Summary:

- Walt Disney’s sales and earnings beat expectations, lifting the stock price by +5% following the announcement of earnings on Wednesday, February 8th, 2023.

- Parsing through the figures, we come away impressed and anticipate profit margins to reach high single digits, 9%-10%, by FY ’25.

- Given the added profitability due to cost restructuring, and material upside tied to theater and parks and resorts business units, we think Walt Disney Company can beat and raise estimates this year.

- We raise Disney’s price target from $157 to $177 in our latest research, as we continue to recommend Walt Disney to our readers following the announcement of earnings.

- Walt Disney’s proxy battle with Nelson Peltz is officially over, which creates less noise around the stock following Q1 ’23 earnings. Bob Iger wins the approval of shareholders with shareholder-friendly announcements throughout Q1 ’23 earnings call.

Drew Angerer

Introduction

Walt Disney (NYSE:DIS) reported phenomenal FY’Q1 ’23 earnings results, which the street responded to very favorably. The company reported a beat on both top line and bottom line results on February 8th, 2023. The stock rallied by +5% to close Wednesday after-hour session. We covered Walt Disney stock in late-January where we offered our prior price target of $157. We publish our financial model, and offer an update to our estimate to reflect the heightened excitement in the stock in the afterhours. The stock is trading at $111 at the time of writing, which is +$10 from when we published in January.

Stock rallied on the back of strong financial results: $0.99 non-GAAP diluted EPS beat of +$0.20. The company reported revenue of $23.51 billion, which beat consensus by +$230 million for FY ‘Q1’23 earnings results.

In terms of bottom line beat, DIS reported $1.810 billion non-GAAP net income for Q1 ’23 earnings. Differences in GAAP versus non-GAAP are driven by a combination of adjustment charges tied to amortization, restructuring, other expenses, and income from non-controlled interests. We expect the company to deliver stronger results in light of the cost restructuring, which ends the proxy battle with activist Nelson Peltz, and reasserts the stance that Walt Disney is on track with both capital returns, and increases to profitability.

The business managed to grow revenue Q1 ’23 to $23.51 billion by +7.7% mostly driven by stronger than expected Disney Resorts revenue, and Direct-to-Consumer also performed well. Worker reduction of 7,000 with the inclusion of a potential dividend in Q4 ’23 resonated with shareholders. Bob Iger also explained the reorganization of the business into three separate units, and how cost reductions would benefit the company, and its shareholders. Bob Iger responded to an analyst from J.P. Morgan, when asked about holding onto ESPN, Bob Iger reiterated that the company plans on holding ESPN with no intentions of selling or spinning off the business unit.

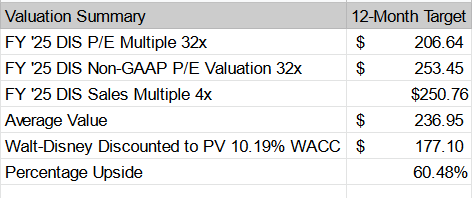

We continue to reiterate our strong buy recommendation on Walt Disney and raise our price target on Walt Disney from $157 to $177, we value Walt Disney at 22x FY ’25 earnings, which we view conservative, but also warranted in light of the business environment. We find ourselves raising our profit margins in our financial model more considerably in-light of the restructuring efforts, which yielded a higher profit assumption in our forecast, which then translated to the +$20 price target increase in our financial model. Furthermore, we find ourselves valuing the business using a blend of non-GAAP and GAAP diluted EPS figures and forward sales to derive our financial estimate along with a discount to present value using the firm’s WACC.

