Summary:

- Intel’s annual capex nut is still the long-term problem.

- The dividend could get eliminated, but Intel’s senior unsecured credit rating by S&P / Moody’s is still A-/A3. The dividend won’t likely survive a credit downgrade to BBB.

- Intel’s added 20,000 jobs since June ’21. Expense management counts as much as capex management.

- In terms of the potential to recover, the PC biz is still roughly 50% of Intel’s revenue and 60% – 70% of operating income. It’s suffering from the post-Covid hangover.

- Continued recovery in free cash flow is a must.

JasonDoiy

Despite the EPS miss on Intel’s Q4 ’22 results and the guide-down for Q1 ’23, Intel’s stock has not made a new low and traded below the October 13, ’22 drop to $24.59, despite two lousy earnings reports, and we could take that as a very small plus.

However, Intel as a stock and a company is facing some very difficult hurdles, not the least of which is a potential dividend cut as these recent Seeking Alpha articles (here and here) noted. (This article written in late August, 2020, detailed that capex was Intel’s Achilles Heel, and it’s only gotten worse since then)

Both articles had the math right: Intel’s dividend is roughly $1.5 billion per quarter or $6 billion per year, and it was only Q4 ’22’s quarter that saw Intel generate positive free cash flow of $2 billion, the first positive quarter of free cash flow since Sept 21’s quarter.

Intel’s history around the dividend is that they will go through periods where the Board will maintain the dividend and not increase it, as they did in June, 2012 to September, 2014, when they kept the quarterly dividend at $0.225 per share for 9 quarters, even though at that time, Intel was still free cash flow positive, with free cash covering the dividend.

Back in 2012 to 2014, Intel’s annual capex was $7 – $8 billion per year, which was still formidable and absorbing about 45% – 50% of Intel’s cash from operations. In 2022, Intel’s capex was $20 billion, and it began to scale much faster in 2017, as Intel realized they were losing out to AMD in the cloud and data-center microprocessor market.

Talk about putting yourself in a box.

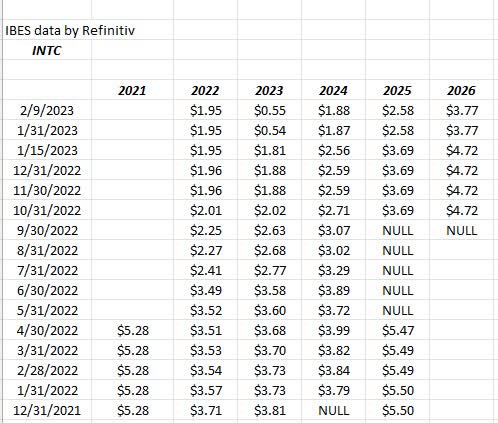

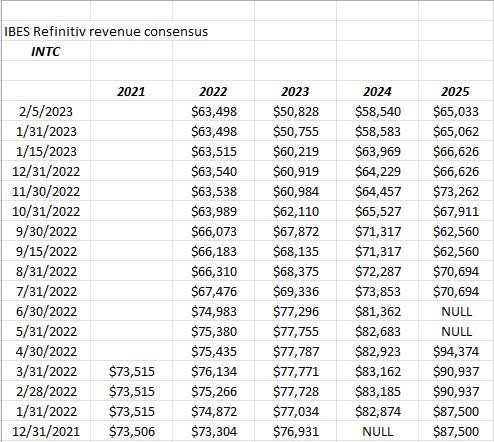

Here’s a quick look at Intel’s forward EPS and revenue estimates:

Intel EPS estimate revisions (IBES data by Refinitiv ) Intel revenue estimate revisions (IBES data by Refinitiv )

Companies with a high degree of operating leverage like Intel has, have the additional problem of small changes in revenue generating large changes in EPS.

Looking at the 2023 revenue estimate for Intel, the $50.8 billion estimate is down about 33% from the 12.31.21 estimate of $76.9 billion, but the EPS estimate has fallen 85% for the same time frame.

