Summary:

- Opendoor is an iBuyer operating in the US market.

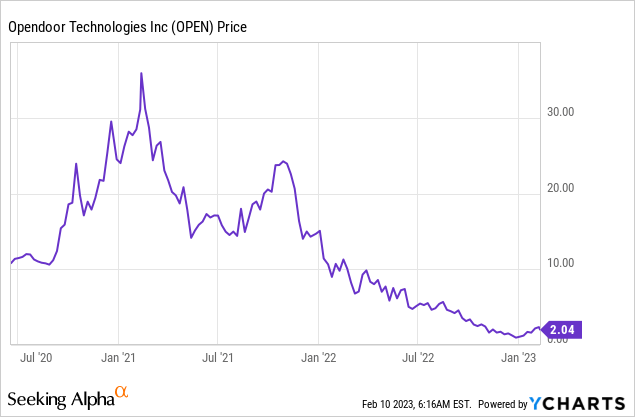

- The business rose to fame as it benefited from COVID-19 demand but has subsequently slumped over 90%.

- Our view of the economic climate suggests the housing market will continue to fall in 2023 and into early 2024.

- Opendoor’s financials are a mess. The company does not have a route to profitability and its balance sheet is full of debt.

- Opendoor is transitioning to facilitating buying/selling, which means investors are essentially buying into a brand and management’s ability to execute.

The Good Brigade

Company description:

Opendoor Technologies Inc. (NASDAQ:OPEN) operates a digital platform for residential real estate in the United States. The company’s software platform allows consumers to buy and sell a property online. Opendoor also offers supplementary services, such as title insurance and escrow services.

Opendoor is an iBuying business, the largest in the US by properties acquired (Source: Opendoor, Zillow, offerpad and Redfin Annual account/data). iBuying is the process of purchasing a property from consumers and looking to sell these at a profit, with some service fees also charged for the service. The selling point to consumers is that Opendoor eliminates all the stress and uncertainty of selling a house with a transparent offer, based on the properties current condition.

Zillow (Z), a competitor to Opendoor, exited the iBuying business in 2022. We have covered this as part of a write up on Zillow, found here. Zillow was bearish on the iBuying market, choosing to focus on the marketplace side of the business. This leaves Opendoor as by far the largest player in the market.

Opendoor has been a value destroyer, with the stock falling from an ATH of $35 to sub-$3. This is the type of drop usually reserved for fraud and financial collapses.

Much of this has been driven by a reversal in the housing market and a change in macro-conditions, something we will assess in detail later.

With Opendoor’s stock somewhat plateaued, now feels like a good time to investigate the company. Much of our analysis will focus on macro conditions and the housing market, with a view to how things will develop going forward. Financial analysis will consider what investors are paying for and will likely need to pay for going forward.

The housing market and macro-economic conditions:

Housing market:

The worldwide real estate market experienced a surprising surge during the COVID-19 pandemic, thanks to government incentives like the UK’s stamp duty holiday. House prices in the US skyrocketed by 15% in 2021, which hadn’t happened in many years. Opendoor benefited greatly from this phenomenon as they were able to acquire a steady flow of properties and sell to a high demand. Their revenue skyrocketed by 210% in 2021, which was a remarkable achievement. However, the pace began to slow down in 2022 as those who wanted to buy or sell had already done so.

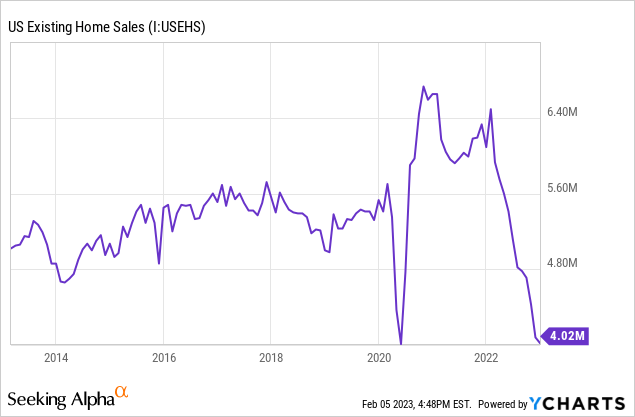

This led to an artificial slump in property sales, observed below in the second half of 2021 and into early 2022.

