Thermo Fisher Scientific: Is This Quality Stock A Buy?

Summary:

- Thermo Fisher Scientific offers solid growth and operates with a recession-resilient business model.

- TMO stock is well-positioned for further inorganic growth in the future.

- The valuation is far from low, however.

JHVEPhoto

Article Thesis

Thermo Fisher Scientific Inc. (NYSE:TMO) is a high-quality growth stock that has been resilient versus recessions in the past. Fundamentally, the company thus looks attractive, especially in the current environment where a potential recession and rising rates cause uncertainties. On the other hand, shares aren’t cheap, which is why I am not buying into TMO yet.

A Resilient Growth Company

Many investors prefer to buy into growth companies, i.e. companies that have a track record of growing at an above-average rate. Many of these companies are tech companies, as the tech industry is experiencing higher overall growth due to a wide range of macro developments such as digitalization, relative to other industries such as consumer staples.

Not all growth companies are tech businesses such as cloud computing players or chip companies, however. Thermo Fisher Scientific is a healthcare company that is focused on markets such as diagnostics and research. While one can argue that this is a more “techy” part of the overall healthcare industry, TMO is still clearly a healthcare player primarily. Its offerings include the production and selling of medical research tools and instruments, diagnosis tools, healthcare setting equipment such as ultra-low-temperature refrigerators, specialized laboratory chemicals, and so on. In short, Thermo Fisher Scientific is active across many different markets in the broad healthcare universe.

The healthcare industry as a whole has been growing for many years, which can be explained by several important macro trends. First, the aging of the population in many high-income countries means that more and more people require medical care, as older individuals do, on average, require more medical attention. Changing demographics do thus more or less automatically cause higher healthcare spending, and that trend will likely not change anytime soon, as the baby boomers are becoming a more relevant healthcare demographic as they near or enter retirement. Second, technological and scientific progress have resulted in new and improved ways to diagnose and treat a wide range of indications. These newer technologies oftentimes go hand in hand with higher prices, oftentimes justified by better patient outcomes. Thus the per-patient spending has been rising over time as well, and I do not see any good reason why this will change in the foreseeable future.

While the healthcare industry does not receive as much attention as the tech industry from growth investors, one can, due to the above factors, still expect that the average healthcare company will generate meaningful business growth in the long run. Thermo Fisher Scientific has shown above-average growth in the past, and that could remain the case going forward, I believe. Markets such as diagnostics (e.g. autoimmunity tests), antigen typing, testing for the organ transplant market, etc. are growing faster than other fields of the healthcare industry. That allowed Thermo Fisher to deliver pretty compelling business growth in the past:

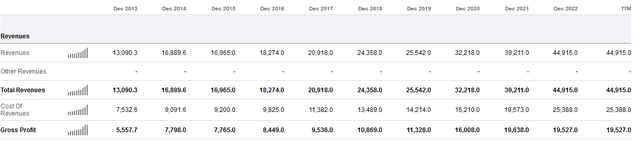

Between 2013 and 2022, Thermo Fisher Scientific was able to grow its revenue by 240%, which pencils out to an annualized growth rate of 13%. A company growing its revenue at a low-teens rate for a long period of time, despite starting at an already sizeable sales number well north of $10 billion, must be doing something right. Gross profit grew slightly faster than TMO’s revenue over the same time frame, although the difference isn’t large. That’s still a good sign, as it signifies that the company did not chase growth by lowering its margins. Instead, it was able to expand its margins, which indicates strong pricing power and efficient operations.

It should be noted that not all of TMO’s growth was organic. Instead, the company used some of its cash flows and its balance sheet to make major acquisitions over the last decade. The largest and most relevant one is the Pharmaceutical Product Development acquisition from 2021 which cost $17.4 billion. This acquisition has added to TMO’s revenue, of course, which also holds true for past acquisitions. Without such acquisitions, TMO would thus not have delivered comparable business growth, but the good news is that the company is well-positioned to pursue acquisitions in the future, too.

