Summary:

- PayPal shares have fallen back to their July 2022 lows since Q4 results, as investors worry whether its problems are more than cyclical.

- E-commerce has decelerated and may not improve until 2024, and P2P growth has also slowed. PayPal CEO is retiring in 2023.

- PayPal is actively cutting costs, and expect these to deliver an 18% EPS growth in 2023 even on mid-single-digit revenue growth.

- The key to PayPal’s upside is e-commerce growth will resume at 10%+ and PayPal will keep or grow its share in branded checkouts.

- We believe PayPal stock is at a “real” P/E of 25x, with limited downside but an outsized return if double-digit growth returns. Buy.

chameleonseye

Introduction: Why is PYPL Stock Down?

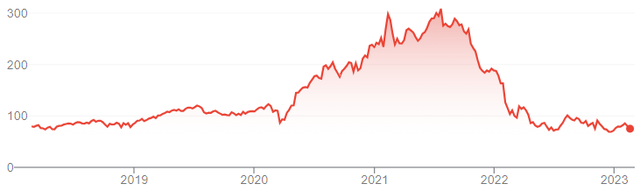

PayPal Holdings, Inc. (NASDAQ:PYPL) released Q4 2022 results after markets closed on February 9. Shares first rose 3.0% on the following day, but have since fallen by 7.6%, and are now near multi-year lows seen in July 2022 (and in 2018):

|

PayPal Share Price (Last 5 Years)  Source: Google Finance (19-Feb-23). |

Compared to when we upgraded our rating on PYPL to Buy in May 2020, shares have fallen 46%, primarily due to a contraction in its P/E multiple (from 47x 2019 Non-GAAP EPS to 18x).

PayPal continues to be in the middle of a downturn. Excluding currency, both Total Payment Volume and revenues grew by 9% year-on-year in Q4, though partly offset by a higher Transaction Expense from a negative mix shift. A deceleration in e-commerce growth was blamed, and this may not improve in 2023.

PayPal’s problems may go deeper than a cyclical downturn. Branded Checkout growth has slowed markedly (with PayPal market share flat or down), as has P2P growth; growth is instead coming from lower-margin Unbranded Processing. Management will no longer guide on new user growth, focusing instead on raising activity levels among existing users. There is no full-year guidance on volume or revenues. CEO Dan Schulman is retiring at the end of 2023.

More positively, PayPal is actively cutting costs, and expects to achieve an 18% growth in Non-GAAP EPS in 2023 even on mid-single-digits revenue growth. The cost cuts have been material even on a GAAP basis, though there will be more reliance on non-cash Share-Based Compensation costs in 2023. Revenue growth is expected to be 9% in Q1 (excluding currency) and at worst mid-single-digits in 2023 (albeit slower in H2 than H1).

We believe PayPal shares currently trade at a “real” earnings multiple of about 25x, implying limited downside but an outsized return (144% by 2025 year-end) if growth returns to double-digits. Buy.

PayPal Q4 2022 Results Headlines

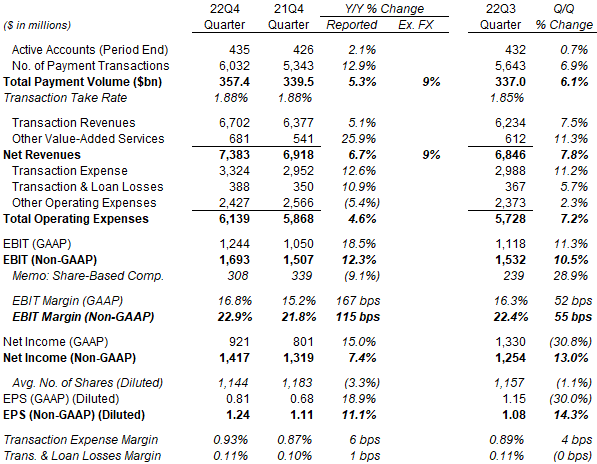

PayPal continues to be in the middle of a downturn, as demonstrated by Q4 2022 results below:

|

PayPal Key Financials (Q4 2022 vs. Prior Periods)  Source: PayPal company filings. NB. All figures are GAAP unless otherwise stated. |

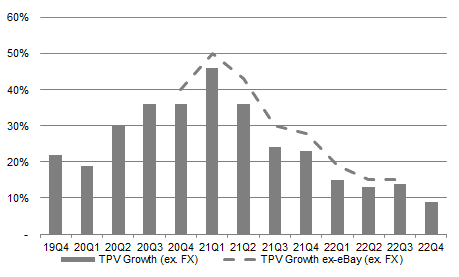

Total Payment Volume (“TPV”) grew by 9% excluding currency (5.3% in dollars) year-on-year, a significant deceleration from the 15% seen in Q2 and Q3 (excluding eBay (EBAY), otherwise 13% and 14%, respectively).

|

PayPal TPV Growth (Since Q4 2019)  Source: PayPal company filings. NB. ex-eBay figure not disclosed for 22Q4; difference is likely immaterial. |

Net Revenues also grew by 9% excluding currency (6.7% in dollars), consisting of a 10% growth in U.S. revenues and a 6% growth (excluding currency, 2% in dollars) In International revenues.

