Summary:

- Amazing catalysts on the horizon for Comcast with Universal Studios Hollywood park opening the much-awaited Super Nintendo World.

- The Super Mario Bros. Movie is set to release on April 7th.

- These two catalysts make for a spicy meatball.

Drew Angerer

Super Nintendo World Hollywood

It happened folks! The Nintendo part of Universal Studios’ Hollywood theme park just opened its Super Nintendo World, the first outside of Japan. I have been anticipating this and racking my brain on who stands to benefit most from the new mustachioed mascot becoming a mainstay in Los Angeles. I first rifled through the Nintendo (OTCPK:NTDOY) IR presentations but couldn’t locate a good source for their licensing structure. Going straight to the source and realizing Comcast (NASDAQ:CMCSA) owns not only the Universal Studios theme parks but also is producing the upcoming Super Mario Bros. movie seems like the most likely beneficiary.

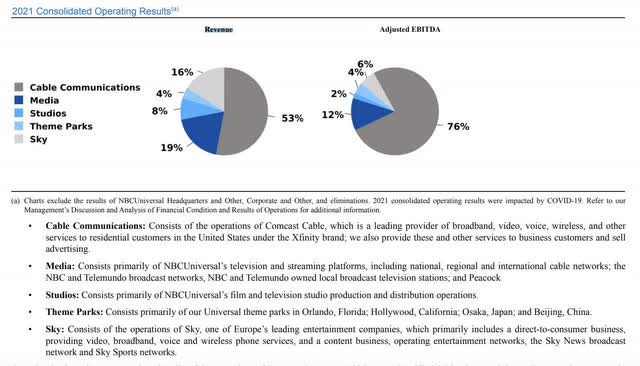

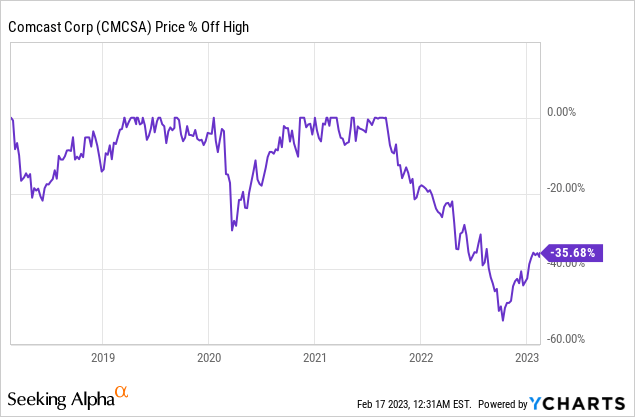

Although NBCUniversal Theme Parks only make up 4.34% of 2022’s total revenue mix, this is a segment I’m looking forward to seeing grow. The mix of the Super Mario Bros. movie, Super Nintendo theme park, low non-GAAP earnings multiple, low GAAP forward earnings multiple plus a dip of 35% off its high seem like catalysts that are too good to resist. Comcast stock is a buy at this point for its 2023 catalysts which should trickle into the income statement by the Summer.

Super Mario Bros. Movie

Now, this is what a Super Mario Movie is supposed to look like! Older millennials like myself who grew up with the franchise have been eagerly awaiting this day to see one of our favorite video game characters adorn the silver screen in all his glory. Nightmares of Dennis Hopper, John Leguizamo, and Bob Hoskins are still lingering from the terrible movie released in 1993. Now that games have advanced to the point where they almost mimic good CGI, the two can meld into one and create an awesome-looking movie. I would not be surprised to see this movie generate more than a Billion worldwide. I will be there on opening day.

The release date of the movie to occur just after the opening of the theme park area is certainly a strategic move by CEO Brian Roberts. I think the teaming of the two is awesome. In my opinion, people who see the movie will want to visit the theme park and vice versa. Just watch how giddy some of these reporters, in their 30s and 40s are to get a preview of this park in this Today Show sneak peek. This is the generation that grew up with the franchise. It also has all the 3-10-year-old children who they are going to take to the movies and the theme park, possibly more for their than their children’s enjoyment!

The park addition itself will have several monetizing factors. One is a wearable, that you have to pay for, where you can collect points around the park to participate in mini games. The other would be apparel. Selling new cool Nintendo gear and accessories is another revenue booster. I don’t need to tell you how cool the park looks; words don’t do it justice. Please see the Today Show link above.