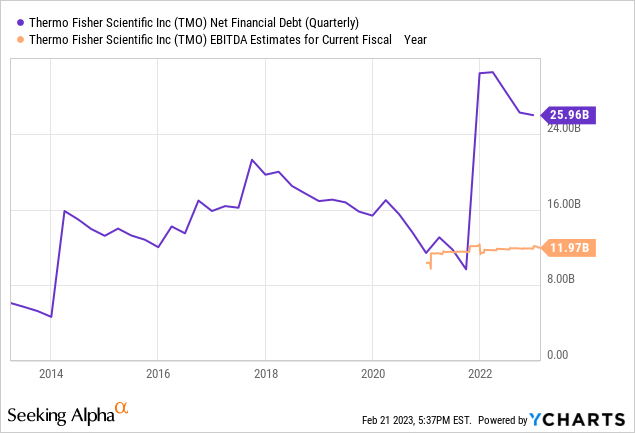

While the company’s net debt has risen substantially over the last decade, by around 300%, its EBITDA has grown a lot as well. On top of that, the net debt to EBITDA ratio is not really high — it stands at 2.2 today, based on current estimates for this year’s EBITDA. This isn’t a low leverage ratio, but it is also far from a threatening level of debt, especially when we consider that TMO’s business is very resilient versus recessions and other macro headwinds, thus the company doesn’t run into problems during economic downturns and similar crises. Thermo Fisher Scientific has reduced its debt load considerably over the last year, which has also happened after past acquisitions, such as in the 2014-2016 time frame, or in the 2018-2021 time frame. I expect that we will see further net debt reduction over the next couple of years, which will improve TMO’s balance sheet strength and give it the flexibility to eventually make another major acquisition. In the meantime, TMO could do some smaller acquisitions.

Since TMO does not need to spend heavily on capital expenditures, which also holds true for many other healthcare companies, its free cash flow conversion is pretty strong: Over the last four quarters, Thermo Fisher Scientific has generated free cash flows of $6.9 billion, with capital expenditures of $2.24 billion and operating cash flows of $9.15 billion. That translates into a free cash flow yield of 3.1% with TMO being valued at $220 billion right now — which is a rather steep valuation. At the same time, however, TMO’s free cash flows are pretty strong relative to the debt load — since the dividend costs just $400 million per year, TMO can pay down billions of dollars in debt every year without any problem. By the end of 2024, TMO’s net debt could thus be in the $15 billion range, if TMO does not make any acquisitions in that time frame, which would make for a pretty strong balance sheet again, especially if TMO experiences some organic EBITDA growth in the meantime. At that point, TMO would have considerable firepower for another major acquisition.

Between organic growth and future acquisitions, TMO should be able to grow at an attractive pace, although growth will likely slowdown from what we have seen over the last decade — growing the company’s sales by 200% over a decade or more becomes harder the larger a company becomes. But even with the revenue growth rate slowing down to 7%-8% per year over the next couple of years, assuming the Wall Street consensus estimate is correct, TMO would still be a company with attractive growth. Earnings per share should grow somewhat faster relative to revenue, as gross margins have been trending up and since operating leverage allows companies to expand their operating margins over time, as scale advantages, such as administrative expenses not going up in line with sales, take hold. Overall, I believe that earnings per share growth in the 10% range should thus be achievable for TMO in the longer run, with occasional acquisitions being factored in.

Valuation Is Important

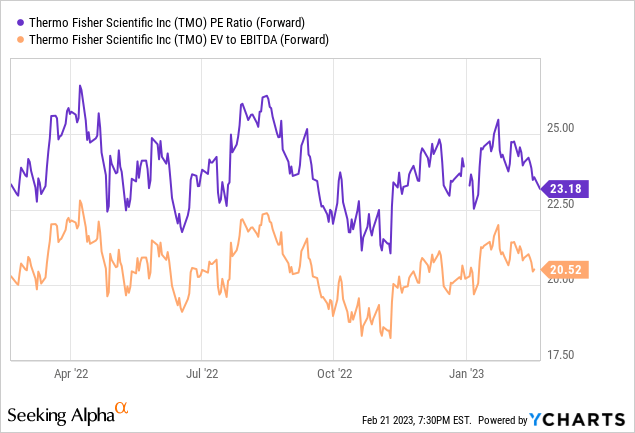

TMO offers above-average growth, a resilient business model, and it benefits from macro tailwinds — but does that mean that shares are a buy? The stock’s valuation should be considered as well, and it’s not really low.

As we can see in the above chart, Thermo Fisher is trading for a little more than 23x forward earnings, while the company also trades at more than 20x its EBITDA (looking at enterprise value here, which accounts for net debt). That’s not an extremely high valuation, but still, this represents a clear premium relative to how the broad market is valued right now. The S&P 500 is valued at around 17x forward net profits, thus TMO trades at a premium of around 35%. While a premium seems justified, that does not necessarily mean that a 30%+ premium is justified — if TMO were to trade at 20x net profits, it would be valued at a premium relative to the broad market as well, but it would be cheaper than it is today. I do not believe that TMO is very overvalued today, but it also isn’t attractively priced. Ideally, one wants to buy shares when they are trading well below fair value — and that is not the case right now.

Takeaway

Thermo Fisher Scientific is a high-quality company for sure, and even though its future growth will likely be slower than in the past, the company should continue to grow at a very solid pace between its organic growth and some M&A. But due to its valuation being far from low, I personally do not want to buy into TMO at current valuations — if shares traded at a lower valuation, they could be a great investment, however.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!