Summary:

- ChatGPT is the latest great thing when it comes to AI.

- Microsoft has an early jump on AI and the ChatGPT module is gaining popularity by the day.

- Could Microsoft eat into Alphabet’s dominance within search?

HJBC

Microsoft Corporation (NASDAQ:MSFT) recently released their Q2 2023 results, which initially saw the stock fall before quickly regaining those losses and more in the days to follow.

The worry investors had initially, which is not going away, is around the slowdown in the business, particularly as it relates to Azure cloud, which has been the company’s largest growth driver for some time now.

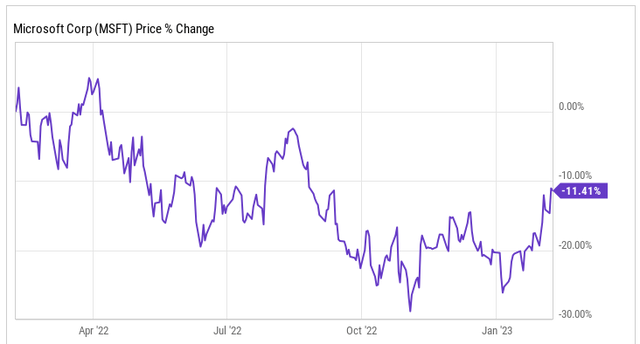

Over the past 12 months, shares of MSFT are down roughly 12%, and that is after a 12% gain to start the year.

ycharts

We will take a look at the earnings release, look at the guidance the management team released and also talk about the potential for Artificial Intelligence moving forward.

Q2 2023 Earnings Results

Microsoft operates with a June 30 fiscal year end, so the earnings released recently were for the Q2 quarter ending December 31, 2022.

The company reported revenues of $52.7 Billion, which was a mere 2% increase year over year, which was one of the slowest growth quarters on record over the past few decades for the company. Analysts were expecting revenues of $52.94 billion for the quarter.

Operating Income for the quarter was $21.6 Billion on an adjusted level, down 3% year over year.

The company generated net income of $17.4 Billion on an adjusted level during the quarter, which was a decrease of 7%. This translated to adjusted EPS of $2.32 per share, which was a 6% decrease from prior year. Analysts were looking for EPS of $2.29, so the company beat expectations here.

So on paper, the quarter was just “OK”, however, a lot of that was to be expected given the drop off in demand we were aware of from not only other earnings reports, but also from the huge demand we saw during 2021 & 2022.

In addition, currency headwinds remain persistent and a drag on results. Looking at revenues and operating income from a currency neutral view, they actually increased 7% and 6%, respectively.

Microsoft has three reportable segments:

- Productivity and Business Processes

- Intelligent Cloud

- Personal Computing

The company’s largest segment, Intelligent Cloud, which includes Azure, generated revenues of $21.5 billion, an increase of 18% year over year, and up 24% currency neutral.