This leads us to the elephant in the room, the nosedive in 2022.

Macro-economic conditions:

Macro-economic conditions have deteriorated in 2022 and will likely continue to do so in 2023.

The main reason for this is a rapid increase in inflation, which has remained above 5% for over a year. In response to this, Central Bankers globally have increased interest rates, which has yet to be successful. The US rate is currently at 4.5%. The net impact has been an almighty squeeze on households and consumers, with a cost-of-living crisis caused by both greater borrowing costs and price increases. Importantly, mortgage costs have increased substantially, with the variable rate in the US now in excess of 6%.

5/1 adjustable mortgage rate average (FRED)

Consumers are paying almost 3x the interest they were not too long ago. The good news is that in the US, people generally lock-in fixed rates for over 5 years and so many will be able to avoid this entirely. The problem for Opendoor, however, is that it removes the incentive to move / purchase a home. Why would people want to take out mortgages at current rates, when they can wait a year or two and hope rates fall. Further, why would people even consider moving when their expenses are increasing, and economic conditions are weakening.

The impact of this has been falling property sales and falling prices, Reuters estimates the fall from peak is 12%. This has the opposite impact on Opendoor to the COVID-19 situation, as now inventory is more difficult to sell, and prices are falling on a regular basis. With inventory more difficult to sell, and at the required margin, new properties are required to be purchased at even lower prices to reflect the greater risk. From a financial perspective, this has reduced GPM from 9.1% in FY21 to 5.3% in the LTM period.

Outlook:

Interest rates are the key catalyst for kick-starting a turnaround in Opendoor’s fortunes. Futures markets are currently pricing in additional rate hikes, peaking at just below 5% in June. This suggests interest rates will remain heightened for the remainder of 2023.

OECD believes inflation will remain in excess of 5% in 2023, before falling in 2024. This will further compound cost-of-living problems and likely contribute to a recession.

Therefore, more of the same is likely the minimum we will see if 2023. It is likely things will deteriorate further and have a compounding effect on Opendoor.

Financials

Opendoor is materially changing the way the business operates, with their CEO stating

we are pulling forward our roadmap with the launch of our marketplace, Exclusives, which connects buyers and sellers of a home. Since our first funding round, we have envisioned Opendoor as the central transaction layer, built first by owning and transacting inventory ourselves, with a plan to launch a marketplace once we’ve built a supply and demand network of customers transacting directly with Opendoor. (Source: Q3 Investor pack).

This suggests they are making a move similar to Zillow and transitioning towards a marketplace-first operation. For this reason, their financial profile may change in the coming years. For now, however, we must assess the business as is.

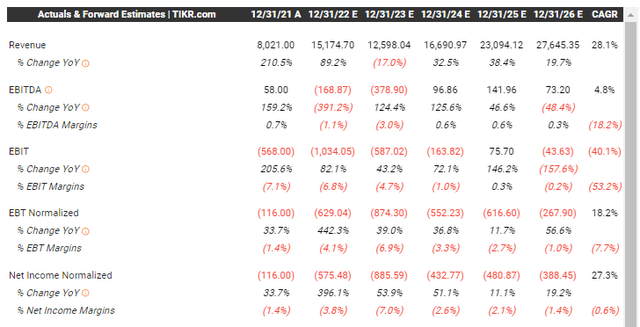

Opendoor – Financial analysis (Tikr Terminal)

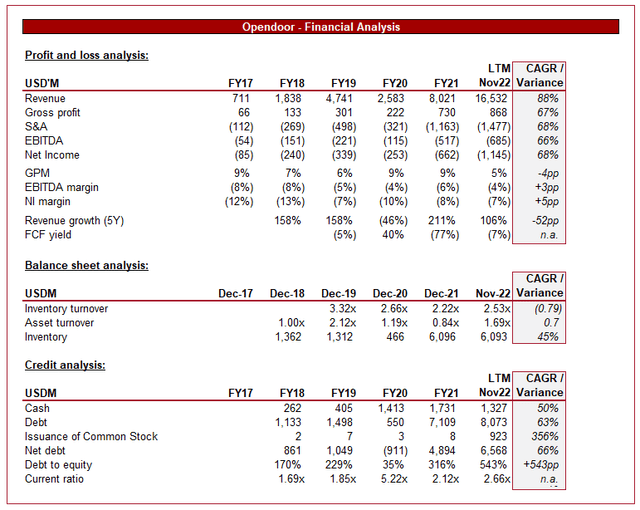

Opendoor’s financials are very messy. They are arguably in line with what is expected of a growing tech company, although we would not necessarily categorize this as tech.

