Summary:

- UnitedHealth shares are down by approximately 6.5% on a year-to-date basis.

- They’re trading below their October 2022 lows.

- UNH stock has posted positive y/y EPS growth during 19 out of the last 20 years.

- And it has a rapidly rising dividend (17.3% 5-year DGR).

- I think shares are fairly valued in the $485 area.

FatCamera/E+ via Getty Images

Throughout the rally that we’ve seen play out during 2023, I’ve been updating my watch list.

My focus these days is on the highest quality dividend growth stocks.

I put capital to work in the markets every month and I want all of those investment dollars to bolster the size of my passive income stream in the present and augment its growth potential over the long-term.

Furthermore, I should note that due to ongoing economic uncertainty, combined with the recent uptick in the broader markets that we’ve experienced, I’m looking to accumulate blue chips to potentially shield myself from future downside momentum.

Although I am concerned about the market giving back some (or potentially all) of the gains that we’ve seen thus far throughout January and February in the near-term (let’s be real, a +15% month on the Nasdaq isn’t sustainable…in the short-term, at least), I am not looking to move to the sidelines.

Although I wouldn’t be surprised to see a dip in the near-term, I’m always looking to use monthly savings to accelerate the compounding process that we discuss every month when it comes to my dividend income stream.

(In case you missed it, here is my most recent portfolio review; I post these here monthly at Seeking Alpha).

As I’ve said many times in the past, I’m not interested in trying to time markets – from a macro perspective – in the near-term.

The way I see it, most short-term movement is sentiment driven (as opposed to being based upon underlying fundamentals) and I know that over the long-term, fundamentals win out.

And, since I’m focused on owning blue chips, these underlying fundamentals tend to rise over the years…leading to not only strong share price gains, but more importantly, rising dividend payments.

I hate chasing momentum and therefore, when thinking about the most attractive companies on my watch list, I’ve been on the lookout for blue chips that have posted relative underperformance.

And, with that being said, I wanted to highlight UnitedHealth Group (NYSE:UNH) as a best-in-breed company that has underperformed recently, despite producing extremely reliable top and bottom-line growth and a rapidly rising dividend.

UnitedHealth Group

UNH is one of those stocks that has regrettably sat on my watch list for years…as I watched the stock roar higher and higher.

UNH shares are up by 115% during the last 5 years and 748% during the last decade.

Admittedly, these gains – and my resentment towards the stock – have made it hard to purchase.

It’s hard to overcome the woulda-coulda-shoulda ramifications of this type of missed opportunity.

But, I know those negative emotions don’t impact future returns and as much as I wished that I had bought shares of UNH back when I first began my dividend growth journey…harboring resentment towards past mistakes isn’t going to do anyone any good.

Now that UNH shares have experienced rare relative weakness…on a year-to-date basis…and more importantly, relative to their October 2022 lows…I’m becoming more and more interested in buying shares.

UNH is down by 6.4% during 2023 thus far.

And, it’s one of the only blue chips that I follow which is down relative to its October lows (most of the names in my portfolio and on my watch list are up double digits since then).

UNH’s recent weakness stems from news regarding higher Medicare Advantage prices coming next year and historically, the uncertainty related to the healthcare insurance space has always kept me away from this company (even though it’s clearly the best-in-breed play).

But, over recent years, as I’ve sort of shifted my focus towards owning the best of the best companies, I’ve come to trust UNH’s management when it comes to dealing with legislators and producing top/bottom-line growth throughout periods of uncertainty.

After all, those 750% 10-year gains didn’t happen by accident…

UnitedHealth Group has produced positive year-over-year growth on the bottom-line during 19 out of the last 20 years…with 2008 during the Great Recession being the only negative growth year.

That is exactly the type of reliable growth that I’m gravitating towards these days and having the opportunity to buy UNH into relative weakness is appealing.

