Summary:

- Amazon’s operations are highly unpredictable, and management’s guidance gives investors little assurance.

- The company has burned through tens of billions in free cash flow the past couple years, a feat that — at this point in its corporate life — is completely unacceptable in our view.

- If Amazon drops the ball and is left behind on new technological advances such as in artificial intelligence and others, shareholders could be left “holding the bag”.

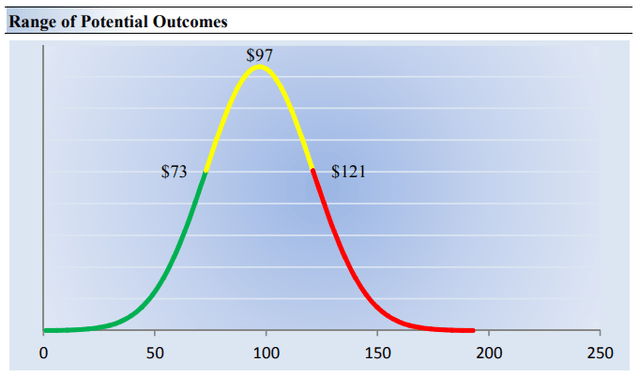

- We value shares about in-line with where they are trading at the moment, but the future is ominous, and we wouldn’t be surprised to see them face pressure through the course of 2023.

HJBC

By Valuentum Analysts

Amazon (NASDAQ:AMZN) is one of the luckiest companies in the stock market, in our view. It is often used as an example of one of the best companies around, but we’re not so sure. If it weren’t for some arguably lucky financing right before the dot-com crash, it might not even be in business today, at least in our opinion. In February 2000, a month before the dot-com market crash, Amazon raised a much-needed ~$670 million in convertible notes from European investors.

If Amazon hadn’t been able to do so, there’d likely be no Amazon as we know it today, and one of the wealthiest men in the world, Jeff Bezos, might have just been a mere footnote in stock market history. Without that last-minute funding, Amazon would likely have been insolvent in 2001-2002 just like many of its other dot-com peers, and it might have not made it to the other side of the dot-com crash.

The company is perhaps the best example of survivorship bias, in our view. As one of the biggest stocks on the marketplace today, we often take Amazon for granted. We might say that it revolutionized the online marketplace, but in reality, the company’s retail business isn’t all that attractive, and the economics of its cloud operations are now being overshadowed by huge company-wide capital investments. We wouldn’t touch Amazon’s shares with a ten-foot pole.

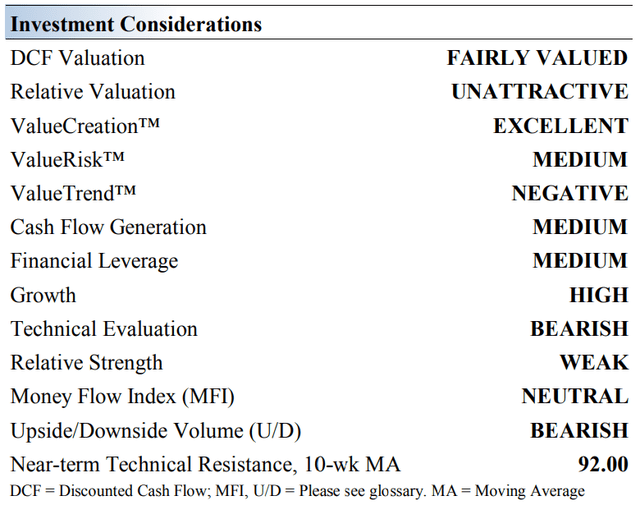

Amazon’s Key Investment Considerations (Image Source: Valuentum)

Amazon is often a crowd favorite in part because it is at the forefront of the consumer experience almost every day. The company’s business operations include its namesake e-commerce platform, its on-demand cloud services provider Amazon Web Services [AWS], online pharmacies, shipping, digital advertising, physical grocery stores, co-branded credit card agreements, video streaming services, and more. Amazon Prime boasts an impressive membership base, too.

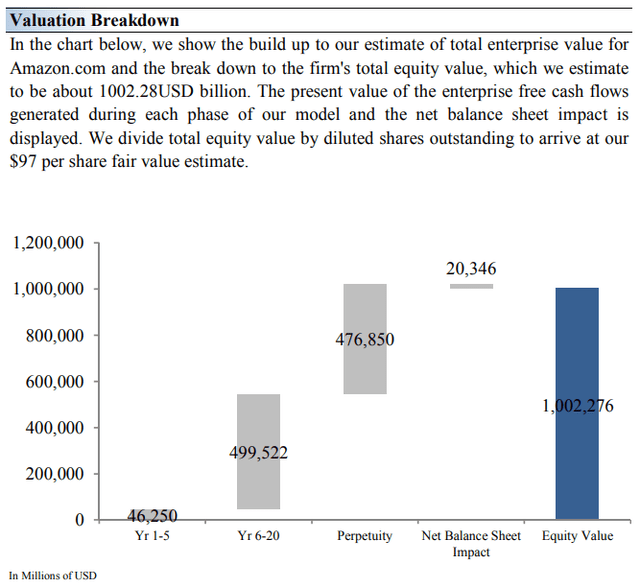

AWS has become a critical part of Amazon, with revenue growth in the segment surpassing overall company growth; AWS accounts for a substantial percentage of the tech giant’s operating income. Amazon’s digital advertising business has grown at a decent clip the past several years. Importantly, however, our fair value estimate is highly sensitive to our long-term/mid-cycle operating margin assumptions. For example, a one percentage point change in our mid-cycle operating margin assumption results in a ~$10-$15 per share change in Amazon’s fair value estimate.

