Summary:

- TXN hasn’t been able to escape the slowdown, with revenue declining year-over-year in the latest quarter.

- However, thanks to their ‘boring’ chips, they’ve been able to hold up significantly better, and the slowdown hasn’t impacted them nearly as much as the hotly debated chip plays.

- For a long-term dividend investor, boring and stable can be exactly what one is looking for – the current price is also conducive to longer-term capital appreciation potential.

Sundry Photography

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on February 7th, 2023.

Texas Instruments (NASDAQ:TXN) put up numbers in their latest earnings that weren’t exactly spectacular. They beat on both the top and bottom lines. Their outlook for the first quarter was in a range that was within the consensus. That’s about the best one can hope for in this environment.

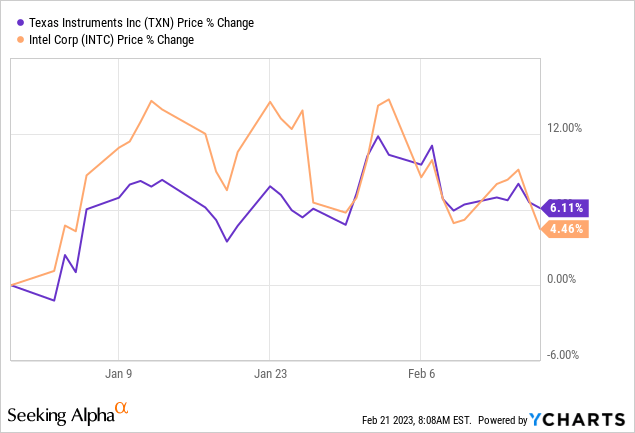

As an Intel (INTC) investor, I know exactly what can happen when you miss earnings, and the guidance given is terrible. More interesting is that since that earnings announcement for INTC shares had snapped back before reversing lower again in the last couple of days. In fact, to start off this year, the market has been rallying, including shares of INTC.

Shares of TXN in this short time frame have actually been quite similar. The overall market seems to be dictating our direction, which is often the case in the short term.

However, this update isn’t about the short-term. Instead, it’s about why I believe that TXN is a long-term play for a dividend investor.

INTC, Advanced Micro Devices (AMD) and NVIDIA (NVDA) all seem to be the semiconductor stocks that get most of the headlines. The battle continually rages on for these names as they are generally making components in the latest and greatest electronics.

That’s precisely what makes TXN different. They make the chips for everything else. And for the most part, everything else is doing fairly well. They didn’t see the same pull-forward demand for electronics, gaming and crypto mining that the other ‘sexy’ names did through 2020 and 2021.

TI “designs, manufactures, tests and sells analog and embedded semiconductors in markets that include industrial, automotive, personal electronics, communications equipment and enterprise systems.”

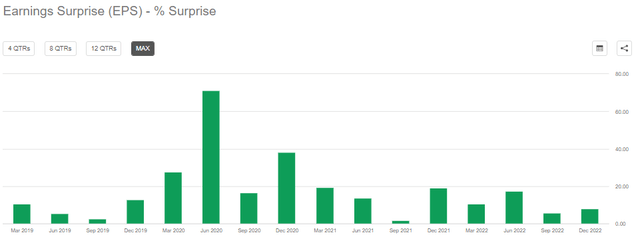

Since our last coverage of Texas Instruments, the stock has done relatively well compared to the S&P 500.

TXN Performance Since Previous Update (Seeking Alpha)

Today, I think it’s still a valuable company that a dividend or dividend growth investor could invest in today.

Past, Recent and Outlook For Earnings

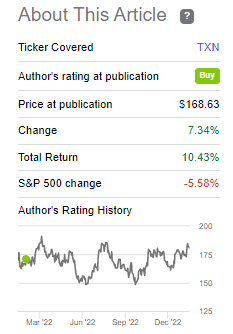

TXN wasn’t totally immune to softness as revenue year-over-year in their latest quarter declined by 3.3%. This was still good for beating analysts’ expectations, a trend in which this company often finds itself. In the last 14 quarters out of 16, they’ve been able to deliver a revenue surprise.

