Summary:

- In this note, we will briefly review Meta’s Q4 2022 earnings report.

- Furthermore, I’ll share five things all smart investors should know about Meta right now.

- Despite having a strong preference for staggered accumulation, I continue to like META as a long-term investment at $173.

Andrii Yalanskyi

Introduction: Brief Review Of Meta’s Q4 2023 Earnings

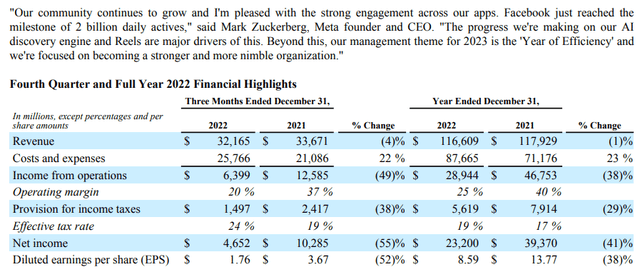

For Q4 2022, Meta Platforms, Inc. (NASDAQ:META) reported revenues of $32.1B, which came in slightly ahead of Street estimates; however, Meta’s diluted EPS of $1.76 fell well short of consensus expectations of $2.23. Now, the big earnings miss was primarily a result of restructuring charges of $4B+. Without these charges, Meta’s EPS would have come in at ~$3, well ahead of consensus expectations.

Meta Q4 2022 Earnings Press Release

Meta Q4 2022 Earnings Presentation

If Meta’s Q3 report was an absolute nightmare, the Q4 report looks worse (at least from a numbers perspective). And yet, Meta’s stock bounced up by more than 25% in the post-earnings session in early February, which is the mirror opposite of the -24% move we got after the Q3 report was released.

As we have discussed in the past, Meta is currently grappling with several headwinds at once – Apple’s IDFA policy changes, greater competitive pressures (from the likes of TikTok), cannibalization of revenues due to rapid growth of Reels [Meta’s short-form video], and a challenging macroeconomic environment. These headwinds are not just hurting Meta’s top-line numbers (where we have seen three-quarters of negative y/y growth) but also causing immense pressure on the bottom line.

Before we discuss the positive reaction to Meta’s Q4 report, I would like you to read TQI’s original investment thesis, where-in we discussed all of the above-mentioned headwinds and their impact on Meta’s near-term financial performance. In my view, Meta’s headwinds are broadly understood, and Q4 numbers were more or less in-line with management guidance.

Here are 5 things smart investors should know about Meta:

1. Meta’s Engagement Metrics Remain Robust

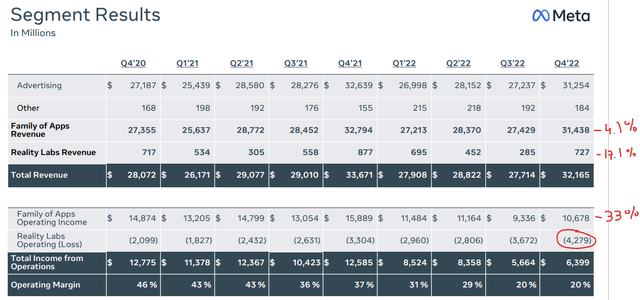

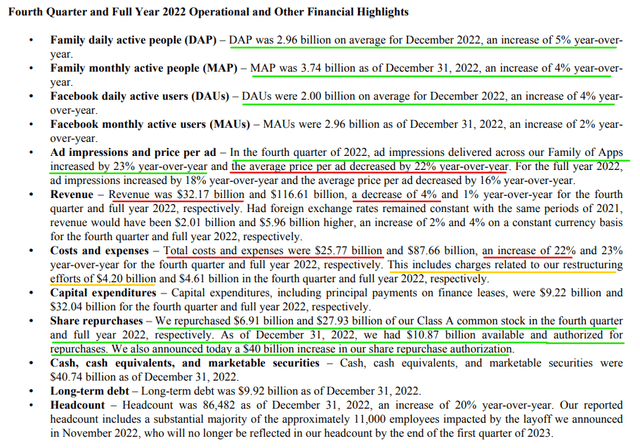

Amid a tough macroeconomic backdrop, Meta’s core advertising business has been suffering a vicious margin compression, which is primarily attributable to declining Ad prices. And these declines got steeper in Q4, with Ad prices plunging -22% y/y. However, Meta’s strong user growth and engagement metrics (Family DAP up 5% y/y and Ad impressions across FoA up 23% y/y) have cushioned the blow to a great extent [revenues are down only ~4.5% y/y].

