Exxon Mobil: One Refinery Coming Up To Cure High Margins

Summary:

- The refinery expansion is equal in size to many refineries.

- Cenovus Energy is also bringing on the brand new Superior Refinery in Wisconsin.

- The company has long started at a location with upstream production and then diversified downstream and sometimes into chemicals as well.

- It is typical for the industry to shut down old costly capacity when margins are low and then build brand new expansion capacity when margins are high.

- Guyana remains the key future production growth driver.

imaginima

The free market has a saying that the “cure for high prices is high prices”. Refining margins have been tremendous due to a shortage of refining capacity. The free market gets messy that way. But Exxon Mobil (NYSE:XOM) has a cure coming online with a major expansion that has the capacity of one refinery.

The refinery expansion is unusual in that it will handle the Permian unconventional production of the company. Our existing refinery capacity tends towards heavy oil. So many producers end up exporting the unconventional light oil produced by upstream operations.

Then again, this pattern fits the typical Exxon Mobil pattern of finding upstream production and then slowly integrating that production with nearby downstream and other related operations to capture more than one profit-making point. Tight cost controls ensure that the profit potential of each step is not lost.

President Biden was clearly playing to his base when he made some comments about Exxon Mobil in the past. That same base is likely not interested in the new refining capacity coming online. But additional capacity to refine is likely to help decrease refining margins throughout the industry. That should help to find its way to lower gasoline and other material prices at some point.

Exxon Mobil is not the only company to be bringing on new refining capacity. Cenovus Energy (CVE) is bringing on the Superior Refinery in the first quarter which is located in Wisconsin. The previous refinery located there had burned to the ground. So, this refinery is a brand new built from nothing refinery with all the modern pollution control devices and latest technology.

Despite some very popular opinions to the contrary, it is fast becoming evident that the industry is investing at least some of the profits and cash proceeds to raise production both in upstream and downstream. The alternative to both the refining expansion and the new Superior refinery would have been to return that cash to shareholders. That clearly did not happen.

It looks as though the downstream industry will expand (as usual) until there is too much capacity. Then typically, older high-cost capacity will be shut down to allow refining margins to recover. That will encourage the next investment cycle in new lower cost capacity. Just as the cure for high prices is high prices, the cure for low prices is low prices. Many do not realize that those low prices they love so much are the one thing that starts the process to the high prices we see now.

Increasing Permian Production

The new refinery should remind politicians and investors that Exxon Mobil made a commitment back in 2019 to increase Permian production to 1 million barrels of production per day. Clearly, the company continues towards that commitment to be achieved by 2024. There will likely continue to be updates about progress towards that goal.

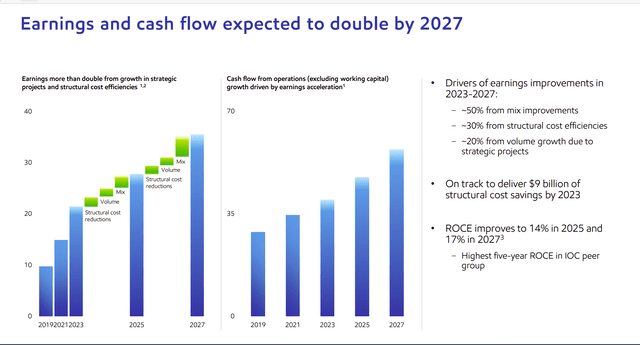

Exxon Mobil Earnings Growth Guidance (Exxon Mobil December 2022, Corporate Plan Presentation Update)

Most remember the corporate goal to double earnings by 2027. To do that, the management needed to activate a very long dormant growth attitude throughout the corporation. The activation process often takes years. Mr. Market has the attention span that is considerably less than that. So, the initial announcement made some time back brought a lot of yawns.

The latest quarterly earnings obviously accelerated the plan. Higher commodity prices has allowed the steady sales of non-core high-cost operations while the increased cash flow allowed some accelerated drilling to bring on lower cost operations. Management noted (as have other managements) that service costs are responding to increasing industry activity. However, this company has a low-cost competitive moat of about two years of activity at a time when the industry really did next to nothing during low prices.