Transaction Revenues grew by 5.7% in dollars and, assuming the same currency impact, by around 7% excluding currency. Growth was “primarily” driven by Braintree (unbranded processing) and Venmo, and lags TPV growth by several points due to both lower volumes (down 31%) and a lower Take Rate (from 2.29% to 1.95%) on eBay. Excluding eBay, Take Rate was up 4 bps year-on-year, though this benefits from hedging gains.

Other Value-Added Service Revenues grew 25.9% in dollars year-on-year, benefiting from both higher Net Interest Income on customer balances (likely from higher interest rates) and from “positive contributions” in merchant and consumer credit products.

Transaction Expense grew 12.6% year-on-year in dollars, much more than revenues, and the Transaction Expense Margin rose 6 bps to 0.93%. This was “primarily” the result of a negative volume mix shift to Braintree, which carry much higher funding costs (for example the costs of customers depositing funds from Visa and Mastercard debit cards). The higher Transaction Expense Margin offsets most of the growth in Transaction Revenues.

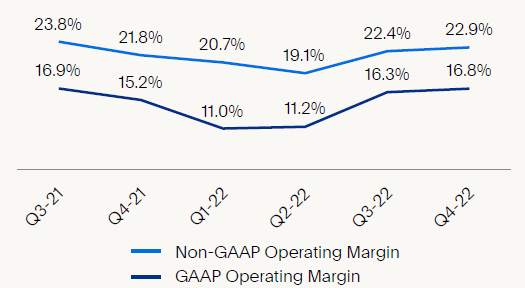

EBIT grew by double-digits year-on-year, and EBIT Margin expanded by more 1 ppt, on both GAAP and Non-GAAP bases, largely from a reduction in Non-Transaction Expenses. We discuss cost cuts in more detail later in this article.

PayPal 2022 Results Headlines

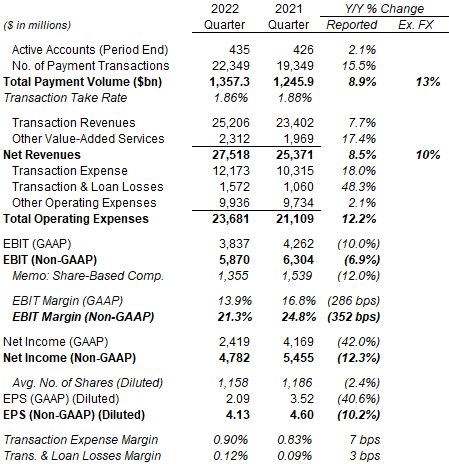

Full-year results follow similar dynamics, but with higher volume revenue growth from earlier quarters in the year:

|

PayPal Key Financials (2022 vs. Prior Year)  Source: PayPal company filings. NB. All figures are GAAP unless otherwise stated. |

EBIT fell year-on-year in 2022 primarily because revenue growth was largely absorbed by higher Transaction Expense, and Transaction & Loan Losses and Other OpEx both grew.

Net Income on GAAP basis fell much more than EBIT because of a prior-year tax benefit related to the transfer of intellectual property and mark-to-market losses on strategic investments.

E-Commerce Deceleration To Blame

Management attributes most of PayPal’s slowdown to a deceleration in e-commerce, following the boost from COVID.

As CEO Dan Schulman said on the buyside call after results:

“Traditionally e-commerce has grown in the mid-teens … That shot up to 30% plus in 2020 … In 2021 that dropped down to about 9% or so growth … In 2022 you had e-commerce growth somewhere in the mid-single-digits, maybe low single digits overall globally. In the holiday period at the end of last year, it looked like global e-commerce was probably flat to slightly up.”

PayPal believes e-commerce growth rates in 2022 differed “massively” by country, with the U.S. in “low-to-mid single digit” and the U.K. (PayPal’s second largest market) “high-single-digit negative”. In China, where PayPal has a “reasonable size business”, its TPV fell 30-40% in 2022 due to COVID-related disruptions.

PayPal expects e-commerce to be only “slightly positive year-over-year” in 2023, but “probably reverts back to double-digits, may be even low-teens” growth in 2024.