Meta Q4 2022 Earnings Press Release

The macro uncertainty persists for now; however, with engagement metrics staying robust during this period, Meta’s financial performance can show a strong rebound once the digital advertising spend recovers. Please note that Meta’s strong engagement metrics are a result of its significant investments in its recommendation AI engine. While Reels monetization is not at the level of Stories or Feed, I think it is only a matter of time before we get an inflection point. According to Meta’s management, Reels will not be cannibalistic by Q4 2023. Furthermore, Meta is working on the monetization of WhatsApp and Facebook Messenger, which is a business now running at ~$10B ARR. Overall, Meta’s Family-of-Apps still remains robust, and the investments being made here are bearing fruit for the social media giant.

2. Mark Zuckerberg & Co. Have Found Cost Religion

In my earnings analysis report for Meta’s Q3 results, I said –

The biggest issue with Meta’s Q3 report was its expense guidance for 2023, which showed a lack of respect for Meta investors and sheer abhorrence to financial discipline.

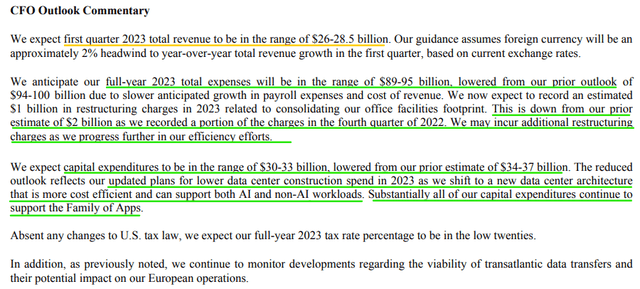

This feeling was echoed by several Meta investors some of whom expressed it via open letters to the management, while some others aired their frustration by selling off the stock down into the $90s. And right since Meta’s capitulatory sell-off on the back of its Q3 results, its management team has been changing the company’s free-spending ways. And the updated expense guide for 2023 is the polar opposite of the expense guide presented to us during the Q3 earnings report. Clearly, Meta’s leadership has gotten cost religion, and this is fantastic news for Meta’s shareholder base.

Meta Q4 2022 Earnings Press Release

Despite making a large 13% cut to its workforce (and promising more), Meta is still set to lose (invest) ~$15-20B on Reality Labs in 2023. Mark hasn’t curtailed spending on his Metaverse ambitions, and in my view, the payoff on this bet is still highly uncertain. The good thing here is that Zuckerberg has now shown a willingness to exercise financial prudence, and the stock market is rewarding this prudence by bidding up Meta’s shares. As an investor in Meta, I am excited to see what the “Year of Efficiency” will bring!

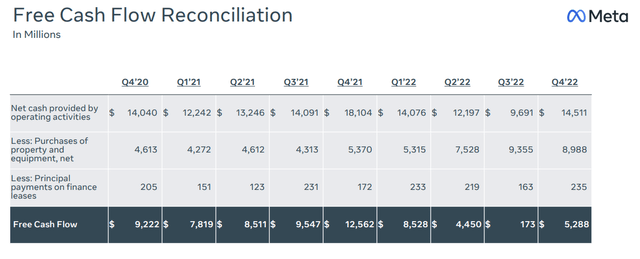

3. Meta’s Free Cash Flow Is Rebounding

In Q4, Meta produced free cash flows of $5.3B. If we were to remove the restructuring charges of ~$4.2B, this figure would have been ~$9.5B. With the company slashing its spending and improving monetization, free cash flow generation is inevitably getting better from here.

Meta Q4 2022 Earnings Presentation

Meta Q4 2022 Earnings Press Release

On top of the remaining ~$10.87B in its buyback authorization, Meta’s board approved another $40B for stock buybacks in Q4. With Meta’s free cash flow generation set to recover gradually in 2023, the buyback program now stands on a solid footing (unlike Q3 2022). In the past, I have posited that Meta’s capital return program combined with a meager ~5% CAGR sales growth will be enough to generate significant alpha for investors over the next decade. And I firmly believe in the power of such financial engineering!

The most positive development from Meta’s Q4 report was Mark and Co. getting cost religion. And now that leadership is re-focused on delivering compounded earnings growth to investors, I feel far more comfortable owning the social media giant now compared to three months ago.

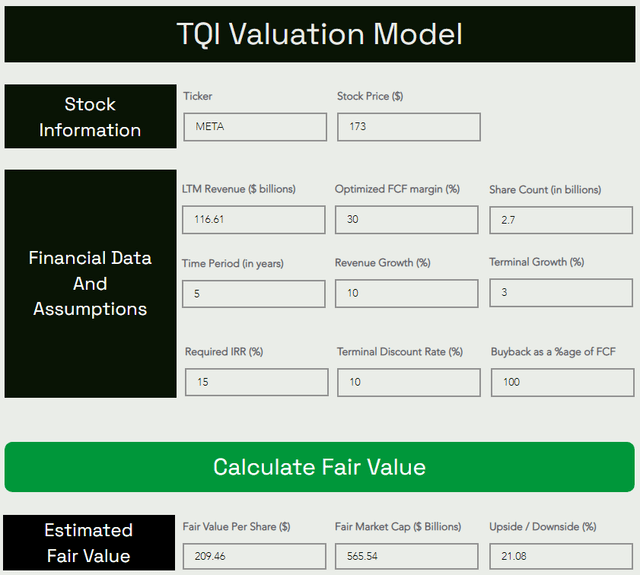

4. Meta’s Stock Is Still Undervalued

Despite having doubled from its bottom, Meta’s stock remains undervalued based on TQI’s valuation model. Here are our conservative assumptions:

