PepsiCo: An Undervalued Dividend Star

Summary:

- PepsiCo continues to generate robust growth thanks to its diverse portfolio and efficient management.

- Cost-cutting initiatives of management will benefit earnings and ultimately increase returns to shareholders.

- Company’s shares are included in the S&P Dividend Aristocrat Index with consistent dividends paid during last half of century.

- DDM suggests the stock is 14% undervalued.

Brandon Bell/Getty Images News

Investment thesis

PepsiCo (NASDAQ:PEP) is a dividend aristocrat which has a strong track record of delivering consistent growth thanks to its strong brand recognition and diverse products portfolio. Management has proved themselves of being able to deliver steady revenue and EPS growth driven by robust marketing together with cost management. My fair value calculations suggest PEP stock is undervalued.

Company information

PepsiCo, founded in 1898, manufactures and distributes food, snacks and beverages worldwide. Company’s product line includes over 500 brands.

According to Argus Research, nearly 11 of the 15 best-selling items in grocery stores are from PepsiCo, and Lay’s, whose sales have grown from $100 million to $30 billion in half a century, is the world’s most successful snack brand.

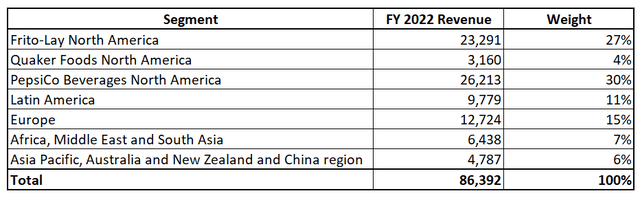

The company disaggregates its revenues by products categories and geographics, North America represents more than 60% of PepsiCo’s revenues.

Financials

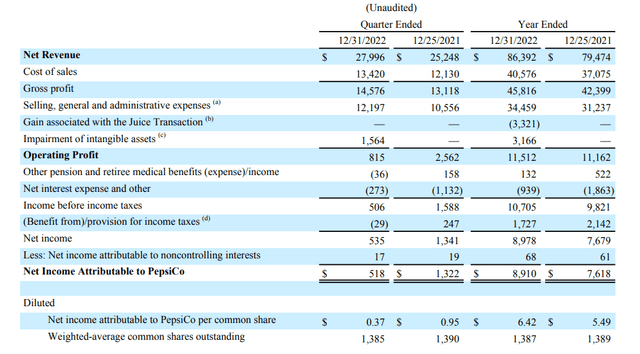

The company released its 4Q2022 financial results on February 9, 2023. Revenue of almost $28 billion increased 10.9% if compared to 4Q2021 and well above consensus projections of $26.8 billion. In terms of normalized actual EPS it was also a slight beat of forecasts. Strong results were mainly due to higher than expected organic revenue.

Overall, the company has very strong reputation in beating consensus estimates. Revenue has topped consensus forecasts in 28 out of the past 32 quarters. EPS has been above estimates in 34 of the past 36 quarters and the left two were in line with consensus expectations.

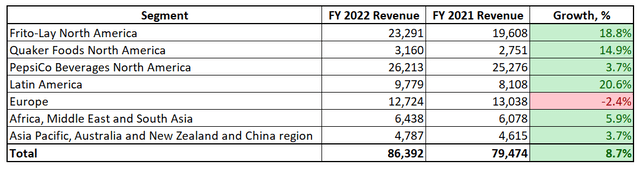

For the full FY2022, revenue rose 8.7% to $86.4 billion, and EPS increased from $6.25 in FY2021 to $6.79 in the latest reporting financial year. Top line demonstrated growth across all reporting segments, except of Europe. Both Americas, which represent 72% of company’s revenues demonstrated very strong double digit growth.

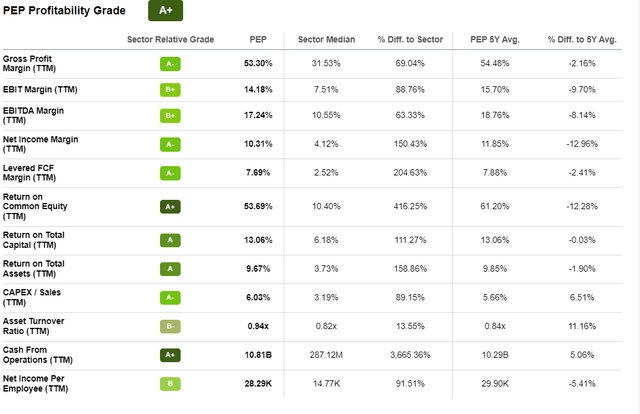

According to management’s remarks, the company successfully navigated through a challenging inflationary environment in FY 2022, which we can see from strong profitability grades and metrics.

Management expects inflationary pressure to remain in FY 2023, but the company’s CFO, Hugh Johnston, explained that to offset inflationary effect PEP will be focused on delivering productivity savings. According to 4Q2022 prepared management remarks, it is expected that the company will be able to deliver at least $1 billion in productivity savings during FY 2023. In terms of top line, management expects a 6% organic revenue growth in FY 2023 and an 8% core constant currency EPS growth.

