Summary:

- Meta Platforms, Inc. reported a strong quarter and the stock price has soared by ~40% in 2023 so far.

- Despite the large price rally (and some remaining headwinds in the near term too), I still see Meta Platforms as a buy-and-forget stock in its current price range.

- Market volatility is likely to create entry opportunities between $150 and $175, which would lead to long-term annual returns in the double-digits.

- And the massive $40B share buyback program at these compressed valuations will add a further boost to Meta Platforms investors’ returns.

Leon Neal

Investment thesis

Meta Platforms, Inc. (NASDAQ:META) reported its 2022 Q4 results on Feb 1. It was a strong quarter. META beat revenue consensus estimates by $480M. And it also announced a massive $40B share buyback program (about 10% of its current market cap).

I have been bullish on META for a while, especially since its P/E dropped to the mid-teens back in 2022. My investment thesis is pretty straightforward. While I admit the company faces substantial short-term challenges, I see these issues as largely irrelevant for investors with longer time horizons (say three to five years or longer). The way I see things, META is a compelling investment opportunity given its financial strength, leading position in a fast-growing sector, and attractive valuation.

After the strong Q4 results, Meta’s stock prices soared by ~18% during extended-hour trading. The momentum continued, and as of this writing, its prices have surged by ~40% so far in 2023. And this leads me to the main thesis of this article. Despite such sharp price rallies and some headwinds ahead, I still view META as buy-and-forget stock under its current valuations.

More specifically, market volatility is likely to create entry opportunities for potential investors between $150 and $175. And as seen in the chart below, my projected annual return for META at these price levels is between about 11% (at a price of $175) and more than 12% at a price of $150, both far higher than the overall market’s expected returns. And the remainder of this article will elaborate on these analyses.

Our roadmap

First, a bit of background on the construction of the chart below. This chart is what we call our investing roadmap. It is our guiding map in both our own investment decisions and also in our market service. As detailed in our earlier article:

- The long-term ROI for a business owner is determined by two factors only: A) the price paid to buy the business and B) the quality of the business. More specifically, factor A is determined by the owner’s earning yield (“OEY”) when we purchased the business. And that is why the P/E ratio is the 1st dimension in our roadmap. Factor B is determined by the quality of the business and that is why ROCE, the most important metric for profitability, is the 2nd dimension in our roadmap.

- The long-term growth rate is governed by ROCE and the Reinvestment Rate (“RR”). High ROCE means every $1 reinvested can lead to a higher growth rate, which leads to more future profits and more flexible capital allocation to fuel further growth. Thus, to summarize:

- Longer-Term ROI = valuation + quality = OEY + Growth Rate = OEY + ROCE*RR

Before we dive into META, the two charts below show the holdings for a UTMA account we are managing for our son. The stocks in this account are all picked by the roadmap, and their places in the roadmap are highlighted in blue in the chart above.

For performance tracking, the charts used the prices as of July 11, 2022 (the date I first wrote about this account on Seeking Alpha), so readers can easily verify the numbers. As seen, the account has been consistently leading the S&P 500 during a highly turbulent period of time. To wit, the account has returned 14.3% since July 2022, beating the S&P 500 by 7.6%.

As we will see next, the key role the roadmap played is to remind us (and hopefully our readers too) to stay focused and not be distracted by short-term noises. As a result, despite the small number of stocks (or probably because of it), a few well-selected stocks can generate superb returns at the same time reducing (instead of increasing) risks.

Source: author. Source: author.

META: Safety and profitability

Let’s get back to META now. The balance sheet remains a fortress. Its level sits at approximately $40.7 billion, which translates to $5.62 per share. Meanwhile, its long-term debt was only around $27.4 billion, resulting in a substantial net cash position. This low level of leverage provides plenty of flexibility for the company to finance its high-risk and high-payoff initiatives and also potential acquisitions. Additionally, when the cash position is adjusted for, its P/E multiple would also become a bit lower (by about 3%~4%).

To wit, at a target price of $175, the effective entry price would be only $169 ($175 – $5.62 of cash per share). Based on consensus estimates, the company’s FW EPS is around $9.11, implying an FW P/E of only 18.5x after adjusting the cash position. At a target price of $150, the implied FW P/E would be only 15.8x after adjusting the cash position.