TXN Revenue Surprise History (Seeking Alpha)

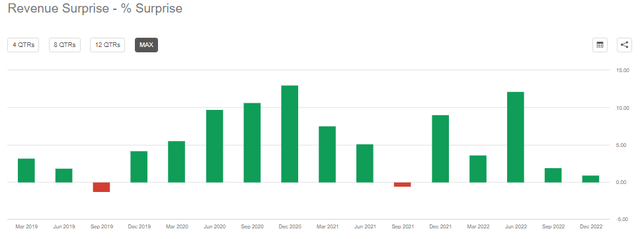

This isn’t limited to the top-line estimates, though. In fact, they ran an even better earnings surprise and beat the record on the EPS side of the equation, where 16 out of the last 16 quarters were beats.

TXN EPS Surprise History (Seeking Alpha)

With their earnings outlook for the first quarter, TI is also within the range of consensus. The latest quarter showed a 3.3% decline year-over-year, but sequentially it declined 11%. The mid-point for Q1 outlook guidance is revenue at $4.35 billion. That would actually be another decline of 11.4% year-over-year. At the mid-point of $1.77 EPS for the quarter, that would be a decline of 26.9%.

One of the areas that they called out specifically in their earnings call was the automotive chip demand, as it bucked the trend of generally lower demand for the quarter.

Revenue was $4.7 billion, a decrease of 11% sequentially and 3% from the same quarter a year ago. As expected, our results reflect weaker demand in all end markets with the exception of automotive. A component of the weaker demand was customers working to reduce their inventories. In first quarter, we expect a weaker than seasonal decline, with the exception of automotive, as we believe customers will continue to reduce inventory levels. Turning to our segments, fourth quarter Analog revenue declined 5% year-over-year and Embedded Processing grew 10%. Our Other segment declined 11% from the year-ago quarter.

They noted that the worst-performing segment was personal electronics (computers, phones, tablets and TVs.) That is exactly confirming what we saw from INTC and AMD. They also noted a sharp drop in communications equipment being, down around 20%. However, for TI, electronics is around 20% of their revenue, and communication equipment is 7%. Industrial at 40% and automotive at 25% of 2022 revenue are much more significant on the outcome of their earnings.

In 2022, industrial and automotive combined made up 65% of TI’s revenue, up about three percentage points from 2021 and up from 42% in 2013. We see good opportunities in all of our markets, but we place additional strategic emphasis on industrial and automotive. Our industrial and automotive customers are increasingly turning to analog and embedded technologies to make their end products smarter, safer, more connected and more efficient. These trends have resulted and will continue to result in growing chip content per application, which will drive faster growth compared to our other markets.

Given their track record, we could be fairly safe to presume that the chances of an EPS or revenue surprise are fairly expected at this point. This is exactly what companies need to do in the short term to generate analyst interest. Most investors actually have or should have a longer outlook for holding companies.

I think looking at the long term is more important as a buy-and-hold type investor with a longer-term outlook. I’m more curious about what the outlook is for years down the road.

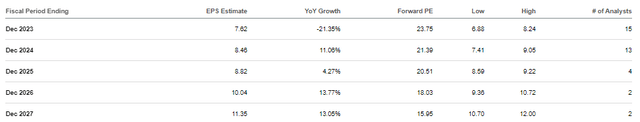

Besides the short-term dip in earnings expected for fiscal 2023, earnings are expected to continue to grow after that. If these estimates are achieved, TXN will be back to record earnings within a few years.

TXN EPS Estimates (Seeking Alpha)

As they mentioned in their earnings call, the growth they expect will be tied to the industrial and automotive industries. That’s where they seem to have a clear edge, and they aren’t walking away from that space to compete elsewhere, even though it might not be the most exciting area if it’s between personal electronic devices and industrial applications.

Is Now The Time To Buy?

As a long-term investor, you still don’t necessarily want to buy at any price. However, thanks to the overall weakness we experienced through 2022 and a soft outlook, shares seem to be a reasonable value today. They aren’t necessarily the cheapest we could see, but Wall Street analysts have an average price target of $183.63.