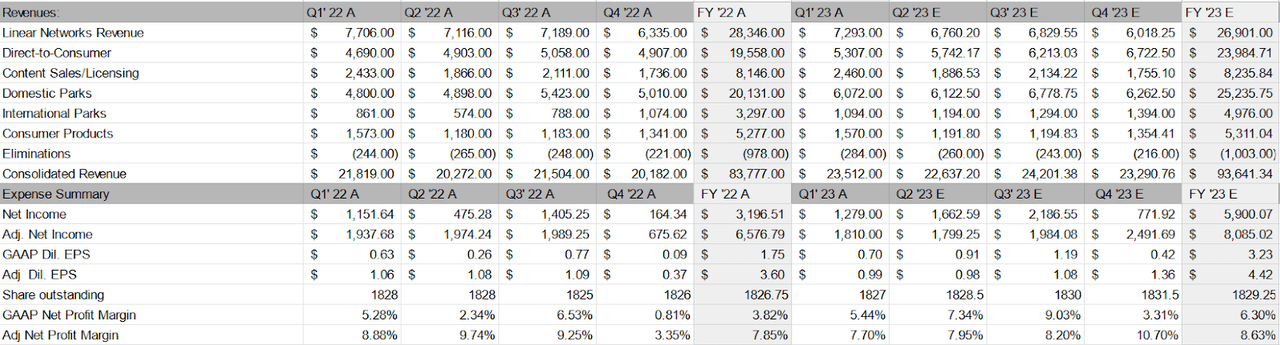

In terms of Q2 ’23 estimates, we forecast $22.637 billion revenue, and $0.98 non-GAAP diluted EPS, which conforms with Wall Street consensus estimates of $23.08 billion, and $0.96 non-GAAP diluted EPS. We expect revenue to be a bit lighter and margins to perform a bit better when compared to consensus, which implies that expectations shift towards margins, and a surprise on revenue when transitioning to the next quarter. We expect employee related charge-offs will be factored back into our diluted EPS figure, which is why our estimate is a little higher on non-GAAP EPS than other analysts, though we acknowledge that the cost cuts will take time to materialize, which is why we also forecast over a multi-year time frame the impact of cost reductions in our net profit discussion from FY ’23 – FY ’25.

We also want to highlight that our FY ’23 revenue and non-GAAP diluted EPS estimates are $93.6 billion and $4.42, respectively. These figures compare to FY ’23 consensus estimates of $90.5 billion, and $4.12 non-GAAP diluted EPS.

We expect the company to beat and raise estimates over the course of the year given a number of factors such as theatrical release slate, strengthening domestic and international parks revenue, and continued 20%+ growth CAGR in the streaming/direct-to-consumer business.

Quick overview on Q1 ’23 earnings results

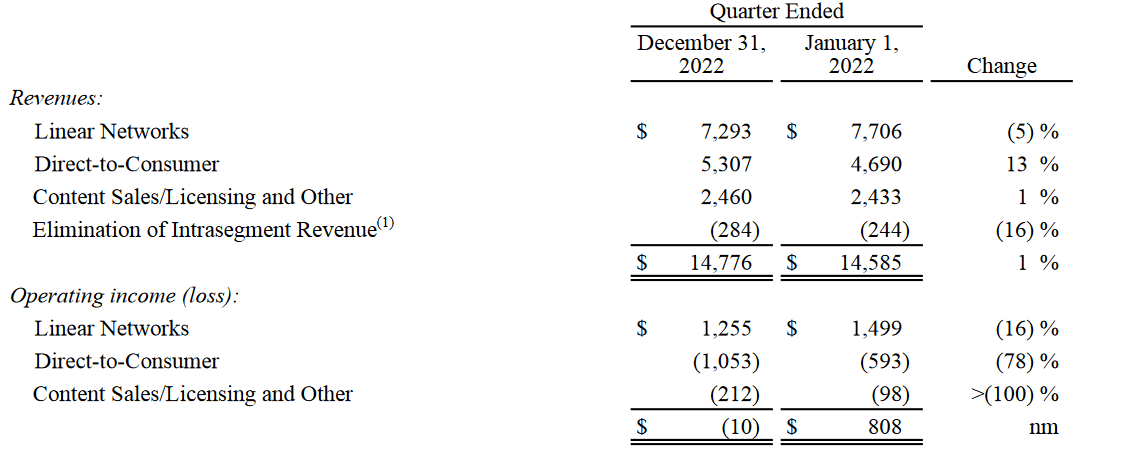

Bob Iger unleashes magic yet again when delivering Q1’23 earnings results. Results were strong given the growth in key operating segments. Direct to consumer segment grew revenue to $5.3 billion Q1′ 23, which represented a +13% y/y increase. The results were strong despite some decline in ARPU from $6.10 to $5.95 representing a -$0.15 decrease to the revenue per subscriber figure, however they mentioned on the earnings call that the company plans on monetizing ads tied to Disney+, which should have a positive impact on the ARPU figure later in the year.

