Apple: Uncertain Economic Fundamentals, Time For A Downgrade

Summary:

- In Q1 2023, Apple reported a 5% decline in sales and an 11% contraction in earnings – missing analyst consensus estimates with regard to both the topline and bottom line.

- Apple did not provide guidance going into 2023, but CFO Luca Maestri said March quarter revenue would have a similar declining trend as the December quarter.

- Meanwhile, retailers in China are reportedly discounting iPhones by as much as $125 – in an effort to push up sales.

- Before turning again more bullish, I would like to see Apple showing a defined commitment to new growth opportunities such as VR and/or [autonomous] driving.

- Anchored on updated EPS assumptions through 2025, I now calculate a fair implied share price for Apple equal to $164.85.

fazon1

Thesis

Going into Apple’s (NASDAQ:AAPL) Q1 2023 earnings reporting I argued that the iPhone maker is a temporary ‘Hold’. However, reflecting on falling revenues (YoY reference) and an even sharper than expected demand slowdown that might drag well into 2023, my ‘Hold’ recommendation remains not as temporary as previously believed. Investors should consider that a 5% Q1 2023 decline in revenue as compared to the same period one year earlier doesn’t justify a stock trading close to x25 P/E. And uncertainty about Apple’s economic fundamentals is amplified by reports that retailers in China have started to cut iPhone prices by up to $125. Moreover, before turning again more bullish, I would like to see Apple showing more defined commitment to new growth opportunities such as VR and/or [autonomous] driving.

For reference, Apple has gradually started to become a relative underperformer: Apple stock is still down approximately 12% for the past twelve months, as compared to a loss of close to 9% for the S&P 500 (SPY).

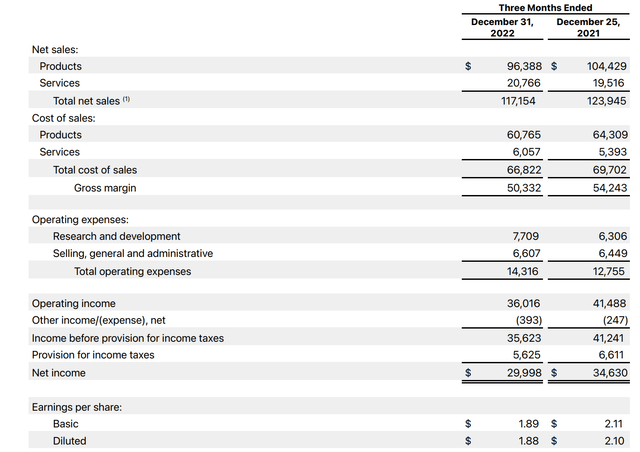

Apple’s Q1 2023 Results

During the period from September to end of December, Apple reported a 5% decline in sales and a 11% contraction in earnings — missing analyst consensus estimates with regards to both topline and bottom line.

In Q1 2023 Apple recorded total revenues of $117.2 billion, as compared to $123.9 billion for the same period one year earlier (5% YoY contraction). Apple’s topline also came in considerably below analyst consensus estimates, missing expectations by about $4.5 billion according to data collected by Refinitv. Similarly, iPhone revenue was $65.78 billion vs $68.29 billion estimated, down 8.17% YoY.

On the backdrop of a lower topline as compared to Q1 2022, paired with an increase in operating costs of close to $1.5 billion, Apple’s net income fell to approximately $30 billion, versus $34.6 billion one year prior — a 13% YoY negative growth. Similarly, EPS was $1.88 vs $1.94 estimated, down 10.9% YoY.

Apple did not provide guidance for the current quarter ending in March, but CFO Luca Maestri said March quarter revenue would have a similar declining trend as the December quarter, with services expected to grow but Mac and iPad sales expected to decline double digits.

On a more positive note, however, Apple disclosed it has 2 billion active devices, an increase from 1.8 billion last year–which might indicate potential upside for Apple’s services business.

iPhone Sales Disappoint

Although Apple’s CEO, Tim Cook, attributed the miss to a strong dollar, production issues in China, and the challenging macroeconomic conditions, it may arguably not be totally unreasonable to fear that iPhone sales have started to enter a more mature market environment — with smartphone sales likely to contract again in 2023 after a challenging 2022 (for reference, see Samsung Electronics’ statement).

