Summary:

- In our previous article, we pointed out that Meta was in a similar situation to Coca-Cola with their “New Coke” in 1985.

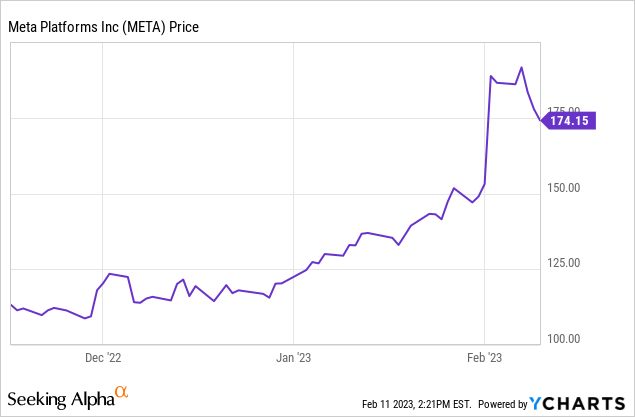

- Meta is up more than 54% since our last rating as we update to a more cautious outlook.

- Although Meta is reining in spending across all divisions, as we expected, we are still quite concerned about Meta’s long-term spending on Reality Labs.

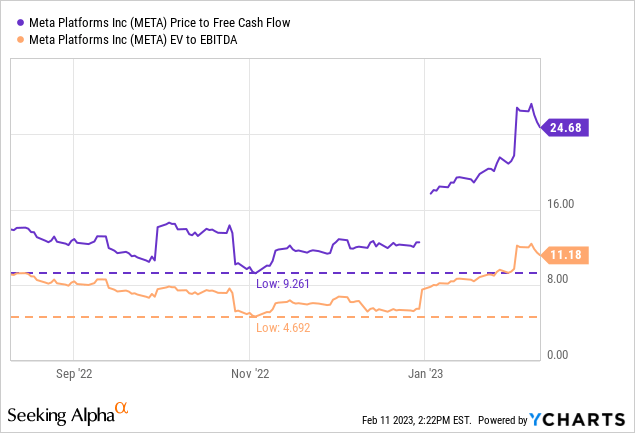

- Meta is no longer a bargain, as it currently trades closer to more normal P/FCF and EV/EBITDA multiples.

- Certain headwinds that prompted a major surge in CapEx may soon turn into tailwinds as Meta continues to build on generative AI and workforce reduction.

Justin Sullivan

In our last article on Meta (NASDAQ:META), we wrote about their difficulties with the Metaverse, profitability, and market share in their legacy business. In particular, we compared it to Coca-Cola (KO) in 1985, when they boldly tried to replace their Classic Coke with “New Coke,” in response to losing market share to competitors.

Meta seems to be in the same situation, deviating from its core business, advertising, to the Metaverse and other ventures that are basically unprofitable gambles on where management believes the future is headed. Like Coca-Cola, Meta seems to be returning to its core business and efficiency, and the “New Coke” problem seems to be solved.

We gave Meta stock a buy rating at $113.02 and that position is currently up 54.09%, but we explain why we are quite cautious and are changing our buy rating to a hold rating with an eye toward 2023, the year of efficiency.

The ‘New Coke’ Problem

We had classified Meta’s Metaverse and overspending as a ‘New Coke’-like problem, because it is still currently the biggest sinkhole in terms of cash, while still not supported by a valid business model. And fortunately, like ‘New Coke,’ Meta, after receiving enough feedback, returned to its legacy business. Looking back, Meta approx. lost $13.7BN on the Metaverse alone in 2022, currently rising to about $35BN+.

Spending $35BN to generate just over $6BN in revenue, we don’t see it as a valid business model. Rather an expensive experiment. For a small business, that’s the same as running an ice cream stand, buying ice cream for almost $6, and selling it for $1. Can you run such kind of business? Yes, if you have enough capital to waste. Should you? Absolutely not, of course. All that money could have been used to buy back more shares when the stock was an absolute bargain, and probably wouldn’t have even gone below $100 in the first place, with a near single-digit P/E ratio.