Now the opposite works with strong and rising revenue, but Intel’s a long way away from that environment it seems.

Either way, the two tables tell a grim story for the microprocessor giant in terms of steadily and consistently lower revisions, particularly revenue revisions across the board.

The longer-term picture:

(This article written by the author in late August, 2020, detailed that capex was Intel’s Achilles Heel, and it’s only gotten worse since then. Actually this article written a year earlier than the article in the previous sentence, uses the Achilles Heel expression, with the conclusion being the stock was undervalued, and I got lucky and the stock rallied into the $60’s.)

Here’s a quick look at Intel’s revenue vs capex:

| Intel | Rev ($ bl’s) | capex ($ bl’s) |

| 2022 | $63 | $20.5 |

| 2021 | $74.7 | $19.4 |

| 2020 | $77.8 | $14.3 |

| 2019 | $71.9 |

$18.1 |

| 2018 | $70.8 | $15.1 |

| 2017 | $62.7 | $11.8 |

| 2016 | $59.4 | $9.1 |

| 2015 | $55.3 | $7.9 |

| 2014 | $55.8 | $10.1 |

Source: valuation spreadsheet from earnings reports, 10-Q’s

Simply put for readers, revenue has grown $8 billion since 2014, while capex has doubled from $10 to $20 billion, basically consuming all of Intel’s cash flow from operations (CFFO).

So how does Intel move forward ?

Well the article linked to Bob Swan’s statement received many nasty comments, but Intel has to cut capex eventually, that is obvious.

I do think a recovery or bounce in the PC segment which is still half of Intel’s revenue but accounts for 60% – 80% of Intel’s operating profit will buy the giant some time.

No question the PC segment slowed in 2022, as a result of the hangover from 2020 and 2021 and the rapid need to “work from home”, etc. so this business should stabilize and recover at least somewhat as we move through 2023.

The cloud and AI or datacenter segment is dominated by AMD and this Intel has a tougher road to hoe to recover share in that market segment.

Morningstar has cut Intel’s moat from wide to narrow, but holds out some hope for 2023 manufacturing process improvement via EUV lithography, and Morningstar does note that Intel retains an 80% market share in the CPU market, although losing about 10% of share to AMD.

Summary/conclusion:

As someone who has no electrical engineering background, the engineering and manufacturing dynamics of a semiconductor or microprocessor giant like Intel are well beyond me, and thus – in the sense of a true financial analyst – I have to follow the numbers, and boy are they grim.

However as noted in the opening paragraph, as a dime-store technical analyst, the fact that Intel has had two pretty lousy quarters of financial results and yet the stock hasn’t made a new low, is worth noting.

For readers that like to bottom-fish, use a stop-loss on Intel at that October 13th, 2022 low of $24.59, or better yet give yourself a margin of error and use $24.

I don’t have an opinion on whether the dividend gets cut: Intel had $28 billion in cash on hand as of 12.31.22, and their debt-to-cap is just 28%, and Intel’s credit rating is still in the A / A- area by the rating agencies, which does indicate the chip giant has some financial flexibility to ride out this extreme turbulence. The dividend elimination would save $6 billion a year, but it would likely send the wrong signal to the capital markets. If the senior unsecured credit rating gets cut to Baa/BBB, Intel may not have a choice at that point. Another positive quarter of free cash flow would help assuage dividend investors anxiety.

Pat Gelsinger, the new evangelical CEO of Intel, said at the Ohio plant opening that Intel’ would cut capex by $5 billion, but that may not be enough.

One final point: tracking Intel’s headcount, the giant has added 20,000 jobs since June ’21 as “revenue per employee” has plummeted. While capex is the focus, reducing SG&A in a meaningful way would buy the giant some time.

Intel is entering its 4th month without making a new low; it’s a small technical ray of sunlight in a very gloomy backdrop.

A few clients have very small positions and right now – unless $24 is taken out and the stock drops below that level on volume – it’s a wait-and-see proposition.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.