Now however, with the startup of the Permian refinery and the growth of Permian production being a real key driver of the small amount of production growth currently shown, it has finally become apparent to the market that management is intent upon growing. That is going to considerably change the stock price pattern from the past. It will also likely result in more dividend increases in the future.

Guyana

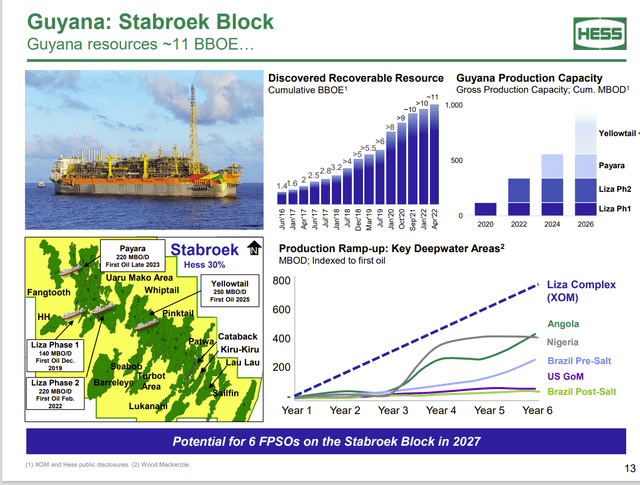

Another key driver to the long-term growth envisioned is the Guyana joint venture.

Hess Presentation Of Guyana Production Growth And FPSO’s Planned Plus Map Of Operations (Hess Corporate Presentation January 5, 2023)

Hess Corporation (HES) presented the latest known plans for the Guyana project with Exxon Mobil (the operator). As shown above, production is getting to the point where the rapid expected growth will become significant even for Exxon Mobil. Hess is a good deal more optimistic about the production by 2027 as the company estimates more than 1 million BOD in production by then. Exxon Mobil is much more conservative by stating about two-thirds to three-quarters of that amount (depending upon where you look and when you ask).

Hess is also forecasting about a 25% compounded increase in cash flow. At that rate, cash flow would triple every five years. That is again the kind of growth that becomes significant even to a far larger company like Exxon Mobil.

When I first began following this project, it was a guidance of 1 million BOD by the end of the decade. Now it has been moved back to 2027. The likely reason is that the robust commodity prices have allowed more activity and a larger capital budget in general. Hess presented at a conference that one discovery alone could justify another FPSO all by itself.

Hess also mentioned that there appears to be a lot of oil at the 18,000 ft level. Most discoveries so far were at 15,000 ft. Therefore, the company implied (sort of) that the next round of exploration will likely be to delineate that lower interval because they “know” the oil is there. All they have to do is “lower risk” exploration to prove it is there. That, combined with the current robust commodity price environment could lead to a lot more activity on this project in the next few years.

One of the interesting things an investor can tell reviewing the presentation, conference calls, and “road shows” is what Mr. Hess calls “sticker shock” of the cost of more FPSO’s now that industry activity has picked up. But those initial FPSO’s which were purchased during the industry downturn demonstrate an important cost advantage that will last for the life of the production which is many years (these are long lived wells).

Other Projects

There is a group of other projects in various stages of development. Some will become material over time. Meanwhile there is the continuing and established business all over the world. But I think this management is signaling through current and future projects that they intend to get the company growing again after a fair amount of time of really just treading water. Given what I have seen so far, I like the chances of this company becoming an income and growth vehicle.

The financial strength of the company is about as good as it gets, and the geographic diversification could not better. So, the likelihood of a steadily increasing dividend in the future appears to be pretty good.

The company has footholds in several green revolution projects. This comes about because it supplies raw materials for plastic and some of the chemicals division products are used by the green revolution. Everything I have seen projects growth for both oil and gas for decades to come. This industry leader could appeal to a wide variety of investors because it appears to promise a low double-digit return, with some of the lowest investment risk around for a stock.

Disclosure: I/we have a beneficial long position in the shares of XOM HES CVE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor and this is not a recommendation to buy or sell a security. Investors are recommended to read all of the company’s filings and press releases as well as do their own research to determine if the company fits their own investment objectives and risk portfolios.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.