Summary:

- After eventually realizing the greater potential of AR, in June 2022, Amazon launched ‘Virtual Try-On for Shoes’, striving to catch up to social commerce platforms like Google, Pinterest, and Snapchat.

- Virtual Try-On features can help Amazon learn more about its customers, including the customer journey and experience, which can feed into the company’s efforts to improve the Amazon shopping experience.

- For a company that is considered a leading e-commerce platform with extensive resources, its delayed rollout of AR technology failed to upstage what competitors like TikTok and Snapchat are doing.

- The proportion of consumers starting their shopping journeys on Amazon is declining, amid the rise of social commerce platforms like YouTube and TikTok.

- Amazon’s strategy of partnering with social media platforms to stay relevant in the age of AR-driven shopping could face hurdles as these competitors strive to become e-commerce destinations themselves.

stockcam

E-commerce is a fast-paced industry where consumer behavior is constantly evolving. While Amazon (NASDAQ:AMZN) has successfully cemented its position as the top e-commerce platform over the past two decades, it continues to encounter new forms of competitive threats. Social media platforms striving to transform into e-commerce destinations have been quick to recognize the potential of Augmented Reality [AR] in improving the online shopping experience. On the other hand, Amazon is lagging social commerce platforms in AR innovation, and has been striving to catch up to sustain its e-commerce leadership.

Amazon’s Virtual Try-Ons

Amid the rise of AR, Amazon underestimated and failed to imagine how the technology can be incorporated into augmenting the shopping experience. Previously, the e-commerce giant used AR for unexciting features, such as AR Stickers or the Amazon Augmented Reality App (encouraging people to have ‘fun’ with their shipping boxes). Meanwhile, social commerce competitors like Google, Pinterest and Snapchat incorporated AR into their e-commerce ventures, allowing people to virtually try-on various forms of apparel.

Eventually realizing its greater potential, in June 2022 Amazon launched ‘Virtual Try-On for Shoes‘, enabling shoppers to visualize how shoes would look on themselves using their mobile phone camera. Virtual Try-Ons allow customers to make more informed purchase decisions, enhancing the shopping experience.

Virtual Try-On features can help Amazon learn more about its customers, including the customer journey, experience, and preferences, which can feed into the company’s efforts improve the Amazon shopping experience. Offering Virtual Try-On features is also essential to maintain the appeal of selling through Amazon marketplace, as it enables digital merchants to constantly learn more about customer journeys and preferences, to feed into their own R&D efforts. Hence, AR-enabled shopping features can offer benefits to shoppers, sellers and the Amazon platform overall.

While the AR feature strives to sustain Amazon’s position as the leading e-commerce destination, it continues to lag social media platforms in AR innovation. For a company that is considered a leading e-commerce platform with extensive resources, even its delayed rollout of AR technology failed to upstage what competitors are already doing. For context, competitors like TikTok and Snapchat have established their AR capabilities to the point where they are able to offer their AR solutions to external brands for marketing purposes.

Moreover, in April 2022, Snapchat extended accessibility of its own AR technology to apparel brands, allowing retailers like Puma to offer virtual try-ons within their own apps and websites. This ultimately subdues the need for retailers to rely on platforms like Amazon to offer AR-enabled shopping experiences.

Amazon has been slow in expanding its Virtual Try-On feature to other forms of apparel, such as eyewear. To truly become a force to be reckoned with in this space, Amazon needs to conquer all apparel categories more swiftly to better challenge competitors, like Google’s Virtual Try-On feature for make-up. The Seattle-based giant will need to significantly step up its AR innovation to maintain its e-commerce crown. The company’s slow-paced innovation in AR technology risks the company losing high-intent shoppers to social media platforms.

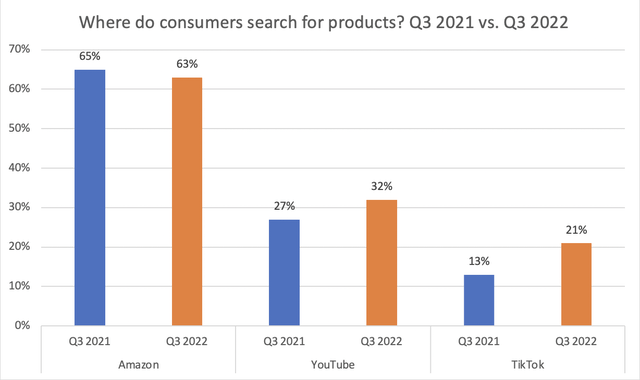

In fact, research from JungleScout revealed that fewer consumers are starting their product searches on Amazon, and instead are increasingly turning to social commerce. YouTube and TikTok have been key players in facilitating AR-enabled e-commerce (in addition to various other e-commerce ventures like live-stream shopping).

