Summary:

- Apple reported its Q1 results a couple of weeks ago, showing declines in revenues and margins, along with a 10% decline in EPS compared to the prior year.

- With a market cap of $2.4T, I don’t see how Apple will be able to produce returns for investors like they did over the last five years.

- Shares are expensive today with a price/earnings over 25x despite projections of slowing growth.

- Apple dumped $19B into buying back stock despite the rich valuation. I’m curious to see how the 1% buyback tax (which came into effect on January 1st) impacts the company moving forward.

Scott Olson

Last time I wrote an article on Apple (NASDAQ:AAPL) was a couple of months ago, and I explained why I would rather own Berkshire Hathaway (BRK.A) (BRK.B), which also has a large stake in Apple. Berkshire actually added shares of Apple in the most recent quarter, but I still think the valuation on Apple means that returns will not be that impressive moving forward. I recently spent some time going over the most recent 10-Q, and I think there are some things worth mentioning for investors considering Apple’s stock.

Investment Thesis

Apple is a business that has developed a cult following for its products over the last decade, and its stock has developed a cult following as well. The company recently reported quarterly earnings, and we saw a decrease in revenue, margins and EPS. If this continues for the rest of the year, it could spell trouble for the stock, which already trades with a rich valuation with its price/earnings ratio over 25x. Management has continued to dump money into buying back stock, and the 0.6% yield is near historical lows for the stock. The company has a market cap of $2.4T, and I don’t know how much bigger the company can grow. I don’t think investors should be buying the stock today because I don’t think the risk/reward profile is favorable with shares over $150.

The 10-Q

One of the things that stood out right away looking at Apple’s first quarter is the decline in revenue, combined with decreasing margins and EPS. Revenue decreased by $6.8B from the prior year Q1, gross and operating margins declined slightly, and EPS was down about 10% for the quarter. The balance sheet is still solid, with plenty of cash ($20.5B) and marketable securities ($30.8B). They do have a fair amount of debt, but they have been able to borrow at ridiculously cheap rates in recent years. It will be worth watching to see if business picks up this year, but I wouldn’t be surprised to see if revenue, margins, and EPS are not as good in fiscal 2023 as they were last year.

I’m curious to see if the company can grow revenue in this uncertain economic environment. I bought one of the new MacBook Pro models recently after the old one started to die on me, but I know a lot of people are not in a position to buy new iPhones, MacBooks, or iPads right now. I enjoy the new computer, but I’m not sure if they will be able to grow revenues without significant updates to the product line or the release of new products. While declining revenue and earnings are a reason for caution, the biggest problem I have with Apple’s stock is the valuation.

Valuation

I have mentioned this in all my articles on Apple, but it is worth mentioning again. I think Apple’s valuation is too rich for investors buying today for two reasons: growth has been slowing down and the massive market cap of $2.4T. I understand why Apple has commanded a premium valuation with its balance sheet and impressive margins, but I have a question each investor should answer for themselves.

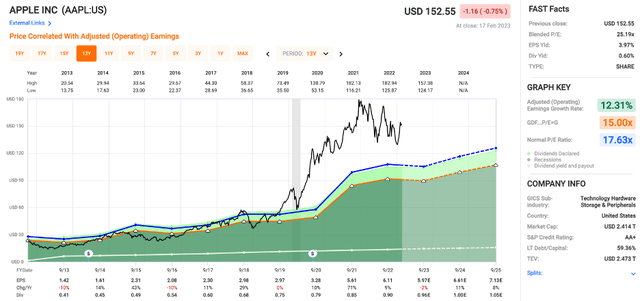

How big can Apple grow? Three trillion market cap? Five? Ten? Inflation aside, I just don’t really see how Apple can significantly increase its market cap from here. Some investors point to buybacks, which is fine, but I just don’t see forward returns for investors looking like the last five years. Shares currently have a price/earnings ratio of 25.2x, which is well over the average multiple from the last decade of 17.6x. While some bulls have argued that the multiple expansion is warranted as Apple’s revenues have started to shift from hardware to services in recent years, I don’t see a favorable risk/reward for investors starting from the current valuation.

Price/Earnings (fastgraphs.com)

Earnings growth is projected to drop slightly in 2023. Looking at the quarterly results they had a 10% drop in EPS compared to prior year, so we will see how the rest of the year plays out. If earnings drop more than projected, investors could significantly overpay for the stock, and I don’t see much in the way of margin of safety with shares over $150. Yes, Apple has a good balance sheet and impressive margins. Yes, passive fund flows and buybacks mean consistent buying demand for the stock. However, I don’t think that the risk/reward is very good for investors buying right now. One of the things that will certainly be a tailwind for Apple’s earnings per share is their massive buyback program.

Buybacks & Dividends

Despite the rich valuation, Apple has continued their massive buyback program. They bought 133M shares for $19B in the quarter. I have said this before, but I would rather see a bigger dividend with the current valuation. One of the other things that I will be watching is the new buyback tax. I doubt this will have an impact on Apple’s buybacks, but the 1% buyback tax went into effect on January 1st, so I’m curious to see if that changes anything for management. For some quick math, they would be on the hook for a $190M tax bill if the new tax was in effect for last quarter. The dividend is due for another hike this year, but the 0.6% yield isn’t much to get excited about, even if the dividend growth has been consistent.

Conclusion

It is worth reminding investors that there were times in the last decade that investors could buy shares of Apple with a price/earnings ratio near 10x and a yield over 2%. Yes, I’m cherrypicking a little bit, but the company had a much smaller market cap, a longer growth runway, and shares basically had a 15x multiple (or lower) until 2019. Today, shares have a multiple over 25x, a market cap of $2.4T, and a yield of 0.60%. I just don’t see how the risk/reward for investors pencils out with shares over $150.

The company continues to dump money into buybacks despite the rich valuation, and I don’t think the token 0.6% dividend is much to get excited about. In the first quarter of fiscal 2023, we saw revenue and margins decrease, and EPS was down about 10%. There are better stocks with more attractive valuations available to investors today. Apple is a great company, but it is a massive company. As they say, trees don’t grow to the sky. The same thing applies to business, and it is why I don’t think the risk/reward is favorable for Apple investors today.

Disclosure: I/we have a beneficial long position in the shares of BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.