Summary:

- While PayPal’s bottom line declined steeply in 2022, top line growth was still solid and free cash flow was stable.

- For fiscal 2023, management issued strong guidance and will focus on improving its cost structure and share buybacks.

- And when assuming that PayPal will still be able to grow at a solid pace in the years to come, the stock is deeply undervalued.

Justin Sullivan

In my last article I said the buying opportunity for PayPal Holdings, Inc. (NASDAQ:PYPL) might vanish quickly. But compared to some other companies and stocks – like Meta Platforms, Inc. (META), Alibaba Group Holding Limited (BABA), Baidu, Inc. (BIDU) or Tencent Holdings Limited (OTCPK:TCEHY), which rebounded quickly after a steep fall – PayPal is still trading rather close to its cyclical low.

While I was incorrect about the short-term performance of PayPal, it does not change my long-term thesis. The stock is still deeply undervalued and now trading even 14% lower than in November when my last article was published. Hence, you can still take advantage of this buying opportunity.

Results

About two weeks ago, PayPal reported annual results for fiscal 2022. And considering that the stock declined almost 80% from its previous high and sentiment surrounding the stock and the company is quite negative, the results were actually good. First, PayPal could beat revenue as well as earnings per share estimates – however, revenue was only $10 million higher than estimates.

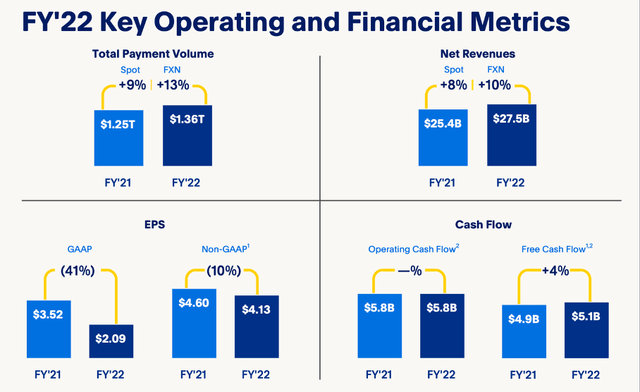

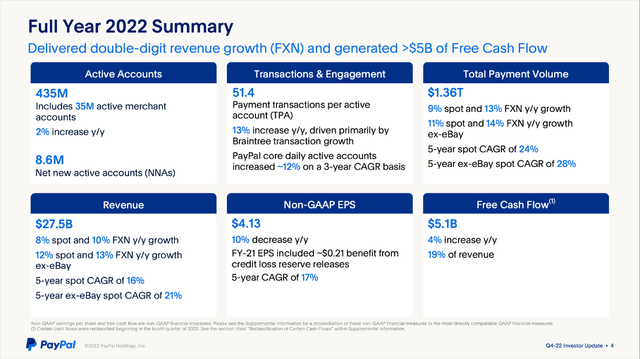

When looking at the full-year results, revenue increased from $25,371 million in fiscal 2021 to $27,518 million in fiscal 2022 – resulting in 8.5% year-over-year growth. However, operating income declined from $4,262 million in fiscal 2021 to $3,837 million in fiscal 2022 resulting in 10.0% YoY growth. And net income per diluted share declined 40.6% YoY from $3.52 in fiscal 2021 to $2.09 in fiscal 2022.

When looking at the non-GAAP results, earnings per share also declined 10.2% year-over-year from $4.60 in the previous year to $4.13 in fiscal 2022. And free cash flow also increased 4.5% year-over-year from $4,889 million in fiscal 2021 to $5,107 million in fiscal 2022.

And when looking at the fourth quarter results, we already see improvements for the top and bottom line. Revenue increased 6.7% YoY from $6,918 million in Q4/21 to $7,383 million in Q4/22. Operating income increased 18.5% YoY from $1,050 million in the same quarter last year to $1,244 million this quarter. And diluted earnings per share also increased 19.1% YoY from $0.68 in Q4/21 to $0.81 in Q4/22.