Note: survey participants could choose more than one option. (JungleScout)

JungleScout’s Q3 2022 survey of 1000 U.S. consumers revealed how the proportion of consumers starting their product searches on Amazon slightly decreased, while TikTok and YouTube witnessed notable increases.

If more and more consumers start their shopping activities through social commerce as opposed to Amazon, it could encourage merchants to list their products on social media platforms directly overtime, as opposed to the Amazon marketplace. More shopping transactions taking place outside of Amazon would hurt Third-party seller services revenue, which comprised 23% of Amazon’s total revenue in 2022.

Furthermore, the impact could extend beyond the Third-party seller services segment. While Amazon has successfully built a robust advertising business over the years, with Amazon sellers increasingly spending on Amazon ads, investors must also keep an eye on Amazon sellers’ ad spend on social media channels.

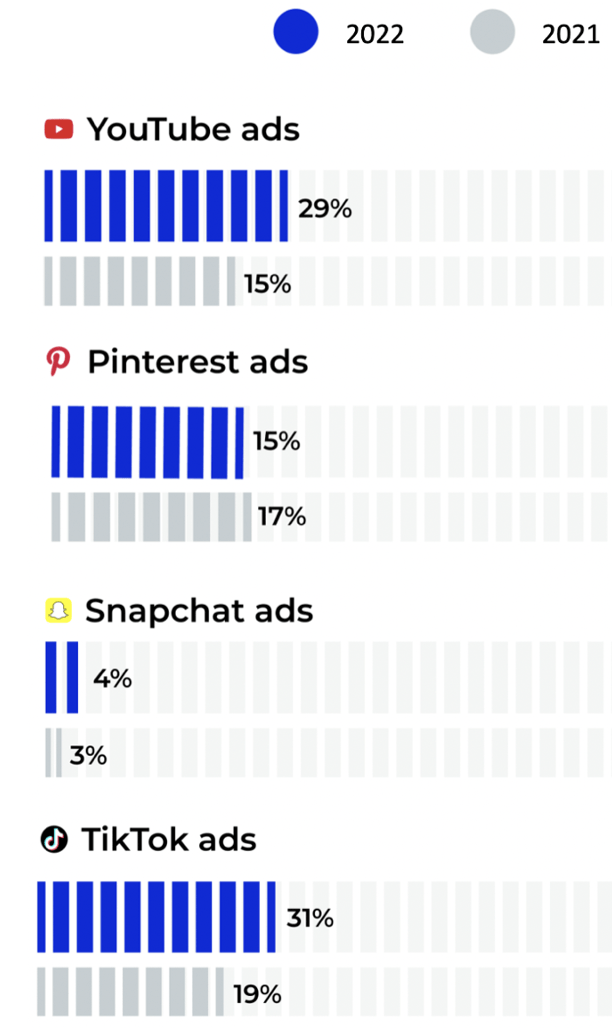

According to results from a JungleScout survey of 2000 Amazon sellers, these merchants increased their ad spend on most social media platforms in 2022. YouTube, Snapchat, Pinterest and TikTok are some of the key social commerce players investing in Augmented Reality. The proportion of surveyed Amazon sellers spending ad dollars on these platforms in 2022 versus 2021 can be found below.

JungleScout

Aside from Pinterest, these social media platforms all witnessed increased ad spend from Amazon sellers.

The primary appeal of Amazon ads is the platform’s ability to attract a recurring stream of high-intent shoppers, conducive to better conversion rates. Though as social media platforms increasingly turn into e-commerce destinations through creative shopping innovations, it augments the appeal of their ad solutions, as more consumers start their shopping journeys from these platforms.

If these social commerce ad solutions yield increasing conversion rates thanks to continuous innovations like AR-enabled shopping experiences, Amazon could potentially lose ad dollars to social media platforms going forward. In 2022, Advertising services comprised 7% of total revenue.