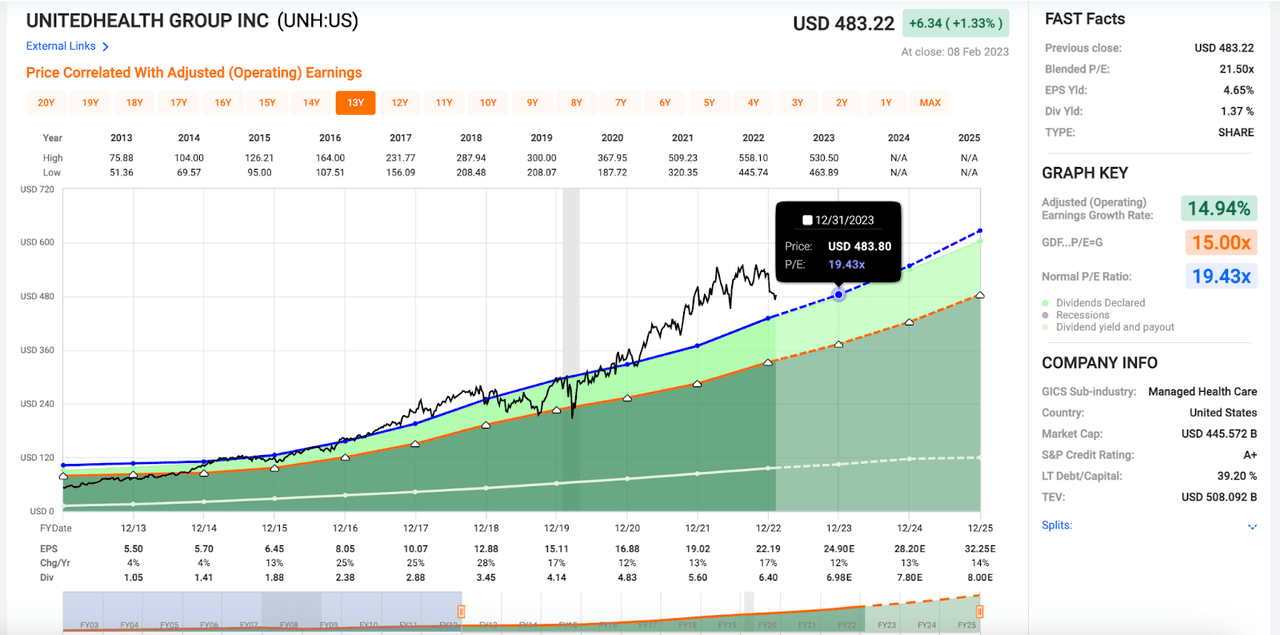

FAST Graphs (FAST Graphs)

After its recent sell-off, UNH shares are trading with a 21.5x blended P/E ratio.

This is still well above the stock’s long-term 20-year average P/E of 17.8x and 10-year average P/E of 19.4x; however, it is exactly in-line with the stock’s 5-year average P/E.

What’s more, due to UNH’s forward growth expectations during 2023, the stock is trading for 19.4x forward earnings…meaning that the stock’s forward valuation is in-line with the 10-year average.

To me, current/forward valuations relative to the trailing 5 and 10-year averages imply fair valuation here…around $485/share.

UNH is expected to post double digit EPS growth during each of the next 3 years and therefore, I think paying fair value here is a fine idea.

Looking at forward growth projections…if UNH were to maintain a 19.5x P/E ratio over the next 3 years, we’re looking at a total return CAGR of nearly 11%.

Those total return prospects, alongside UNH’s strong dividend growth history (13-year dividend growth streak + 17.4% 5-year DGR), make this a stock that I’d be able to sleep well at night with throughout a wide variety of economic conditions.

Last week UNH was trading for $470/share, and I was happy to stay patient (due to the macro rally we’ve seen in recent weeks), hoping to see the stock fall to 52-week lows in the $440 area…

UNH trading for $440/share would equate to a 17.5x forward P/E ratio…meaning a slight discount to the 20-year average.

At that price point, I’d feel comfortable investing heavily.

Because of my macro concerns, I’m not in a hurry to put my February cash to work.

I’m happy to continue to watch earnings reports and gauge the relative values up and down my portfolio + watch list (over 100 blue chip dividend growth stocks).

But, even if that weakness doesn’t occur, don’t be surprised to see me buying UNH in the $485 area in the relatively near future.

Because of UNH’s extremely high quality, this stock now sits near the top of my current watch list and I have plenty of cash sitting on the sidelines ready to be allocated to the market before the month is over.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in UNH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Nicholas Ward is long: AAPL, ABBV, ACN, ADBE,ADC, ADP, AMGN,AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, BAH, BAM, BEPC, BIPC, BLK, BMY, BN, BR, BTI, BX, CARR, CCI, CMCSA, CMG, CMI, CPT, CRM, CSCO, CSL, DE, DEO, DIS, DLR, DPZ, ECL, ENB, ESS, FB, FRT, GOOGL, HD, HON, HRL, HSY, ICE, ITW, JNJ, KO, LHX, LMT, LOW, MA, MAA, MCD, MDT, MKC, MO, MRK, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, OTIS, PEP, PH, PLD, PLTR, PYPL, QCOM, REXR, ROP, RSG, RTX, SBUX, SHW, SPGI, STZ, SWK, TXN, V, VZ, WM, WPC.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our "Learn How To Invest Better" Library

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.