Total payment volume for the full year increased from $1.25 trillion in fiscal 2021 to $1.36 trillion in fiscal 2022 – resulting in 9% year-over-year growth. In the fourth quarter, TPV increased from $339,530 million in the same quarter last year to $357,378 million – 5.3% year-over-year growth. Payment transactions per active account increased from 45.4 in Q4/21 to 51.4 in Q4/22 – resulting in 13.2% YoY growth. And the number of payment transactions increased from 5,343 million in Q4/21 to 6,032 million in Q422 – resulting in 12.9% YoY growth.

And when looking at revenue in Q4/22 in more detail, transaction revenue increased 5.1% year-over-year from $6,377 million in the same quarter last year to $6,702 million this quarter and was driven mainly by Braintree as well as Venmo. Growth was also driven by “revenues from other value-added services” as revenue increased 25.9% year-over-year from $541 million in Q4/21 to $681 million in Q4/22.

Accounts Still Increased

In my last article about PayPal, I wrote about the scandal that hit PayPal at the beginning of November and is already forgotten by now:

In our hectic and short-lived time, some might already have forgotten the controversy about PayPal one month ago. PayPal threatened to fine users up to $2,500 for spreading misinformation creating an uprising on social media. We will not see if this had any actual impact until PayPal reports its fourth quarter results. Many users threatened to delete their PayPal accounts, but in my opinion the network effects of PayPal are quite strong and, unless several million users delete their accounts, it won’t matter.

But now we know that the number of active accounts increased from 432 million in Q3/22 to 435 million in Q4/22 – an increase of 0.7% – and compared to one year earlier accounts increased 2.1% from 426 million. Of course, it might be possible that we are not seeing the effects yet as PayPal is counting every account that has completed a transaction in the last 12 months and hence it is possible that millions of people stopped using PayPal without deleting the accounts (however, this seems unlikely in my opinion).

And as PayPal is introducing a new metric – the monthly active users – we will see such negative effects (if they should occur) better in the future. Right now, PayPal has approximately 190 million monthly active users.

Strong Guidance

Although both CEO Dan Schulman as well as CFO Rabinovitch pointed out how difficult it is to make assumptions for 2023 and both are seeing e-commerce growth slowing down, PayPal issued a strong guidance for fiscal 2023 and is expecting improvement on several metrics. And Rabinovitch mentioned the great start for fiscal 2023 during the company’s earnings call:

The first quarter is off to a great start and sets us up well for the year ahead. We are encouraged by what we’re seeing, but remain vigilant as there continues to be potential for variability as we move through 2023.

Schulman however is expecting inflation to cool and is therefore assuming that discretionary spending vs. non-discretionary spending will increase again, and PayPal will profit from that trend.

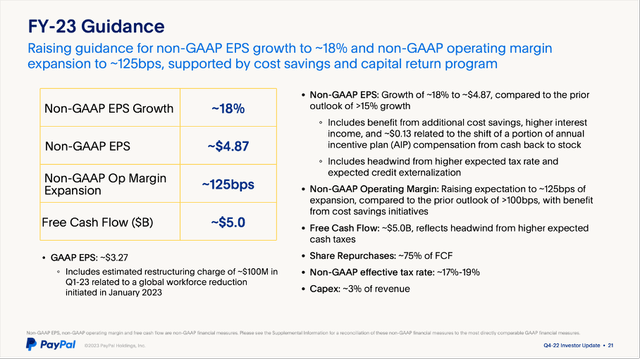

Overall, PayPal is expecting GAAP EPS to be around $3.27 and non-GAAP earnings per share to be $4.87 – resulting in 18% increase compared to 2022. The company is also expecting non-GAAP operating margin to improve by 125bps. And finally, free cash flow will be around $5 billion once again.