However, PayPal’s problems may go deeper than a cyclical downturn.

Worries About PayPal’s Growth Engine

There are some reasons to worry about PayPal’s growth engine.

1. E-commerce Market Share Now Flat

One, while the deceleration in e-commerce must have contributed to PayPal’s slowdown, PayPal has also stopped gaining share.

PayPal’s TPV growth was significantly higher than e-commerce growth in pre-COVID years, being at 25-28% (excluding currency) in 2016-19 (vs. e-commerce’s mid-teens). With COVID-19, it matched e-commerce growth in 2020 (31% vs. 30%+) and exceeded it dramatically in 2021 (38% ex-eBay, vs.9%). However, in 2022 PayPal only held share in e-commerce globally and in the U.S., where performance was uneven during Q4, as Dan Schulman explained on the earnings call:

“If you exclude Amazon (AMZN) in the U.S. in the fourth quarter, we held share … If you include Amazon, which had an extra Prime Day in the holidays, we might have lost 1 or 2 basis points”

2. P2P Growth Has Slowed

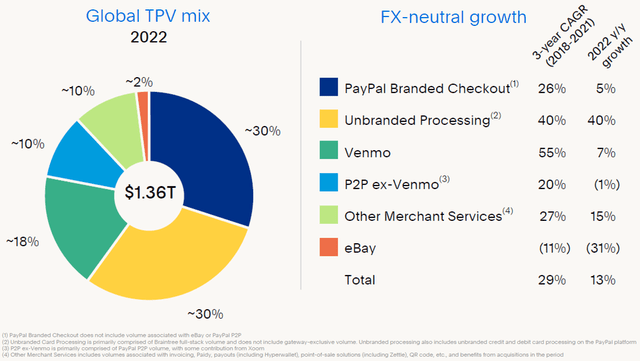

Two, PayPal’s growth has also slowed in peer-to-peer (“P2P”) payments, with Venmo growing just 7% in 2022 and P2P ex-Venmo shrinking by 1% (both figures excluding currency):

|

PayPal TPV Mix & Growth By Category (2022)  Source: PayPal results presentation (Q4 2022). |

P2P is free except for some features like Instant Transfer, but it is important to PayPal strategically because P2P balances drive other, revenue-generating volumes on the platform. Schulman acknowledged this and stated that PayPal intends to “meaningfully” improve its offering:

“We need to re-establish P2P as a core anchor for PayPal and Venmo. It is a key driver of usage and often establishes the amount of balance an individual consumer holds in their wallet. The more people store in their balance, the more they use checkout and the better our overall economics. We plan to meaningfully enhance the overall P2P experience, including revamping the onboarding experience, reducing declines and introducing more value-added capabilities.” – CEO

PayPal’s weaker P2P growth has likely been at least in part caused by the rise of new competitors, notably Block’s (SQ) Cash App, which management acknowledged was ahead of Venmo in its card offering.

Instead, growth is coming from lower-margin Unbranded Processing, which is “primarily” Braintree but “also includes” unbranded debit and credit card processing.

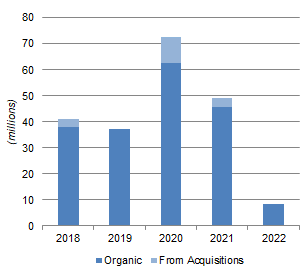

3. New User Growth Has Slowed

Third, PayPal’s user growth has slowed, shrinking one of the drivers behind its volume and revenue growth. “Net New Actives” (“NNAs”) was just 2.9m in Q4 and 8.6m for the year, compared to 49m in 2021 (or around 40m in pre-COVID 2018-19). This means Active Accounts only grew 2% in 2022, compared to 13% in 2021 (or 14% in 2019):

|

PayPal Net New Actives by Quarter (2018-22)  Source: PayPal company filings. |

Since Q4 2021 results (when it disclosed that 4.5m accounts were “illegitimately” set up to take advantage of incentives), PayPal has focused on raising activity levels among existing users instead of gaining more users. At Q4 2022 results management announced that PayPal will no longer provide guidance on NNAs, signalling that user growth is unlikely to return as a key growth driver in the near future.

PayPal has also not provided guidance on volume or revenues for 2023, citing uncertainties around the macroeconomic and geopolitical environment.

PayPal Ability to Gain Market Share

We believe PayPal should be able to maintain or grow its market share in branded checkout.

