Summary:

- Meta Platforms has finally announced plans to roll out a subscription service for the firm’s social media empire.

- Meta will soon allow users to verify their accounts for up to $14.99 a month – with the service first being tested in Australia and New Zealand.

- Although it is too early to model the financial impact for Meta’s 2023 profitability and beyond, I am confident to estimate that the subscription will be value accretive.

- Personally, I estimate a $9 billion/ year SAM opportunity for Meta’s social media subscription service.

- In my opinion, there is arguably little risk to launching the subscription service. In the worst case, the subscription strategy is rejected.

Justin Sullivan

Thesis

Meta Platforms (NASDAQ:META) finally announced plans to roll out a subscription service for the firm’s social media empire. Reportedly, Meta will soon allow users to verify their accounts for up to $14.99 a month – with the service first being tested in Australia and New Zealand. In my opinion, the subscription strategy makes perfect sense and will highly likely not only expand Meta’s top line, but also make the company’s user monetization more resilient, less reliable on advertising.

Subscriptions Are Likely Value Accretive

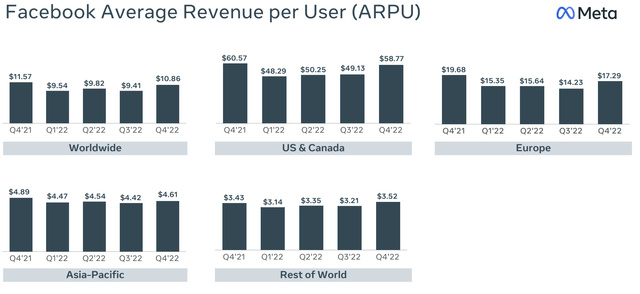

Although it is too early to model the financial impact of subscriptions for Meta’s 2023 profitability and beyond, I am confident to estimate that the subscription will be value accretive. Investors should consider that a $14.99 monthly subscription could accumulate up to $179.88 of annual revenue per verified user. For reference, Meta’s TTM ARPU worldwide is only $39.63. Admittedly, the metric jumps to close to $206.44 for US & Canada user. But investors should consider that Meta will likely roll out the subscription service only ex-NAM, where the strategy will be revenue accretive.

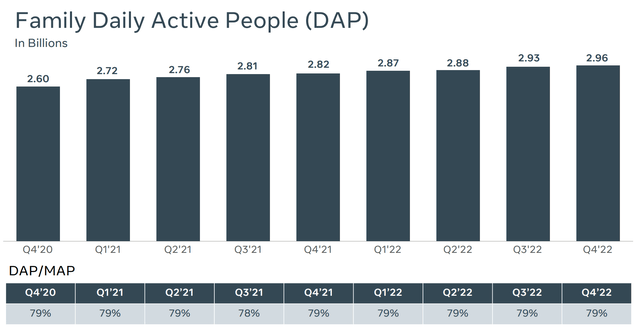

As of Q4 2022, Meta had 2.96 billion monthly active users (for reference, about 90% of the user base is not based in US or Canada). Accordingly, assuming a worldwide subscription penetration of 100%, Meta’s annual revenue would expand to $532 billion, close to x4 Meta’s current top line. Of course, a 100% subscription is unreasonable, especially for the less affluent ex-NAM market. But the potential opportunity to replace ad-based revenues with subscription service should be relatively straightforward.

Understandably, many Seeking Alpha readers are likely reluctant to pay for Instagram/ Facebook subscriptions. However, readers should acknowledge that the subscription market is likely not addressed to them, but to ‘influencers’, as Meta promises:

prominence in some areas of the platform – like search, comments and recommendations

as well as

extra impersonation protection against accounts claiming to be you, and get direct access to customer support

Consequently, a better way to think about the subscription TAM would be accounting only for the ‘influencers’, or the Serviceable Addressable Market (‘SAM’). According to Forbes estimates, more than 50 million people globally consider themselves ‘influencer’. Assuming that these 50 million influencer would pay the $14.99 monthly fee, the subscription SAM would open a market opportunity of close to $9 billion, without adding any material cost considerations.

As a final argument regarding the subscription strategy: Would this strategy – to some extent – be acceptable for Messenger and WhatsApp? Yes, I think so. Of course, pricing needs to be adjusted aggressively. But the opportunity will nevertheless be attractive. And with that frame of reference, it is good to see that Meta is open to testing the subscription strategy.

Risks To Subscriptions?

In my opinion, there is arguably little risk to launching the subscription service. In the worst case, the subscription strategy is rejected. But arguably, even if unsuccessful, the strategy will likely neither churn social media users, nor will it materially add to Meta’s cost base.

Conclusion

Meta Platforms is finally announced plans to roll out a subscription service for the firm’s social media empire. Reportedly, Meta will soon allow users to verify their accounts for up to $14.99 a month – with the service first being tested in Australia and New Zealand. Although it is too early to model the financial impact for Meta’s 2023 profitability and beyond, I am confident to estimate that the subscription will be value accretive. Personally, I estimate a $9 billion/ year SAM opportunity for Meta’s social media subscription service. However, the opportunity could be much larger if Meta decides to somehow expand the strategy to WhatsApp and Messenger. Meta stock continues to be a ‘Strong Buy’.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advice