It was also noted in the earnings release that the company reported a $1.1 billion operating loss in the segment, which increased by +500 million, this was driven by higher losses tied to Disney+. However, it was also noted that losses in Hulu, and improved results from ESPN+ helped offset losses.

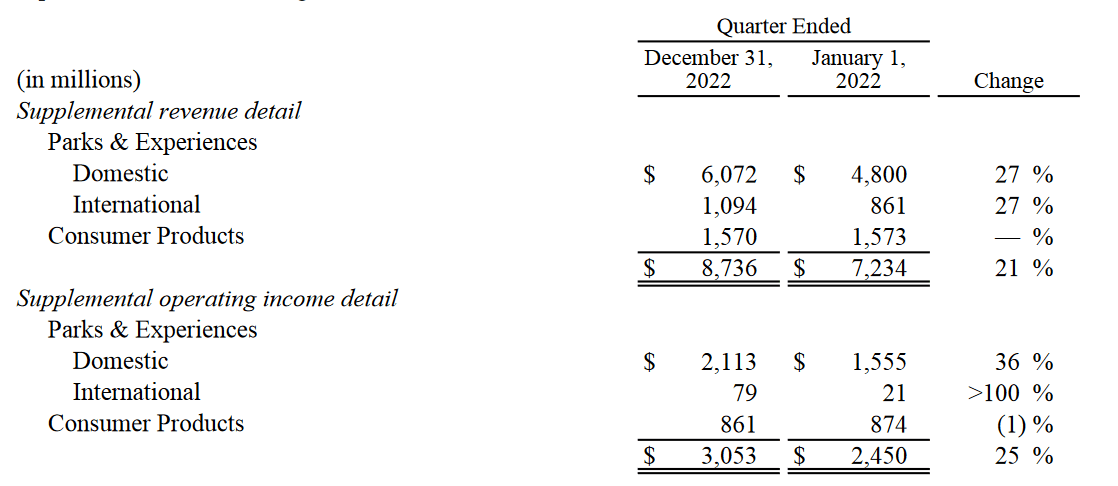

Overall, revenue tied to television, streaming, and television licensing was $14.776 billion, which represented +1% y/y growth, whereas the physical portfolio carried the quarter. The company reported y/y revenue growth across its consolidated Parks portfolio and consumer products portfolio of +21% y/y from $7.234 billion Q1 ’22 to $8.736 billion Q1 ’23, which drove the bulk of total revenue growth for the quarter.

When combining the $14.776 billion revenue from the media segments, and $8.736 billion from parks and consumer products, we arrive at the $23.51 billion revenue headline revenue figure. We simply extrapolate all of the business units to summarize our revenue forecast for the next several years when describing Walt Disney results in our financial model (later in the report).

Figure 1. Walt Disney Television, Streaming, and Content Licensing Results Summary

Walt Disney Q1 ’23 Earnings Release (Walt Disney)

Figure 2. Walt Disney Parks Resorts, Experiences and Consumer Products Summary

Walt Disney Q1 ’23 earnings release (Walt Disney)

The surprise on the quarterly earnings results came primarily from Disney Parks, Experiences and Products, which increased sales +21% to $8.7 billion Q1 ’23. Segment operating income increased +25% to $3.1 billion. Walt Disney noted in the earnings report that the higher operating results were driven by higher park attendance whereas consumer products remained flat.

The key highlights regarding costs can be summarized by a company-wide cost reduction plan, which will reduce non-content-related expenses by -$2.5 billion, excluding inflation. Bob Iger anticipates that the cost reduction will be split between 50% marketing, 30% labor, and 20% technology related spending and procurement related/other expenses.

Bob Iger goes on to mention, “Longer term, we also expect to realize additional efficiencies in our content spending with an annualized savings target of approximately $3 billion of future spending outside of sports.”

However, it was noted that non-content related savings was also included in guidance in the prior-quarter, so the difference is an additional -$1.5 billion in cost savings tied to marketing, labor, technology related spending. It’s anticipated that the savings will be realized by the end of FY ’24. However, it was also noted that the company will experience operating expense growth in the high single-digit range 8%-9% over the next couple years.