This is an important consideration. For example, Amazon often gives a rather large range for its levels of profitability when it comes to guidance. Such a large range of expected profitability translates into even a bigger range for a company’s cash-flow-derived intrinsic value. To a very large degree, this aspect of Amazon’s financial unpredictability makes shares largely “uninvestable,” in our view. Perhaps Amazon could be given the benefit of the doubt years ago when it wasn’t generating profits, but that time has passed, in our view. Amazon needs to figure out how to generate consistently strong profits and free cash flow year in and year out.

During the past several years, the company has been busy acquiring assets. Amazon acquired Whole Foods for ~$13.7 billion in 2017 to support its grocery business. In 2020, Amazon launched its online pharmacy to further disrupt the brick-and-mortar retail space. Amazon is contemplating launching department stores in the US to assist in its efforts to grow its apparel and appliance sales. The firm is also aggressively growing its shipping operations, highlighting its ability to grow across numerous verticals. Its Amazon Prime service is steadily becoming a big player in video streaming on the back of its original content investments. We love Amazon Prime’s video collection.

Latest Quarterly Results

In Amazon’s fourth-quarter 2022 report, released February 2, the company registered net sales growth of 8.6% on a year-over-year basis in the quarter. Its ‘North America’ segment sales increased 13% on a year-over-year basis, but its ‘International’ segment sales fell 8% on a year-over-year basis as foreign exchange headwinds weighed on results. Amazon Web Services (AWS) sales advanced 20% in the quarter, but the firm wasn’t able to generate much in the way of earnings, with non-GAAP earnings per share coming in at a mere $0.03 in the period. Those that don’t care that Amazon isn’t earning much money these days might be a big part of the reason why we saw the junk-tech bust in 2022. Amazon needs to change.

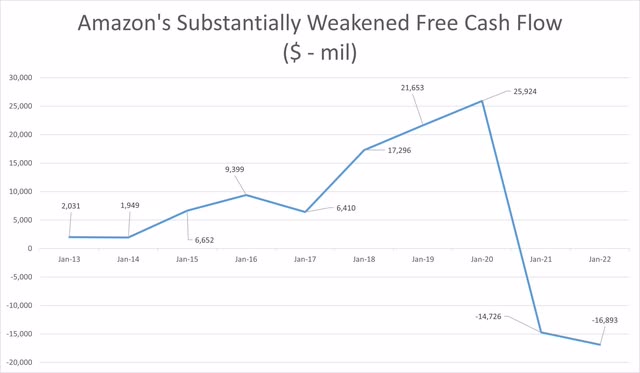

Amazon’s free cash flow has weakened substantially. (Data Source: Seeking Alpha)

Looking ahead, Amazon noted that net sales for the current first quarter of 2023 are expected in the range of $121-$126 billion (implying 4%-8% growth), but the company’s target for operating income of $0-$4 billion in the period suggests that profits may fall considerably from the first quarter of 2022, using the midpoint of the range. Again, it’s just unacceptable to us that Amazon has such a large range for earnings this far into its corporate life. For 2022, Amazon burned through $16.9 billion in free cash flow, slightly worse than its free cash flow burn last year, and for this reason, shares aren’t being considered for inclusion in any of our simulated newsletter portfolios. Amazon ended the quarter with $70 billion in cash and marketable securities and $67.15 billion in long-term debt, good for a very modest net cash position.

At Valuentum, we like to focus on the two cash-based sources of intrinsic value — net cash on the balance sheet and future expected free cash flow. For Amazon, it receives modest credit for its balance sheet, but its future expected free cash flow, at least in the near term, is absolutely atrocious. We simply do not understand why Amazon cannot get its spending under control. It seems to be operating more like a social service burning through all of its operating cash flow and more, instead of acting like a for-profit entity. We think that this might come back to bite its shareholders, if technology leaps forward and happens to leave Amazon behind. With Microsoft (MSFT) and Alphabet (GOOG) (GOOGL) pushing forward with artificial intelligence, Amazon faces an uphill battle, in our view. Its lack of free cash flow generation is simply unacceptable.

Concluding Thoughts

Amazon’s Valuation Breakdown (Image Source: Valuentum)

Range of Potential Outcomes (Image Source: Valuentum)

Our fair value estimate for Amazon’s shares is about in-line with where they are trading at as of the time of this writing, but we’re not happy with the company’s execution and believe the firm’s equity could face pressure to the low end of our fair value estimate range. This isn’t the early 2000s anymore. In our belief the market simply shouldn’t have much of an appetite for a company that is content to burn through tens of billions of dollars in free cash flow every year. Amazon was back on track toward the latter part of last decade, but shareholders could be in for a terrible surprise if the company continues to burn through valuable capital as technology potentially passes it by. We’re concerned about this tech giant.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.