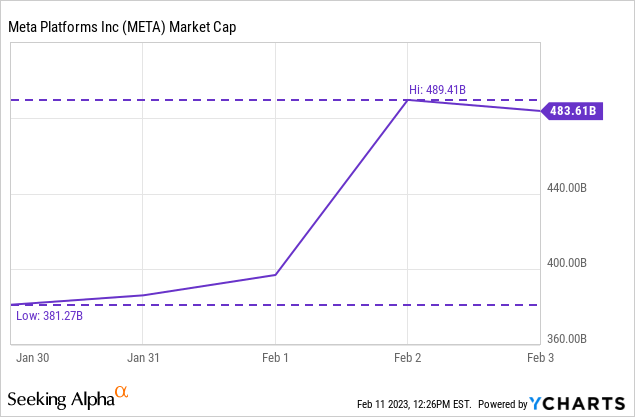

Speaking of buybacks, as most know, Meta announced that it was expanding its buyback program by $40 billion. The reaction the following day, however, was much more extreme. The stock stood at $153 before earnings, and rose to $197 the day after, meaning it added about $100BN to market cap in response to their $40BN buyback and financial results.

And speaking of the Metaverse, although Meta is keen on reducing costs and efficiency across all sectors, it is currently still wasting capital on its long-term Metaverse plans.

On Reality Labs, we still expect our full year Reality Labs losses to increase in 2023, and we are going to continue to invest meaningfully in this area given the significant long-term opportunities that we see. (Q4 Earnings Call)

However, we believe that Meta, as with previous mistakes in over-hiring and overspending, will also turn around in this area and eventually cave in when they realize that the long-term potential may be less than what they expected. And even if the Metaverse becomes the “next big thing,” it is not certain that Meta will be the market leader even if tens of billions of dollars are spent.

As mentioned earlier, for the amount of investment in the Metaverse, the ROIC is extremely poor, and so is the amount of output in terms of software and hardware for those tens of billions of dollars invested. It is not always the players who invest the most capital, but perhaps those who have the best capital controls at the end of the day. Don’t take our word for it, but the word of everyone who has tried the Metaverse.

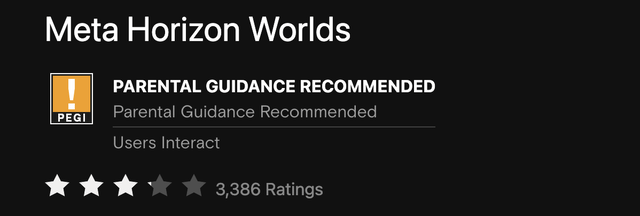

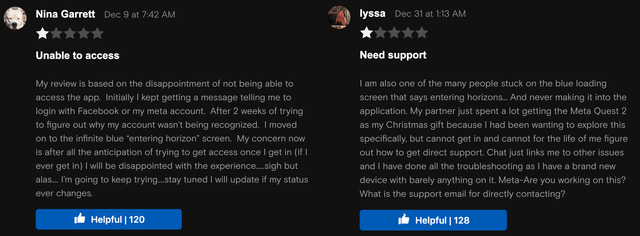

Meta Horizon Worlds has a rating of about 40%, with Google users, and a terrible rating with the Oculus store. Despite pumping $35BN into the project in late December, the Metaverse was still seriously riddled with bugs, with many users reporting not being able to even access it.

Almost the majority are 1-star reviews about not being able to access the application, loud screaming children in their ears, or being banned for the smallest comments, or having complaints. One person who was banned, with 859 people who found the comments helpful, said this on the topic:

Props to Facebook. Having zero human moderation, no appeal process, or really any safeguard whatsoever against this kind of thing, they’ve really optimized and streamlined the account banning process, Allowing people to be locked out of their apps with great efficiency. (Meta Horizon Worlds Review)

That $35 billion could have been invested in expanding their AI capabilities, and as mentioned in the earnings call, in better capabilities like Generative AI, which can help them with both content and internal efficiency while prioritizing medium-term goals. The rollout of ChatGPT with Bing, along with DALL-E 2 and other A.I. models, is actually a valid business model that is already generating revenue for certain players.

There could be very useful applications, such as Meta’s Workplace, which also has better reviews, but is very unlikely to be worth the amount of money invested in it, looking at revenues and huge net losses. Even from a hardware perspective, the Metaverse is already dying. Headset sales were down 2% year over year as of 2021. And Meta is not alone. Sony (SONY) recently reportedly halved their VR2 sales expectations. Halved! After pre-orders went so lackluster, they reportedly lowered their quarterly forecast from 2M units to 1M units.