Revenue growth has been phenomenal, driven in recent years by COVID but has been impressive since listing. Increased capital has allowed Opendoor to fund greater purchases and drive sales.

CoGS have grown in line with revenue, suggesting an inability to improve monetization and source better deals. Although not a certainty, our belief would be that Opendoor’s improved brand image could mean greater bargaining power with sellers / agents. This is not the case so far.

S&A expenses have increased at a CAGR of 68% v. 88% in revenue, suggesting their customer acquisition cost is attractive. This likely supports how they have been able to grow revenue at the rate they have.

Margins have been improving over time, mainly because their cost base outside of S&A and CoGS is relatively fixed. LTM GPM has fallen, as we established earlier, due to falling prices reducing their ability to generate profits on sales.

What is quite concerning on the balance sheet side is the amount of stock held as of November 2022. With prices continuing to fall, there is a great risk that they will not be able to achieve their desired margin and might have to hold onto stock longer than desired. We are already seeing evidence of this with Inventory turnover falling y-o-y since Dec-19. With GPM being thin at 5-10%, the margin for error is very low. It should be noted that as a % of revenue, inventory is lower than Dec-21 and Dec-18, however.

When looking at our credit analysis section, we see how this growth has been financed. Opendoor has taken on a substantial amount of debt and issued additional shares in order to finance inventory. Debt to equity has reached astronomical levels and the business is still currently EBIT negative. CFO was $555M in the LTM period, which is markedly below their cash balance. For this reason, it is unlikely further cash will need to be raised in the near term. This said, the balance sheet does not look good. With margins so thin, it’s difficult to see how the business would even be able to fund interest payments, which are almost 50% of gross profits.

Overall, it is clear to see why Zillow exited the iBuying market. Margins are thin and the business becomes asset heavy. It is difficult to see how the business can continue in its current form with iBuying operations in our view, given its level of debt and current profitability profile. Should it fully transition into a marketplace, the question then becomes if that business will fare any better. If we use Zillow as an example, GPM is 20% and EBIT margin is -6%. This suggests Opendoor will find itself in an almost identical position when it comes to bottom-line profitability.

Valuation

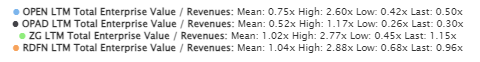

Opendoor stock is currently trading at a 0.5x multiple on LTM revenue, which is slightly below its peer group average.

Valuation (Tikr Terminal)

If an investor desired exposure to the tech real estate space, it would be difficult to justify a 0.5x multiple for a business which has a difficult route to profitability when Zillow is available for 1.15x.

The reality is, it is extremely difficult to price the asset until a clear route to profitability is established and what the economics of that are.

Analysts believe EBITDA positivity will be established in 2 years, and marginally so in 2024. Into 2026, the business will likely still not be earning enough to meet its interest payments.

Analyst forecasts – OPEN (Tikr Terminal)

Conclusion

Many are quick to suggest a company is undervalued if it experiences a large fall in share price. Many are also quick to suggest a company is a tech business when it really isn’t. We think both of these are the case here. Although revenue growth has been impressive, there is no real route to profitability. With the business looking to shift into being a marketplace and less iBuying, you are basically buying a brand at this point. Further, the business may have technologies in the name, but it is very asset heavy currently and there is a real risk that current inventory cannot be realized at a profitable level.

With the upcoming year expected to be more of the same, we may see Opendoor’s share price fall further. Any upside will be present if the valuation falls to a level that reflects purely the value of the brand, or if current inventory can be sold at a level above current margins.

We rate this stock a sell.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.