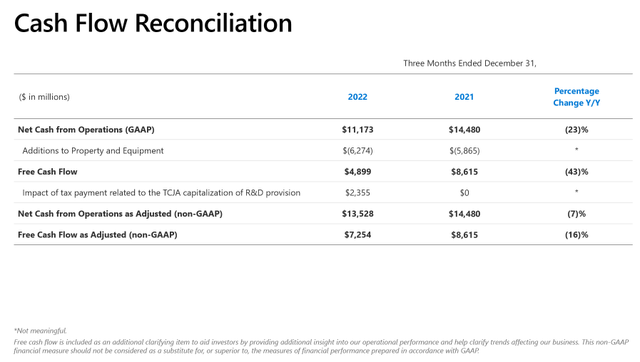

During the second quarter of its fiscal 2023, Microsoft’s free cash flow generation wasn’t as strong, falling to $7.25 billion on a non-GAAP basis versus $8.62 billion in the same period a year ago. Adjusted net cash flow from operations also faced pressure, falling 7% in the quarter, to $13.5 billion, as lower net income, unfavorable changes in deferred income taxes and accounts payable, as well as higher capital spending weighed on performance.

Though Microsoft’s GAAP cash generation in the period faced pressure as a result of a one-time $2.36 billion impact related to a tax payment (TCIA capitalization of R&D provision), the company remains a veritable cash-generating machine. We expect Microsoft to continue to generate gobs and gobs of free cash flow for shareholders, a key component of our investment thesis on shares.

Microsoft faced a one-time item that impacted its cash flow generation during the quarter ended December 31, 2022. (Image Source: Microsoft)

Microsoft finished 2022 with nearly $100 billion in total cash, cash equivalents, and short-term investments versus short- and long-term debt of $48.2 billion on the balance sheet. This is good for a robust net cash position at this time.

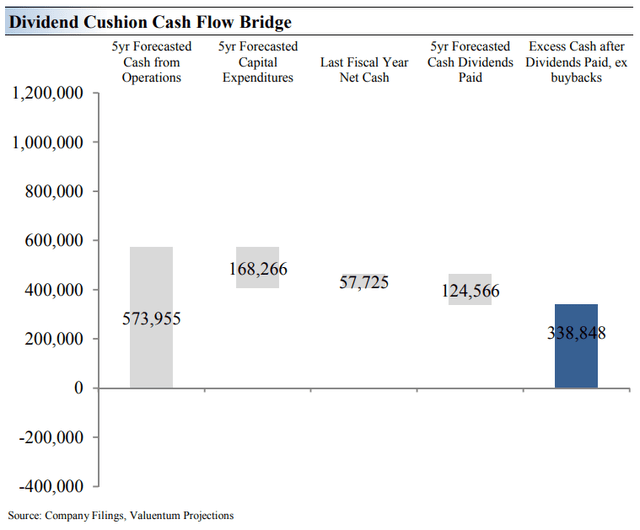

During the calendar fourth quarter, Microsoft’s adjusted free cash flow measure covered cash dividends 1.43x, and on a GAAP basis during the first half of its fiscal 2023 (the six months ended December 31), the company generated ~$21.8 billion in free cash flow, which handily covered the $9.7 billion in cash dividends paid over the same time period.

We expect Microsoft to have considerable excess cash to cover its payout in the coming years. (Image Source: Microsoft)

With the DOJ cracking down on Alphabet’s (GOOG) (GOOGL) prized search business, uncertainty regarding Microsoft’s proposed deal to buy Activision has never been higher, in our view. Regardless of whether that deal is completed, however, we’re still fans of Microsoft, even as we expect the company’s shares to be choppy following its fiscal second-quarter 2023 results and more cautious outlook for technology, more generally.

Concluding Thoughts

All told, we remain big fans of Microsoft’s business, net cash position, strong free cash flow generation, and dividend growth prospects. The company’s investment in OpenAI ChatGPT is icing on the cake, in our view, as AI should benefit its operations across the board from Azure to Bing and beyond. We expect shares to be choppy in the near term, but Microsoft has valuation upside potential to the high end of our fair value estimate range ($300+), in our view. As we noted earlier, very few firms these days are exciting as Microsoft, and we like them. The company has a dividend yield of ~1% at this time.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.