Summary:

- Adobe’s stock price has increased by 4355.56% from 2009 low, representing a strong market growth.

- Adobe is rebounding from the strong support of $274.73, which is a key support level for long-term investors.

- The formation of a reverse triangle indicates the possibility of a trend reversal, and any market correction is regarded as a good buying opportunity.

Robert Giroux

Adobe Inc. (NASDAQ:ADBE) is the market leader in multimedia and creative software development. The company was established in 1982 with the purpose of providing creative software solutions and has a significant impact on the digital media industry. The company has various products used by individuals and organizations around the world for graphic design, web development, and document management. Adobe is established as a reliable investment opportunity for individuals and institutions looking to diversify portfolios.

This article examines Adobe’s financial performance, stock price movements, and future prospects in order to identify investment opportunities for long-term investors. Adobe’s revenue has grown by 334.16%, from 2013 to 2022. In addition, the stock price has increased by 4355.56% from the lows of 2009, which is a strong growth within 13 years. The recent decline in the share price of Adobe in 2022 has brought prices close to the attractive Covid-19 lows. Currently, the stock price is rebounding from the key level support of $275. A market drop back to the key support is viewed as an excellent buying opportunity for long-term investors.

Financial Performance

Adobe is consistently generating high revenue from the popularity of creative and marketing solutions, as well as the rising demand for digital content across a broad spectrum of industries. In recent years, Adobe’s revenue is driven by the expansion of the cloud-based subscription business, which gives customers internet access to Adobe’s products and services. Adobe reported revenue of $4.53 billion for the fourth quarter of 2022, an increase of 2.25% from the previous quarter. The total revenue for 2022 is $17.606 billion, compared to $15.785 billion in 2021. It is observed that the company’s annual revenue is consistently increasing on a yearly basis. The company’s revenue increased by 334.16% from $4.055 billion in 2013 to $17.606 billion in 2022.

Adobe’s impressive financial performance was driven by the continued expansion in cloud subscription revenue. Adobe is well positioned to sustain robust revenue growth, as demand for creative and marketing solutions is anticipated to remain robust. Moreover, Adobe’s expansion in new technologies with innovative products will contribute to future revenue growth. Consistently high revenue is viewed as a positive indicator of a company’s financial performance and can positively affect the stock price.

Adobe Support At Strong Key Levels

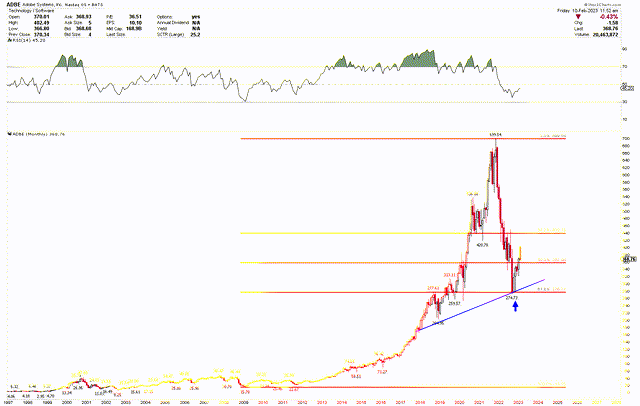

The price of Adobe has risen in a parabolic fashion from the low of $15.70 in February 2009 to the high of $699.54 in November 2021, as depicted by the monthly chart below. The 4355.67% price increase demonstrates the significance of the investment over the past few years. However, it is observed that the greatest price movement occurred after the Covid-19 pandemic, when the price soared from a low of $255.13 in March 2020 to a high of $699.54 within 18 months. This rapid increase in the stock price of Adobe was caused by increased volatility. The increased volatility in the stock price was observed as a result of the increased demand for cloud-based software and services. Additionally, the price increase was caused by the accelerated trend towards digital content creation, as people spend more time online due to social distance measures and online restrictions.