Third-party seller services and Advertising services grew 14% and 21%, respectively last year, together making up 30% of total sales revenue in 2022. Amazon does not granularly disclose each segment’s contribution the bottom line. The stock currently trades at 69.58x Forward P/E (GAAP), a premium to the sector average of 15.57x. While net income reflects the financial performance of all Amazon divisions (like AWS), any deceleration in the growth rates for Third-party seller services and Advertising services could undermine net profit going forward, and subsequently discourage investors from paying a premium for Amazon stock.

Amazon partners with Snapchat

Realizing that social media platforms are ahead of the game in AR e-commerce, in November 2022 Amazon partnered with Snapchat to catch up faster. Amazon highlighted the deal in its latest quarterly earnings release:

Partnered with Snapchat to launch an augmented reality shopping experience that allows millions of Snapchatters to digitally try-on thousands of Amazon eyewear styles via Snapchat and seamlessly purchase those items in the Amazon store. This experience is enabled by Amazon’s 3D Asset technology, which easily integrates with third-party apps like Snapchat, to provide 3D assets for augmented reality-based shopping and dynamically supply up-to-date product details, pricing, and availability.

Snapchat is indeed a well-established player in AR e-commerce. In a press release from August 2022, the company proclaimed that its “true-to-size eyewear Lens technology… drove a 42% higher return on ad spend”. Amazon is yet to offer its own performance metrics relating to its AR initiatives.

Nevertheless, this new strategy integrating Amazon’s 3D Asset technology with third-party apps bolsters its own social commerce endeavors, enabling the e-commerce giant to drive traffic from social media platforms to Amazon.

Snapchat’s motive behind this deal is to broaden the range of products available on its platform, to encourage online shoppers to start their shopping journeys from Snapchat and augment its appeal as a shopping discovery/ inspiration destination.

On this line of thought, Amazon’s strategy of partnering with social media platforms to stay relevant in the age of AR-driven shopping could face hurdles as they may be reluctant to divert their own app/ website visitors towards Amazon. Nonetheless, partnering with the AR-driven social media platform, Snapchat, while developing its own AR capabilities is indeed a wise move, thereby staying relevant among younger generations.

A note on defending Amazon’s moat

A key element of Amazon’ moat is its marketplace. The daily recurrence of high-intent shoppers to the Amazon website makes it an ideal platform to list, sell and advertise products. Sustaining the prominence of its marketplace is vital to defending its moat. Amazon will need to fight hard to not just catch up in the AR space, but also become more agile and applicably innovative.

The company needs to recognize more efficiently the potential of new technology trends, and effectively incorporate them into its shopping experience to maintain the allure of the Amazon marketplace, and fend off competitive threats from social commerce platforms. On the other hand, Amazon continues to benefit from solid e-commerce fundamentals, namely a well-established logistics and fulfilment network. The company is well-positioned to leverage this asset to deal with rising competitors, as it is doing with its ‘Buy with Prime‘ program.

Summary

After eventually realizing the greater potential of AR, in June 2022 Amazon launched ‘Virtual Try-On for Shoes’, striving to catch up to social commerce platforms like Google, Pinterest and Snapchat. Virtual Try-On features can help Amazon learn more about its customers, including the customer journey, experience, and preferences, which can feed into the company’s efforts improve the Amazon shopping experience. Nonetheless, for a company that is considered a leading e-commerce platform with extensive resources, even its delayed rollout of AR technology failed to upstage what competitors like TikTok and Snapchat are already doing.

The proportion of consumers starting their shopping journeys on Amazon is declining, amid the rise of social commerce platforms like YouTube and TikTok. Realizing that social media platforms are ahead of the game in AR e-commerce, in November 2022 Amazon partnered with Snapchat to catch up faster. Amazon’s strategy of partnering with social media platforms to stay relevant in the age of AR-driven shopping could face hurdles as these competitors strive to become e-commerce destinations themselves. Amazon needs to recognize more efficiently the potential of new technology trends, and effectively incorporate them into its shopping experience to maintain the appeal of the Amazon marketplace.

Any investment decisions in Amazon stock should take into consideration its various business divisions. Given that this article relates specifically to Amazon’s AR ventures, a neutral ‘hold’ rating will be assigned to the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.