Share Buybacks

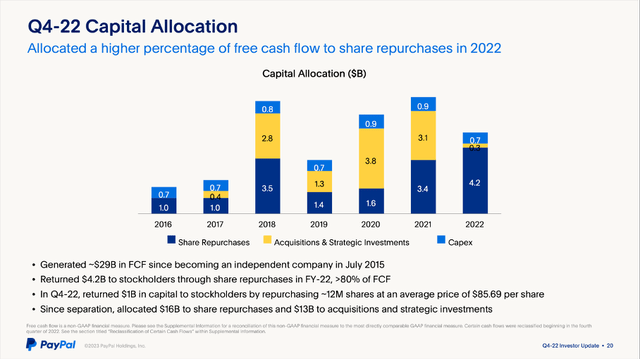

And management is planning to spend about 75% of generated free cash flow on share buybacks once again – similar to fiscal 2022 when PayPal spent $4.2 billion on share buybacks (about 80% of generated free cash flow).

And as PayPal is still deeply undervalued, buying back shares as long as the stock is trading for these depressed price levels is a good strategic move (this is also the viewpoint of the company’s CFO). On December 31, 2022, PayPal also had $7,776 million in cash and cash equivalents as well as $3,092 million in short-term investments on its balance sheet and it could use these liquid assets for share buybacks as well. When taking the current market capitalization this is enough to repurchase about 12% of the company’s shares. Of course, we should not ignore $10,417 million in long-term debt that needs to be repaid as well – however, the debt levels are no reason to worry.

Improving Cost Structure

Aside from share buybacks, management will also focus on improving its cost structure in fiscal 2023, which is including laying off about 7% of the company’s workforce – as described during the last earnings call:

As we look towards 2023, I want to lay out our thinking about the year ahead. First, we have identified an incremental $600 million of cost savings on top of the $1.3 billion of cost savings previously identified. This includes the very difficult decision to reduce our headcount by 7% as we continue to improve our processes and sharpen our focus. We will also continue to reduce our external vendor spend and real estate footprint.

Aside from the cost reductions described above, PayPal is also continuing to work on removing complexity within the organization.

Growth Initiatives

We already mentioned above that PayPal was introducing a new metric – the monthly active users. PayPal is focusing on this metrics as the company will prioritize engagement in the coming years. Increasing the engagement and activity of existing users and driving more daily use is seen as one of the greatest opportunities to grow. And as we have mentioned above, transactions per users are growing with a healthy pace already.

In 2023, PayPal will also focus on the modernization of its checkout experience and will put significant resources behind this process (enabled by the cost savings mentioned above).

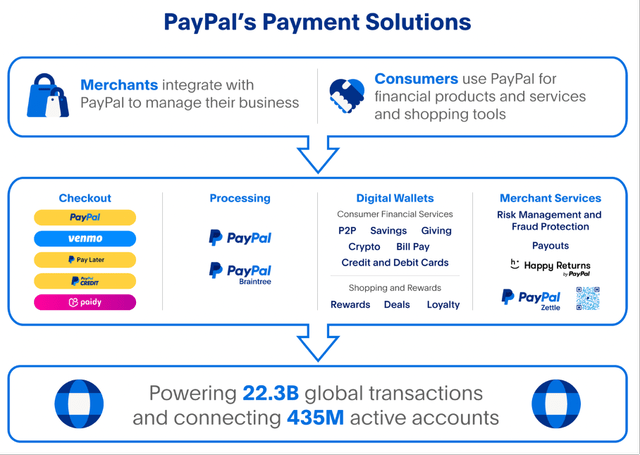

And PayPal has a wide range of payment solutions – for merchants as well as consumers. This is including checkout and processing services as well as digital wallets and merchant services. And one growth area PayPal will focus on is growing its unbranded processing services. Aside from Braintree, which is already growing with a healthy pace and will continue to grow, the company will also launch PPCP (PayPal Complete Payments) and this should expand the unbranded total addressable market by as much as $750 billion.

