Summary:

- Roku reported much better revenues than expected for the fourth quarter.

- Key monetization figure ARPU saw a sequential drop-off, however.

- Path to EBITDA profitability now clear.

Justin Sullivan

Shares of streaming company Roku (NASDAQ:ROKU) soared 11% on Thursday, after the company presented earnings for its fourth-quarter that showed decent growth in key performance metrics such as active accounts and streaming hours, a proxy for platform engagement. Roku’s average revenue per user growth in Q4’22 left something to be desired, however, as the company only saw 2% year over year growth. Although Roku beat expectations, the company has seen no real top line growth in the fourth-quarter. I believe Roku is an attractive recovery bet in FY 2023 and if the streaming company meets its profit target next year, shares could be up for a major up-side revaluation!

ROKU beats on the top and bottom lines

From an estimate point of view, Roku performed well in the fourth-quarter: the streaming company reported Q4’22 revenues of $867M compared to an average top line estimate of $802M. Roku generated an adjusted loss of $(1.70) per-share compared to an estimate of $(1.73).

Roku’s score card was mixed in the fourth-quarter and showed monetization challenges for the streaming company in the quarters ahead. Although Roku beat estimates for the fourth-quarter regarding its top line, the company failed to generate any real revenue growth year over year: Roku’s Q4’22 revenues were $867.1M which translated to just 0.2% year over year growth. Roku’s revenue picture has been challenged by a down-turn in the digital advertising market which has caused advertisers to pull back from ad spending on Roku’s streaming platform. However, customer-focused performance metrics on the Roku platform showed healthy growth in the fourth-quarter with active accounts growing 16% year over year to a new record of 70 million and streaming hours, a measure of platform engagement, soaring 23% year over year to a new record of 23.9 billion. Including the Q4’22 account net-add of 4.6M, Roku added 9.9M accounts throughout FY 2022 so customers are still gravitating to Roku’s streaming offers.

What was less than great, however, was that Roku’s average revenue per user/ARPU, a metric that measures customer monetization, declined in the fourth-quarter: Roku’s Q4’22 ARPU dropped 5.3% quarter over quarter to $41.68 due to a challenged revenue situation in a weak ad market.

|

Actual Results |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Q4’22 |

Growth Y/Y |

|

Active Accounts (millions) |

60.1 |

61.3 |

63.1 |

65.4 |

70.0 |

16% |

|

Streaming Hours (billions) |

19.5 |

20.9 |

20.7 |

21.9 |

23.9 |

23% |

|

Average Revenue Per User/ARPU ($) |

$40.67 |

$42.60 |

$43.81 |

$44.01 |

$41.68 |

2% |

(Source: Author)

Disappointing outlook for Q1’23

The fourth-quarter is typically a very strong quarter for Roku due to the inclusion of the holiday period. This implies that streaming companies typically see a drop-off in account acquisition and revenue growth rates in the first-quarter. For Q1’23, Roku projects revenues of just about $700M, implying a 4.6% decline year over year as the ad market is expected to remain challenging.

The key to an upward revaluation: Profitability

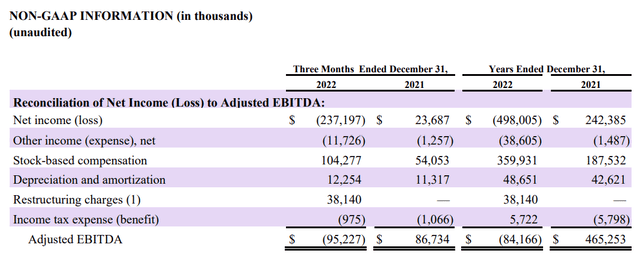

Roku has one problem that stands in the way of major share price appreciation: the streaming platform is not profitable. Roku’s adjusted EBITDA was $(95.2)M in the fourth and decelerating revenue growth made the problem only worse for Roku. In FY 2022, Roku lost $84.1M in adjusted EBITDA which is the result of economic pressures (ad market weakness) as well as weaker customer monetization.

Source: Roku

Roku’s guidance for Q1’23 implies an adjusted EBITDA loss of $110M, but the company has also said, most importantly, that it targets positive adjusted EBITDA in FY 2024 which would finally put to the rest the never-ending discussion about when ROKU will be profitable. Roku expects to achieve profitability next year by cutting operating expenditures, investing in new partnerships and driving platform engagement. In a bid to control costs, Roku cut 200 jobs last year and more job cuts may follow. The possibility of EBITDA profitability as early as next year was the key catalyst behind Roku’s 11% share price surge.

Roku’s valuation

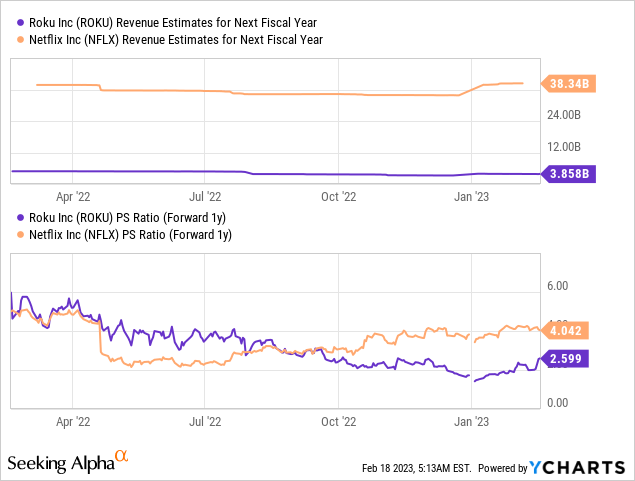

Favorable, secular long term trends support an investment in Roku because the share of Pay TV is declining. Roku is expected to grow its revenues to $3.86B in FY 2024, implying 18% year over year growth. Roku’s shares are currently valued at a P/S ratio of 2.6 X while Netflix (NFLX) is valued at a price-to-sales ratio of 4.0 X although Netflix is expected to grow its top line only 12% next year. Investors have started to worry about Roku’s platform profitability for quite some time now. The new outlook for FY 2024, however, could help reduce some of the negative sentiment that has been hanging over Roku’s shares lately.

Risks with Roku

The biggest commercial risk for Roku right now is a further deterioration in the monetization metric average revenue per user. The revenue forecast for the first-quarter also strongly implies that advertisers will continue to spend money cautiously. If Roku fails to achieve its profitability targets in FY 2024, investors are likely going to punish Roku with a lower P/S ratio. A significantly weakening ARPU metric would likely change my mind about the streaming company.

Final thoughts

There were a couple of good things and a couple of not so good things in Roku’s earnings release for the fourth-quarter.

What was not so good was the ARPU metric for the fourth-quarter, the general top line performance (just 0.2% year over year growth) and the revenue outlook for Q1’23.

The good news was that the company continued to acquire new active accounts at a double-digit rate in Q4’22 and engagement metrics were up. The real surprise, however, was the profit outlook for FY 2024 which has led to resurgent buying interest in Roku’s shares. I believe Roku can continue to revalue to the up-side as long as the streaming company can show that its losses are narrowing and that its profit targets in FY 2024 are reachable!

Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.