In addition to its strong balance sheet and cheap valuation, it boasts outstanding profitability across all metrics, even when compared to its FAANG peers as seen in the charts below. For instance, its 79.6% gross margin is the highest among the FAANG group. In terms of bottom-line-oriented metrics, its EBIT margin (28.8%) and EBITDA margin (36.2%) are also the highest among this group. Its net margin (19.9%) is a close third to second to Apple’s 24.5% and Google’s 21.2%.

The second plot below also displays its return on capital employed (“ROCE”) over the past decade. We consider ROCE to be the most fundamental profitability metric as it measures the return on capital actually employed (e.g., idle cash is excluded). Examining ROCE over a longer time frame provides unmatched insights into the stability of the competitive moat. In META’s case, it has maintained an average ROCE of 61.3% in recent years, slightly lower than its 10-year average of 67%. But 61.3% is still among the top level even within the FAANG group.

Source: author and Seeking Alpha.

META: a leader in a fast-growing sector

I consider META to be one of the most successful social media platforms in the world, and I see secular growth potential for both the whole sector and especially META. META is currently the dominant leader in the social media space (as seen from the latest statistics shown below). At the same time, the company continues to invest in new products and technologies, such as virtual reality and artificial intelligence, which all hold the potential to drive non-linear growth the way I see things. Additionally, the increasing amount of time people spend on the Internet, particularly on mobile devices, is expected to further boost its growth potential in the coming years.

META: Back to the roadmap

Let me summarize the key points with the aid of the roadmap again. Currently, my estimates of META’s Owner’s Earning Yield (“OEY”) stand at approximately 5.4% based on an FW P/E ratio of 18.5x As aforementioned (again, with its cash position adjusted for). My projection for its growth rate is around 6.1%, estimated from its average ROCE of 61% in recent years and its reinvestment rate of 10%. The combination of the OEY and organic growth would result in an overall expected return of 11.5% at the current market price of ~$175.

If its stock price drops to $150 again (which is likely in my view given its historical volatility), the adjusted entry P/E would be 15.8x only as analyzed earlier (with cash position adjusted). The OEY would be 6.2% in this case. And when combined with the growth rate, the total return potential would be 12.3%.

Risks and final thoughts

As aforementioned, Meta Platforms, Inc. does face some risks in the near term. The company almost constantly faces controversies, such as privacy concerns and regulatory reviews. These issues could impact (and have impacted) the company’s near-term stock price fluctuations. The ongoing geopolitical conflicts and currency exchange rates are also expected to persist and pressure its earnings. Its competition with TikTok is also ongoing and is a major concern for many investors.

However, I am optimistic about Meta Platforms, Inc. I see it in a much strong position to leverage its large user base, technological capabilities, and vast resources to remain competitive with TikTok. At the same time, TikTok faces tremendous regulatory challenges in both the U.S. and around the world. In the U.S., TikTok was the subject of matter of national security concerns. Both the U.S. federal government and many states have expressed concerns about TikTok in terms of intelligence gathering, censorship, and privacy.

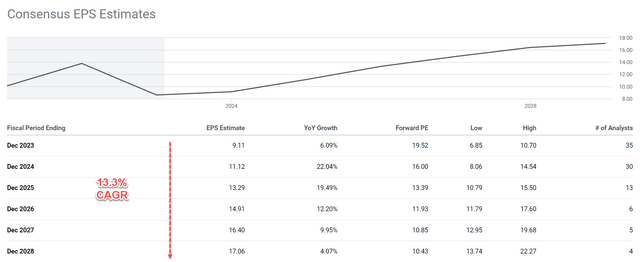

To conclude, my thesis is that Meta Platforms, Inc. is a buy-and-forget stock under current conditions. Despite near-term speedbumps, I see outsized returns potential in the long term thanks to its strong financial position, leading role in a rapid-growing market segment, and also attractive valuation. My projected total return is in the double digits (11~12%) in a price range of $150 to $175. And my projections for Meta Platforms, Inc. could even be on the conservative side, as consensus estimates predict an EPS growth of more than 13% as shown below, compared to my estimate of 6.1%.

Source: Author based on Seeking Alpha data

Disclosure: I/we have a beneficial long position in the shares of ALL STOCKS LISTED IN THE UTMA PORTFOLIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.