Summary:

- Unity recently acquired ironSource in a highly dilutive all-stock transaction.

- Expenses are growing more rapidly than revenue.

- The current macro environment is unfavorable.

Arsenii Palivoda

Thesis

After a dismal 2022, Unity Software (NYSE:U) is off to a decent start in 2023, returning almost 25% year-to-date, giving a reason for investors to be a happy at a time when they very much need one. While we understand that Unity’s engine is a powerful platform for mobile developers, we are alarmed by emerging trends within the company.

Even excluding the aberration of the company’s second quarter report (a miss from median top-line revenue estimates of about $40 million), things haven’t improved. More worrying is the fact that management has recently turned to debt funding for reasons that are unclear.

Expenses Growing Faster Than Revenue

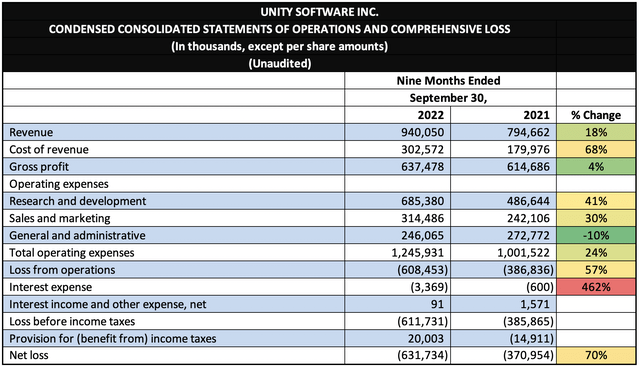

Let’s start by looking at the numbers that Unity has posted so far, the nine months ending September 30th (full year figures will be released on February 22nd).

Company Figures, Author Calculations

Across the board it’s a bit of a bloodbath. Revenue grew by 18% year over year while costs of revenue grew 68%. Worse, sales and marketing have grown by 30%, which could indicate that the company’s customer acquisition costs are growing faster than revenue. This is something we’ll be keeping an eye on with the 4th quarter results out due this month–companies whose growth fails to outpace customer acquisition costs over time run the risk of cannibalizing themselves.

All this is not to mention that Unity’s net loss expanded by 70%–a 52% difference from revenue growth.

Bulls may point out that the company is making strides toward profitability, and that while the numbers indicate short-term pain, the long term picture is overall positive.

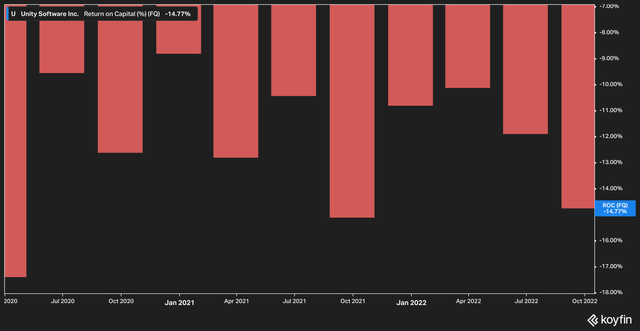

To answer this we turn to the company’s return on capital [ROC]. Of course, since the company currently generates a loss, we expect that the ROC will be negative. ROC is a good proxy to measure management’s efficiency at deploying capital, so we use it as an indirect way to see if a company’s management team is making strides.

Unfortunately, the company’s ROC has trended negatively over the past three quarters, resulting in a negative 14% in the 3rd quarter.

Stock Based Comp

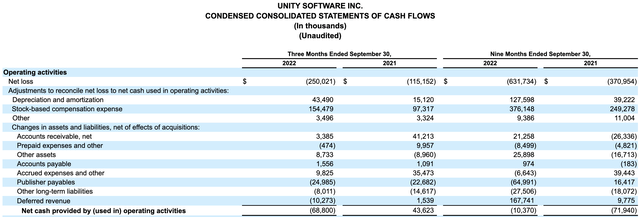

Of course, the income statement only gives us part of the picture. Let’s review Unity’s operating cash flow numbers.

While it’s positive to see that the company has narrowed its operating cash flow losses from negative $71 million to negative $10 million, we want to highlight that stock based compensation grew by 51%, from $249 million in the nine months ending September 30, 2021, to $376 million in the same time period in 2022.

