Summary:

- Rivian is set to report earnings for the fourth quarter next week. Production guidance for FY 2023 is very much anticipated.

- The production outlook could surprise considering that R1T and R1S production ramped up in Q4’22.

- Shares, despite a major price correction in the last twelve months, are still expensive based on revenues.

Mario Tama

Rivian Automotive (NASDAQ:RIVN) is scheduled to report earnings for the fourth-quarter on February 28, 2023. The electric vehicle company already reported Q4’22 production and delivery numbers in January, but the outlook for FY 2023 is likely going to be Rivian’s most important disclosure next week… and clearly a moment of truth for the EV company. Rivian likely also generated a large loss in the fourth-quarter as the electric vehicle company is still ramping up production of the R1T, R1S and EDV 700 commercial vans throughout the fourth-quarter. I believe Rivian could achieve a production volume of around 50 thousand EVs in FY 2023, a production target the firm actually already laid out at the beginning of FY 2022. Rivian faces a critical moment of truth next week, which is when it has to convince investors that recent production momentum will continue in FY 2023!

Rivian’s Q4’22 earnings: two potential catalysts ahead

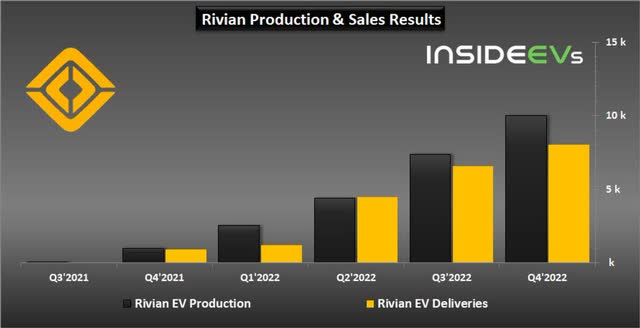

Rivian failed to reach its 25 thousand EV production target in FY 2022 — which has already been disclosed at the beginning of January: the EV company reported a total production volume of 24,337 electric vehicles in FY 2022 which was slightly less than its production forecast for the full-year. Rivian produced 10,020 electric vehicles in the last quarter of FY 2022 and delivered 8,054 electric vehicles, showing 36% quarter-over-quarter production growth. Rivian has seen — despite multiple setbacks in FY 2022 due to supply chain constraints and higher than expected production costs — a nice ramp in production and deliveries towards the end of the year, and investors are keen to know if this momentum can continue in FY 2023.

If the supply chain situation continues to improve in FY 2023, I believe Rivian could double its production this year to about 48-50 thousand electric vehicles, which could translate to revenues of $4.10-4.25B.

Another catalyst for Rivian next week could be the number of reservations the EV company secured since its last reservation update from November. Customers preordered 114 thousand Rivian EVs as of November 7, 2022, and the company added 16 thousand reservations between the end of June 2022 and the first week of November 2022 which calculates to an increase of 4 thousand reservations per month. I estimate that Rivian could report 125-126 thousand net pre-orders next week which could put Rivian’s potential sales volume, based off of its order book, in the range of $10.6-$10.7B, assuming an average sales price of $85 thousand per electric vehicle.

Any surprises regarding production outlook, speed of the ramp or reservation numbers would likely be catalysts for the share of Rivian to move higher.

Demand may be slowing, but production growth will likely remain robust

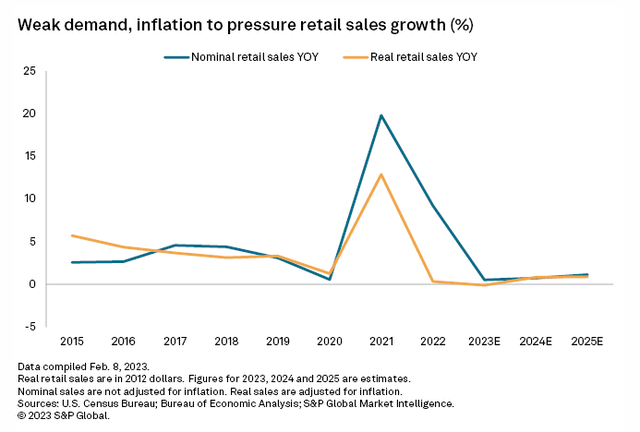

There are signs that consumer demand may be weakening in 2023, but this would not be a big issue for Rivian, I believe, largely because it has such a large backlog of orders to fulfill. High inflation is expected to continue to weigh on consumer demand in 2023 which could also affect the auto sector… and Rivian’s reservation growth rate. Consumer demand spiked in 2020 and 2021, but as inflation continues to weigh on consumers, they might feel less confident buying expensive electric vehicles.

Source: S&P Global Market Intelligence

For Rivian, this could mean slowing reservation growth throughout the year, but it would likely not affect its production growth rate. I estimate that Rivian had a production-to-reservation ratio of 20% at the end of 2023, meaning it produced one electric vehicle in its manufacturing facility for every five reservations it likely held on its books at the end of FY 2023. The size of the order book will keep Rivian busy for at least the next 2-3 years.