Movies and cinemas seem to be recovering

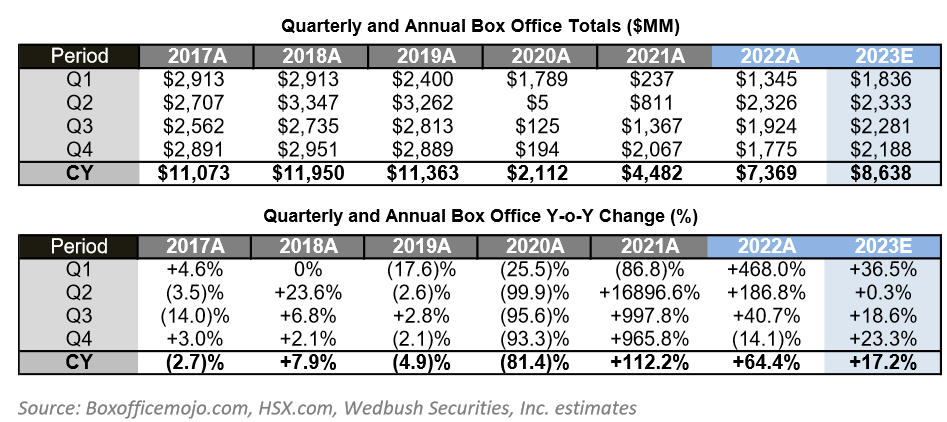

FY ’23 revenue driven very little in the way of box office contribution, though content sale/licensing likely recovers given the overall box office recovering. For now, we become increasingly encouraged, as analyst Alicia Reese at Wedbush estimates that CY ’21 $4.48 billion box office receipts improved to $7.37 billion in CY ’22.

We like these figures, as it represents +64% growth in direct box office revenue, which had little effect on Walt Disney results. Mainly because of the differences in timing of box office, and also because consumers might be waiting for the film to show-up on Disney+ as opposed to watching the film at the box office.

We anticipate that these figures could recover to pre-pandemic levels depending on the amount of content slate, and the number of theaters still operating, which would imply box office totals of $11-$12 billion when referring back to 2017-2019 levels. It really depends on the strength of film release, and the willingness of customers to return to theaters. We think Wedbush estimates of +17.2% growth in 2023 seem fairly conservative.

Figure 3. Quarterly and Annual Box Office Totals

Theater revenue United States 2022 (Wedbush)

We also want to highlight the massive recovery in the box office, though we’re not necessarily back to pre-pandemic levels… the numbers look a lot better lately.

It’s worth noting that Walt Disney still generates revenue from this category under the DMED (Disney Media Entertainment and Distribution), which reports revenue under the content sales and licensing segment, which we estimate $8.2 billion in FY ’23 sales or 1%-2% growth, but wouldn’t be surprised if this segment performs better in light of theater attendance in conjunction with the number of films scheduled for launch this upcoming year.