The chart

Having listened to quite a few Mohnish Pabrai interviews, I concur with him that one of the best places to look for value is the at or near 52 Week low charts. Find the quality and investigate. I already had a small position in Comcast before this article due to its screening on Joel Greenblatt’s magic formula list at the beginning of the year for large caps. Now that these neat couple of catalysts have arrived, I have increased my position quite a bit. Down 35% off the stock’s high is something I like. Anything more than 30% is certainly attractive as that is where the broader market would be considered a crash or severe bear.

Income statement trends

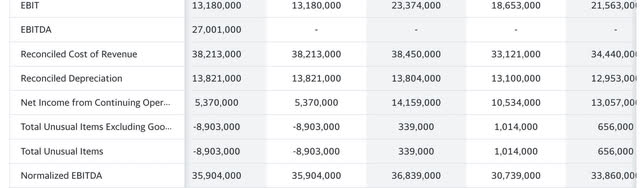

Cash flow and EBITDA

Firstly, we start with the revenue and EBITDA mix. The Theme Parks and Studios segment, which is the focus of this article, represents 12% of the total revenue mix and 6% of the EBITDA mix. I fully expect to see the full-year numbers for both of these items increase quite a bit both on the top and bottom lines. It should also have an impact on the overall media segment’s numbers as they incorporate the Nintendo franchise into their streaming platforms, attracting new customers. Let’s also not forget merchandise sales should increase and a full year where all the parks across the world are finally open full blast.

Looking at the revenue trends for Comcast from 2019 on the right to TTM on the left, we see a definite uptrend in the numbers. The cost of revenue has been flat since 2021, which is positive when matched up against an increasing top line.

The same time frame for normalized EBITDA shows growth from $33.8 Billion to $35.9 Billion, a CAGR of 1.52%. Certainly not a growth stock, but generating quite a lot of EBITDA and trading at only 4.65 X EBITDA. I use EBITDA for media and communications companies because as Joel Greenblatt points out in “You Can Be A Stock Market Genius”, similar companies have large amounts of goodwill and amortization. Goodwill and intangible assets are a huge amount of Comcast’s $257 Billion in total assets, ringing in at $159.7 Billion or 62% of the total asset mix. The Studios also provide a fair amount of PPE at $112 Billion gross PPE. This allows for a depreciation expense of about $1 Billion a year against those assets. Comcast’s total depreciation and amortization for the twelve months ending December 31, 2022, was $34.734B according to Macrotrends.

The Goodwill is attributable to purchases of companies, media channels, or brands for a price paid more than their net asset value. As many of these assets have an indefinite life span but a lot of beneficial depreciation, EBITDA for a media company is similar to AFFO for a high-quality REIT.

Valuation

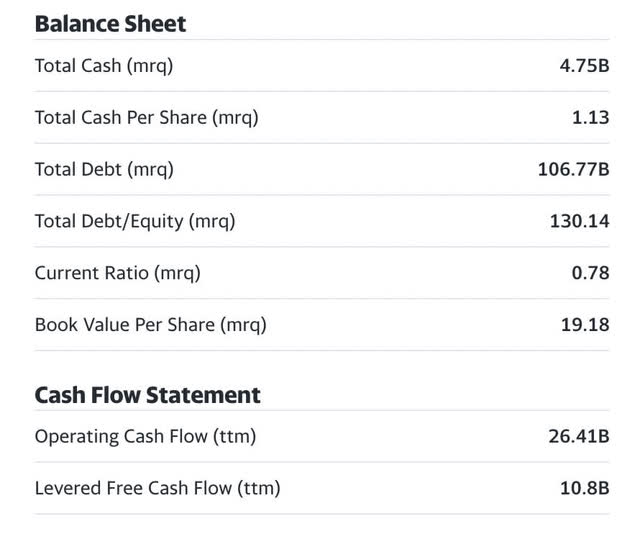

Right away my eyes tell me that the forward GAAP earnings at just over 11 X, combined with the current price-to-book value will be ideal to pit up against the Graham number for a conservative price target. These two numbers multiplied would be around Ben Graham’s magic number of 22.5.

With the formula being the SQRT of 22.5 X (EPS) X (Book Value), our inputs would be $19.18 Book Value, and our forward EPS equivalent to analyst average estimates of $3.63 a share (source: Yahoo Finance). Therefore SQRT 22.5 X ($3.63) X ($19.18)= $39.57, basically trading right at fair value with this GAAP metric.

