Summary:

- INTC made the drastic decision to retain dividends while implementing a pay cut across the board, potentially alienating its talented engineers at a time of necessary R&D investments.

- The company has been losing ground in the x86 segment to AMD as well, further exemplifying its growing list of problems, on top of PC demand destruction.

- With the management’s bleak forward guidance and commentary, we remain surprised by INTC stock’s current support level at the mid $20s.

- The INTC stock is one that is hard to love, even at these 9Y low stock prices.

denisgo

We had previously covered Intel Corporation (NASDAQ:INTC) here, covering the challenges of its expansion plans in Germany, with a brief outlook on the country’s energy crisis. We also discussed the management’s prompt decision to divest non-core businesses, which might help to streamline the business and improve operating efficiencies during the ongoing PC demand destruction.

For this article, we will focus on INTC’s recent FQ4’22 performance, as well as its decision to retain dividends, while implementing a pay cut across the board. In our view, the company’s cost-saving strategy may have been too aggressive and negatively impact its future R&D prospects. In the absence of pay cuts among its peers, the management may have difficulty retaining its top talent moving forward.

Mr. Market Remains Highly Sympathetic To INTC

INTC 1Y EV/Revenue and P/E Valuations

INTC is currently trading at an EV/NTM Revenue of 2.76x and NTM P/E of 56.94x, lower than its 3Y pre-pandemic EV/Revenue mean of 3.28x though massively inflated from its 3Y P/E mean of 12.23x. Otherwise, it is still trading very optimistically against its 1Y mean of 2.28x and 15.60x, respectively.

Based on INTC’s projected FY2024 EPS of $1.87 and 1Y P/E mean, we are looking at a moderate price target of $29.17. This mirrors the consensus estimates target of $28 as well, suggesting minimal upside potential from current levels.

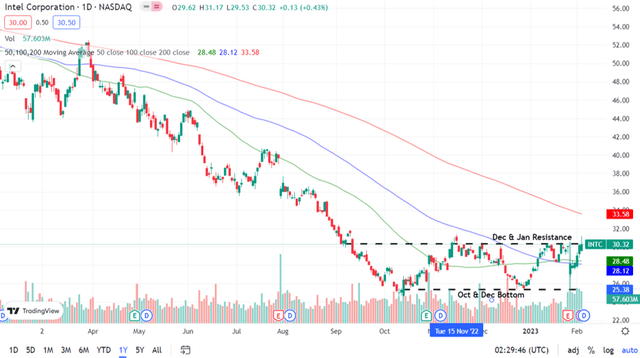

INTC 1Y Stock Price

The sustained support level was visible in INTC’s October and December bottom at the mid $20s, demonstrating the improved price to start nibbling then. On the other hand, the stock had been unable to break through the December and January resistance levels of $30, suggesting more uncertainties ahead.

We were surprised that INTC’s stock price declined by only -8.6% on January 26, 2023, despite the underperforming FQ4’22 earnings call. Its quarterly performance had been drastically impacted by the PC headwinds, with both top and bottom lines missing the consensus estimates by a wide margin, with FQ4’22 revenues of $14B (-31.6% YoY & -3.4% from estimates) and non-GAAP EPS of $0.10 (-90.8% YoY & -50% from estimates). Notably, the company also did not deliver on what we’d call “kitchen sink” guidance calling for EPS at $0.20 from the previous quarter.

In addition, INTC’s FQ1’23 guidance was dismal, with revenues between $10.5B and $11.5B against the consensus of $13.96B, and FQ1’22 levels of $18.35B. Its EPS guidance of -$0.15 failed to meet expectations as well, against the consensus of $0.25, and FQ1’22 levels of $1.98. Pat Gelsinger, CEO of INTC, said:

We expect macro weakness to persist at least through the first half of the year with the possibility of second half improvements. However, given the uncertainty in the current environment, we are not going to provide revenue guidance beyond Q1… To various degrees, all our markets are being impacted by macro uncertainty, rising interest rates, geopolitical tensions in Europe and COVID impacts in Asia, especially in China. (Seeking Alpha)

These events suggested that Mr. Market remained somewhat sympathetic to INTC indeed. However, we were less convinced, since the company’s forward execution had been discounted drastically. It is only expected to report FY2024 revenues of $58.74B, EPS of $1.87, and cash from operations of $21.42B, against FY2019 levels of $71.96B, $4.87, and $33.14B, respectively.