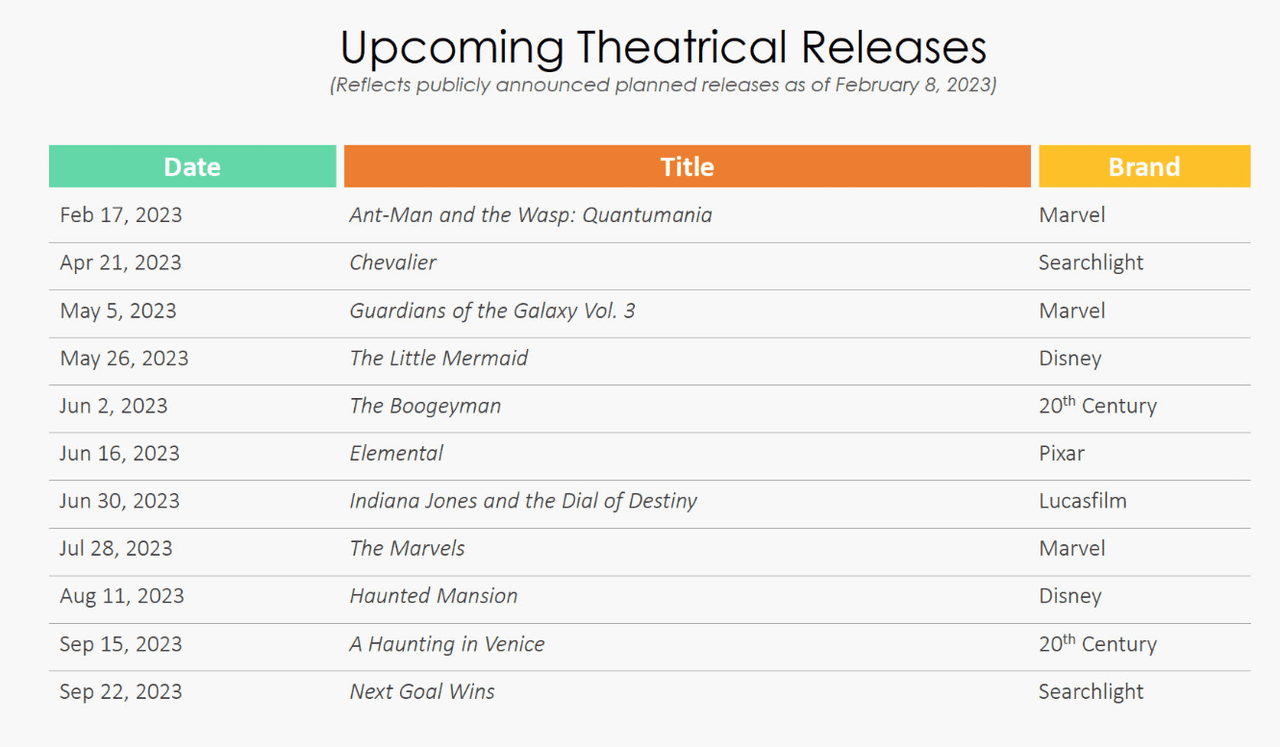

Figure 4. Walt Disney Theatrical Release Schedule 2023

Walt Disney Q1 ’23 Earnings Presentation (Walt Disney)

We like the upcoming film slate, and anticipate the launch of Guardians of the Galaxy Vol. 3, Indiana Jones and the Dial of Destiny to move the needle meaningfully for theatrical releases as we progress through the year, implying upside to our own revenue estimates though we imagine we’re higher than consensus expectations already. Despite that being the case, we expect the animated film, Elemental from Pixar to also perform really well and add to the strong content mix.

Nelson Peltz backs out of proxy battle

Following the announcement of quarterly earnings, and the discussion of cost reductions it’s worth noting that Nelson Peltz declared publicly on CNBC an end to the Proxy Battle with Walt Disney.

Nelson Peltz goes on live air with Jim Cramer,

“You can only win once. This was a great win for all shareholders. The management team is doing everything we wanted them to do. We will be watching and rooting, and the proxy fight is over.”

For the most part, we’re thrilled the proxy fight is over, given the $5.5 billion dollars in announced cost cuts over the past week. We think the business fundamentals improve materially, and it’s no surprise Nelson Peltz backed out, as he got exactly what he wanted.

Financial model discussion and overview

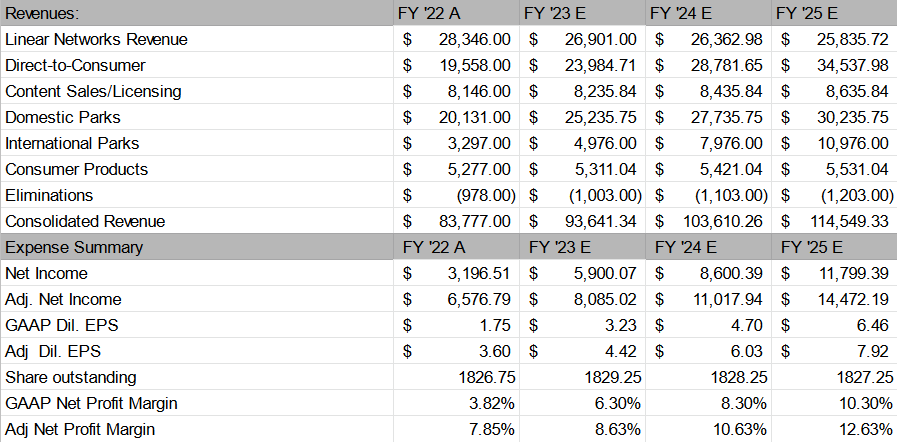

Given the impact of cost cuts, we expect 21% annualized non-GAAP diluted EPS growth over the next 3-year period, making it one of the faster growers in the basket of stocks we cover. We anticipate +$1.5 billion in bottom line impact in FY ’23, +$2.7 billion in FY ’24, and +$3.47 billion in FY ’25.