Difficulties in PayPal’s market share are likely to be on the user side, not on merchants. Among merchants, PayPal has coverage of 35m merchants, including 80% of the top 1,500 in the U.S. and Europe, and “quite low” churn. PayPal has also been adding high-profile merchants, for example with Venmo going live on Amazon’s U.S. checkout in Q4 (with “millions” of users having linked Venmo to their Amazon accounts) and on Starbucks’ (SBUX) app this month.

PayPal’s efforts to grow share among users revolve around improving its product, and show some signs of success. Management stated that, among the one third of the top 100 merchants where the most advanced checkout flows have been implemented, PayPal is gaining share, including in mobile. PayPal’s Buy Now Pay Later (“BNPL”) offering has also been a success, with volume up 160% to $20.3bn in 2022 while competitors are “starting to slow quite meaningfully”.

In other areas, PayPal is clearly growing share in unbranded checkout, as shown in the figures above, while whether its efforts to grow share again in P2P will succeed remains to be seen. However, competition in the latter should lessen in 2023, with current and potential disruptors hindered by the difficult funding environment in Fintech.

CEO Retirement Adds to Uncertainty

Dan Schulman announced that he will be retiring at 2023 year-end, having turned 65 in January.

This will be an orderly succession. The Board has up to a year to search for a successor, there will be a transition period, Dan Schulman has stated he will be flexible if needed to stay on, and he intends to continue as a director.

However, this does add to uncertainty around PayPal’s strategy and execution, especially with CFO Blake Jorgensen having been on medical leave since September 2022, the month after being announced for the role. (Previous CFO John Rainey left to join Walmart (WMT) as CFO in May 2022.)

Cost Cuts To Drive 18% EPS Growth

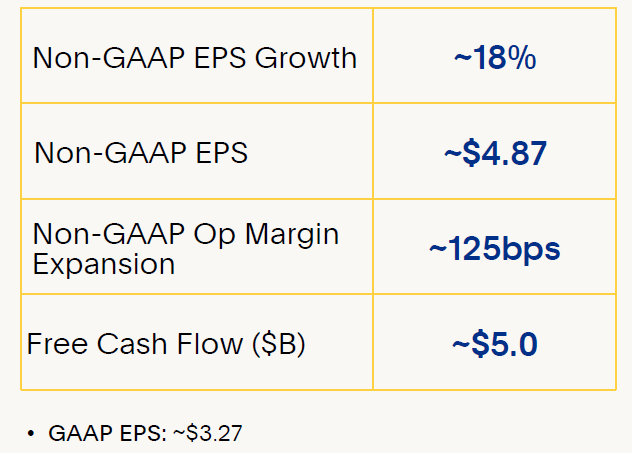

More positively, PayPal is actively cutting costs, and expects to achieve an 18% growth in Non-GAAP EPS in 2023.

Management has identified $600m of new cost cuts, in addition to the $1.3bn announced at Q2 2022 results. Headcount actions will be taken “across the organization”, though with Technology and Development impacted “a little” less.

Cost cuts have already been under way in recent quarters and are visible in EBIT margins. Q4 2022 EBIT margin was more than 1 ppt higher year-on-year, and 50 bps higher sequentially, on both GAAP and Non-GAAP bases:

|

PayPal EBIT Margins By Quarter (Last 6 Quarters)  Source: PayPal results presentation (Q4 2022). |

However, PayPal continues to frame its earnings and margin targets on a Non-GAAP basis, which excludes non-cash Share-Based Compensation (“SBC”) costs (among other things), and 2023 targets will partly be achieved by a shift in from cash to SBC in its annual incentive plan. In this PayPal is behaving like many other Technology companies.

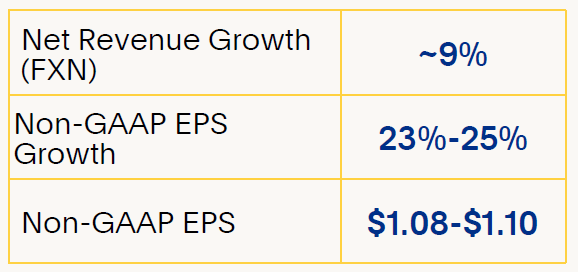

In any event, PayPal expects the costs cuts will enable an 18% growth in Non-GAAP EPS in 2023, even with a “planning assumption” of only mid-single-digit constant-currency revenue growth:

|

PayPal Outlook (2023)  Source: PayPal results presentation (Q4 2022). |

Management described the outlook as based on cost structure designed “around a worst-case revenue scenario”. The team’s expectation remains that PayPal will grow at or above the level of e-commerce growth. Just as importantly, the new cost structure is expected to enable “a path to sustainable operating margin expansion year on year on year”.