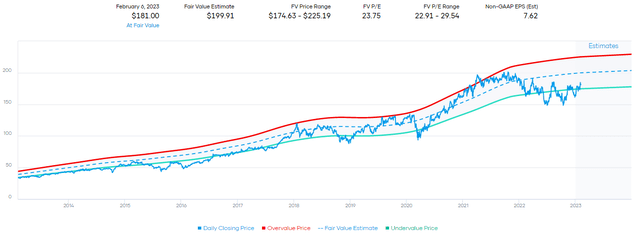

Based on the historical P/E range, the fair value estimate also indicates we could see some upside from here. Shares are trading on the lower end of the range, just into the fair value range.

TXN Fair Value Estimate Based on Historical P/E Range (Portfolio Insight)

Dividends And Buybacks

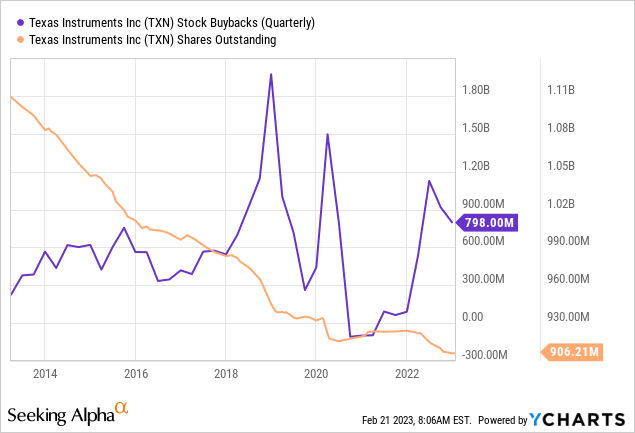

This company has provided investors with significant dividend growth and share repurchases over the years. Earnings growth can be helped through repurchases as shares outstanding are decreased. They’ve consistently been buying back shares, and that includes the latest quarter, where they repurchased $848 million.

This has led to a material decline in the total amount of shares outstanding, so they aren’t just going to cover executive compensation. They’ve had a real impact on the benefit of shareholders.

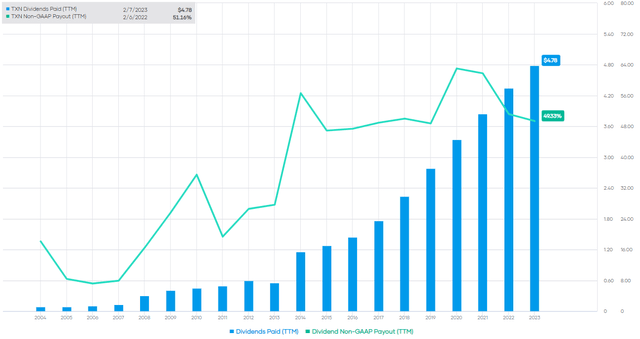

That’s not the only way they return capital back to shareholders, as they pay a competitive and growing dividend. The latest dividend increase last year of 7.8% was slower but still helped combat inflation’s negative effects on purchasing power.

Historically, they had been aggressively raising their dividend with a 10-year CAGR of 20.19%. That type of growth might not return in the next several years as they work through the short-term uncertainty of the overall economic picture.

TXN Dividend And Payout Ratio (Portfolio Insight)

The payout ratio has lingered around 50 to 60% for the last nearly ten years despite the aggressive raises – which means they were backed by earnings growth. With the earnings outlook at the moment, it would mean that they go closer to a 65% payout ratio. However, that should quickly reverse and reduce back down once the anticipated earnings growth resumes.

Conclusion

Overall, Texas Instruments is a well-rounded investment that offers growth potential, income and a reasonable valuation. They have to work through an uncertain economy just as any other company does for now, but in the coming years, growth is still anticipated. Additionally, the company’s dividend yield of 2.74% provides a steady stream of income for investors. Along with earnings growth in the future, the income should continue to grow as well with dividend increases.

Disclosure: I/we have a beneficial long position in the shares of TXN, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.