Summary:

- Cisco Systems, Inc. has announced its 12th consecutive annual dividend increase.

- The Cisco dividend growth rate continues slow down, but that seems more caution than a lack of ability.

- The dividend looks relatively safe based on EPS and FCF.

- Recent fiscal Q2 quarterly results had a flurry of good news for investors.

Justin Sullivan

This article about Cisco Systems, Inc. (NASDAQ:CSCO) was written last year after Cisco announced its 2022 dividend increase. My 2022 article was a follow up to my 2016 article arguing (let’s say predicting) Cisco was going to be a reliable dividend-paying stock. It is nice to be right, as rare as it may be.

With Cisco just reporting an EPS beat for its fiscal Q2, a revenue beat, and a 12th consecutive dividend increase, how do things stack up now? Let’s find out. For consistency and ease of comparison, we are mostly using the same outline/format as the previous article linked above.

New Dividend

Cisco’s new quarterly dividend of 39 cents per share gives it a nice round current yield of 3.25% based on today’s closing price. Given that CSCO stock is up nearly 8% after hours, the current yield drops to 3%, which is still respectable given the numbers you will see below.

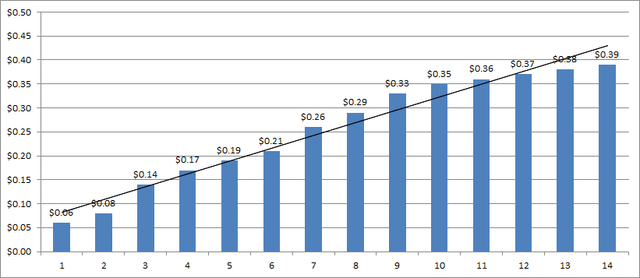

- Since first initiating a dividend of 6 cents in 2011, Cisco’s quarterly dividend has now gone up more than 6-fold in 12 years. Impressive to say the least.

- The dividend growth rate slowdown continues: going from 24% to 11% to 13% to 6% around 3% the last four years, including the current increase.

Cisco’s current yield continues being in the middle of the pack when compared to the old tech companies, with Intel (INTC) and IBM (IBM) yielding more, while HP Inc. (HPQ) yields lower.

Dividend Coverage

Let us look at the dividend coverage using three metrics:

- Payout ratio: Cisco’s new dividend puts its forward payout ratio at a comfortable 43%, which is much less than IBM’s 70% and Intel’s… well, Intel is in such shambles that it does not have a payout ratio in the classic sense right now. Cisco’s payout ratio has gone down since 2016 and by a hair since 2022, which is good news. Please note, I am using $3.55 as the forward EPS based on current Seeking Alpha data, which I am sure will be updated soon to reflect the fact that Cisco has guided for $3.73 to $3.78 per share. Using those numbers, the payout ratio goes as low as 40%.

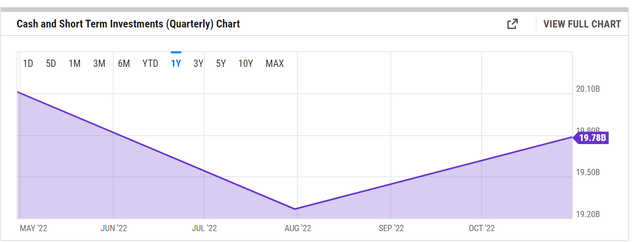

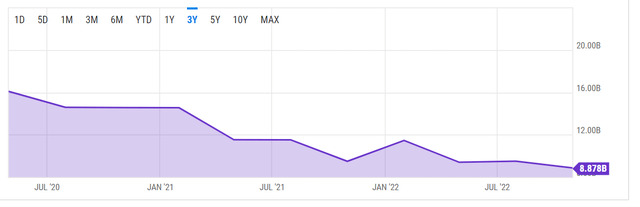

- Cash on hand: Cisco’s cash on hand continues dropping, both in absolute terms as well as a percentage of its market cap. Right now, cash on hand and short-term investments now represent “just” 10% of its market cap. This percentage remains steady from 2022 but is one-fifth of what it was in 2016. Everything else being equal, you want your company to have more cash on hand, but given how poorly Cisco’s business was valued by the market for its cash holdings in the past, this may not be a bad thing if the company is spending on reducing debt, growth, and, dare I say, key employees compensation. Cisco’s debt has gone down considerably in the last two years, as shown below, and most of us will agree this is a much wiser use of cash than letting it be 50% of your market cap.