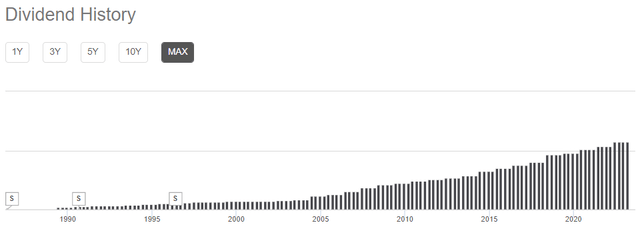

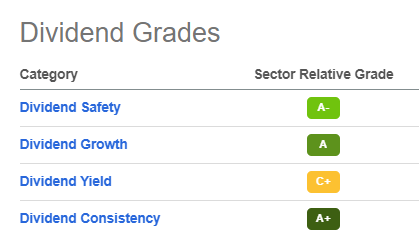

The company has very rich history of paying dividends which lasts more than 50 years with consistent dividend hikes. PEP is awarded an A+ Consistency Grade in Seeking Alpha Factor Grades.

During last earnings call management announced a 10% annualized dividend hike, which will represent PepsiCo’s 51st consecutive annualized dividend per share increase.

In summary, PepsiCo’s financials are strong and management has high conviction that FY 2023 results will be even stronger.

Valuation

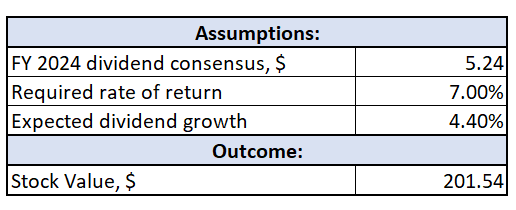

For dividend aristocrats, like PEP, to assess stock fair value, I prefer to use Dividend Discount Model [DDM]. In order to conduct valuation I need to figure out three variables.

First, for next year dividend I would like to use consensus estimate for PEP FY 2024 dividend, which is at $5.24 level. I believe that, considering the company’s strong track record of delivering financial results above consensus estimates, we are on the safe side to choose FY 2024 consensus forecast for DDM.

Second, for the required rate of return company’s WACC is a reasonable choice. Currently, GuruFocus estimates PEP’s WACC at 6.52%, but to be more cautious I prefer to round it up to 7%.

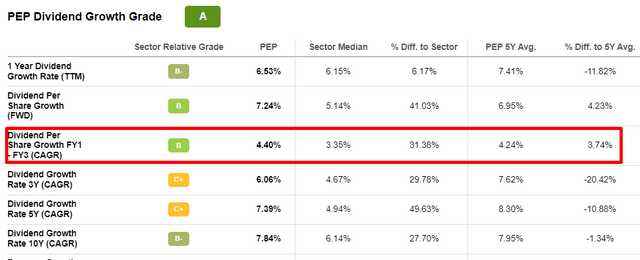

Third, for dividend growth rate, I prefer to be conservative because DDM is very sensitive to change in growth rates, so I use the most modes metric which is Dividend per share growth FY1-FY3 CAGR.

Finally, incorporating all variables together, I ended up with a stock fair value of $201.54 which indicates about 14% upside potential for the share price.

Author’s calculations

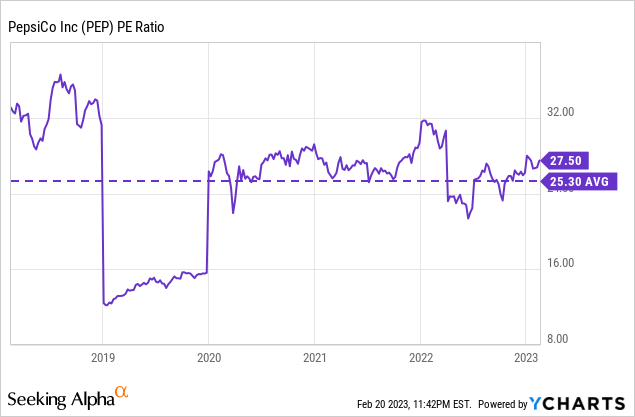

To challenge the DDM outcome I also usually conduct multiples analysis. PEP is a value stock, so I believe that analysis of historical P/E levels would be reasonable to cross-check the DDM.

If we look at the above chart, we can see that at the moment PEP is trading above 5-year P/E average, but it is important to look forward and consider company’s EPS consensus estimates for FY 2024. Incorporating FY2024 EPS consensus estimates we end up at forward P/E of 22.28 which is well below the 5-year average.

To sum up, based on my DDM calculations as well as multiples analysis I have high conviction that the company’s shares are currently traded at a discount of about 14%.

Risks to consider

Before investing in PEP stock risks must be considered.

First of all, with inflationary pressure still in place, company’s margins might suffer from increased costs. Management is mitigating this risk by implementing cost saving initiatives mainly related to streamlining supply chain via automation and digitalization.

Second major risk which I see is consumers becoming more health-conscious. Consumer’s concerns about health effects of PEP products might force the company to reformulate product recipes which can affect taste of snacks and beverages produced by PepsiCo.

Third, PepsiCo’s products are produced from raw materials like corn, sugar, oil. It means that company’s costs are vulnerable to fluctuations in commodities markets which is risky during current complex geopolitical tensions which involve countries exporting commodities.

Bottom line

To conclude, the company’s strong financial results together with dividends growth and consistency give me firm conviction that PEP represents a compelling investment opportunity. The stock is a strong buy given growth perspectives together with stellar dividend growth and consistency grades, which outweigh potential risks.

SeekingAlpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.