However, a parabolic move in the stock price of Adobe was not typical, and a price exceeding more than 4000% in a short period, resulted in a significant correction due to overvaluation. Adobe’s share price dropped by 60.73% from November 2021 high of $699.54 to September 2022 low of $274.73. The price is currently trading near the Covid-19 pandemic lows, a level at which the stock is attractive to buy for investors. The chart also illustrates the blue support line, which indicates market buying interest. As the price continues to trade above this blue line, the market will remain bullish on a long-term basis.

Adobe Monthly (stockcharts.com)

On the other hand, the recent correction of 60.73% has also brought the price to the 61.8% Fibonacci retracement of the move from $15.70 to $699.54. Adobe’s 61.8% Fibonacci level is regarded as a significant key level due to its intersection with the blue trend line at $274.73. Price is currently rebounding strongly from the key level, and it is likely that the next drop back to the key support level will present an excellent buying opportunity for the stock.

What is Next in Adobe?

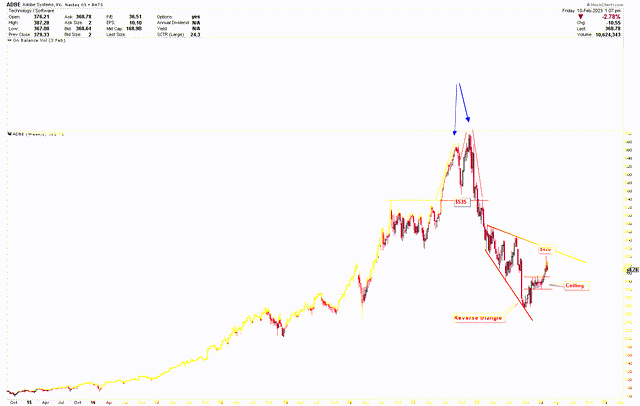

The weekly chart below for Adobe shows the drop from the 2021 high. It is discovered that Adobe has formed a double top in 2021, with the first peak occurring in August 2021 at $673.88 and the second peak occurring in November 2021 at $699.54. The neckline of this double top was broken at $535, and the price dropped dramatically as a result of the confirmation of the double top. However, starting in March 2022, the price is forming a reverse triangle on the weekly chart due to increased volatility in the stock. The formation of a reverse triangle within a bearish trend indicates the possibility of a trend reversal. When the trend becomes less downward and more sideways, bears are losing control and bulls are beginning to push the price back up. The upper trend line of the reverse triangle is currently around $420, and a break above this level is considered a big breakout and significantly higher prices. The price consolidation for nine weeks between October 2022 and December 2022 also indicates a coiling action and higher price towards the $420 region, where the decision will be made.

Adobe Weekly (stockcharts.com)

Adobe’s stock price remains within the consolidation pattern and is awaiting a breakout from the $420 region. When the price breaks higher, it will move quickly higher. However, it appears that the price has the potential to fall further, allowing long-term investors to enter the market at a 61.8% Fibonacci retracement of around $274.73.

Risk Factors

Despite Adobe’s strong financial performance, investing in the company in 2023 is risky due to economic uncertainty, market volatility, and recession fears. On the other hand, any significant changes in the competitive landscape, such as the introduction of new products or the emergence of new competitors, could have a negative effect on Adobe’s financial performance and share price. On the other hand, the company operates in a rapidly changing technology industry, and any significant changes in technology or advancements in competing products have a negative effect on the company’s financial performance and stock price. Price is currently forming a reverse triangle, resulting in extremely volatile price movements. The increased volatility raises the market risk, and if the stock price breaks below the key support of $274.73, it will fall significantly lower.

Conclusion

On the basis of the preceding discussion, it is concluded that Adobe is currently operating in a very healthy market, and the company’s revenue is expected to increase in the coming years as a result of strong demand. Additionally, the stock price is rebounding from the attractive 61.8% Fibonacci retracement level of $274.73. A retracement back to this level is viewed as a strong buying opportunity to accumulate new positions. However, a breakout above $420 will also break the reverse triangle, resulting in the possibility of higher prices. Therefore, investors must buy the stock if a pullback to $274.73 occurs or if the price of the stock breaches $420.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.