This is an eye-watering figure. We also want to point out that this number is significant because, in addition to the dilutive effective on existing shareholders that stock-based compensation has, the company purchased ironSource in a $4.4 billion all-stock transaction.

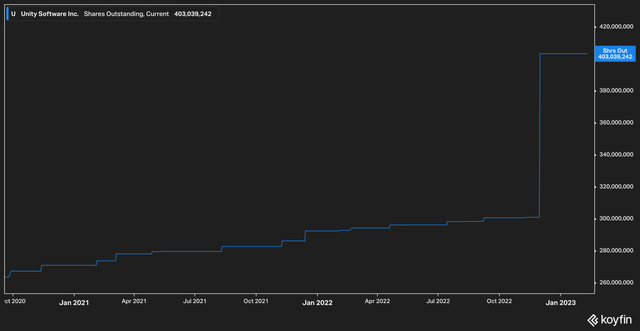

While this move was largely hailed as a positive synergy play for Unity, the effect on shareholders has been… tough. Let’s take a look at Unity’s current share count.

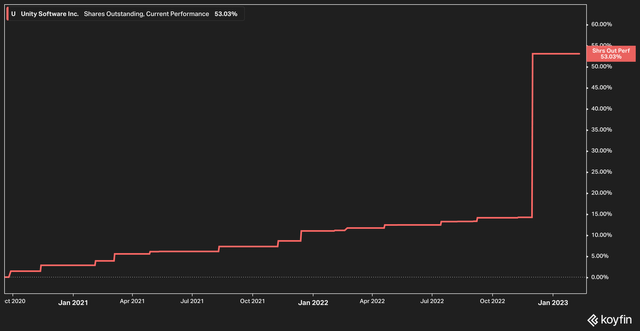

The enormous upward rise in share count is a result of the ironSource deal. This spike somewhat obscures the rapid stock-based comp growth within the company. Viewing the share count as a percentage of growth, however, allows us to assess the dilution more clearly.

While stockholders since Unity’s IPO had only been diluted by 15% overall prior to the ironSource deal, they have since seen the share count spike by over 50%.

An Interesting Wrinkle In The ironSource Deal

At the same time the company executed its $4.4 billion all-stock transaction, the board authorized up to $2.5 billion stock repurchase. Of course, this is simply an authorization–the company may not buy anything back, but it at least gives management the option.

The company is effectively giving itself a buy-now-pay-later opportunity. By financing the purchase of ironSource with its own shares, Unity incurred no debt. Then, by authorizing the share repurchase, the company is effectively allowing itself to retroactively fund the purchase with cash by buying back the shares.

Depending on your view, this could either be pretty smart or aggravating. On the one hand, shareholders saw their direct stakes in the company diluted significantly. On the other hand, an already unprofitable company did not have to tap pricey debt markets to fund the purchase. Individual investors will have to determine which camp they fall into based on their time horizon and investment style.

Our View

There’s a lot to unpack with Unity. We think the company has completed its ‘final form’ so to speak with its acquisition of ironSource, and we think–hope–that the company will turn away from further acquisitions at this point to focus on organic growth and the path to profitability.

However, major concerns remain. The aforementioned costs are a large concern. If the company cannot reign in its customer acquisition costs and bring overall expenses into line as it scales, then we have a tough time seeing how things end well.

We also want to see the company’s return on capital improve. In an interesting twist, since the company paid all-stock for ironSource, the base of capital on which to calculate returns was not altered. This is important because we will be able to assess the company’s return on capital in the 4th quarter (and going forward) as an apples-to-apples comparison versus the 3rd quarter. This will provide investors with a real-time window to assess exactly how accretive the ironSource transaction was, and how quickly.

Stock based compensation remains a major philosophical issue for us as well. While we fully understand that stock based comp is a necessary component of attracting and retaining talent–especially in tech–the rapid growth at Unity is a cause for concern for us.

For now, however, we remain negative on the company for the reasons outlined above but also due to the secular headwinds in advertising. As marketing budgets decline and companies tighten their belts along with inflation-weary consumers, we believe that Unity will not be immune.

We will keep our eye on Unity going forward. We can certainly see a positive outlook for the company, but we think the road ahead will be rocky.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.