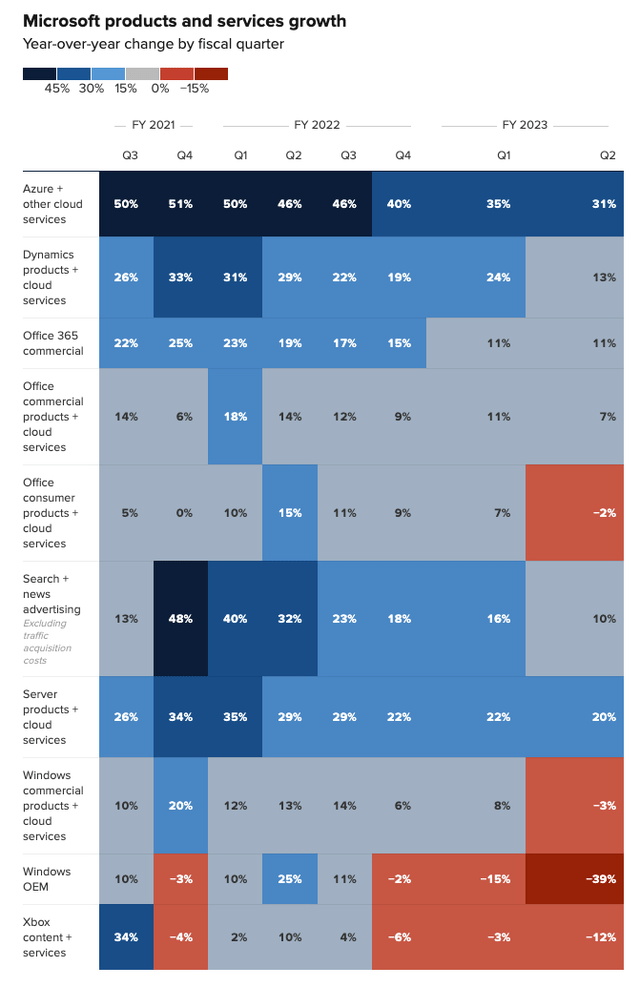

So cloud continued to grow at a strong clip, but the growth is slowing. Looking here at this chart, you can see how Azure in particular has seen slowing growth by quarter.

CNBC

Azure, which is the second largest cloud provider trailing on Amazon’s AWS (AMZN), grew 31% during the quarter, which was a far cry from the 46% growth they saw 12 months prior.

Windows OEM saw a decrease of 39%, which is now three straight quarters of declines, but this is in line with the strong demand that was seen in the prior year.

Guidance and Artificial Intelligence

In addition to rather weak results, the company also announced Q3 guidance that left investors looking for more.

Management is looking for Q3 revenue to be between $50.5 billion and $51.5 billion. The company also said they expect further slowing growth as it pertains to Azure.

PC demand is expected to remain weak in the near term, as such, the company has looked to cut costs by reducing its workforce, something that has been the normal within the tech sector the past few months.

So where does the company go from here?

Well, I introduce to you ChatGPT, which is an Artificial Intelligence module that has gained huge popularity amongst its users thus far. The chatbot was built by OpenAI, which happens to be a company that Elon Musk helped create. Microsoft has now invested over $10 billion into the company, which appears to already be paying dividends.

Artificial Intelligence has all the buzz right now and Microsoft is the clear leader. Alphabet (GOOG) had an AI day following Microsoft’s and they were met with major disappointment in which GOOG shares fell over 7% following the event.

AI could help MSFT tap into Google’s search dominance, as they have implemented it into their Bing search engine. Another avenue to look is that AI will increase the demand for cloud, which should help benefit Microsoft’s Azure business moving forward as more and more companies invest and rollout different AI offerings.

Valuation

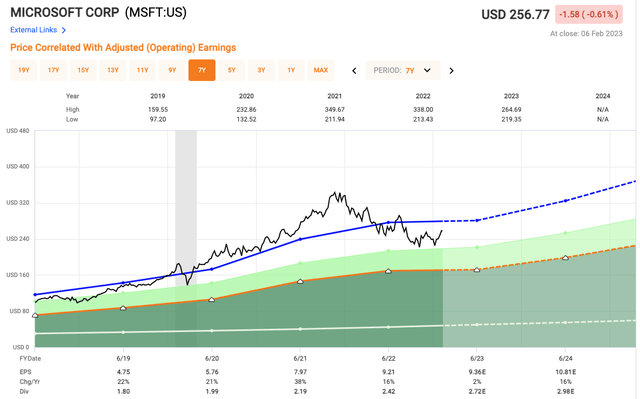

In terms of valuation, analysts are looking for June 2024 EPS of $10.81, which equates to a forward earnings multiple of 23.7x. Over the past 5 years, shares of MSFT have traded closer to 30x. The past five years have been a bit of an anomaly for the tech sector, so let’s look further out over the past decade, in which we see shares of MSFT trading at an average earnings multiple of roughly 25x.

Fast Graphs

Investor Takeaway

Artificial Intelligence is the new buzz word, and how popular it has become in such a short period of time almost makes it feel a little bubble like.

We are going to see all types of companies bringing forward their AI offerings, but right now Microsoft is the clear leader in the space. The AI craze could also be a boost to the company’s cloud segment as well, which could help reignite growth for the company.

Given the run up in stocks, I do expect a decent pullback in the near future, at which I believe would be a VERY appealing time in my eyes to add some shares of MSFT. The current valuation is below both their five year and 10-year average, so the stock is not expensive by any means.

The company has a well diversified portfolio of products and offerings, along with the second largest cloud service in the space.

According to grand view research, they expect the cloud sector to grow nearly 15% per year through the year 2030, which gives plenty of runway for these major cloud players.

Microsoft is a great business to own long-term, and they are led by a strong management team backed by a AAA rated balance sheet, making them technically safer than the US government.

What are your thoughts on Microsoft and ChatGPT?

Disclaimer: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No marketing to add