Reconfiguring it to get a high end based on EBITDA, we have $35.9 Billion in EBITDA TTM and 4.22 Billion shares outstanding. This would give us an EBITDA per share of $8.5. A reconstituted formula of SQRT 22.5 X($8.5) X (19.18)= $60.56 a share, basically right back to its Sept. 2021 high. Blending the two would give us an average price target of $50 a share.

Balance sheet snapshot

Total cash at $4.5 Billion is not a very large cash position for a company of this size. Luckily they have ample free cash flow to compensate. Long term equity investments are minimal as well and only add another $450 million in equity investments to the company’s liquidity. The current ratio is under 1 and debt to equity is at 130%. The balance sheet is not great, but at these prices, the catalyst opportunities outweigh the balance sheet negatives in my mind. Let the company focus on debt restructuring and reduction after they complete their initiatives and Orlando park buildout in 2025.

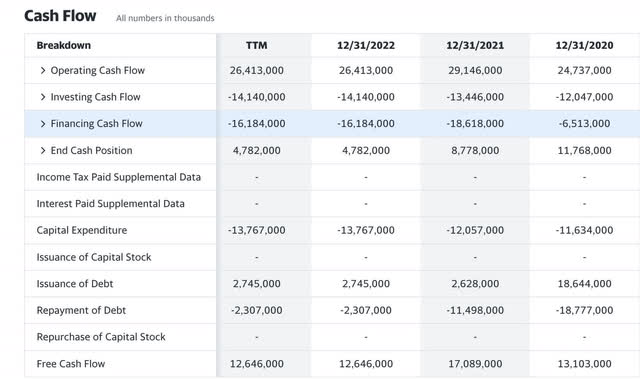

The dividend

With a forward annual dividend of $1.16 a share and 4.22 Billion shares outstanding, that is a dividend commitment of $4.89 Billion. The past 3 years’ average free cash flow has been $14.27 Billion. This is a payout ratio of only 34.2%. The 2.92% yield is an excellent bonus to the investment thesis. Although free cash flow has been leaner TTM versus 2021, construction on Super Nintendo World is now complete and we could hope to see cash from operations increase upon opening. However, capex may continue to increase with the new Universal Park in Orlando on the horizon for 2025. The dividend looks safe here, nonetheless.

Risks and competition

Comcast’s peers fall between media and media theme park mixes. Most notable would be Charter (CHTR) and Disney (DIS). Charter trades at a much higher book value, 5X, and Disney trades at a much higher price-to-earnings ratio. Comcast in a sense is an interesting conglomerate that is hard to comp. They have a lot of businesses, but not ones that counteract or cancel out one another like General Electric (GE) ended up with. The main bear points would be that the company has too much debt and is too tied to traditional television.

The company has transitioned to become more of a broadband/fiber provider, which now makes companies like AT&T (T) and Verizon (VZ) possible comps for the company as well. The theme parks are huge catalysts in my mind, with the park in Beijing operating at full capacity this year as well. As long as this business grows, it should ease any pain in cable customer losses and hopefully continue the top line growth trend.

Summary

Having eagerly awaited both the park addition and the film release, I hope to have a chance to add more at these prices in the months to come. Disney better have some counter punches at their theme parks as I would expect them to lose some business in Los Angeles due to the Universal addition. Also, the Orlando addition is coming in 2025:

The Orlando build will be a part of that resort’s larger, much-anticipated Epic Universe park expected to open in 2025. Comcast CEO Brian Roberts announced Epic Universe in 2019, calling it “the single-largest investment Comcast NBC Universal has made in its theme park business. Then-Universal Parks & Resorts head Tom Williams described the “vision” for Epic Universe as “historic.” He said the new park would be “the most immersive and innovative theme park we have ever created.

Mario in my mind resonates even more with the American culture than the Japanese, although it is a Japanese creation. Mario may become the new Mickey Mouse in the decade to come. Even though the theme parks have been out in Japan for some time now, I don’t think the full impact of how big the Mario Franchise is will be realized until the parks are opened here stateside. There will be possible synergies in shows and apparel that are too numerous to count. The cable communications monster is doing a good job of pivoting/investing for growth in other areas. I can’t wait to see the result. Wish I had a warp pipe to 2024!

Comcast is a buy with a blended average price of GAAP and Non-GAAP Graham numbers at $50 a share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of CMCSA, DIS, VZ, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.