We expect that the improvements to profitability will be reflected in bottom line financial results, as our model forecasts 6.3% GAAP net profit margin FY ’23 improves to 10.3% FY ’25 over the next 3-years, which is pretty significant.

This is easier to achieve assuming the business also generates 7% sales CAGR from FY ’23 – FY ’25, which seems achievable given the growth in films, direct to consumer, parks and resorts, which should translate to better margins on higher volume and efficiency over time.

Figure 5. Financial Model Quarterly FY’23 Estimates

Walt Disney Quarterly Estimate (Trade Theory)

Figure 6. Financial Model Annual FY ’23 to FY ’25

Financial Model Walt Disney Multi-Year (Trade Theory)

Our FY ’23 revenue estimate is a bit more aggressive than other analysts, but given the growth comparisons, and where the business is headed we think Walt Disney outperforms given slower networks revenue decline, better than expected theatrical release revenue, reversion to growth in subscriber monetization metrics with better advertising revenue from both ESPN+ and Disney+.

Re-opening of China likely adds upside to international resorts revenue over the next couple years, and we also expect better profits in general given the overall emphasis on cost efficient growth.

Figure 7. Price Target Summary

Walt Disney Valuation Model (Trade Theory)

We think investors are missing some of the keys to unlocking the magic kingdom, because of the complexity of the business. But, we try our best to summarize the upside thesis to Walt Disney as we value the business using a combination of the firms non-GAAP, and GAAP dil. EPS using the same exact growth based 32x P/E multiple. We also apply a 4x sales multiple to forward revenue to arrive at an average value of $236.95, which we discount by 10.19% using the firm’s WACC to arrive at a $177 price target. Given where the stock is trading at the time of writing at $110 per share, we expect +60% upside in the stock over the next 12-month period.

Investment thesis summarized

We think our inputs are fairly conservative in our model, as we do compare to Wall Street estimates still. However, we expect a bit more of a surprise on FY ’23 revenue, which could drive a number of expectation beats over the course of the year. We like the narrative on cost efficient growth. We expect Bob Iger’s pitch to investors to play a key role in keeping shareholder activism to a limit with Nelson Peltz exiting the Proxy battle.

Given the triumphant return of Bob Iger, and the willingness to make some necessary adjustments over the near-term we like the stock. Disney will likely grow into becoming a larger streaming business, even with subscriber losses in the conventional TV bundle opportunity. We think the stock is attractively positioned especially after the FOX acquisition, which has further strengthened the portfolio opening additional opportunities in streaming.

Furthermore, among all the blue chip stocks we actively cover, with the exception of Coinbase, Walt Disney’s returns over the next 12-months seem relatively compelling at +60%. We think investors will eventually buy into the narrative of a media conglomerate turnaround driven by one of the smartest and most brilliant minds in the media business – Bob Iger.

Also, we appreciate the fact that Bob Iger wants to hold onto as many media assets as possible, including ESPN and ESPN+. We’re hopeful the company is able to buy some additional movie studios or other programming assets as the business increases profitability. We think owning content, brand, and channels is how Walt Disney navigates the transition towards internet streaming and Internet linear TV.

We believe DIS is positioned for growth ahead of a 500 million global subscriber opportunity. Retaining parks and resorts, and merchandising also helps differentiate DIS from NFLX. It’s why we continue to reiterate our strong buy recommendation on Walt Disney and why we raise the price target even higher from $157 to $177. DIS isn’t easy to understand, but we think investors will buy into the profit recovery narrative. Numbers likely become more impressive over the next couple of quarters and years, which is why we have added conviction in Walt Disney and recommend the stock to our readers on Seeking Alpha.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.