Rivian’s valuation and potential top line headwinds due to Tesla’s price actions

While I acknowledge that Rivian could surprise to the upside next week if the production outlook for FY 2023 comes in strong, I really dislike Rivian’s valuation… which I believe is the ultimate metric that determines a buy, hold or sell decision.

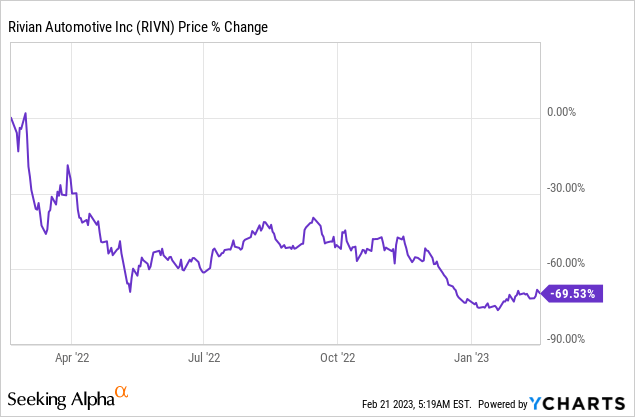

Despite a 70% downside revaluation in the last twelve months, shares of Rivian are still expensive and investors may want to think twice about buying into Rivian even if the EV company surprises to the upside next week. In fact, I believe an upside move in the stock price next week would be a reason to sell the stock, not buy it… because Rivian remains overpriced as it is.

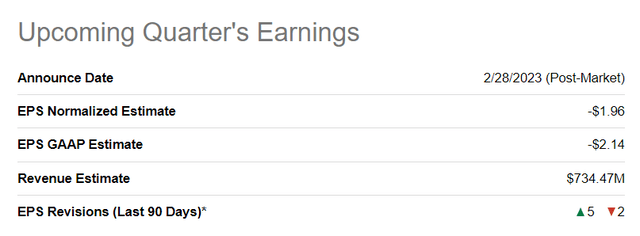

The current projection for Q4’22 revenues is $734.5M, which I believe Rivian could even beat next week.

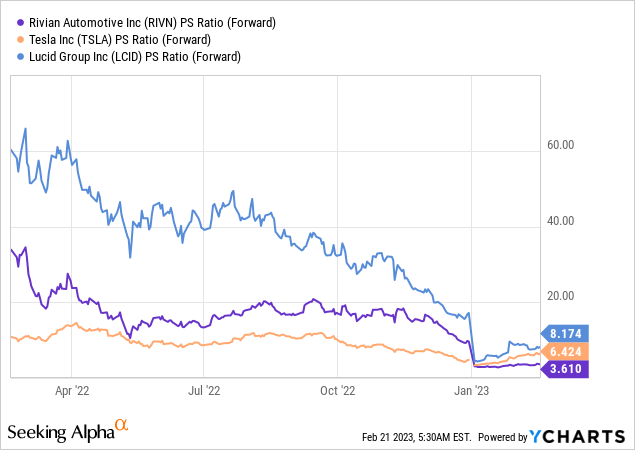

Rivian’s 2023 revenues are expected to grow 200% year over year to $5.2B, so Rivian will continue to grow its revenues rapidly as it works through its order book and brings its production levels up in FY 2023. However, Rivian is currently valued at a premium price of 3.6 X despite operating losses in the billions. Rivian had an operating loss of $5.1B in the first nine months of FY 2022. Rivian is only expected to be profitable in FY 2027… and a lot can happen in this time, especially regarding competition. Tesla (TSLA) recently dropped its prices for key EV products, which could result in slowing reservation and revenue growth for Rivian.

Although Rivian appears “cheap” relative to other EV companies, such as Tesla or Lucid Group (LCID), I believe investors are currently still overpaying for Rivian’s potential.

Risks with Rivian

The production outlook for FY 2023 is going to be what matters next week, which is why I believe Rivian’s guidance could be a short term catalyst for the firm’s shares. A strong guidance for FY 2023 could tell investors that Rivian’s manufacturing momentum is sustainable and a doubling of production, in my opinion, is not an outrageous expectation. A weak outlook for FY 2023, on the other hand, is likely to push Rivian into a new down-leg. A longer term risk for Rivian as well as the industry is growing top line pressure and slowing growth due to increasing pricing pressure from industry leaders such as Tesla.

Final thoughts

Production figures for Q4’22 have already been reported, so Rivian won’t be punished again for missing its FY 2022 production forecast next week. While it is widely expected that Rivian didn’t make a profit last year, the outlook for FY 2023 really could surprise to the upside due to the accelerating momentum in Rivian’s production ramp in Q4’22.

Rivian is facing a moment of truth next week: investors are awaiting a strong production outlook after multiple disappointments in FY 2022 and if Rivian can’t deliver this, then shares may be set for further pain. I believe Rivian has some surprise potential next week, but I would not recommend buying the electric vehicle company. The company’s shares have been brutalized in the last twelve months, losing 70% of their value, but they are still expensive. If anything, a post-earnings upside move in the stock may be a good reason to sell into the strength!

Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.