And of course, Buy Now, Pay Later is also contributing to growth for PayPal. According to PayPal, its BNPL service is now one of the most popular in the world with almost 200 million loans to over 30 million consumers since launching the service in 2020. And about 300,000 merchants are including the Buy Now, Pay Later service on the product pages. I already mentioned in my last article the high growth rates analysts are expecting for Buy Now, Pay Later services in the years to come.

Intrinsic Value Calculation

PayPal is another fascinating stock right now. Like Meta Platforms or Alibaba, which got completely crushed, PayPal’s steep decline also seems completely unjustified. But while Meta Platforms already recovered and doubled from its previous bottom, PayPal is still trading close to its cyclical lows.

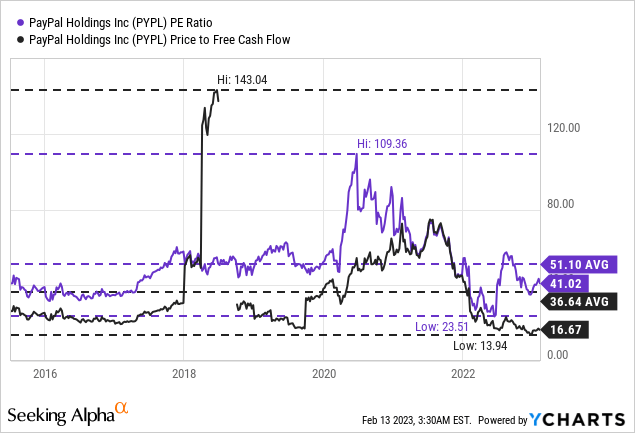

When looking at the price-earnings ratio, PayPal doesn’t seem like a bargain at this point. Although PayPal is trading below its average P/E ratio of 51.10 (since the IPO), a P/E ratio of 41 is still extremely expensive. However, we must take into account that earnings per share are unusual low right now and when using adjusted earnings per share of $4.13, the company is trading for 19 times earnings. And while we can criticize using adjusted earnings per share, free cash flow is the better metric anyway and PayPal is trading about 16.5 times free cash flow right now, which is not only below the average of 36.64 but rather close to its lowest P/FCF ratio ever.

Aside from simple valuation metrics, we are also using a discount cash flow calculation to determine an intrinsic value for PayPal. As basis we can take the expected free cash flow for fiscal 2023 (which will be around $5 billion and similar to the free cash flow in the last four quarters). When assuming 1,144 million outstanding shares and a discount rate of 10%, PayPal must grow slightly above 4% from now till perpetuity to be fairly valued.

And while PayPal’s growth rate slowed down last year, revenue grew still with a CAGR of 15.69% in the last three years and operating income increased with a CAGR of 13.17% (earnings per share could hardly grow in the last three years). In my last articles, I was therefore more optimistic about the growth potential and calculated an intrinsic value of $120 to $135 in the previous two articles.

Although I don’t want to make the mistake of being overly optimistic; I think we can calculate with higher growth rates for PayPal. For fiscal 2024 I would assume strong growth after several mediocre years and therefore calculate with 15% growth. In the following years we assume growth to slow down to 6% growth till perpetuity in 10 years from now. This is leading to an intrinsic value of $157.62 for PayPal. And even when this calculation might be a bit too optimistic, PayPal remains deeply undervalued in my opinion.

Conclusion

PayPal is still in a downtrend and from a technical point of view, we don’t find strong support levels at the cycle lows. Nevertheless, the double bottom around $67 could actually be the cycle low and in my opinion the risk of PayPal declining even lower is limited. And not only can we assume limited downside risk, from a fundamental point of view, the stock has huge upside potential and is trading way below its intrinsic value.

Disclosure: I/we have a beneficial long position in the shares of BABA, BIDU, META, PYPL, TCEHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.