This is the reason why we remain uncertain about INTC stock, since its dividends may potentially be impacted, due to the reduced cash flow and increased capex towards its foundry dreams. By FY2022, the company only reported $15.43B (-47.6% YoY) of cash from operations against $25.05B (23.2% YoY) of capital expenditures.

For now, management has guided for $4B in annualized revenues for the IFS pipeline, while similarly engaging other potential customers globally. However, this number was just a drop in the ocean in comparison to Taiwan Semiconductor Manufacturing Company’s (NYSE:TSM) performance in FY2022, with revenues of 2.26B TWD (+42.6% YoY ex-currency) or the equivalent of $73.64B (+28.7% YoY).

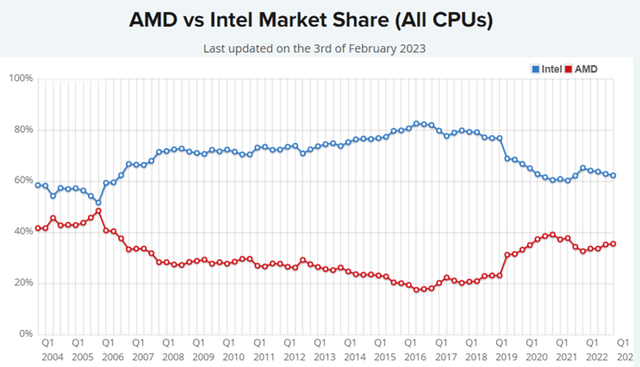

CPU Benchmarks

INTC’s dominance in the x86 segment has further deteriorated with Advanced Micro Devices, Inc. (NASDAQ:AMD) gaining ground in the x86 CPU market to 35.5% by Q1’23, opposed to 32.6% in Q1’22. With the former continuing to lose both desktop and laptop end-segments, the only bright spot was that INTC had gained in the server market to 94.2% in the latest quarter, against 92.6% previously.

While INTC reported a robust cash/investments of $28.33B (-3.1% YoY) by FQ4’22, its reliance on debts also expanded to $37.68B (+12.4% YoY). Otherwise, it grew tremendously by 48.9% from pre-pandemic debt levels of $25.3B. Oddly, the company chose to increase its annual dividend paid out to $5.99B (+6.2% YoY), raising the question of its dividend safety ahead, especially attributed to its projected reduced cash from operations through FY2024.

Perhaps this was why the INTC management had embarked on an ambitious transformational journey towards $10B in cost savings by 2025. Between February 2021 and December 2022, it achieved $1.5B in savings through workforce reductions and multiple divestitures.

On top of that, the executives opted for pay cuts of between -5% to -25% across the board, barring the hourly workforce. Only time will tell if these might contribute to $3B in total savings and $20B in operation expenses by the end of 2023, since the company reported total expenses of $24.53B (+12.8% YoY) in FY2022.

In addition, we were uncertain how these pay cuts might impact its eventual R&D pipeline ahead. While workforce reductions normally impacted underperforming employees, a broad-stroke pay cut might diminish morale and alienate talented engineers, especially worsened by the prolonged interest rate pains through 2023.

While shareholders might naturally be happy about the sustained dividend payouts, we were not so certain about the management’s choice of preserving dividends at the potential cost of talent. This is why we are increasingly concerned about the potential deterioration of INTC’s R&D prowess ahead, since the company has been losing x86 market share thus far.

While we are not so bearish to conclude that INTC’s dividends may be suspended, we reckon the management may opt to retain the payouts at current levels of $1.46 annually, with minimal shares repurchased moving forward. This number implies a forward dividend yield of 4.87% for those who add here.

Otherwise, investors who had been opportune enough to add at the recent bottom of $24.59 would have enjoyed a speculative yield of 5.93%, against INTC’s 4Y average of 2.86% and sector median of 1.54%. That is not too bad indeed, since the company has been continuously paying out dividends for 29 years.

Nonetheless, we prefer to rate INTC as a Hold here, since the stock may remain volatile in the short term. Even if the stock retraces to its support level at the mid $20s, investors must note that the stock may continue underperforming for the next few quarters, before the PC headwinds are lifted and its foundry business turns profitable. This stock requires a long-term investment strategy and tremendous patience in our opinion.

Disclosure: I/we have a beneficial long position in the shares of INTC, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.