9% Revenue Growth Expected in Q1 2023

For Q1 2023, PayPal has guided to a 9% year-on-year growth in revenue (excluding currency):

|

PayPal Outlook (Q1 2023)  Source: PayPal results presentation (Q4 2022). |

CEO Dan Schulman described Q1 as “off to a very strong start”, with “widespread acceleration both in January and February”, including in branded checkout.

However, growth is expected to slow during 2023, with H2 growing less than H1, due to PayPal lapping some large merchant additions in Braintree in prior years and pricing changes that helped H1 more than H2 in 2022.

Valuation: Is PayPal Stock Expensive?

We believe PayPal shares are at a “real” earnings multiple of about 25x.

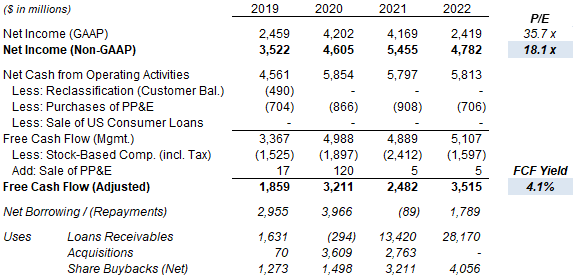

With shares at $74.66, relative to 2022 financials, PYPL stock is trading at an 18.1x P/E on Non-GAAP EPS and a 35.7x P/E on GAAP EPS; FCF Yield, after deducting share-based compensation costs, is 4.1% (a 24x multiple):

|

PayPal Valuation & Cash Flows (2019-22)  Source: PayPal company filings. NB. FCF restated in 2021 to exclude cashflows on collateral related to derivatives. |

Among these metrics we believe FCF Yield (based on our definition, not management’s) is the most representative, because it excludes non-cash one-offs (like restructuring and mark-to-market investment losses) that are included in GAAP EPS but deducts non-cash SBC costs (which are a real cost) that are excluded from Non-GAAP EPS.

Relative to the new 2023 outlook, PYPL stock is trading at 15.3 x Non-GAAP EPS ($4.87) and 22.8x GAAP EPS ($3.27). Management guided to FCF of “around $5bn” (on their definition), slightly lower year-on-year, which implies a FCF Yield (on our definition) slightly lower than the 4.1% from 2022 figures as well.

Management intends to spend “around 75%” of 2023 FCF on share repurchases, which implies $3.75bn or 4.3% of the current market capitalization, though some of these will merely offset dilution by SBC. Buybacks of $4.1bn in 2022 did reduce the share count net of SBC, resulting in a Q4 share count that was 3.3% lower year-on-year.

We believe PayPal’s 25x “real” earnings multiple implies limited downside but an outsized return if growth returns to double-digits.

Growing BNPL balances may be a risk in the event of a recession. Receivables on PayPal’s balance sheet stood at $7.4bn at 2022 year-end, up 53% year-on-year with BNPL the largest driver. Management aims to externalize a “meaningful portion” of this in 2023. A precedent transaction is PayPal’s sale of $7.6bn of U.S. consumer credit receivables to Synchrony Financial (SYF) in 2018, which also resulted in the latter becoming the exclusive issuer of PayPal Credit online consumer financing up to 2028 and taking on the associated credit risks.

PayPal Stock Forecasts

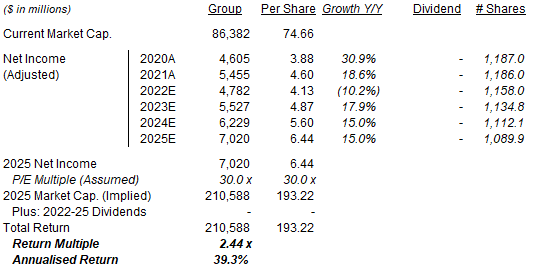

We update our forecasts with the 2023 outlook and reduce our exit multiple again. We now assume:

- 2023 Non-GAAP EPS of $4.87 (was $4.69)

- Thereafter EPS growth to be 15% (unchanged)

- No dividends (unchanged)

- Share count to fall by 2.0% annually (was 1.0%)

- P/E to be at 30x at 2025 year-end (was 32.5x)

Our new 2025 EPS forecast is $6.44, 4% higher than before ($6.21):

|

Illustrative PayPal Return Forecasts  Source: Librarian Capital estimates. |

With shares at $74.66, our forecasts indicate an exit price of $193 and a total return of 144% (39.3% annualized) by 2025 year-end. The exit price is 38% lower than PYPL’s peak of around $310 in July 2021.

Reducing our 2025 exit P/E further to 20x would reduce our forecasted return to 63% (21.0% annualized).

Conclusion: Is PYPL Stock a Buy?

We reiterate our Buy rating on PYPL stock.

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.