TQI Valuation Model (TQIG.org)

As you can see above, META’s fair value is ~$565.5B ($209.5 per share). With the stock trading at ~$175, it is currently trading at a discount of ~17% to its fair value. Clearly, META’s stock appears to be massively undervalued.

However, what sort of returns could one expect in the future by buying Meta at current levels?

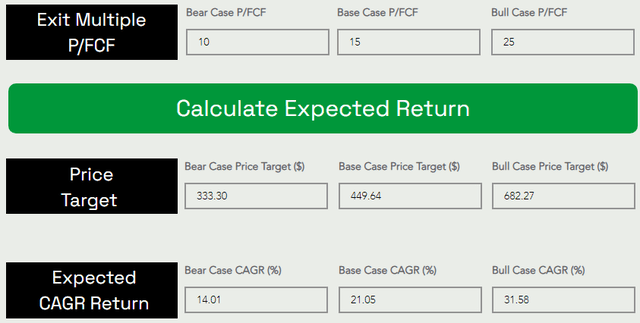

TQI Valuation Model (TQIG.org)

Assuming a base case P/FCF exit multiple of ~15x, I see META’s stock trading at ~$450 per share at the end of 2027, which implies a ~21.05% CAGR return over the next five years. Based on valuation, Meta is a fantastic buy!

5. Technicals Call For A Pullback In META Stock

Back in late October, I rated Meta a “Strong Buy” in the $90s and said the following at the time –

The latest downdraft in Meta’s stock looks like a capitulatory move. At ~$250-260B in market cap, Meta is ridiculously cheap. Yes, cheap could get cheaper, as we have seen over the last few quarters; however, the risk/reward situation is still heavily tilted in favor of bulls and too compelling to ignore for long-term-oriented investors.

While it is impossible to time bottoms, Meta appears to have bottomed right at those levels, with the stock now up ~100%. We own META in TQI’s GARP portfolio at ~$153 per share, and I feel comfortable owning Meta at that price over the long run. Now, let’s look at the recent action.

After announcing its Q4 results, Meta’s stock bounced up by more than 25% in a single session. While the results were nothing to write home about, Meta’s management getting cost religion and further improvements in engagement metrics are seemingly enough to lure investors back into the social media giant’s undervalued stock.

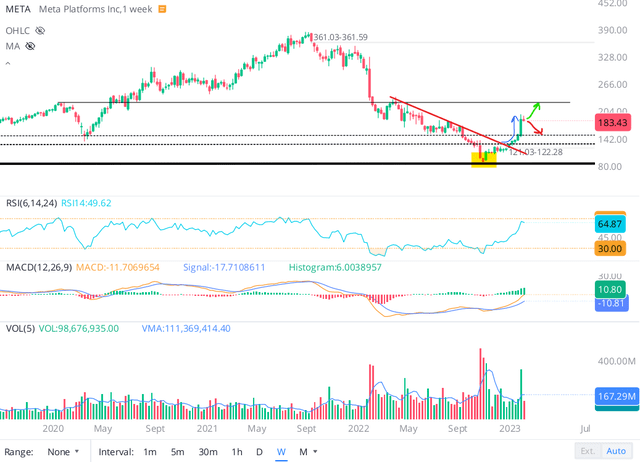

WeBull Desktop

As you can see on the chart above, META has literally gone vertical after breaking out to the upside from the downward-sloping trendline marked in red. Now, such vertical moves tend to get retraced, and hence, I think a re-test of the $130-150 range is likely to materialize at some point. However, if META can consolidate at (or around) current levels, and move higher, then the stock could test pre-COVID highs at $225-250 on the upside.

Concluding Thoughts

From a technical perspective, Meta’s stock is in a “no trade” zone. Hence, I don’t like a short-term trade here. However, a long-term investment makes sense even at these levels due to improving business fundamentals and reasonable valuation. Overall, I like the idea of accumulating META shares for the long run.

Key Takeaway: I rate Meta stock a “Buy” at $173, with a strong preference for staggered accumulation via a 6-12 month DCA plan.

As always, thank you for reading, and happy investing. If you have any thoughts, questions, and/or concerns, please share them below.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month). New users can also avail of special introductory pricing!