Summary:

- Roku, Inc.’s stock had a post-earnings surge, with investors betting on the streaming platform’s early-stage turnaround and its leadership position in connected TV.

- Despite the worst being behind it, Roku may not return to profitability until FY24, leaving investors to wonder if it’s worth the risk to wait?

- With an FY24 EBITDA multiple of nearly 44x hinging on its ability to return to profitability, Roku must prove that its growth justifies the premium valuation.

Justin Sullivan

Roku, Inc. (NASDAQ:ROKU) stunned the bears further as it held its post-earnings gains. With a short interest as a percentage of float of below 9%, there are still some stubborn short-sellers that remain.

The company called out some “green shoot type uptick” in its ads business, which likely fueled the earnings surge, giving investors optimism in a recovery in H2’23.

However, a return to adjusted EBITDA profitability remains elusive in the near term. Notwithstanding, management is committed to delivering profitability in FY24, bolstered by its cost-optimization strategies.

Accordingly, Roku has guided YoY OpEx growth to fall from 40% in FQ1 to “single-digit YoY growth by Q4 2023.” As such, it does relieve some of our previous concerns about Roku needing to invest more to defend its market leadership.

The market has likely given management the benefit of the doubt for now, with further upside likely dependent on its execution over the next few quarters.

Roku’s move into Roku-branded TV is expected to strengthen its data insights and gain a more significant device foothold to spur new accounts growth. However, investors must pay close attention to its gross margin evolution, as the ramp has yet to occur.

The company’s Q1 guidance suggests that FQ4 could be a critical inflection point on its gross margin trajectory, as management guided a gross margin of 44.3% (Vs. FQ4’s 42%).

Wall Street’s consensus estimates suggest that Roku’s gross margin could recover to 45% by FQ4’23, moving it closer to recovering its bottom line.

Interestingly, management highlighted that they would focus on expanding their partnership with third-party demand-side platforms or DSPs and leaders in retail media ads. As such, it suggests that Roku has levers to pull and drive advertiser demand on its inventory with other platforms.

Could the potential growth on its platform be slowing, behooving Roku to open up with other players, which could dilute its core profitability? It’s important for investors to note that Roku already has a full-stack approach in connected TV (CTV) advertising, coupled with its own DSP.

Notwithstanding, we believe it demonstrated the potential for Roku’s market leadership to be capitalized further to drive growth, if necessary.

Management anticipates the potential stabilization of the ad market in 2023, which should bolster ROKU’s late December lows from being breached.

With that in mind, what are some of the potential pitfalls that investors need to consider carefully before jumping on board?

With the remarkable recovery from its December lows, ROKU is no longer that attractive. It last traded at an FY25 EBITDA multiple of 43.5x, undoubtedly a growth multiple.

Therefore, Roku will likely need to drive global growth ex-U.S. to justify its valuations further. Roku highlighted that Roku TV garnered a 38% U.S. market share of units sold in Q4. Management also articulated it remains confident of gaining share.

But Roku already has a relatively high market share leadership in the U.S., suggesting that monetization growth could be a more significant lever to focus on. As such, investors will need to assess its average revenue per user (ARPU) metric, which didn’t inspire confidence in Q4, as it fell 5.3% QoQ.

We believe for Roku to return to its high-growth phase and justify its growth premium, it needs to demonstrate a more robust cadence in its monetization growth. Otherwise, investors will need to be prepared for value compression, as it could demonstrate that its high-growth trajectory is a thing of the past.

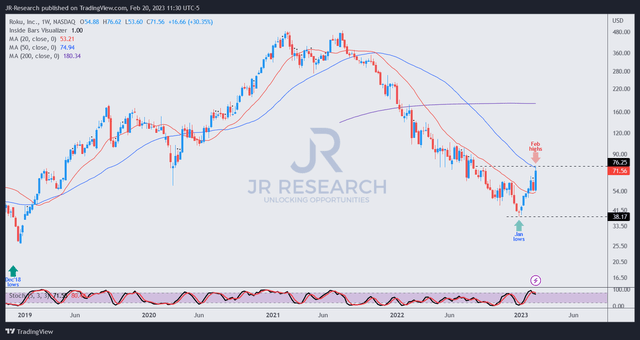

ROKU price chart (weekly) (TradingView)

ROKU re-tested a critical resistance zone after its post-earning surge, likely attracting investors believing the company’s turnaround is still in the early stages.

As the CTV platform market leader, Roku will likely benefit if the scatter market recovers in H2, coupled with the cost-optimization strategies highlighted, driving operating leverage.

However, Roku, Inc.’s valuation suggests much of its near-term optimism is likely reflected already.

Rating: Hold (Reiterated).

Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!