An Update To Our Valuation

In updating our valuation, we point out that we may even have been too downbeat about the short-term CapEx outlook. The earnings call announced that they were spending much more than previously assumed:

Turning now to the CapEx outlook for 2023, we expect capital expenditures to be in the range of $30 billion to $33 billion, lowered from our prior estimate of $34 billion to $37 billion. (Q4 Earnings Call)

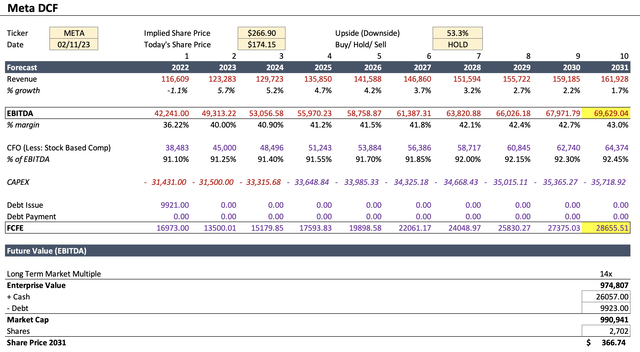

The same applies to expenses and EBITDA margins. In the long term, however, we believe that we may have been a bit too optimistic in terms of investments towards the second half of the decade, and we have raised our outlook accordingly. In terms of cash flow from operations, we have also made a significant increase, because Meta is expected to experience a major tailwind from declining labor costs.

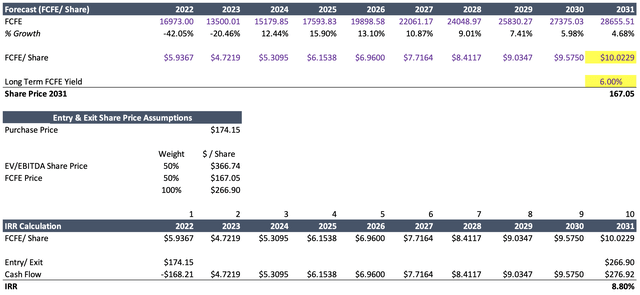

From an EV/EBITDA valuation, at a 14x multiple, we derive a fairly upbeat valuation of around $990BN or $366.74 per share. However, our P/FCFE valuation, which is much more focused on CapEx, indicates a much lower valuation.

We believe Meta, adjusted for share-based compensation, should be able to generate approximately $10.02 per share in free cash flow to equity. However, we have changed our long-term free cash flow yield from 5% to 6% to reflect the rise in interest rates that puts pressure on our valuation, as we did not previously expect the Federal Reserve to be able to bring interest rates to 5.25%, as is now expected.

This valuation, focusing more on Meta’s heavy CapEx, gives us a valuation of $167.05 per share. That means that at a 50% weight of both valuations, we expect Meta to quote $266.90 by 2031, or an IRR of 8.80%.

Our valuation represents a rather conservative estimate, with Meta’s revenue growth growing very slowly, but still able to make progress in terms of increasing EBITDA and FCF margins. For example, we believe Meta’s investments in AI could increase the productivity of their staff, allowing them to run their operation with less staff and overhead.

Currently, AI is already massively deployed to fix errors in code, help programmers generate code, and could replace much of their staff in the distant future. On the other hand, Meta has come under considerable fire in the recent past for trying to make acquisitions and could face some regulatory headwinds.

The Bottom Line

After rising 54.09% since our last buy rating, we are currently cautious on Meta. Our estimated IRR of 8.80% allows us to give Meta a hold rating, as it is fairly reasonably valued compared to the underpriced one when we ran our last valuation model last November.

We think it may not be in Meta’s interest to chase “the next big thing,” but they do have some tailwinds in terms of the development of generative AI, headwinds from Reels disappearing, less-than-expected headwinds from TikTok competition, and more. Corporate governance seems to be moving in the right direction, with steps toward greater efficiency and returning free cash flows to previous levels.

In terms of revenue growth, we believe their best years may be behind us, but there is much more value to be generated from operating and free cash flow margins. And with that, Meta seems to have solved the “New Coke” problem, focusing on their legacy business, as we foresaw.

We are going to be more proactive about cutting projects that aren’t performing or may no longer be as crucial. But my main focus is on increasing the efficiency of how we execute our top priorities. (Q4 Earnings Call)

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.