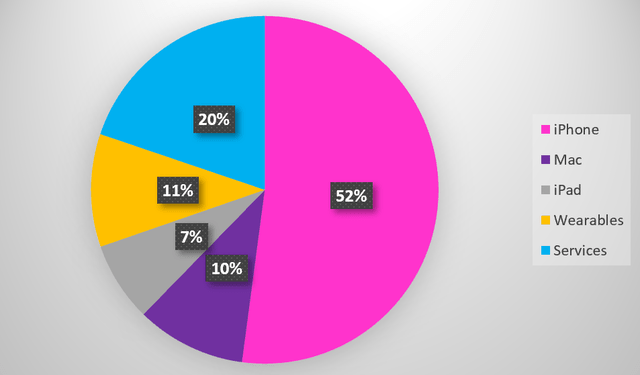

With that frame of reference, investors should consider that the iPhone accounts for about 52% of Apple’s total sales, and an even larger share of profits. And a weak demand for smartphones/ iPhones could materially pressure Apple’s profitability.

Apple FY 2022 reporting; Author’s Graph

With regards to a slowing demand for iPhones, I would like to highlight the recent challenges in China — where iPhone sales units have dropped by about 13.2% in 2022, falling to 285.8 million. And in an effort to push sales, Apple merchants in China are lowering the prices of their iPhone 14 models by as much as $125. Online stores such as JD.com have shown a decrease in the price of the iPhone 14 Pro and Pro Max models by $125, with an additional discount available to members of the online store. Physical retailers have also reduced prices, ranging from $95 to $125.

Where Are The VR/AR Headset And The Apple Car?

With iPhone sales stumbling, Apple’s growth story needs support from new product opportunities. In that context, I have previously voiced bullish sentiment with regards to the company’s ambitions to push into VR/AR and connected driving. But after long-standing rumors about Apple developing a VR headset and a car, the market is still waiting for any official comments regarding how these projects progress.

Given the lack of visibility, being invested in Apple because of speculative new product announcements is somewhat like Waiting for Godot — a stretched act of patience. And with Meta Platforms (META) pushing ahead in VR with a focused R&D budget that rivals Apple’s entire R&D budget across product lines, it would not be unreasonable to assume that the lack of an Apple announcement is due to the fact that the iPhone maker might not be able to match the technology of the Meta Quest Pro.

That said, before turning again more bullish on Apple stock, I would like to see the company showing more defined commitment to new growth opportunities.

Target Price: Lower To $164.85

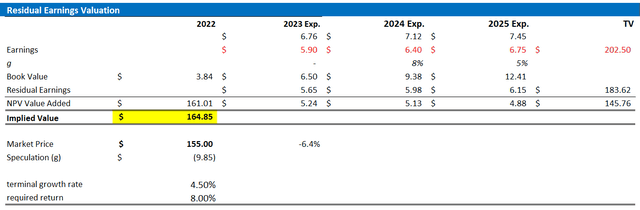

Reflecting on a weaker than expected Q1 2023, and a continued soft demand for iPhones going into 2023, I estimate that Apple’s EPS in 2023 will likely fall somewhere between $5.8 and $6. Moreover, without any visibility for new product launches, I also lower my EPS expectations for 2024 and 2025, to $6.4 and 6.75, respectively.

I continue to anchor on a 4.5% terminal growth rate (two percentage point higher than estimated nominal global GDP growth), as well as on a 8% cost of equity.

Given the EPS updates as highlighted below, I now calculate a fair implied share price of $164.85.

Author’s EPS Estimates; Author’s Calculation

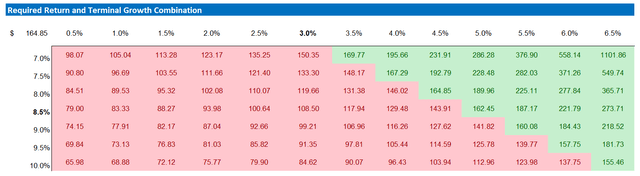

Below is also the updated sensitivity table.

Author’s EPS Estimates; Author’s Calculation

Conclusion

I have been a long standing Apple bull. But reflecting on falling revenue in 2022, paired with an uncertain 2023, I am downgrading the stock from a structural ‘Buy’ to ‘Hold’. In my opinion, the company’s growth story needs support from new product opportunities such as VR/AR and connected driving, but there has been no official announcement regarding these projects. The lack of visibility and commitment to new growth opportunities raises uncertainty about Apple’s economic fundamentals and its ability to match the technology of competitors in new markets.

Anchored on updated EPS assumptions through 2025, I now calculate a fair implied share price for Apple equal to $164.85.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advise