CSCO Cash on Hand (YCharts.com) CSCO Debt (YCharts.com)

- Free cash flow: According to YCharts, Cisco’s lowest quarterly free cash flow in the last five years was $2.17 billion, same as in 2022. The current outstanding share count is about 4.10 billion, which is lower by 2.5% compared to 2022. Multiplying the new current quarterly dividend of 39 cents by the number of shares outstanding, we arrive at the ~$1.60 billion the company has currently committed to shareholders. This is lower than the lowest quarterly free cash flow in five years. These numbers are all moving in the right direction, generally speaking, and the difference is much starker, obviously, if you compare it to the 2016 numbers here.

To summarize, the dividend still appears very safe. While Cisco did not announce a new buyback this time around, the $15B buyback it announced last year is likely still in effect and is large enough to retire about 300 Million shares in total. While Cisco is “still” a technology company, and I fully expect RSUs and Options adding to the float, it at least won’t be as bad as the new tech companies. At minimum, the buyback will help in preventing further dilution.

Dividend Growth

Cisco began paying dividends in 2011, and the dividend has gone up more than 600%, from 6 cents per share/qtr. to 39 cents per share/qtr. Cisco continues climbing up the dividend pedigree ladder.

CSCO DG (Author, with data from Seeking Alpha)

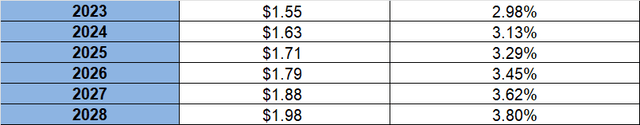

Extrapolation and Future Returns

The table below shows the expected five-year yield on cost for an investor who buys Cisco at the current level, assuming it increases the dividend by 5% per year. Readers may point out the slowing dividend growth rate (around 3%), but the company has enough room in EPS and free cash flow (“FCF”) to surprise us with a larger increase at least a couple of times in the future. In addition, as mentioned earlier, 2023’s EPS outlook has increased more than expected, adding further room for Cisco to reward shareholders better.

- Earnings are still expected to grow at 7% per year for the next five years. Last time, I believed this was too optimistic, but this time around, I am far more convinced about Cisco’s turnaround based on a subscription model, as I wrote here.

- If CSCO maintains the current payout ratio of 40%, investors are looking at an annual dividend of $2.31 in five years. This would represent a nearly 48% increase from the current level.

- All these numbers above compare favorably with 2016 as well as with 2022.

SA Dividend Grades

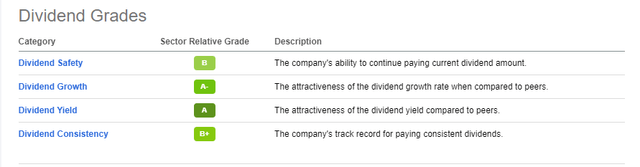

With the strong numbers reported above, it is no surprise that Seeking Alpha’s quant ratings system flashes all green for Cisco’s dividend across all four categories: safety, growth, yield, and consistency.

CSCO Dividend Rating (Seekingalpha.com)

Earnings Recap

Although this article is focused more on Cisco’s dividend, a quick earnings recap is in order, as without earnings, the dividend has no footing.

- EPS beat by 2 cents and revenue beat by nearly $200 Million.

- Lending credibility to my theory that Cisco is turning into a product-based company, product revenue went up 9% while services went up just 2%. In particular, subscription-based revenue went up 15%. Products tend to have higher margin and higher customer stickiness.

- Very likely as a result of the strength shown by the product and subscription segments, Cisco guided up on both revenue and EPS for FY 2023 with a 10% revenue growth projected. EPS revision was large to the extent that the new low end ($3.73) is 15 cents higher than the previous high end ($3.58).

Conclusion

I continue to believe Cisco Systems, Inc. is in the midst of a successful turnaround and I may soon initiate a position in the stock, although I currently hold IBM in its place. I will continue watching the product and subscription updates from Cisco, and whether they continue getting larger in terms of the overall revenue. In the meantime, Cisco Systems, Inc. is paying out a decent and highly sustainable divided with plenty of room for growth.

Disclosure: I/we have a beneficial long position in the shares of IBM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.